Sound crypto investing requires robust research. This listicle provides 10 essential crypto research tools to empower you with data-driven insights for navigating the 2025 market. These tools address the challenge of accessing reliable and comprehensive cryptocurrency data, offering features for on-chain analysis, market tracking, and sentiment evaluation. Whether you're analyzing Bitcoin's price action, researching DeFi protocols, or evaluating altcoin potential, these crypto research tools—including Coindive, Glassnode, CoinMarketCap, Santiment, TradingView, CryptoQuant, DeFi Llama, Nansen, Messari, and Token Terminal—will elevate your analysis.

Coindive positions itself as the all-in-one crypto community and market tracker, aiming to streamline the research process for crypto investors by providing actionable insights derived from a comprehensive analysis of social media and market trends. This tool goes beyond simply aggregating data; it attempts to filter out the noise and present clear, concise visualizations of community performance, enabling users to identify genuine engagement and emerging opportunities. This focus on actionable intelligence makes it a valuable tool for various stakeholders in the crypto space, from casual enthusiasts to seasoned traders and analysts.

One of Coindive’s core strengths lies in its comprehensive social monitoring capabilities. It tracks conversations across major platforms like Twitter, Telegram, Discord, and Reddit, providing a holistic view of community sentiment and activity surrounding specific crypto projects. This feature allows users to stay ahead of the curve by identifying shifting sentiment, popularity surges, and key announcements directly from the source. Furthermore, customizable alerts empower users to focus on specific metrics and receive real-time notifications regarding social activity, sentiment changes, and important project updates. For example, a trader could set alerts for sudden increases in positive sentiment around a specific altcoin, potentially signaling an upcoming price rally. Similarly, a crypto content creator can monitor community discussions to identify trending topics and tailor their content accordingly.

Coindive distinguishes itself from other crypto research tools with its AI-powered price alerts. These alerts go beyond simple price triggers by providing crucial context, linking price movements to broader market events, sector trends, and project-specific updates. This contextualized information allows investors to make more informed decisions, understanding the "why" behind price fluctuations rather than just the "what." This feature is particularly valuable for altcoin investors and portfolio managers who need to navigate the volatile altcoin market. While other tools may offer basic price alerts, Coindive’s AI-driven approach aims to provide a deeper understanding of the factors driving market dynamics.

While Coindive offers a compelling suite of features, some potential drawbacks exist. New users may face a learning curve due to the platform's extensive functionalities and data-rich interface. Navigating the dashboard and configuring customized alerts may require some initial exploration. Additionally, specific pricing details for Coindive's subscription plans are not readily available on the website, which may require potential users to inquire directly. This lack of transparency could be a deterrent for budget-conscious investors.

Pros:

Cons:

Website: https://coindive.app

Coindive earns its place on this list of top crypto research tools by offering a unique blend of social listening, AI-powered insights, and market tracking. Its ability to filter out the noise and deliver actionable intelligence makes it a powerful tool for anyone serious about navigating the complexities of the cryptocurrency market. While further transparency regarding pricing would be beneficial, the platform’s comprehensive features and focus on contextualized data make it a valuable asset for crypto investors, traders, and analysts alike.

Glassnode stands out among crypto research tools for its comprehensive on-chain analytics and market intelligence, catering to serious investors and institutions. It aggregates data from a multitude of blockchains, transforming raw data into actionable insights through intuitive dashboards and advanced metrics. This makes it a powerful tool for understanding market trends, investor behavior, and the underlying health of various cryptocurrencies. If you're looking for in-depth on-chain analysis to inform your investment strategies, Glassnode deserves a closer look.

Glassnode provides a suite of features designed for advanced crypto research. Customizable charts and dashboards allow you to visualize on-chain metrics tailored to your specific needs. Key indicators like Spent Output Profit Ratio (SOPR), Market Value to Realized Value (MVRV), and Network Value to Transactions (NVT) ratio offer insights into market cycles and potential bubbles. The platform enables multiple timeframe analysis, letting you examine historical trends across different cryptocurrencies, including Bitcoin, Ethereum, and others. Furthermore, Glassnode publishes institutional-grade research reports and provides API access for integrating data into custom platforms, facilitating algorithmic trading and personalized analysis.

Practical Applications and Use Cases:

Pricing and Technical Requirements:

Glassnode offers tiered subscription plans, ranging from free limited access to high-end institutional packages. The pricing increases with the level of data access and features offered. While specific pricing isn't always publicly available, it's generally considered a premium service compared to free crypto research tools. There are no specific technical requirements other than a stable internet connection and a web browser.

Comparison with Similar Tools:

While other platforms like Santiment and CryptoQuant offer similar on-chain analytics, Glassnode distinguishes itself through its data depth, visualization tools, and regular expert-driven research reports. Its comprehensive coverage of various blockchains makes it a one-stop shop for serious crypto researchers.

Implementation and Setup Tips:

Start with the free tier to familiarize yourself with the platform and its features. Explore the pre-built dashboards and experiment with customizing charts. If you require more advanced features and data, consider upgrading to a paid subscription. The learning curve can be steep for beginners, so take advantage of Glassnode’s documentation and educational resources.

