Navigating the crypto market requires diligent research. Informed decisions are driven by data, and the right tools can transform how you analyze trends and explore this complex landscape. The volatile nature of cryptocurrencies necessitates a robust research strategy, emphasizing access to reliable data and insightful analysis. Whether a seasoned trader or a blockchain developer, understanding market dynamics, on-chain metrics, and emerging trends is paramount to success.

This toolkit of top crypto research sites equips you with the essential resources for confident navigation. We'll explore platforms offering real-time market data, in-depth project analysis, sentiment tracking, and on-chain analytics. Choosing the right tool depends on your individual needs, whether tracking portfolio performance or identifying promising altcoins. Key factors to consider include data accuracy, depth of analysis, the user interface, available features (like charting tools or portfolio trackers), and associated costs.

An effective crypto research tool provides actionable insights in a clear and accessible format, empowering informed decision-making. Some platforms, like CoinMarketCap, offer free access with limited features, while others operate on a subscription basis, unlocking comprehensive data and advanced analytics. Consider these points when evaluating various platforms:

By the end of this article, you'll have a curated list of essential crypto research sites and a clear understanding of how to leverage their power to maximize your crypto journey.

Coindive stands out as a leading platform by combining community monitoring and market analysis in one place. It addresses the significant challenge of information overload in the cryptocurrency world, helping users find actionable insights. Rather than manually searching various social media platforms, Coindive aggregates important data from sources like Twitter, Telegram, Discord, and Reddit, offering a complete view of project sentiment and community engagement. This proves particularly useful for investors, traders, and analysts evaluating a cryptocurrency project's health and potential.

Coindive's strength lies in its real-time, customizable alerts. Users can set notifications for specific keywords, sentiment changes, significant social activity increases, and official announcements. This allows for proactive market monitoring and quick responses to impactful events. The platform's AI-powered price alerts provide further context by linking price fluctuations to relevant project-specific events and overall market trends, explaining the reasons behind price action.

For instance, if positive sentiment about a specific altcoin suddenly surges on Twitter, Coindive will alert you to this change. It will also connect this shift to a recent project announcement or partnership, offering valuable insight into the price increase. This integrated analysis empowers users to make more informed decisions, differentiating between genuine community enthusiasm and manufactured hype.

A key feature of Coindive is its advanced filtering capabilities. These filters help remove bot activity and inorganic engagement, giving a more accurate view of real community growth and sentiment. This is crucial for finding projects with genuine support and avoiding those reliant on artificial hype. The platform also incorporates market and sector data directly into its dashboards, presenting a comprehensive overview of the crypto market. The backing of CoinGecko adds to its credibility and ensures continued platform development.

Pros:

Cons:

Website: https://coindive.app

After signing up, explore Coindive’s customization options. Define your key projects and keywords, set up relevant alerts, and adjust the dashboards to fit your investment strategy. Start with a smaller number of alerts and gradually increase them as you become more familiar with the platform.

While specific pricing details aren't available on the website, Coindive likely uses a freemium or subscription model, considering its advanced features. Compared to manually tracking social media and market information, Coindive saves considerable time and provides deeper insights. This makes it a valuable tool for serious crypto investors, analysts, and researchers. Its ability to link social sentiment with market movements offers a unique advantage, helping users make informed decisions in the volatile cryptocurrency market.

Founded in 2013, CoinDesk has become a prominent voice in the cryptocurrency world. Its extensive content caters to a broad audience, from experienced cryptocurrency traders to newcomers exploring the market. The platform offers a mix of news, analytical pieces, and data resources, making it a valuable tool for various purposes.

Practical Applications and Use Cases:

Market Analysis & Trend Identification: CoinDesk's in-depth articles and research reports offer valuable market analysis, assisting investors and traders in identifying emerging trends and potential investment opportunities. The CoinDesk 20 index, which tracks the performance of the top cryptocurrencies, provides a snapshot of the overall market condition and informs strategic portfolio management.

Due Diligence & Project Research: For those researching potential investments in specific crypto projects, CoinDesk's reporting on regulatory changes and broader industry news provides critical information for conducting thorough due diligence.

Staying Informed: CoinDesk's comprehensive news coverage keeps users current on the latest developments in the dynamic cryptocurrency market. This is especially beneficial for portfolio managers, institutional investors, and enthusiasts who need to monitor market fluctuations and news.

Content Creation: Crypto content creators can use CoinDesk's data, reports, and news as reputable sources to enhance their work.

Educational Resource: While potentially overwhelming for beginners, CoinDesk does offer valuable educational content to help understand fundamental cryptocurrency concepts.

