Making informed crypto decisions requires robust data. This listicle presents 10 essential research tools to navigate the 2025 market. Discover resources to analyze market trends, assess project fundamentals, and gauge community sentiment. From seasoned investors to newcomers, these tools offer valuable data to sharpen your crypto strategy. This list arms you with the insights needed to avoid costly mistakes and capitalize on emerging opportunities.

Coindive positions itself as a comprehensive crypto research hub, consolidating market data with social sentiment analysis to offer actionable insights. For investors and traders seeking an edge in the volatile cryptocurrency market, Coindive aims to provide a streamlined approach to understanding the "why" behind market movements, going beyond simple price charts. This tool is particularly valuable for those who recognize the significant impact of social sentiment and community engagement on cryptocurrency prices. By aggregating data from key platforms like Twitter, Telegram, Discord, and Reddit, Coindive offers a holistic view of project activity, community sentiment, and emerging trends. This allows users to anticipate potential market shifts and make more informed decisions.

One of Coindive's core strengths lies in its customizable alert system. Users can tailor alerts for specific social activity thresholds, sentiment shifts, and even AI-powered price predictions contextualized with market events. This functionality is crucial for identifying emerging trends early on and capitalizing on potential opportunities or mitigating risks. The platform's AI-driven context for price movements helps connect seemingly disparate data points, offering a more nuanced understanding of market dynamics. For instance, a sudden price surge can be linked to a specific announcement or a surge in positive sentiment on social media, offering valuable context for informed decision-making.

Compared to relying solely on individual social media platforms or basic market trackers, Coindive's aggregation and filtering system offers a significant advantage. Its advanced filtering mechanisms aim to sift through the noise of bot activity and spam, providing a clearer picture of genuine community engagement and sentiment. This is particularly valuable in the crypto space, which is often rife with manipulated social media activity. While similar platforms like LunarCrush and Santiment also offer social sentiment analysis, Coindive differentiates itself by its integration with CoinGecko, leveraging the established data and credibility of this well-regarded platform.

While Coindive boasts an impressive feature set, the platform's complexity might present a learning curve for new users. Navigating the various dashboards and customizing alerts effectively may require some initial investment of time and effort. Additionally, the lack of transparent pricing information on the website is a notable drawback. Potential users need to contact Coindive directly to understand the different subscription plans and associated costs, which can be a barrier to entry.

Key Features: Real-time social sentiment analysis, customizable alerts, AI-powered price predictions with context, advanced spam and bot filtering, CoinGecko integration.

Pros: Comprehensive insights, real-time data, customizable alerts, AI-driven context, advanced filtering, trusted backing.

Cons: Potential learning curve for new users, lack of transparent pricing information.

Website: https://coindive.app

Coindive earns its place on this list due to its comprehensive approach to crypto research. It bridges the gap between market data and social sentiment, offering a powerful tool for understanding the forces driving cryptocurrency markets. While the potential learning curve and lack of transparent pricing are areas for improvement, the platform's powerful features and CoinGecko backing make it a valuable resource for serious crypto investors and researchers seeking a data-driven edge. To get started, visit the website and explore the available features. Contact their team directly to inquire about pricing and subscription plans.