Pros:

Cons:

Website: https://glassnode.com

In conclusion, Glassnode is a powerful crypto research tool for investors seeking in-depth on-chain analytics. While it comes with a premium price tag, its comprehensive data and sophisticated features make it a valuable resource for serious crypto investors, traders, analysts, and researchers. By leveraging its insights, you can gain a deeper understanding of the crypto market and make more informed investment decisions.

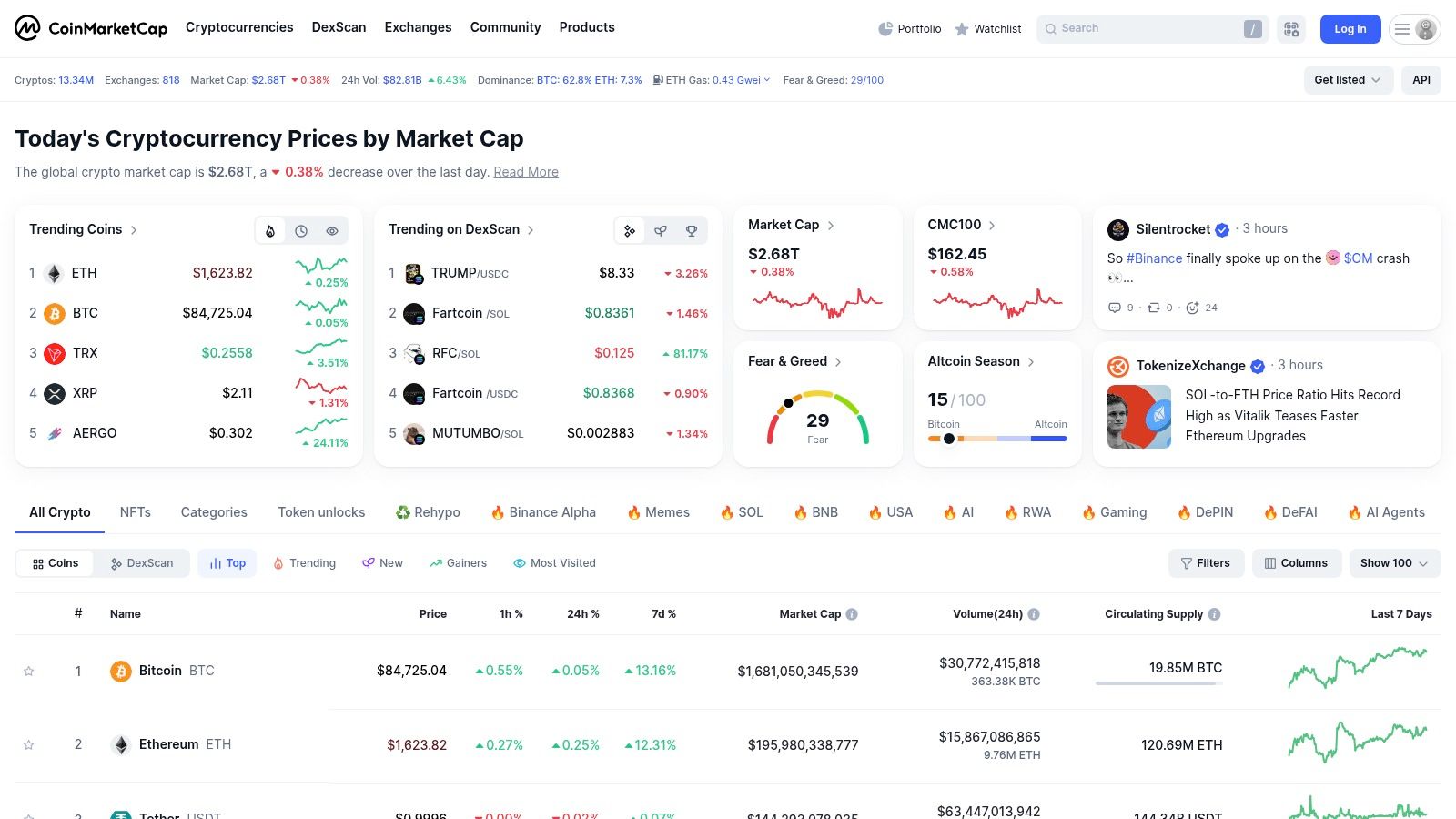

CoinMarketCap is a cornerstone resource for anyone involved in the cryptocurrency space, making it a crucial addition to any crypto research tool kit. It provides a bird's-eye view of the crypto market, offering real-time data on thousands of cryptocurrencies, from established players like Bitcoin and Ethereum to emerging altcoins. This breadth of information makes it invaluable for tracking market trends, comparing asset performance, and identifying potential investment opportunities. Whether you're a seasoned trader, a casual investor, or a crypto content creator, CoinMarketCap likely has something to offer. It's a powerful tool for understanding the current state of the crypto market and informing investment decisions.

One of CoinMarketCap's key strengths lies in its user-friendly interface. Even those new to crypto can easily navigate the platform and access essential information such as real-time price data, market capitalization rankings, and historical price charts. This accessibility expands its utility beyond experienced traders and analysts, making it a valuable resource for beginners just starting their crypto journey. More sophisticated users will appreciate features like exchange volume tracking, which can be used to gauge market liquidity and identify potential arbitrage opportunities. The watchlist functionality allows users to monitor specific cryptocurrencies and receive alerts on price movements, streamlining the research process.