Comprehensive News Coverage: CoinDesk provides a broad spectrum of content, ranging from breaking news to detailed analyses of market trends.

CoinDesk 20 Index: This index provides an easy way to track the performance of the top 20 cryptocurrencies based on market capitalization.

CoinDesk Research: Subscribers gain access to extensive research reports and data-driven analysis.

Real-Time Price Tracking: CoinDesk delivers up-to-the-minute price information for a wide array of cryptocurrencies.

Educational Resources: Beginners can access articles and guides designed to help them navigate the complex world of cryptocurrency.

Pros:

High-Quality Journalism: CoinDesk maintains a high standard of journalism, contributing to its credibility as a trusted information source.

Established Reputation: It's a well-known and respected platform within the crypto community.

Extensive Coverage: CoinDesk offers global coverage of regulatory developments, critical for making well-informed investment decisions.

Expert Opinions: The platform regularly features analysis and commentary from industry experts.

Cons:

Premium Content Behind Paywall: Some of the more in-depth research and analysis requires a paid subscription to CoinDesk Research.

Can Be Overwhelming for Beginners: The sheer amount of information can feel overwhelming for newcomers to cryptocurrency.

Occasional Bias: While aiming for objectivity, some critics have pointed out occasional bias in CoinDesk's reporting.

Much of CoinDesk's content is free. However, premium research and data are available via a paid CoinDesk Research subscription. Pricing details can be found on their website. Accessing CoinDesk requires only a web browser and internet connection.

Similar platforms, such as The Block and Messari, offer in-depth research and analysis. However, CoinDesk arguably maintains a broader appeal due to its wider range of content, encompassing news and educational resources.

Implementation/Setup Tips:

Start with the Basics: New to crypto? Begin with CoinDesk's educational resources and gradually explore the more advanced content.

Utilize the Search Function: CoinDesk's extensive archive contains valuable historical data and analysis.

Follow Relevant Sections: Customize your experience by following sections aligned with your interests (e.g., market analysis, regulations, specific cryptocurrencies).