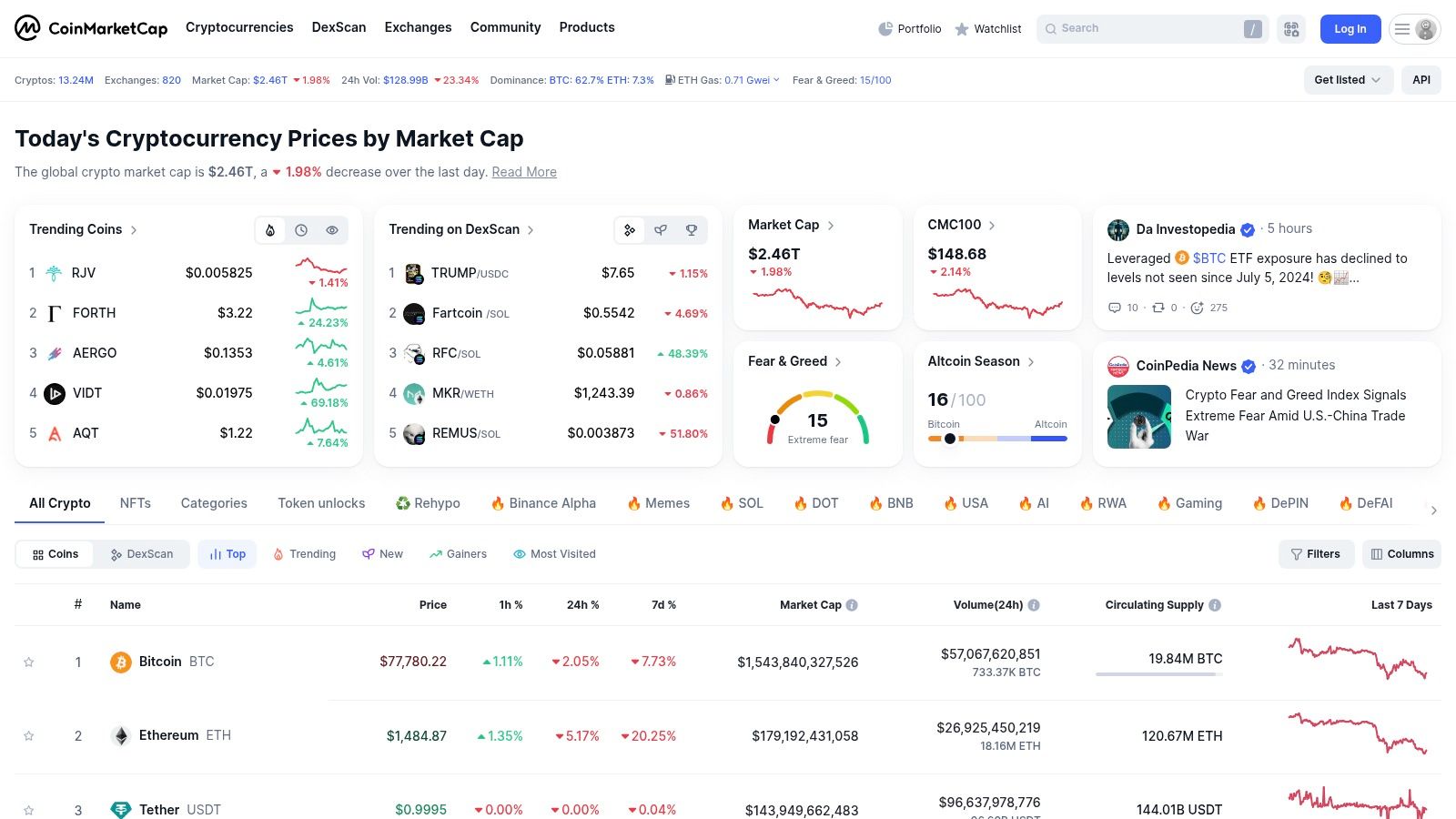

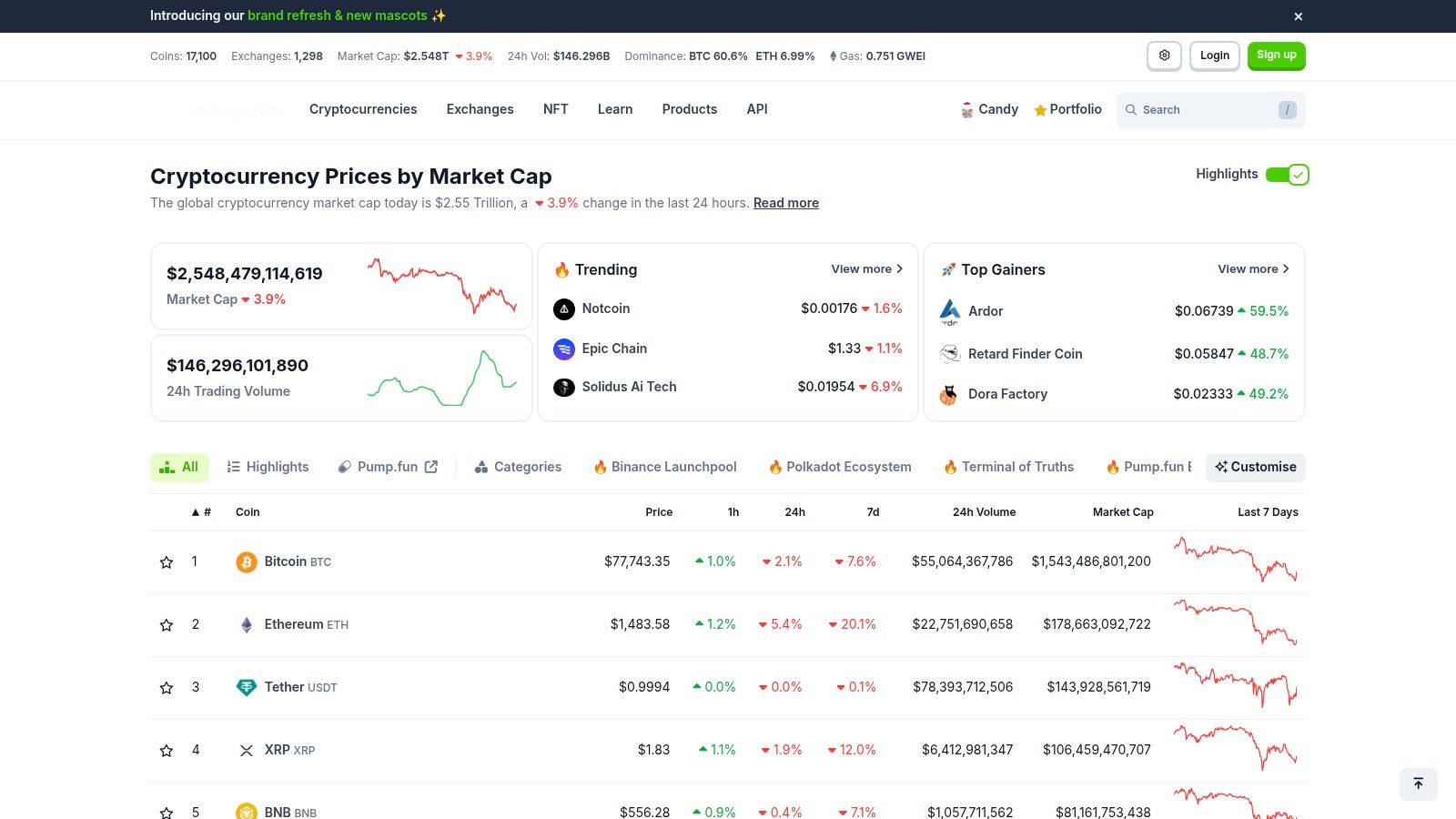

CoinMarketCap is a cornerstone resource for anyone involved in the cryptocurrency space. Its breadth of coverage, encompassing thousands of cryptocurrencies and tokens, makes it a one-stop shop for tracking market movements, comparing project performance, and getting a bird's-eye view of the crypto landscape. Its primary function is to provide real-time and historical data, including market capitalization, price, trading volume, circulating supply, and other crucial metrics. This allows users to understand the current market standing of any given cryptocurrency and how it has performed over time. Beyond basic market data, CoinMarketCap also offers valuable insights into exchange rankings, helping users identify reputable and liquid trading platforms.