Beyond basic market data, CoinMarketCap offers additional tools for deeper crypto research. Its "Alexandria" platform provides educational resources on various aspects of the cryptocurrency market, including blockchain technology, decentralized finance (DeFi), and specific crypto projects. This educational component can be particularly useful for those looking to broaden their understanding of the underlying technologies and trends driving the market. Furthermore, CoinMarketCap offers portfolio tracking tools, allowing users to monitor the performance of their crypto holdings across different exchanges and wallets. This feature simplifies portfolio management and provides valuable insights into investment performance.

While CoinMarketCap is largely free to use, access to some advanced features, such as historical data downloads and API access, requires a paid subscription. This tiered pricing model allows users to choose the level of access that best suits their needs. It's worth noting that while CoinMarketCap strives for accuracy, occasional data discrepancies can occur due to variations in reporting from different exchanges. For the most accurate data, cross-referencing information with other reputable sources is recommended. Furthermore, CoinMarketCap's on-chain analysis capabilities are limited compared to specialized blockchain explorers. For in-depth on-chain data, platforms like Glassnode or CryptoQuant may be more suitable.

Pros:

Cons:

Website: https://coinmarketcap.com

In conclusion, CoinMarketCap’s comprehensive data, user-friendly interface, and free access to core features solidify its place as a go-to crypto research tool. While it may not be the ideal platform for highly specialized on-chain analysis, its breadth of coverage and accessibility make it indispensable for anyone looking to navigate the dynamic world of cryptocurrencies. Whether you are a hodler, altcoin investor, crypto portfolio manager, or institutional investor, CoinMarketCap offers a valuable suite of tools to inform your crypto research and investment strategies.

Santiment is a powerful crypto research tool designed for serious investors and analysts seeking a deeper understanding of market dynamics. Unlike traditional technical analysis tools, Santiment emphasizes behavioral analytics and social sentiment, providing a unique perspective on market trends. It achieves this by combining on-chain data, social media metrics, and development activity insights, allowing users to identify potential opportunities or risks before they become widely apparent. This makes it a valuable addition to any crypto researcher's toolkit.

For example, imagine tracking the social sentiment around a particular altcoin. A sudden surge in positive mentions across platforms like Twitter, Reddit, and Telegram, coupled with increased developer activity on the project's GitHub repository, as identified by Santiment, could signal growing interest and potential price appreciation. Conversely, a spike in negative sentiment combined with declining developer activity could foreshadow trouble. This focus on behavioral analytics sets Santiment apart from other crypto research tools that primarily focus on price and volume data.

Santiment’s key features include social media sentiment analysis across various platforms, developer activity tracking, on-chain metrics such as whale transaction monitoring, and a custom alerting system for price movements and specific metrics. Its NLP-powered news filtering and analysis further helps users cut through the noise and focus on relevant information. This comprehensive suite of tools allows for a multifaceted approach to crypto research, enabling users to make more informed investment decisions.

While Santiment offers several unique advantages, including its social sentiment indicators and focus on developer activity, it's essential to consider the potential drawbacks. The platform's subscription cost can be relatively high for full access, potentially creating a barrier to entry for some users. Furthermore, certain metrics might be challenging to interpret without sufficient context, requiring a learning curve for novice users. Lastly, limited historical data access in lower-tier plans might restrict the depth of analysis for budget-conscious users.

Similar tools like Glassnode and IntoTheBlock also offer on-chain analytics, but Santiment distinguishes itself with its comprehensive social sentiment analysis. Glassnode focuses more on providing raw on-chain data, while IntoTheBlock offers a more simplified user interface. Santiment strikes a balance, offering advanced metrics alongside user-friendly visualizations.

Pricing: Santiment offers various subscription tiers, ranging from free access with limited features to enterprise-level plans with custom data feeds. Specific pricing details can be found on their website.

Technical Requirements: Santiment is a web-based platform, requiring no specific software installation. A stable internet connection and a modern web browser are sufficient for accessing the platform's features.

Implementation/Setup Tips: Start with a free account to explore the platform's features and identify the metrics most relevant to your investment strategy. Consider upgrading to a paid plan for access to historical data and advanced analytics. Santiment’s customizable dashboards allow users to tailor the platform to their specific research needs.

Website: https://santiment.net

Santiment earns its place on this list of crypto research tools due to its unique approach to market intelligence. By incorporating social sentiment, developer activity, and on-chain data, Santiment offers a comprehensive view of the crypto market, empowering users to make more informed decisions. While the cost may be a factor, the platform's powerful insights can provide a significant edge for serious crypto investors and analysts.

TradingView is a robust charting platform and a must-have among crypto research tools for serious traders and analysts. It offers a comprehensive suite of features that go far beyond basic price charts, empowering users to perform in-depth technical analysis and explore potential trading opportunities in the cryptocurrency market. While applicable to both traditional and crypto markets, its extensive cryptocurrency coverage makes it a valuable asset for crypto research. It's not simply a charting tool; it’s a platform that combines advanced technical analysis with social networking, allowing users to share and discuss trading ideas, further enhancing the research process.

TradingView’s strength lies in its advanced charting capabilities. With hundreds of built-in technical indicators, from the classic Relative Strength Index (RSI) and Moving Averages (MA) to more esoteric studies, traders can meticulously analyze price action and identify potential entry and exit points. The platform also allows users to create their own custom indicators using Pine Script, TradingView's proprietary scripting language, providing unparalleled flexibility for experienced traders. This allows for backtesting trading strategies and developing custom alerts, further enriching the crypto research process.