Website: https://www.coindesk.com/

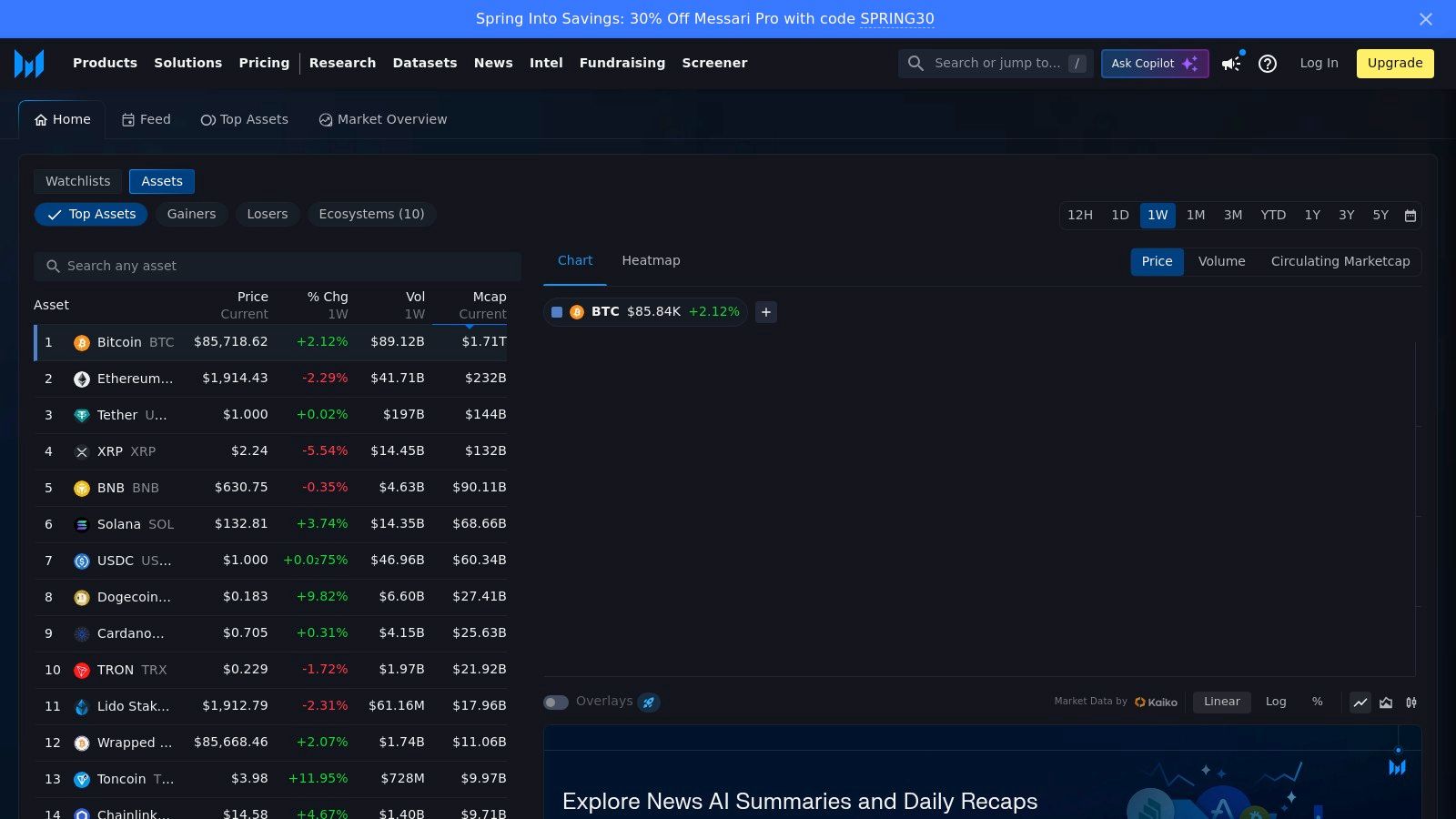

Founded in 2018 by Ryan Selkis, Messari has quickly become an essential resource for serious cryptocurrency research. Its comprehensive suite of tools and data caters to a wide range of users, from individual investors to large institutions, securing its place on this list. At the heart of Messari's value proposition is a commitment to transparency, evident in its detailed project profiles, standardized disclosures, and robust data collection methodology.

For those looking to understand the fundamentals of a specific project, Messari offers in-depth profiles. These cover a wide spectrum of information, from tokenomics and team backgrounds to key financial metrics and community activity. The platform's project screener enables users to filter projects based on specific criteria, allowing for targeted research and comparative analysis. Beyond individual project data, Messari delivers daily market insights and publishes thematic research reports, keeping users informed of the latest trends and important developments.

Messari’s advanced charting and data visualization tools allow users to perform their own technical and fundamental analysis. Institutional clients further benefit from API access, which facilitates seamless integration with their existing workflows. For broader market analysis, consider our resource: Our guide on Cryptocurrency Market Research: A Complete Guide to Global Adoption Trends.

While Messari offers some free tools, the full platform experience requires a Messari Pro subscription, starting at $25/month. This unlocks access to the comprehensive research platform, detailed project profiles, and advanced screeners. While the cost may be a factor for casual investors, the depth of analysis and the quality of data make it a valuable investment for serious crypto researchers, traders, and portfolio managers. Enterprise-level data access, though expensive for individuals, offers institutions the detailed data required for informed decision-making.

One potential challenge for new users is the learning curve associated with fully utilizing Messari's extensive toolset. The platform can initially feel overwhelming; however, the well-structured design and numerous educational resources help to streamline the onboarding process.

Key Features:

Pros:

Cons:

Website: https://messari.io/

In conclusion, Messari distinguishes itself as a leading resource for in-depth cryptocurrency research. The cost of the Pro subscription may present a barrier to entry for some. However, the value derived from the platform's high-quality data, robust analytical tools, and valuable market insights makes it a worthwhile investment for those committed to navigating the complexities of the crypto market.