For the practical crypto investor, CoinMarketCap is indispensable for several reasons. Portfolio tracking and watchlist features allow users to monitor their investments and keep tabs on promising projects. The platform's historical price charts and market performance metrics empower users to conduct basic technical analysis and identify trends. While CoinMarketCap does offer a premium API for institutional investors needing deeper data dives, the free version provides ample information for the majority of users. Compared to similar sites like Coingecko, CoinMarketCap boasts a slightly larger market coverage and arguably a more user-friendly interface, making it particularly suitable for beginners. However, Coingecko often provides more granular on-chain data, potentially giving it an edge for more advanced users.

Implementation/Setup Tips:

Getting started with CoinMarketCap is straightforward. Simply visit the website (https://coinmarketcap.com) and begin exploring. Creating a free account unlocks additional features such as personalized watchlists and portfolio tracking. Familiarize yourself with the different sections of the website, including the rankings, market overview, and individual cryptocurrency pages. The educational resources and glossary are excellent for newcomers seeking to expand their crypto knowledge.

Pros:

Cons:

CoinMarketCap earns its spot on this list because it serves as a fundamental research tool for a broad spectrum of crypto participants, from casual observers to seasoned traders. Its comprehensive data, ease of use, and freely accessible core functionalities make it an essential resource for understanding and navigating the cryptocurrency market. While more specialized platforms exist for specific needs, CoinMarketCap remains a valuable starting point and ongoing reference for all things crypto.

Glassnode stands out as a premier on-chain market intelligence platform, offering in-depth metrics and insights for Bitcoin and other major cryptocurrencies. Unlike basic market trackers, Glassnode delves into the underlying blockchain data to provide a granular understanding of network health, investor sentiment, and user behavior. This makes it an invaluable tool for serious crypto investors, analysts, and researchers seeking a data-driven edge. Its focus on on-chain analysis allows users to move beyond surface-level price action and understand the fundamental drivers behind market movements.

For example, Glassnode's "HODL Waves" metric visualizes the age distribution of held Bitcoin, offering insights into long-term holder accumulation patterns and potential market tops and bottoms. Similarly, its wallet distribution analysis reveals how Bitcoin is distributed among different wallet sizes, helping to identify whale activity and potential market manipulation. Furthermore, Glassnode provides crucial metrics on miner behavior and network security, including hash rate, mining difficulty, and miner revenue. This allows investors to assess the security and stability of the underlying blockchain network. Market sentiment indicators, derived from on-chain data such as transaction volume and active addresses, offer a more objective perspective compared to traditional social sentiment analysis.

Glassnode's data is renowned for its accuracy and minimal latency, ensuring users have access to the most up-to-date information. They also publish regular market reports and analyses, providing valuable context and interpretation of the on-chain data. While similar platforms like Santiment and CryptoQuant offer overlapping functionalities, Glassnode is often considered the gold standard for its depth of analysis and professional-grade insights, particularly appealing to institutional investors.

However, this depth comes at a cost. Glassnode has a steep learning curve for beginners unfamiliar with on-chain analysis concepts. Its full feature set requires a subscription, which can be expensive for casual users. Furthermore, while Glassnode supports several major cryptocurrencies, its focus remains primarily on Bitcoin and Ethereum, potentially limiting its utility for altcoin investors.

Pricing: Glassnode offers a tiered subscription model, starting with a free tier that provides limited access to historical data and basic metrics. Paid tiers unlock more advanced metrics, real-time data, and access to the platform's API. Specific pricing details are available on their website.

Technical Requirements: Glassnode is a web-based platform accessible from any modern browser. An API is also available for developers and institutional investors who want to integrate Glassnode data into their own applications and trading systems.

Implementation/Setup Tips: Start with the free tier to familiarize yourself with the platform's interface and data offerings. Explore the various metrics and charts available and consult the platform's documentation and educational resources to understand their implications. Consider upgrading to a paid tier if you require access to more advanced features and real-time data.

Website: https://glassnode.com

In conclusion, Glassnode's sophisticated on-chain analytics make it a powerful tool for serious crypto investors who want to go beyond surface-level market data. While it has a learning curve and a cost associated with accessing its full potential, the depth of insights it provides justifies its place as a top-tier crypto research tool.

TradingView has cemented its position as a leading charting platform, appealing to both traditional market traders and cryptocurrency enthusiasts. Its comprehensive charting tools, social features, and exchange integrations make it a valuable asset for analyzing crypto markets and making informed trading decisions. This platform empowers users to dissect market trends, formulate trading strategies, and connect with a vibrant community of fellow traders, justifying its inclusion in this list of essential crypto research tools.

A key strength of TradingView lies in its advanced charting capabilities. Users have access to a vast library of technical indicators, from classic moving averages and RSI to more esoteric tools like the Ichimoku Cloud and Fibonacci retracements. The platform supports multiple chart types, including candlestick, bar, line, and Heikin-Ashi, catering to diverse analytical preferences. Beyond pre-built indicators, TradingView allows users to create custom indicators using Pine Script, its proprietary scripting language. This feature opens up a world of possibilities for experienced traders who want to develop and test their own unique indicators.

The social aspect of TradingView further enhances its value. The platform fosters a thriving community where traders can share ideas, discuss strategies, and learn from one another. Users can publish their chart analyses, complete with annotations and commentary, allowing others to follow their reasoning and gain insights. This collaborative environment provides a valuable learning opportunity, especially for newer traders seeking guidance from experienced analysts.