Beyond charting, TradingView functions as a social network for traders. Users can share their chart setups, trading ideas, and analyses with the community, fostering a collaborative learning environment. This social aspect allows less experienced users to learn from seasoned professionals and gain different perspectives on the market. Following experienced traders and observing their analyses can provide valuable insights into market sentiment and potential trading strategies. Furthermore, TradingView's multi-timeframe analysis capabilities allow users to analyze price action across various timeframes, from minutes to years, providing a holistic view of market trends. Its screener tools help identify trading opportunities based on specific criteria, saving valuable research time.

While TradingView offers a free tier with basic functionality, the free version has limitations regarding the number of alerts and saved chart layouts. Upgrading to a paid subscription unlocks additional features like more indicators, chart layouts, and alerts. Several paid tiers cater to different needs and budgets, offering increasing functionality with each level. While there are no specific technical requirements beyond a web browser or mobile device, the learning curve for advanced features, especially Pine Script, can be steep. One notable drawback is the lack of native on-chain data integration. While price data is comprehensive, traders seeking on-chain metrics for deeper fundamental analysis will need to supplement TradingView with other crypto research tools.

Compared to other charting platforms, TradingView offers a more comprehensive and customizable experience. While platforms like Coinigy and Cryptowatch offer similar functionalities, TradingView’s extensive indicator library, social networking features, and the power of Pine Script set it apart. To begin using TradingView for crypto research, simply create a free account and start exploring the available charts and indicators. Familiarize yourself with the drawing tools and basic indicators before delving into the more advanced features. Joining the community and exploring publicly shared ideas can provide valuable learning opportunities.

For crypto investors, enthusiasts, traders, analysts, and even content creators, TradingView offers a robust platform to perform in-depth technical analysis, explore trading ideas, and share insights. Its place in this list of crypto research tools is well-deserved, solidifying its position as a leader in the charting and technical analysis space. Its comprehensive features, combined with the collaborative environment of its social network, make it an invaluable tool for anyone serious about navigating the complexities of the cryptocurrency market. You can explore TradingView and its features by visiting https://www.tradingview.com.

CryptoQuant earns its place among the top crypto research tools by offering specialized, institutional-grade on-chain data analytics primarily focused on Bitcoin and Ethereum. For serious investors and traders seeking in-depth insights into market dynamics, CryptoQuant offers a powerful lens through which to interpret on-chain activity and anticipate potential market movements. This platform distinguishes itself by its meticulous tracking of exchange flows, miner behavior, and derivatives markets, offering a unique perspective beyond basic price charts.

CryptoQuant's strength lies in its ability to provide actionable intelligence derived from on-chain data. For example, tracking exchange inflows and outflows can offer insights into potential buying or selling pressure. Monitoring miner behavior, such as miner reserve changes, can signal potential shifts in market sentiment. Derivatives market analytics provide valuable context for understanding open interest and funding rates, helping traders gauge the overall market positioning. The platform’s customizable alerts empower users to stay ahead of significant on-chain movements, enabling quick reactions to developing market trends. This granular level of analysis makes CryptoQuant particularly suitable for institutional investors, professional traders, and serious crypto researchers who require sophisticated tools for market analysis.

Compared to broader crypto research tools like Glassnode or Messari, which offer comprehensive coverage of a wider range of cryptocurrencies, CryptoQuant adopts a more specialized approach. This focused approach allows for a deeper dive into the Bitcoin and Ethereum ecosystems. While this specialization might be a con for those interested in altcoin analysis, it serves as a significant pro for Bitcoin and Ethereum focused investors. CryptoQuant also provides excellent coverage of Korean exchanges, making it a valuable resource for understanding market dynamics within this significant region of the crypto market.

CryptoQuant offers different tiered subscription plans, with higher tiers unlocking access to more comprehensive data sets and features. While the basic plan provides access to core functionalities, professional traders may find the higher tiers necessary to unlock the full potential of the platform. Technical requirements are minimal, with access primarily through a web browser. Setup is straightforward, involving account creation and subscription selection.

Implementation tips for effective use of CryptoQuant include focusing on key indicators relevant to your investment strategy, utilizing the customizable alert system to monitor critical on-chain movements, and combining on-chain insights with other market data for a holistic view. While CryptoQuant provides powerful analytical tools, it’s crucial to remember that on-chain data is just one piece of the puzzle and should be used in conjunction with other research methods. CryptoQuant offers valuable resources, including educational materials and community forums, to help users maximize the platform’s potential. Overall, CryptoQuant is a robust crypto research tool specifically designed for those seeking in-depth analysis of Bitcoin and Ethereum on-chain activity. For investors and analysts needing a granular view of exchange flows, miner behavior, and derivatives markets, CryptoQuant deserves serious consideration. You can explore the platform and its offerings further at https://cryptoquant.com.