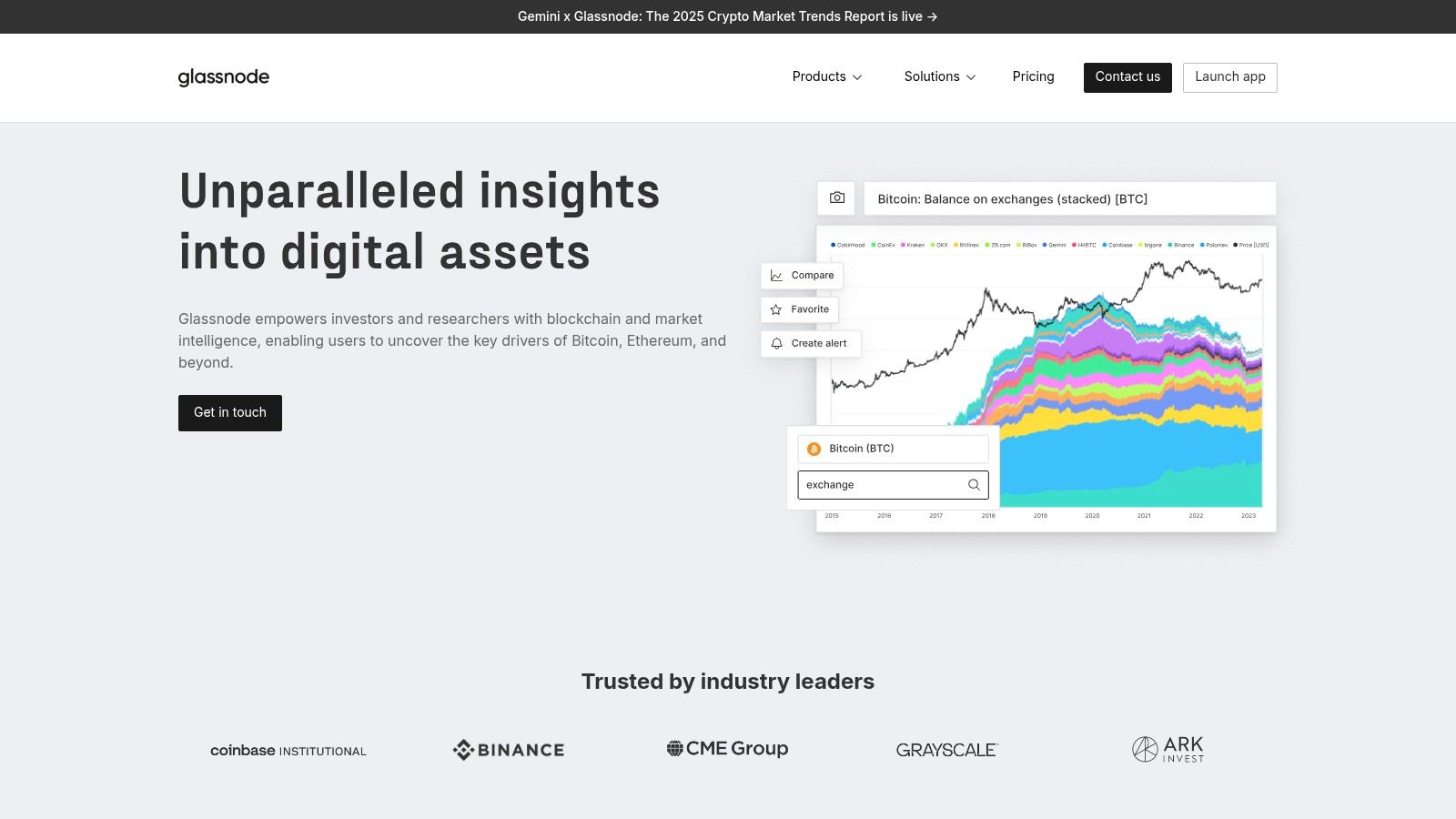

Glassnode earns its place on this list by offering remarkable depth in on-chain analytics. Unlike platforms that primarily focus on price movements, Glassnode digs into the underlying blockchain activity. This provides a granular view of network health, investor behavior, and overarching market cycles. This data-driven approach makes it a powerful tool for both technical and fundamental cryptocurrency research.

For technically-minded analysts, Glassnode features advanced charting tools. These come with customizable parameters and a wide array of on-chain metrics. This includes proprietary indicators like SOPR (Spent Output Profit Ratio), MVRV (Market Value to Realized Value), and NVT (Network Value to Transactions Ratio). These metrics help identify potential market tops and bottoms, assess investor sentiment, and evaluate overall network health.

For instance, using SOPR, analysts can determine if short-term holders are selling at a profit or a loss. This provides insight into potential future price fluctuations. Similarly, MVRV can help identify overvalued or undervalued market conditions.

Fundamental researchers also benefit from Glassnode's long-term trend and network growth insights. Metrics such as the number of active addresses, transaction volume, and hash rate offer valuable context. They illuminate the underlying strength of a given cryptocurrency. Analyzing these metrics alongside macroeconomic factors allows researchers to develop a more complete market perspective.

Glassnode further provides a weekly insights newsletter and in-depth market reports. These keep users informed on the latest on-chain trends and deliver actionable market intelligence. Access to historical data, stretching back to the inception of various blockchains, allows for backtesting strategies and detailed historical analysis.

While Glassnode's analytical depth is a strength, it also presents a learning curve. Understanding and interpreting on-chain metrics requires dedicated time and effort. Full access requires a subscription to their Studio tier, potentially expensive for individual investors. Free and basic paid tiers exist but significantly restrict access to the platform's more advanced features. Finally, while Glassnode extensively covers major cryptocurrencies like Bitcoin and Ethereum, coverage of smaller altcoins is less comprehensive than platforms like CoinGecko or CoinMarketCap.

Pricing: Glassnode uses a tiered subscription model with free, basic paid, and premium "Studio" options. The Studio subscription unlocks all on-chain metrics, advanced charting, and API access.