Integration with cryptocurrency exchanges is another significant advantage. While the depth of integration varies by exchange, TradingView allows users to directly execute trades on supported platforms, streamlining the trading process. This integration is particularly useful for active traders who rely on technical analysis to inform their decisions.

For practical application, consider a crypto researcher analyzing Bitcoin's price action. Using TradingView, they can overlay multiple technical indicators on a Bitcoin chart, identify potential support and resistance levels, and backtest trading strategies based on historical data. They can then share their analysis with the community, sparking discussions and gathering feedback.

TradingView offers a tiered subscription model. The free tier provides a robust set of features, suitable for casual traders and researchers. Paid subscriptions unlock additional features like more indicators, chart layouts, and access to real-time data feeds. While the free tier is quite powerful, serious traders will likely find the Pro, Pro+, or Premium subscriptions worthwhile for the enhanced functionalities they offer. No special technical requirements are needed beyond a web browser or the mobile app.

Compared to other charting platforms like Coinigy and Cryptowatch, TradingView stands out with its broader community, more extensive charting tools, and the flexibility of Pine Script for custom indicator development. However, the sheer number of features can be overwhelming for beginners. Starting with the free tier and gradually exploring the platform's capabilities is recommended.

To get started, simply create a free account on the TradingView website (https://www.tradingview.com). Familiarize yourself with the charting interface, experiment with different indicators, and explore the community discussions. As you gain experience, consider upgrading to a paid subscription to unlock the full potential of this powerful platform.

Santiment stands out as a powerful crypto research tool specializing in behavioral analytics. Unlike platforms that primarily focus on price charts and trading volume, Santiment delves deeper into the underlying market dynamics, offering insights into social sentiment, developer activity, and on-chain metrics. This approach empowers investors to anticipate potential market shifts before they manifest in price movements, a crucial advantage in the volatile cryptocurrency market. This makes it particularly valuable for identifying emerging trends, spotting potential market tops and bottoms, and conducting fundamental analysis of crypto projects.

For example, imagine tracking the social sentiment around a specific altcoin. A sudden surge in positive mentions across social media platforms, coupled with increased developer activity on the project's GitHub repository, could signal growing community interest and potential future price appreciation. Santiment allows you to monitor these factors in real-time, providing actionable insights for your investment strategy. Similarly, tracking whale transactions (large movements of cryptocurrency by influential holders) can offer a glimpse into potential market manipulation or accumulation phases.

Santiment's proprietary metrics, like the Network Value to Transactions (NVT) ratio, provide further analytical depth. The NVT ratio, analogous to the price-to-earnings ratio in traditional finance, helps assess whether a cryptocurrency is overvalued or undervalued based on its network activity. This is just one example of how Santiment equips users with unique data points for informed decision-making.

Features and Benefits:

Pricing and Technical Requirements:

Santiment offers different subscription tiers, ranging from a free version with limited historical data to premium plans with full access to all features. The paid plans unlock historical data, advanced metrics, and customizable alerts. The platform is accessible through a web browser, eliminating the need for any specialized software installations.

Pros and Cons:

Pros:

Cons:

Comparison with Similar Tools:

While platforms like Glassnode and CryptoQuant also provide on-chain data, Santiment differentiates itself with its focus on social sentiment analysis and a wider range of behavioral metrics. For investors seeking a holistic view of the market, combining Santiment's insights with on-chain data from other platforms can be a powerful strategy.

Implementation and Setup Tips:

Start with the free tier to familiarize yourself with the platform. Explore the available metrics and experiment with different data visualizations. Once you're comfortable, consider upgrading to a paid plan for access to the full feature set, particularly historical data and customizable alerts. Utilizing Santiment's educational resources and market reports can further enhance your understanding of the platform's capabilities.

Website: https://santiment.net

Santiment earns its place on this list due to its unique focus on behavioral analytics, offering a distinct perspective on cryptocurrency markets that complements traditional chart analysis. Its combination of social sentiment, developer activity, and on-chain data empowers investors with a comprehensive understanding of market dynamics, allowing them to identify opportunities and manage risks more effectively.

CoinGecko stands out as a comprehensive and user-friendly cryptocurrency data aggregator, providing a wealth of information beyond simple price tracking. It’s a valuable resource for a broad spectrum of users, from casual crypto enthusiasts to seasoned traders and institutional investors, thanks to its diverse features and accessible interface. Its inclusion in this list is warranted by its unique blend of market overview, in-depth project analysis, and exchange scrutiny, making it a powerful tool for navigating the complex cryptocurrency landscape.

One of CoinGecko's key strengths lies in its wide range of metrics. While price data is readily available, CoinGecko goes further by offering insights into developer activity, community growth, and liquidity. This allows users to assess a project’s overall health and potential for future growth, moving beyond speculative price movements. For example, a developer activity score can indicate ongoing development and commitment to the project, while community growth metrics can reflect increasing adoption and interest. These metrics are invaluable for fundamental analysis and identifying promising long-term investments.

Furthermore, CoinGecko's proprietary Trust Score for cryptocurrency exchanges adds a crucial layer of security analysis. This score helps users evaluate the reliability and trustworthiness of different exchanges, mitigating the risks associated with platform insolvency or fraudulent activity. This is particularly important for new investors navigating the often confusing exchange landscape. Similar platforms like CoinMarketCap also provide exchange listings, but CoinGecko's Trust Score adds a valuable differentiating factor for risk assessment.

CoinGecko also extends its coverage to the burgeoning DeFi and NFT markets. Tracking DeFi protocols allows users to monitor total value locked (TVL), yield farming opportunities, and other key metrics in the decentralized finance space. Similarly, NFT market data and collection tracking provides valuable insights into the evolving world of digital collectibles. This broad coverage makes CoinGecko a one-stop shop for staying informed across different segments of the cryptocurrency market.