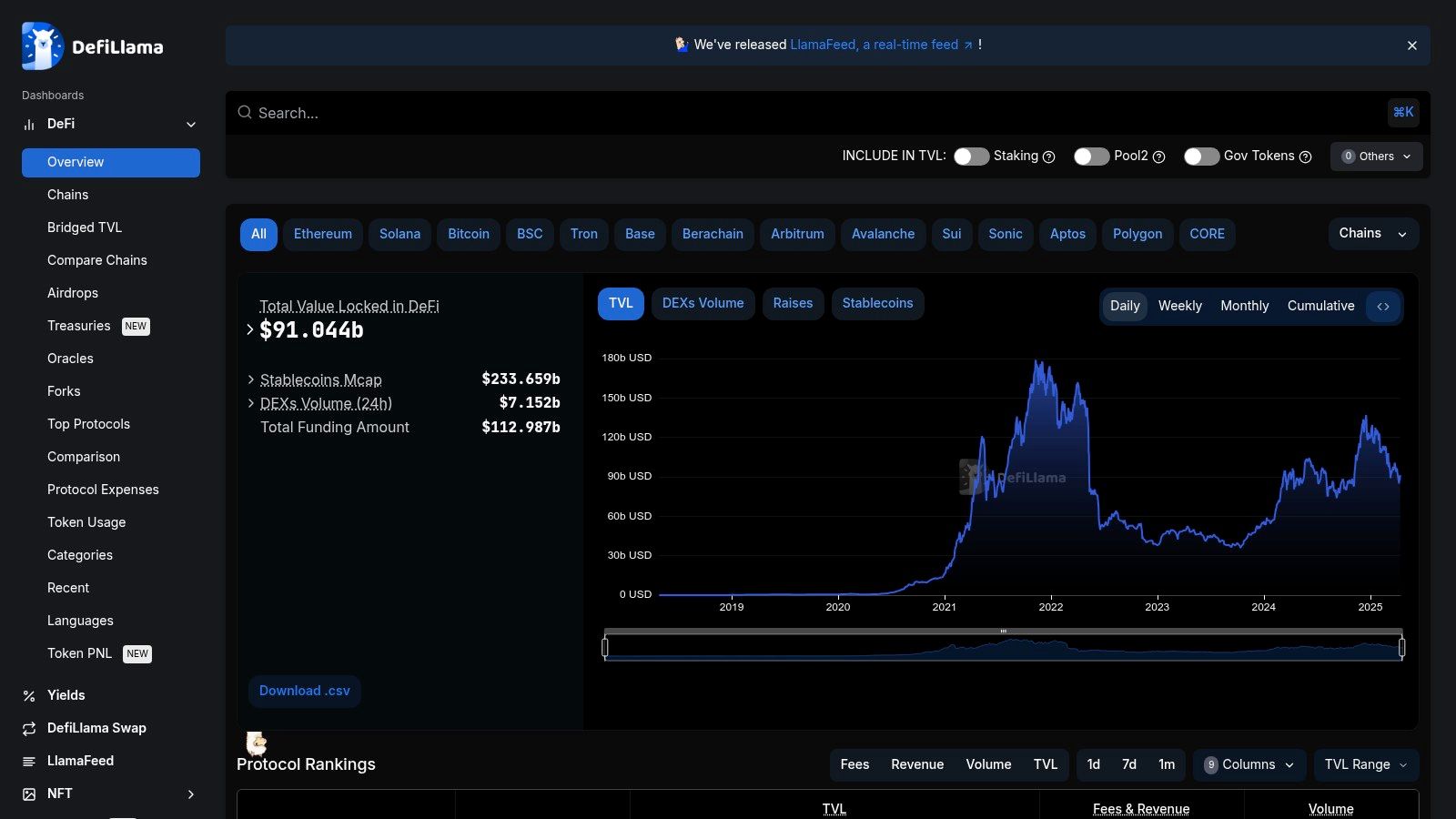

DeFi Llama has established itself as the leading Total Value Locked (TVL) aggregator in the decentralized finance (DeFi) space. This makes it an indispensable crypto research tool for anyone serious about understanding the DeFi landscape. Whether you're a seasoned investor, a blockchain developer, or a crypto content creator, DeFi Llama provides crucial data insights for making informed decisions. It offers a comprehensive overview of DeFi protocols across a multitude of blockchains, presenting data on liquidity, yields, and other key metrics. This allows researchers to analyze trends, compare protocols, and identify promising investment opportunities. Its depth of information and cross-chain coverage sets it apart as a must-have tool in any crypto researcher's arsenal.

DeFi Llama’s primary strength lies in its comprehensive TVL tracking. It aggregates data from hundreds of DeFi protocols across over 100 blockchains, providing a holistic view of the DeFi ecosystem. This cross-chain compatibility is essential in today's fragmented DeFi landscape. Researchers can easily compare the performance of different protocols, track the flow of capital between chains, and identify emerging trends. Furthermore, DeFi Llama offers historical TVL data and growth metrics, enabling users to analyze long-term trends and assess the overall health of the DeFi market. This historical context provides invaluable insights for researchers and investors alike.

Beyond TVL, DeFi Llama offers a wealth of information on yield farming opportunities, presenting data on various yield strategies across different platforms. This feature is particularly useful for investors seeking to maximize returns on their crypto holdings. Protocol-specific analytics and breakdowns offer deeper insights into individual DeFi platforms. This granular data empowers researchers to understand the mechanics of each protocol, assess its risks and rewards, and compare it to similar offerings. The platform also tracks stablecoins and bridges, offering a clear picture of the crucial infrastructure underpinning the DeFi ecosystem.