Technical Requirements: Accessing Glassnode requires only a web browser and an internet connection.

Implementation Tip: Begin by exploring the free resources and familiarizing yourself with the basic on-chain metrics. Consider the paid Studio tier if you need the full suite of tools and data.

While platforms like Santiment and CryptoQuant offer similar on-chain analytics, Glassnode distinguishes itself through its data depth and proprietary indicators. Compared to broader market data platforms, it provides a more granular and specialized focus on on-chain data.

Website: https://glassnode.com/

In conclusion, Glassnode is a valuable resource for serious crypto investors, traders, and researchers seeking a data-driven approach. While the learning curve and cost may be a barrier for some, the insights gained from its on-chain analysis can provide a significant advantage in the volatile cryptocurrency markets.

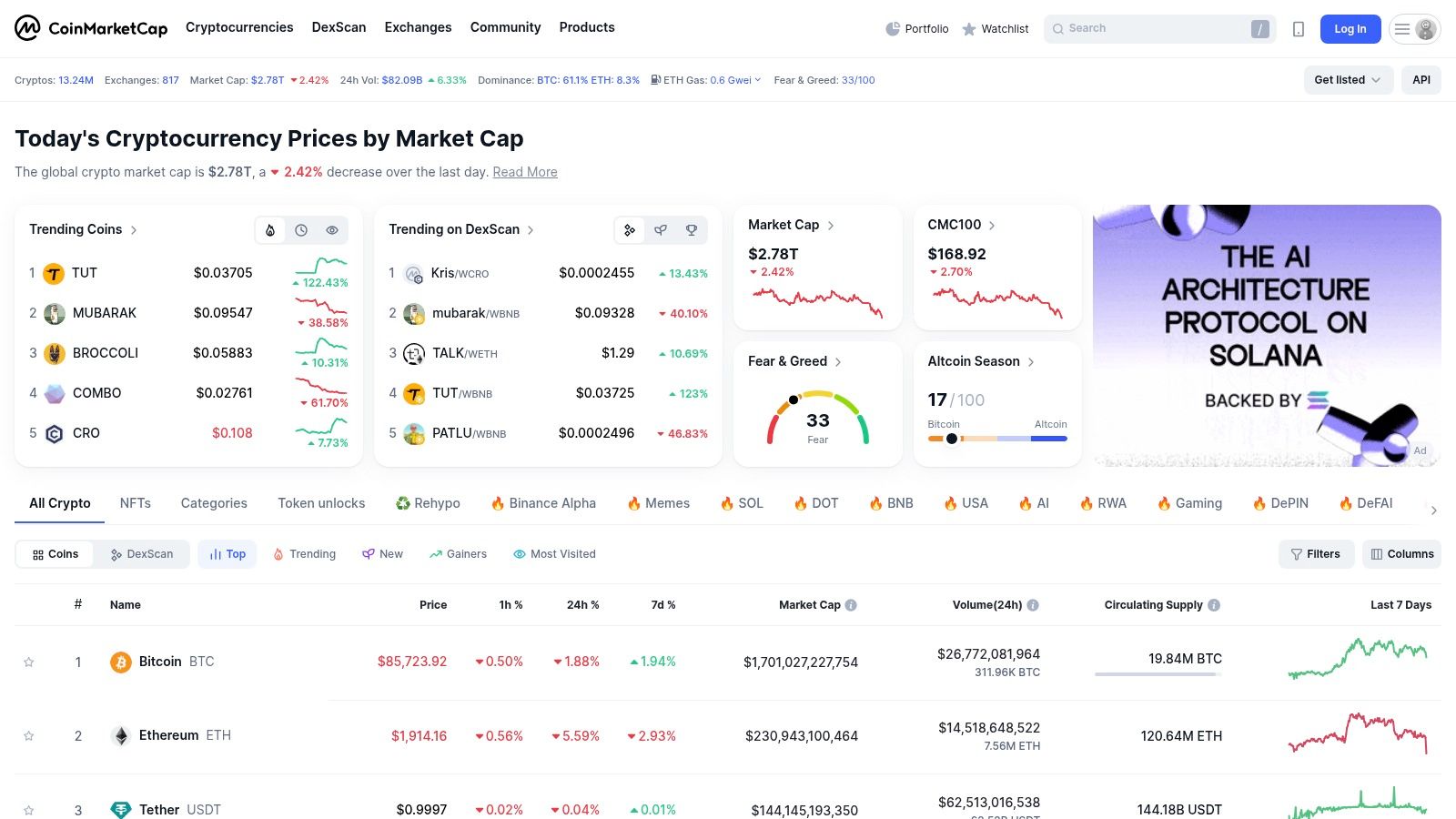

Launched in 2013, CoinMarketCap has become a cornerstone of the cryptocurrency ecosystem. Widely recognized as the leading data aggregator for cryptocurrencies, it serves a diverse user base, from casual onlookers to seasoned institutional investors. The platform offers a comprehensive overview of the crypto market, tracking prices, trading volumes, and market capitalizations for over 20,000 cryptocurrencies. Its 2020 acquisition by Binance raised some concerns regarding potential conflicts of interest, but also fueled expansion and feature development.