Features and Benefits:

Pros:

Cons:

Implementation and Setup Tips:

Using CoinGecko is straightforward. Simply visit the website (https://www.coingecko.com) and start exploring. The platform is free to use for the vast majority of its features. Creating an account allows you to personalize your experience, set up watchlists, and track your portfolio. While a premium subscription unlocks additional features, the free version offers ample functionality for most users. The mobile app is also readily available for iOS and Android devices, offering convenient access to market data on the go.

For traders and analysts, while CoinGecko provides a solid foundation for fundamental analysis, it's important to note that its technical analysis tools are less advanced than those found in dedicated trading platforms like TradingView. Therefore, combining CoinGecko's fundamental data with a specialized charting platform can provide a more complete analytical approach. For example, you can use CoinGecko to research project fundamentals and then export the historical price data into TradingView for in-depth technical analysis.

DeFi Pulse has established itself as the industry standard for tracking the Decentralized Finance (DeFi) ecosystem, primarily on the Ethereum blockchain. Its focus on key metrics like Total Value Locked (TVL) provides crucial insights into the overall health and growth of the DeFi market, making it an invaluable tool for a range of users, from individual investors to institutional players. By offering a clear and concise overview of the DeFi landscape, DeFi Pulse empowers users to make informed decisions based on real-time data.

For crypto investors, DeFi Pulse offers a quick way to gauge market sentiment and identify trending protocols. Tracking TVL across different protocols allows investors to compare the relative popularity and capital flow within the DeFi space, helping them allocate resources effectively. Historical data on protocol growth and market share provides valuable context for understanding long-term trends and potential future performance. Furthermore, the comparison of DeFi lending rates across various platforms empowers investors to optimize their yield farming strategies. Traders and analysts can leverage DeFi Pulse data to identify emerging opportunities and assess market risks. The gas price tracker provides valuable information for optimizing transaction timing and minimizing costs on the Ethereum network.

While DeFi Pulse excels in providing high-level insights into the DeFi ecosystem, it does have limitations. Its primary focus on Ethereum-based DeFi protocols means it may not capture the full picture of the broader decentralized finance landscape, especially with the growth of DeFi on other blockchains. Additionally, the platform's focus on core metrics like TVL, while valuable, lacks the advanced charting and technical analysis tools that some traders and analysts might require. While DeFi Pulse provides some risk assessment metrics, users seeking in-depth risk analysis may need to supplement their research with other tools.

DeFi Pulse is freely accessible, requiring no specific technical setup or software installation. Simply visiting the website (https://defipulse.com) allows users to access the core metrics and data.

Compared to more generalized crypto analytics platforms, DeFi Pulse's specialization in DeFi offers a deeper, more focused perspective. While platforms like CoinGecko and CoinMarketCap provide some DeFi data, DeFi Pulse's dedication to the sector makes it the preferred choice for users specifically interested in this rapidly evolving market segment. Its simple and intuitive interface makes it easy for both newcomers and experienced users to navigate and extract valuable information.

In conclusion, DeFi Pulse earns its place on this list as the leading resource for monitoring the DeFi ecosystem. Its free access, focused interface, and industry-standard metrics make it an indispensable tool for anyone involved in or interested in the world of decentralized finance. While its limitations regarding blockchain coverage and advanced analysis tools should be considered, its strengths in providing a clear overview of the DeFi market make it a valuable asset for crypto investors, traders, analysts, and researchers alike.