A significant advantage of DeFi Llama is its completely free and open-source nature. Unlike other crypto research tools that often employ tiered subscription models, DeFi Llama offers all its features without any cost, making it accessible to everyone. Its open-source approach encourages community contributions, ensuring data accuracy and continuous improvement.

While DeFi Llama excels in breadth of data, it does have some limitations. It offers limited technical analysis tools, which might be a drawback for advanced traders. Currently, there is no mobile app available, restricting access to desktop users. Occasionally, there can be delays in data updates for smaller, less popular protocols.

Despite these minor drawbacks, DeFi Llama’s comprehensive data, cross-chain coverage, and free access make it an invaluable crypto research tool. Its focus on DeFi makes it particularly relevant for investors, analysts, and developers working in the decentralized finance space. For anyone seeking to navigate the complex and ever-evolving world of DeFi, DeFi Llama is a must-have resource. You can explore the platform and its features at https://defillama.com.

Nansen stands out among crypto research tools by offering a powerful combination of on-chain data analysis and a sophisticated wallet labeling system. This allows users to move beyond raw transaction data and understand the "who" behind the movements, providing invaluable context for making informed investment decisions. This makes it a particularly potent tool for identifying emerging trends, conducting due diligence on projects, and understanding market sentiment. For those seeking a deeper dive into the motivations and actions of key players in the crypto market, Nansen offers a unique perspective.

Nansen's core strength lies in its ability to identify and label wallets of known entities, including institutional investors, venture capitalists, and prominent traders, often referred to as "smart money." By tracking the activities of these wallets, users can gain insights into which projects are attracting serious investment and potentially anticipate market movements. This feature sets Nansen apart from other on-chain analytics platforms that primarily focus on raw transaction data. For example, while platforms like Glassnode provide comprehensive blockchain metrics, Nansen adds a layer of social intelligence by revealing the actions of key players.

Beyond wallet tracking, Nansen offers robust NFT market analytics, including collection tracking and identification of trending projects. This feature is particularly useful for NFT investors and traders looking to identify promising new collections and understand market dynamics. Furthermore, Nansen's "Token God Mode" allows for deep analysis of token holder distributions, helping users identify whale concentrations and potential price manipulation risks. Smart alerts for significant wallet movements provide timely notifications of large transactions, enabling users to react quickly to market changes. Nansen also offers detailed dashboards for DeFi protocols, enabling analysis of user behavior and identification of emerging trends within the decentralized finance space.

While Nansen is a powerful tool, it's essential to consider its limitations. The platform operates on a subscription model with varying tiers, and the cost can be prohibitive for individual investors. Pricing ranges from several hundred to thousands of dollars per year depending on the chosen plan and the specific features included. The platform primarily focuses on Ethereum and EVM-compatible chains, limiting its utility for analyzing projects on other blockchains. Finally, the sheer volume of data presented can be overwhelming for new users, requiring some time and effort to navigate and effectively utilize the platform's features.

Despite these limitations, Nansen earns its place among top crypto research tools due to its unique wallet labeling system, superior NFT analytics, and intuitive interface. For serious investors and analysts, the actionable insights provided by Nansen can be invaluable, justifying the premium price. Implementation is straightforward, requiring only a subscription and account creation. No specific technical requirements are needed beyond a web browser and a stable internet connection. If you're looking to gain an edge in the crypto market by understanding the movements of "smart money," Nansen is a powerful tool worth considering. Visit their website at https://www.nansen.ai for more information.