CoinMarketCap's breadth of coverage is impressive. It offers a centralized platform to track a vast array of crypto assets and exchanges. This makes it invaluable for both market analysis and portfolio management. Free access to basic market data provides a low barrier to entry for beginners, while more in-depth data and tools, available through a subscription service, cater to the needs of advanced users.

Real-Time Price Tracking: Access up-to-the-minute price data for thousands of cryptocurrencies, allowing for swift reactions to market fluctuations.

Detailed Market Data: Beyond simple price tracking, CoinMarketCap delivers essential metrics such as trading volume, liquidity, and market dominance. These deeper insights provide a more nuanced view of market dynamics and help identify trends and investment opportunities.

CMC Alexandria: This educational resource hub provides valuable information and context related to the cryptocurrency market, guiding newcomers through the intricacies of blockchain technology and digital assets.

Portfolio Tracking & Price Alerts: Create personalized portfolios to track your crypto holdings and set price alerts to notify you of significant price movements. This feature is particularly valuable for active traders.

Exchange Rankings & Watchlists: Compare and analyze various cryptocurrency exchanges using metrics like trading volume and liquidity. Create watchlists to monitor specific cryptocurrencies and exchanges of interest.

Market Overview: Get a quick snapshot of the current cryptocurrency market, including top gainers and losers.

Price Discovery: Easily determine the current market price of a specific cryptocurrency across multiple exchanges.

Due Diligence: Research new cryptocurrency projects and evaluate their market performance before making investment decisions.

Portfolio Management: Track the performance of your cryptocurrency holdings over time.

Exchange Selection: Select reputable cryptocurrency exchanges based on their rankings, features, and other relevant factors.

Pros:

Cons:

Pricing: Basic market data is free. Subscription pricing for enhanced features is available on the CoinMarketCap website.

Technical Requirements: Access to the internet via a web browser or mobile device.

Comparison with Similar Tools: While competitors like CoinGecko offer overlapping functionalities, CoinMarketCap remains a popular choice due to its wide coverage and user-friendly design.

Implementation/Setup Tips: Visit https://coinmarketcap.com/ to access the platform. Creating a free account unlocks personalized features like portfolio tracking and price alerts.

Despite some limitations, CoinMarketCap remains a valuable tool for anyone engaged in the cryptocurrency market. Its comprehensive data, user-friendly interface, and free access to basic market data make it a popular platform for both new and experienced crypto enthusiasts. Users should, however, be mindful of the platform's dependence on aggregated data and the potential for bias stemming from its connection to Binance. Supplementing your research with other sources is always recommended.

Santiment distinguishes itself by focusing on behavioral analytics and social sentiment within the crypto market. While other platforms often prioritize on-chain metrics and price charts, Santiment explores the psychological factors driving market trends. This allows investors to assess overall sentiment, identify potential FOMO (Fear Of Missing Out) or FUD (Fear, Uncertainty, and Doubt) influences, and make more informed decisions.

For investors, traders, and analysts, understanding market psychology is as critical as technical analysis. Santiment bridges this gap by integrating on-chain data with social media activity and development metrics. A sudden surge in positive social sentiment for a particular altcoin, combined with rising developer activity on GitHub, could signal an impending price increase. Conversely, a spike in negative sentiment, coupled with large transactions moving funds off exchanges, might suggest an upcoming correction.

Social Sentiment Analysis: Santiment gathers and analyzes social media discussions from platforms like Twitter, Reddit, and crypto forums. This provides insights into prevailing sentiment towards various projects, helping identify trending topics, gauge community reactions, and anticipate market shifts.

Developer Activity Metrics: Tracking GitHub contributions offers a valuable assessment of a project's health and development progress. Increased activity often signals active development and innovation, while declining activity could be a warning sign.

Whale Transaction Monitoring: Monitoring large holder transactions allows users to observe whale behavior, a key factor influencing market movements. Understanding whale accumulation or distribution patterns can offer valuable predictive insights.

Network Growth and Usage Metrics: Analyzing metrics like active addresses and transaction volume provides insights into network activity and blockchain adoption.