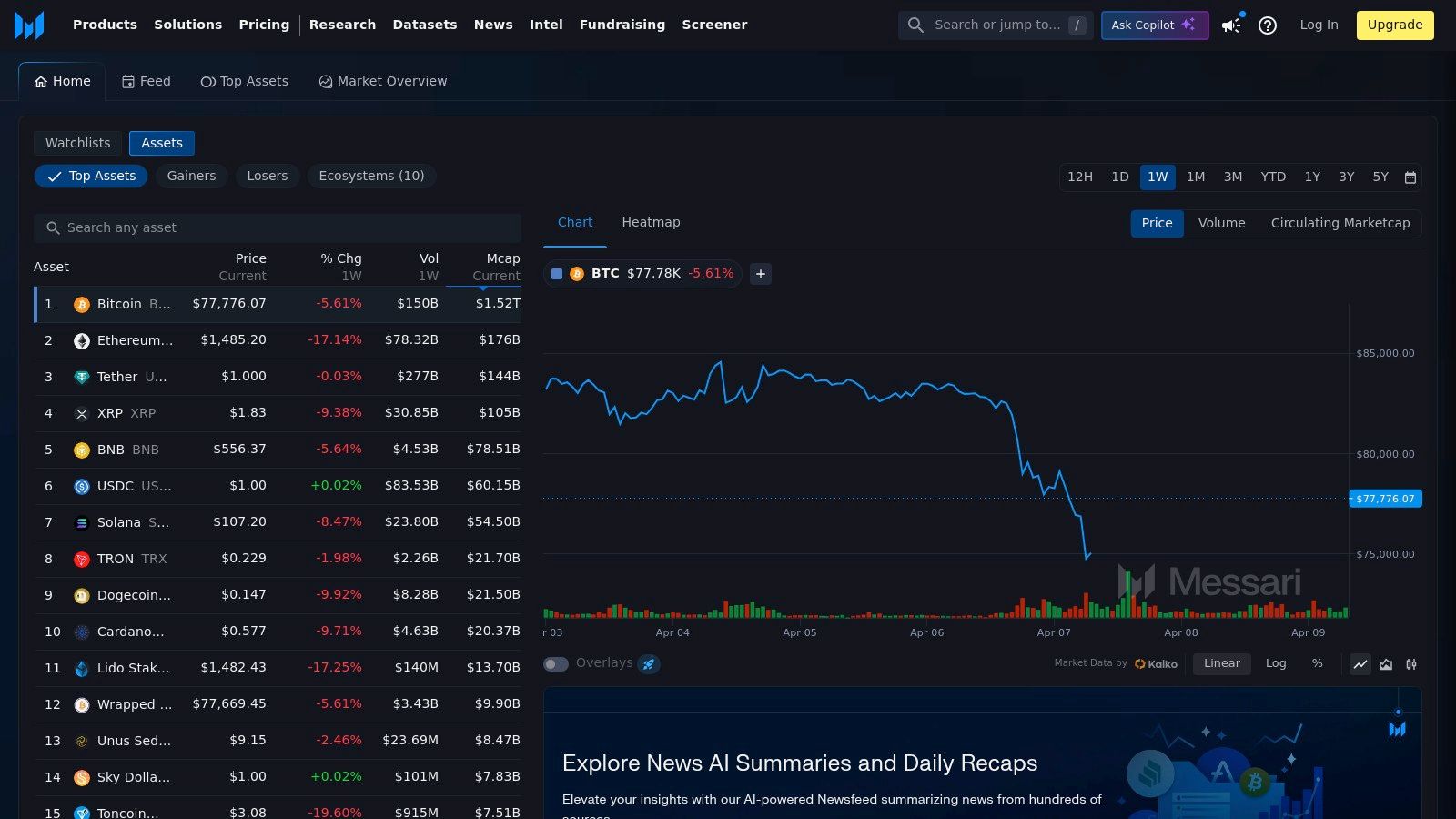

Messari is a powerful crypto intelligence platform catering to serious investors, analysts, and researchers seeking in-depth data and insights. It goes beyond basic market data to provide a comprehensive view of crypto projects, including tokenomics, governance structures, and regulatory landscapes. This depth of information makes Messari an invaluable tool for navigating the complex crypto market. It allows users to not just track prices, but understand the underlying forces driving project valuations.

One of Messari's key strengths lies in its detailed token profiles. These profiles offer a holistic overview of a project, including its team, technology, token distribution, and financial metrics. For example, you can delve into a project's treasury holdings, understand its token release schedule, and analyze its market capitalization relative to other projects. This granular data empowers investors to make informed decisions based on fundamentals rather than hype. The platform also excels in its governance tracking features, providing insights into the decision-making processes of Decentralized Autonomous Organizations (DAOs) and other tokenized projects. This is particularly useful for evaluating the long-term viability and stability of a project. Learn more about Messari to discover additional features and benefits.

Furthermore, Messari provides professional research reports on market trends and specific projects. These reports offer valuable insights into the broader crypto landscape and can help investors identify emerging opportunities and potential risks. The platform’s customizable dashboard is another highlight, allowing users to track multiple assets and create personalized watchlists. This feature is essential for staying organized and efficiently monitoring investments. Compared to free resources like CoinGecko or CoinMarketCap, which focus primarily on price tracking and basic information, Messari provides a significantly deeper level of analysis. While platforms like Glassnode also offer on-chain analytics, Messari's focus extends to the broader fundamental and qualitative aspects of crypto projects.

However, Messari's advanced features come at a cost. While a free version offers limited access, the majority of valuable insights, including the in-depth research reports and governance data, require a Pro subscription priced at $25 per month. The Enterprise tier, designed for institutional investors, is considerably more expensive, making it less accessible for individual users. Moreover, the platform's research can be quite technical and may present a steep learning curve for beginners. Despite these limitations, Messari's comprehensive data, high-quality research, and focus on transparency justify its place on this list. It’s a powerful tool for any serious crypto investor seeking to gain a competitive edge. Visiting the Messari website (https://messari.io) provides a complete overview of available features and pricing plans.

Nansen distinguishes itself as a powerful blockchain analytics platform by combining on-chain data with a vast, proprietary database of labeled wallets. This allows users to go beyond raw transaction data and understand the behavior of key market players, including institutional investors, large traders ("whales"), and even specific smart contracts. This focus on identifying and tracking "smart money" makes Nansen a valuable tool for investors and analysts seeking alpha in the cryptocurrency market. Imagine being able to see what the most successful crypto investors are buying and selling – Nansen provides that kind of insight.

Nansen’s key strength lies in its ability to link on-chain activity to real-world entities. Features like "Token God Mode" provide an in-depth analysis of specific tokens, including holder distribution, transaction history, and smart money involvement. "NFT Paradise," another key feature, offers similar analytics for NFT collections, enabling users to identify trending projects and potentially lucrative investment opportunities. The platform's real-time alerts for significant on-chain movements empower users to react quickly to market shifts and potentially capitalize on emerging trends. For example, you could receive an alert when a known whale makes a large purchase of a specific altcoin, providing a potential signal for price appreciation.

While Nansen excels in providing granular data on Ethereum and EVM-compatible chains, its coverage of other blockchains is less extensive. This is a crucial consideration for investors with diversified portfolios across various ecosystems. Furthermore, Nansen comes with a significant price tag, with subscriptions starting at $149 per month. This cost may be prohibitive for casual investors, but for serious traders and analysts, the insights provided can justify the expense. Finally, Nansen has a steep learning curve. Its rich feature set and the complexity of blockchain data require time and effort to fully understand and utilize effectively.

Practical Applications and Use Cases:

Comparison with Similar Tools:

Nansen competes with other blockchain analytics platforms like Glassnode and Messari. While Glassnode offers a broader range of on-chain metrics and historical data, Nansen's strength lies in its wallet labeling and focus on smart money tracking. Messari provides more fundamental analysis and research reports, while Nansen excels in real-time on-chain data and alerts.