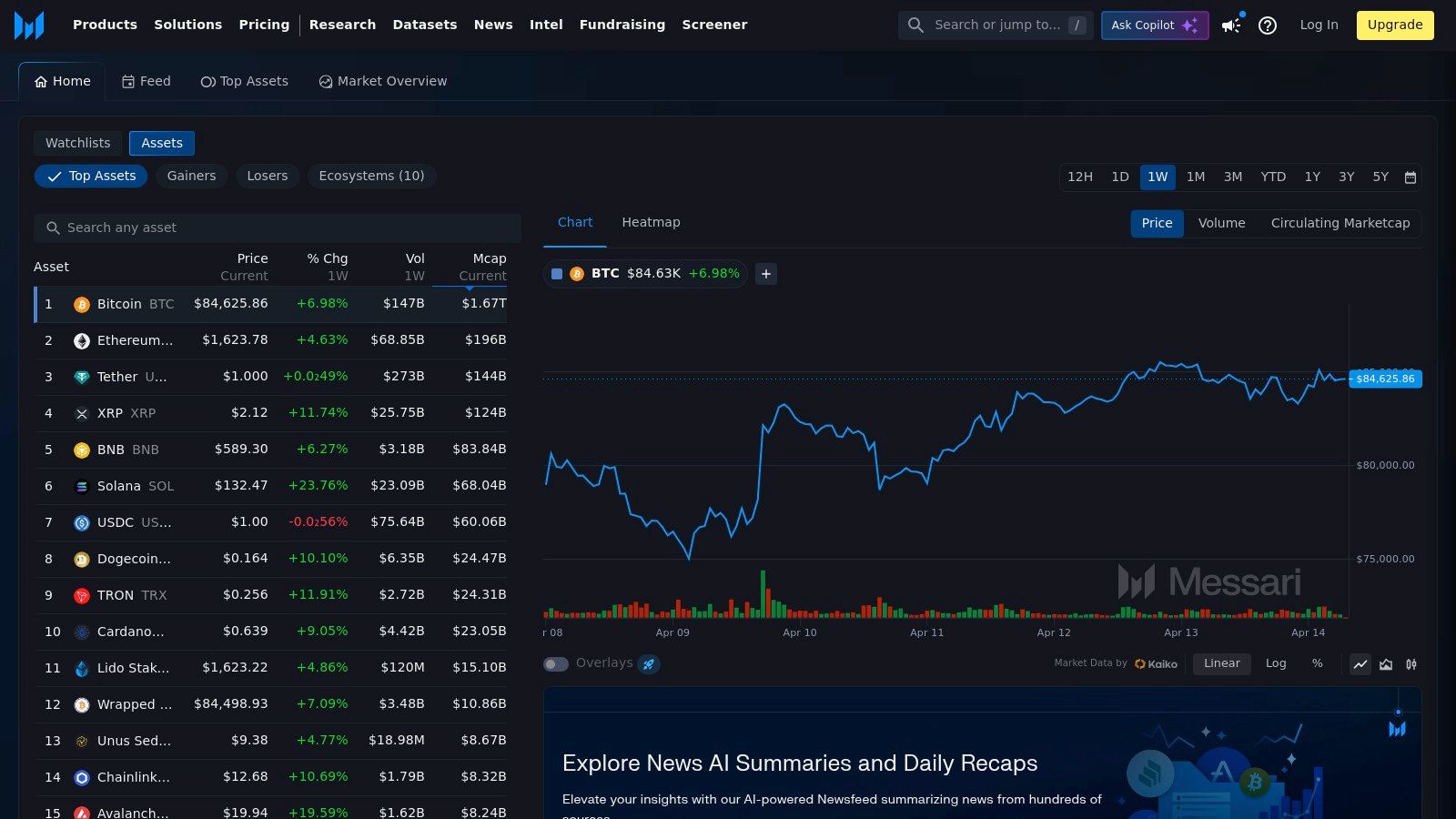

Messari is a powerful crypto research tool designed for serious investors, analysts, and researchers looking for in-depth market intelligence. It stands out among other crypto research tools by offering a comprehensive suite of features, including in-depth research reports, advanced asset screening, and a focus on governance and regulatory analysis, making it an invaluable resource for navigating the complex crypto landscape. Whether you're evaluating a new project, tracking market trends, or managing a portfolio, Messari provides the tools and data you need to make informed decisions.

One of Messari's key strengths lies in its professional research reports. These reports delve deep into specific projects and market trends, providing valuable insights not readily available elsewhere. Analysts explore tokenomics, competitive landscapes, regulatory hurdles, and other crucial factors, equipping users with a comprehensive understanding of the asset. While similar platforms like CoinGecko and CoinMarketCap offer basic project overviews, Messari’s research reports provide a significantly more analytical and nuanced perspective. This makes Messari a particularly valuable crypto research tool for those seeking a deeper understanding of the market.

Messari's screener tool is another standout feature, allowing users to compare crypto assets across a vast range of metrics. You can filter by market capitalization, trading volume, sector, and various other criteria to identify potential investment opportunities. This functionality is particularly useful for conducting comparative analyses and identifying undervalued projects. Combined with their standardized data presentation across hundreds of assets, Messari facilitates efficient and accurate comparisons, a crucial aspect of effective crypto research.

Furthermore, Messari offers unique insights into the governance of Decentralized Autonomous Organizations (DAOs). Tracking proposals, voting patterns, and treasury management, Messari provides valuable transparency into the decision-making processes of these increasingly important entities. This feature is particularly relevant for investors interested in participating in DAO governance or understanding the dynamics of decentralized projects. This focus on governance and regulatory analysis distinguishes Messari from many other crypto research tools.

While Messari’s free tier offers considerable functionality, including basic asset profiles and market data, access to the platform's most valuable features, like the full library of research reports and advanced screening tools, requires a paid subscription. These subscriptions can be expensive, which may be a barrier for some individual investors. Free users also experience delayed access to research reports, potentially impacting their ability to capitalize on timely market insights. Additionally, while Messari provides robust fundamental analysis, it lacks the real-time data feeds found in specialized trading platforms.

Pros:

Cons:

Website: https://messari.io

In conclusion, Messari earns its place on this list of top crypto research tools by offering a professional-grade platform for in-depth market intelligence. While the cost of a premium subscription might be a deterrent for some, the wealth of information and analytical tools provided make Messari a compelling choice for serious crypto investors, analysts, and researchers. Its combination of high-quality research, standardized data, and unique focus on governance makes it a valuable resource for anyone seeking to gain a competitive edge in the crypto market.

Token Terminal stands out among crypto research tools by offering a unique, finance-first perspective on cryptocurrency projects. Instead of focusing solely on technical analysis or on-chain metrics, Token Terminal applies traditional financial analysis principles to the crypto market. This approach makes it particularly valuable for investors seeking to evaluate crypto assets based on their fundamental financial health and potential for long-term growth, rather than simply riding short-term speculative waves. This platform allows you to delve into the financial performance of various protocols, treating them as businesses generating revenue and, in some cases, profit. This makes it an invaluable tool for those looking to conduct thorough due diligence and make informed investment decisions in the crypto space. It bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi), making crypto more accessible and understandable for institutional investors and those familiar with established financial analysis methods.