Unique Focus on Social Sentiment: Santiment’s emphasis on social sentiment as a leading indicator sets it apart.

Comprehensive Tracking of Development Activity: The platform offers detailed analysis of project development, enabling thorough technical assessments.

User-Friendly Dashboards: Complex data is presented in an accessible and actionable format.

Holistic Analysis: Combining multiple data sources provides a comprehensive market overview.

Subscription Required for Full Access: Full access requires a subscription starting at $49/month, potentially limiting access for some users. The free tier offers limited historical data and restricted features.

Limited Historical Data in Free Tier: Restricted historical data in the free tier can hinder backtesting and in-depth historical analysis.

Sentiment Analysis Can Produce False Signals: Social sentiment can be manipulated and isn't always a reliable price predictor.

Coverage Focused Mostly on Larger Market Cap Projects: While covering a range of projects, Santiment primarily focuses on larger market cap assets.

Accessing Santiment is simple. Visit their website (https://santiment.net/) and create an account. The free tier offers a starting point for exploring the platform. For advanced features and historical data, a paid subscription is recommended.

While platforms like Glassnode and Messari provide on-chain analytics, Santiment’s inclusion of social sentiment and developer activity data offers a more comprehensive understanding of market dynamics. This combined approach makes it a valuable tool for investors seeking insights beyond numerical metrics.

For researchers, portfolio managers, and content creators, Santiment's data-driven insights offer a unique perspective that can inform investment strategies, content creation, and a more nuanced understanding of the crypto market.

The Block distinguishes itself through rigorous, institutional-grade research and in-depth analysis of the digital asset market. Founded in 2018, it has quickly gained recognition for its thorough due diligence and factual reporting. While its primary audience is professional, the insights offered are invaluable for serious crypto investors, researchers, and analysts seeking a deeper understanding of market trends, regulatory shifts, and emerging sectors within the crypto space.

For institutional investors, portfolio managers, and analysts, The Block Research provides crucial data-driven insights for navigating the complexities of the crypto market. Their premium research reports offer deep dives into specific sectors.

These sectors include DeFi, NFTs, and mining, analyzing market dynamics, competitive landscapes, and regulatory implications. This information empowers institutions to make well-informed investment decisions and develop robust strategies. The Block's Genesis subscription further enhances access to exclusive research, data, and analytical tools.

Crypto researchers and content creators can utilize The Block's publicly available resources, such as their daily newsletter and articles, to stay informed on key industry developments. This content provides valuable context for understanding market movements and evaluating project potential. Furthermore, The Block's coverage of regulatory developments is particularly useful for navigating the evolving legal landscape surrounding cryptocurrency.

Pros:

Cons:

Website: https://www.theblock.co/

While the premium research may be expensive for individual investors, subscribing to The Block's free daily newsletter provides a valuable way to stay updated on key industry developments. For those considering premium research, carefully assess the cost-benefit based on individual investment needs and the required depth of analysis.

Similar to Delphi Digital and Messari, The Block caters to institutional investors with its comprehensive research offerings. However, unlike platforms like TradingView or Coinglass, which prioritize charting and technical analysis tools, The Block's core focus remains on fundamental research and market intelligence.

By incorporating The Block’s insights into your research process, you can gain a more nuanced understanding of the factors influencing the cryptocurrency market. This enhanced understanding can contribute to making better-informed investment decisions. However, potential subscribers should be prepared for a significant financial investment to fully utilize their premium research services.

CryptoQuant stands out as a powerful on-chain analytics platform designed for understanding Bitcoin and Ethereum market dynamics. Unlike platforms that merely aggregate price data, CryptoQuant delves into the blockchain itself. It provides valuable insights into exchange flows, miner behavior, and whale activity: factors often signaling impending market shifts. This makes it particularly useful for serious traders and investors seeking an advantage in the volatile cryptocurrency market.

One of CryptoQuant's core strengths is its visualization of complex on-chain data. Metrics like "Exchange Netflow" are displayed in easy-to-understand charts, allowing users to quickly grasp the net movement of cryptocurrencies into and out of exchanges. This can provide crucial clues about potential buying or selling pressure.

For example, a sustained net outflow from exchanges could suggest accumulation by long-term holders, a potentially bullish signal. Monitoring "Miner Position Change" can also offer insights into miner selling behavior, which can influence short-term price action.

CryptoQuant integrates futures market data, offering a broader perspective beyond its core on-chain metrics. This provides a more holistic view of the market landscape. The platform's alert system notifies users of significant on-chain movements, enabling proactive trading decisions.