Implementation and Setup Tips:

Website: https://www.nansen.ai

Nansen's unique combination of on-chain data and labeled wallet tracking makes it a powerful tool for serious crypto investors and analysts. While the high cost and learning curve may be barriers for some, the insights provided can be invaluable for those seeking an edge in the volatile world of cryptocurrency. Its inclusion in this list is warranted for its unique ability to provide insights into the often opaque movements of significant market players.

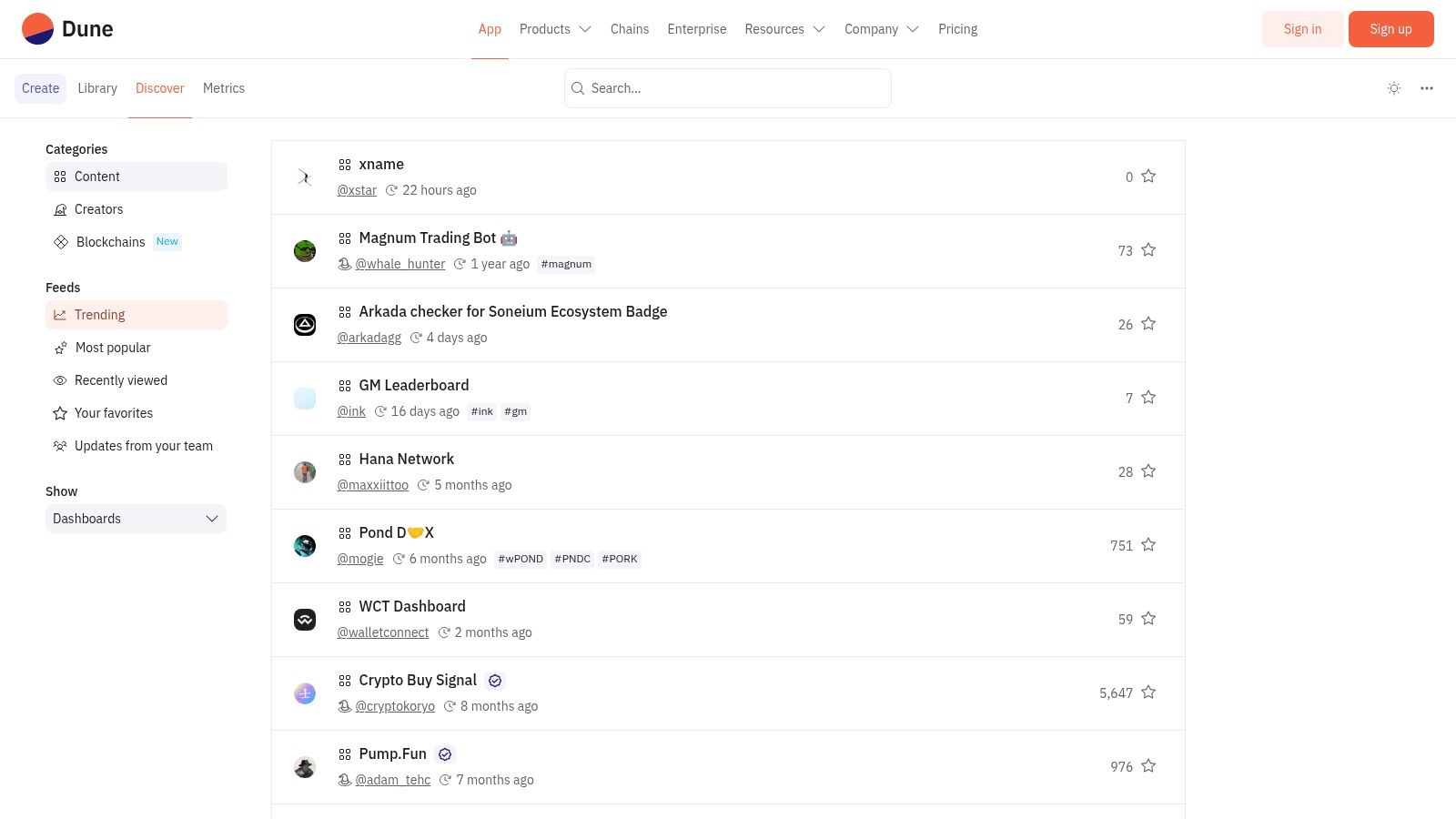

Dune Analytics empowers users to explore the vast landscape of blockchain data through the flexible lens of custom SQL queries. It distinguishes itself as a community-driven platform, enabling users not only to conduct their own analyses but also to share their findings with a wider audience through interactive dashboards. This democratizes access to crucial on-chain metrics, making sophisticated data analysis accessible even to those without extensive technical backgrounds. Dune primarily focuses on Ethereum Virtual Machine (EVM)-compatible blockchains, including Ethereum and Polygon, providing a rich dataset for analyzing decentralized applications (dApps), decentralized finance (DeFi) protocols, and NFT marketplaces.

For crypto investors, traders, and analysts, Dune offers powerful tools to gain a deeper understanding of market trends and individual project performance. Imagine tracking the total value locked (TVL) in a specific DeFi protocol, analyzing the trading volume of a particular NFT collection, or monitoring the growth of a new blockchain ecosystem – all achievable with custom queries on Dune. This granular level of data access provides valuable insights for informed investment decisions. Crypto content creators and researchers can leverage Dune's data and visualization capabilities to create compelling and data-driven narratives, enriching their content and supporting their research findings. Even institutional investors and portfolio managers can utilize the platform's sophisticated analytics to assess risk, identify opportunities, and monitor their crypto holdings.