Token Terminal's core strength lies in its presentation of key financial metrics for a variety of crypto protocols. These metrics include revenue, profit, Price-to-Earnings (P/E) ratios, and Price-to-Sales (P/S) ratios. This data allows investors to compare the financial performance of different protocols and assess their relative valuations. The platform also provides historical financial performance data, enabling users to track trends and identify potential investment opportunities. Comparative analysis tools further facilitate the evaluation of different protocols side-by-side, making it easier to spot undervalued projects. Institutional users also benefit from API access, allowing them to integrate Token Terminal's data directly into their proprietary systems. You can learn more about Token Terminal and its features in this in-depth blog post.

While Token Terminal excels in its fundamental analysis approach, it's important to acknowledge its limitations. One drawback is its coverage, which primarily focuses on established protocols. Smaller or newer projects may not be included in its database. Additionally, some of the more advanced features, like detailed historical data and comparative analysis tools, often require a paid subscription. Finally, while Token Terminal offers valuable financial insights, it doesn't provide the same level of technical and on-chain data as some other specialized crypto research tools. Therefore, it's best used in conjunction with other resources for a more comprehensive analysis. This makes Token Terminal an excellent addition to any crypto research toolkit, particularly for those focused on fundamental analysis and long-term investment strategies. For those interested in specific pricing and technical requirements, it is recommended to visit the Token Terminal website directly for the most up-to-date information.

Pros:

Cons:

Website: https://tokenterminal.com

| Service | Core Features ✨ | User Experience ★ | Value Proposition 💰 | Target Audience 👥 | Notes |

|---|---|---|---|---|---|

| Coindive 🏆 | Multi-channel alerts, AI price context | Intuitive dashboard, customizable alerts | Noise filtering, actionable insights | Traders, Analysts, Enthusiasts | Backed by CoinGecko, robust community tracking |

| Glassnode | On-chain metrics, advanced dashboards | Detailed visuals, expert reports | Institutional-grade data | Investors, Institutions | Expensive, steep learning curve |

| CoinMarketCap | Real-time data, market cap rankings | User-friendly, broad coin coverage | Free access to essential data | Beginners, Retail traders | Some advanced features require payment |

| Santiment | Social sentiment, developer & on-chain tracking | Customizable dashboard, timely alerts | Early trend detection via behavioral data | Investors, Researchers | High subscription cost for full access |

| TradingView | Advanced charting, indicator tools | Robust charting, active community | Versatile for crypto & traditional markets | Traders, Analysts | Free tier has limited alerts & saves |

| CryptoQuant | Exchange flows, miner behavior analysis | Clean interface, quick alerts | Real-time on-chain analytics | Institutional traders | Niche focus, higher-tier plans needed |

| DeFi Llama | TVL tracking, protocol metrics | Open-source, comprehensive data | Free, largest DeFi TVL aggregator | DeFi researchers, Investors | Limited technical analysis tools |

| Nansen | Wallet labeling, smart alerts | Intuitive, actionable insights | Early trend detection via smart money | Professional traders, Analysts | Expensive, concentrated on Ethereum chains |

| Messari | Asset profiles, in-depth research | Standardized data presentation | Professional-grade crypto intelligence | Investors, Analysts | Pro features locked behind subscription |

| Token Terminal | Revenue, P/E analysis, financial metrics | Clean, straightforward UI | TradFi approach to crypto valuation | Long-term investors, TradFi | Limited coverage of smaller protocols |

Navigating the complexities of the cryptocurrency market requires more than just intuition; it demands robust research and data-driven insights. This article explored ten powerful crypto research tools—Coindive, Glassnode, CoinMarketCap, Santiment, TradingView, CryptoQuant, DeFi Llama, Nansen, Messari, and Token Terminal—each offering unique functionalities to cater to diverse research needs. From on-chain analytics and market intelligence to social sentiment analysis and DeFi-specific data, these platforms provide a comprehensive toolkit for any serious crypto enthusiast. Key takeaways include understanding the importance of triangulating data from multiple sources, recognizing the specific strengths of each tool, and aligning your research approach with your individual investment goals.

Choosing the right tool depends heavily on your specific needs. For example, if you're focused on on-chain metrics, Glassnode or CryptoQuant might be ideal. If you're interested in DeFi protocols, DeFi Llama is a valuable resource. For a broader market overview, platforms like CoinMarketCap and TradingView provide essential data. As your research progresses, remember to consider factors such as data accuracy, platform usability, and the depth of analysis offered. For investors interested in more traditional finance research alongside crypto, exploring robust financial risk assessment tools can provide a broader perspective on market dynamics. This resource from Discover Top Financial Risk Assessment Tools for 2025 from PDF AI can be a valuable addition to your research arsenal.

The crypto market is dynamic and constantly evolving. By consistently utilizing these crypto research tools and honing your analytical skills, you position yourself to make informed decisions and navigate the exciting world of digital assets with greater confidence. Start streamlining your research process and uncovering valuable insights today with Coindive, a powerful platform that aggregates and analyzes data from various sources, helping you make smarter crypto investment decisions.