While platforms like Glassnode and Nansen offer broader cryptocurrency coverage, CryptoQuant’s focus on Bitcoin and Ethereum, combined with its intuitive interface, makes it an excellent choice for those interested in these two dominant cryptocurrencies.

Here’s a quick breakdown of the advantages and disadvantages:

| Pros | Cons |

|---|---|

| Focused on exchange flows as indicators | Premium features require a paid subscription |

| User-friendly data visualization | Primarily focused on Bitcoin and Ethereum |

| Community insights from analysts | Advanced features have a steep learning curve |

| Valuable free tier metrics | Some data interpretation requires technical knowledge |

Start with the free tier to familiarize yourself with the platform and its core metrics. Focus on understanding the implications of exchange flows and miner behavior. As your understanding grows, consider a paid subscription for more advanced features and historical data. Be prepared to invest time in learning on-chain analysis.

Website: https://cryptoquant.com/

In summary, CryptoQuant empowers investors with tools to analyze on-chain data and make more informed trading decisions. While premium features come at a cost (starting at $30/month), the insights gained can be invaluable for serious crypto investors.

| Platform | Core Features ✨ | Quality ★ | Value Proposition 💰 | Audience 👥 |

|---|---|---|---|---|

| 🏆 Coindive | Real-time alerts, AI-driven context | ★★★★ (intuitive & customizable) | Actionable insights cutting through noise | Investors, traders, enthusiasts |

| CoinDesk | News, price tracking, research reports | ★★★★ (trusted journalism) | Authoritative crypto news | Beginners & professionals |

| Messari | In-depth research, detailed analytics | ★★★★ (data-driven rigor) | Pro-grade market transparency | Institutions & advanced investors |

| Glassnode | On-chain analytics, proprietary indicators | ★★★★ (data-rich, insightful) | Deep blockchain intelligence | Technical analysts & researchers |

| CoinMarketCap | Real-time tracking, extensive market data | ★★★☆ (accessible & broad) | Comprehensive crypto statistics | Newcomers & casual investors |

| Santiment | Social sentiment, developer activity metrics | ★★★☆ (holistic & integrated) | Behavioral market insights | Crypto enthusiasts & analysts |

| The Block | Institutional research, in-depth reports | ★★★★ (professional, thorough) | Advanced industry analysis | Professional investors & firms |

| CryptoQuant | Exchange flows, miner data, on-chain metrics | ★★★☆ (specialized & technical) | Advanced on-chain market intelligence | Data analysts & institutions |

Choosing the right crypto research tools hinges on individual needs and investment goals. Active traders focused on short-term market movements might prioritize real-time data and charting tools like CryptoQuant or Glassnode. Meanwhile, fundamental analysts, those who evaluate assets based on underlying value, may find in-depth reports from resources like Messari or CoinDesk more valuable.

Blockchain developers, on the other hand, could benefit from industry news and technical analysis provided by platforms like The Block. Content creators and community managers can gain insights into market sentiment and social trends through sentiment analysis platforms like Santiment. For a broader overview of market trends and overall cryptocurrency data, CoinMarketCap remains a valuable resource.

Getting started with these platforms often involves account creation. Many offer free tiers with limited access, enabling users to explore basic functionalities. Premium features often come with subscription fees, making budget considerations an important factor in platform selection. Carefully assess which features truly align with your research needs to optimize your investment in research tools.

Beyond financial cost, resource considerations also include time commitment. Some platforms demand more time for effective navigation and data interpretation. Consider the complexity of the platform and the learning curve associated with mastering its tools. This time investment should be factored into your research process.

Integration and compatibility with existing tools are also crucial. Evaluate whether the chosen platform integrates seamlessly with your existing trading tools or portfolio trackers. Some platforms offer API access, allowing for deeper integration and custom analysis. This level of integration can significantly streamline your workflow and enhance your research capabilities.

Based on our exploration of leading crypto research platforms, several key takeaways emerge:

Data is king: Accurate and reliable data forms the cornerstone of sound investment decisions. Scrutinize the data sources and methodologies employed by each platform.

Context is crucial: Raw data without interpretation can be misleading. Look for platforms that provide context, analysis, and insights to make sense of market trends.

Community insights matter: Understanding market sentiment and the dynamics of online communities can provide valuable signals for investment decisions. Consider platforms that offer sentiment analysis and community engagement metrics.

Tailor your toolkit: No single platform suits every investor. Select the tools that align most effectively with your specific research needs and investment style. A customized toolkit will optimize your research efforts and lead to more informed decisions.

The crypto market is characterized by its dynamic and complex nature. Constant vigilance and informed decision-making are essential for success. Coindive offers a streamlined approach, delivering project updates, community insights, and AI-driven context to empower data-driven decisions.