One of Dune’s key strengths lies in its community-driven nature. Thousands of freely accessible community-created dashboards cover a wide range of metrics, eliminating the need for users to write their own SQL queries for common analyses. This provides a valuable starting point for beginners while also offering a rich library of insights for experienced users. For more tailored analyses, Dune's custom SQL functionality allows users to create highly specific metrics not readily available on other platforms. This empowers users to go beyond pre-defined metrics and explore the data in unique ways. A query wizard also assists non-technical users in building queries through a visual interface, lowering the barrier to entry for those unfamiliar with SQL. Furthermore, the transparent and verifiable nature of the data methodology, coupled with regular updates to support new protocols and blockchains, ensures the platform's reliability and relevance.

However, Dune does have some drawbacks. Creating truly custom queries requires SQL proficiency, presenting a learning curve for some users. While the free tier provides access to a wealth of community dashboards and allows for basic query execution, it has limitations on query complexity and execution time. Unlocking the full potential of Dune requires a Pro subscription, currently priced at $390/month, which might be a significant investment for individual users. Building visually appealing and effective dashboards can also take time and effort, even with the available tools.

Compared to blockchain explorers like Etherscan or Blockchair, Dune provides a more analytical approach. While explorers offer detailed transaction information, Dune focuses on aggregating and visualizing data to uncover broader trends and patterns. Tools like Nansen offer similar on-chain analytics but often come at a higher price point and may focus on specific areas like NFT analysis. Dune offers a more balanced approach, providing robust functionality at a relatively accessible price (for the Pro version) while fostering a strong community that contributes to the platform's growth and value.

For those looking to get started with Dune, exploring the community-created dashboards is an excellent first step. Familiarize yourself with the platform's interface and the types of data available. The Dune documentation and numerous online tutorials provide valuable resources for learning SQL and mastering the art of dashboard creation. As you gain experience, consider the Pro subscription to unlock the full potential of custom queries and advanced features. By leveraging the power of community insights and the flexibility of custom SQL, Dune Analytics equips users with the tools they need to navigate the complexities of the blockchain ecosystem and make informed decisions in the dynamic world of crypto. You can access Dune Analytics at https://dune.com.

| Platform | Core Features ✨ | User Experience ★ | Value & Price 💰 | Target Audience 👥 |

|---|---|---|---|---|

| 🏆 Coindive | Custom alerts, AI insights, multi-channel tracking | Intuitive, reliable, advanced filtering | Great value; pricing details not disclosed | Traders, investors, crypto enthusiasts |

| CoinMarketCap | Real-time market data, charts, portfolio tracking | User-friendly, ideal for beginners | Freemium model; premium for advanced features | Market participants, crypto newcomers |

| Glassnode | On-chain analytics, network health, sentiment metrics | Professional, data-rich but complex | More expensive; subscription required | Institutional investors, advanced users |

| TradingView | Advanced charting, technical indicators, social trading features | Robust yet can overwhelm newcomers | Free tier available; paid upgrades | Active traders, technical analysts |

| Santiment | Social sentiment, developer activity, whale tracking | Customizable alerts; less intuitive UI | Subscription-based for full features | Research-focused investors, analysts |

| CoinGecko | Crypto aggregator, trust score, comprehensive metrics | User-friendly, widely accessible | Freemium model; premium for advanced insights | General crypto users, enthusiasts |

| DeFi Pulse | TVL tracking, lending rates, focused DeFi analytics | Simple and focused interface | Free core metrics; limited scope | DeFi participants, researchers |

| Messari | In-depth research, token profiles, governance tracking | Professional-grade, rigorous | Pro subscription needed; relatively pricey | Institutional investors, seasoned analysts |

| Nansen | Wallet labeling, smart alerts, on-chain trend analysis | Intuitive visualizations; steep learning curve | Premium pricing with advanced insights | Professional traders, institutional players |

| Dune Analytics | Custom SQL queries, community dashboards, data explorations | Community-driven; requires SQL skills | Free & Pro tiers; high cost for Pro features | Data analysts, blockchain researchers |

The cryptocurrency market thrives on information. From understanding market trends and on-chain metrics to analyzing DeFi protocols and identifying emerging altcoins, the right tools can significantly impact your success. This list of 10 crypto research tools offers a diverse range of functionalities, from CoinMarketCap's broad overview to Nansen's sophisticated on-chain analytics and Dune Analytics' customizable dashboards. Key takeaways include the importance of combining both fundamental and technical analysis, leveraging real-time data, and understanding the specific strengths of each platform. TradingView’s charting capabilities combined with Santiment’s social sentiment analysis, for example, can offer a powerful edge. Similarly, understanding DeFi Pulse’s metrics alongside Messari’s in-depth project research can illuminate promising investment opportunities. For those interested in exploring more advanced screening tools, ChartsWatcher’s article on stock screeners offers valuable insights applicable to many markets.

When selecting a tool, consider your specific needs and investment strategy. Are you focused on day trading, long-term investing, or DeFi? Do you prioritize on-chain data, social sentiment, or market trends? Choosing the right combination of tools will empower you to make informed decisions. Remember to factor in cost, ease of use, and data reliability during your evaluation. Implementing these tools requires a disciplined approach. Start with a few key metrics and gradually expand your analysis as you gain experience. Avoid information overload by focusing on the data most relevant to your strategy.

The crypto market is dynamic and challenging, but with diligent research and the right tools, you can navigate its complexities and unlock its potential. Want to streamline your crypto research process and gain a competitive edge? Explore Coindive, a powerful platform that aggregates crucial data and insights, helping you make informed investment decisions in the ever-evolving world of cryptocurrency.