The cryptocurrency market demands informed decisions. This listicle provides 10 essential research tools empowering you with the data necessary to navigate this complex space. From on-chain metrics and social sentiment to market trends and DeFi performance, these tools address the challenge of gathering reliable crypto intelligence. Discover resources like Coindive, CoinMarketCap, Glassnode, and more to enhance your crypto research and decision-making.

Coindive positions itself as an all-in-one crypto community and market intelligence platform, aiming to decipher the often chaotic world of digital currencies. Its core strength lies in aggregating real-time social data from various platforms like Twitter, Telegram, Discord, and Reddit, filtering out the noise and presenting actionable insights. This allows users to gauge community sentiment, track trending topics, and identify potential investment opportunities or red flags based on genuine community engagement, rather than manipulated hype. This is particularly valuable in the crypto space, where social sentiment can significantly impact asset prices. For example, a sudden surge in positive mentions of a particular altcoin across relevant Telegram groups, coupled with increased development activity reported on GitHub, could signal a potential price increase. Coindive helps identify these trends early on, allowing users to make more informed decisions.

Coindive's customizable alert system is a key feature, enabling users to receive timely notifications on specific events, including social activity spikes, shifts in community sentiment, custom keyword mentions, and even AI-driven price alerts. The platform's AI goes beyond simply notifying price changes; it attempts to provide context by linking those movements to broader market events and sector trends. This feature is particularly valuable for traders and analysts who need to understand the "why" behind price fluctuations, not just the "what." For instance, an AI-powered alert might notify a user of a sudden price drop in a specific DeFi token, simultaneously highlighting a related exploit or vulnerability discussed on relevant forums, offering immediate context for the price action.

Compared to tools like LunarCrush or Santiment, which primarily focus on sentiment analysis and on-chain metrics, Coindive takes a more holistic approach by incorporating a wider range of social channels and integrating AI-driven contextual analysis. This broader perspective allows users to gain a deeper understanding of market dynamics and community engagement.

While Coindive's comprehensive data aggregation and AI-powered insights make it a powerful tool for experienced crypto investors, portfolio managers, and analysts, its wealth of features might feel overwhelming for beginners. Furthermore, the lack of transparent pricing information on the website is a drawback, requiring potential users to contact the company directly for subscription details.

Pros:

Cons:

Website: https://coindive.app

Coindive earns its place on this list by offering a unique combination of social listening, AI-driven analysis, and customizable alerts. Its comprehensive approach empowers investors to move beyond surface-level market observation and delve into the underlying social and market forces driving the crypto space. While the complexity and lack of transparent pricing might pose initial hurdles, the potential for gaining valuable, actionable insights makes Coindive a worthy consideration for serious crypto researchers and investors.

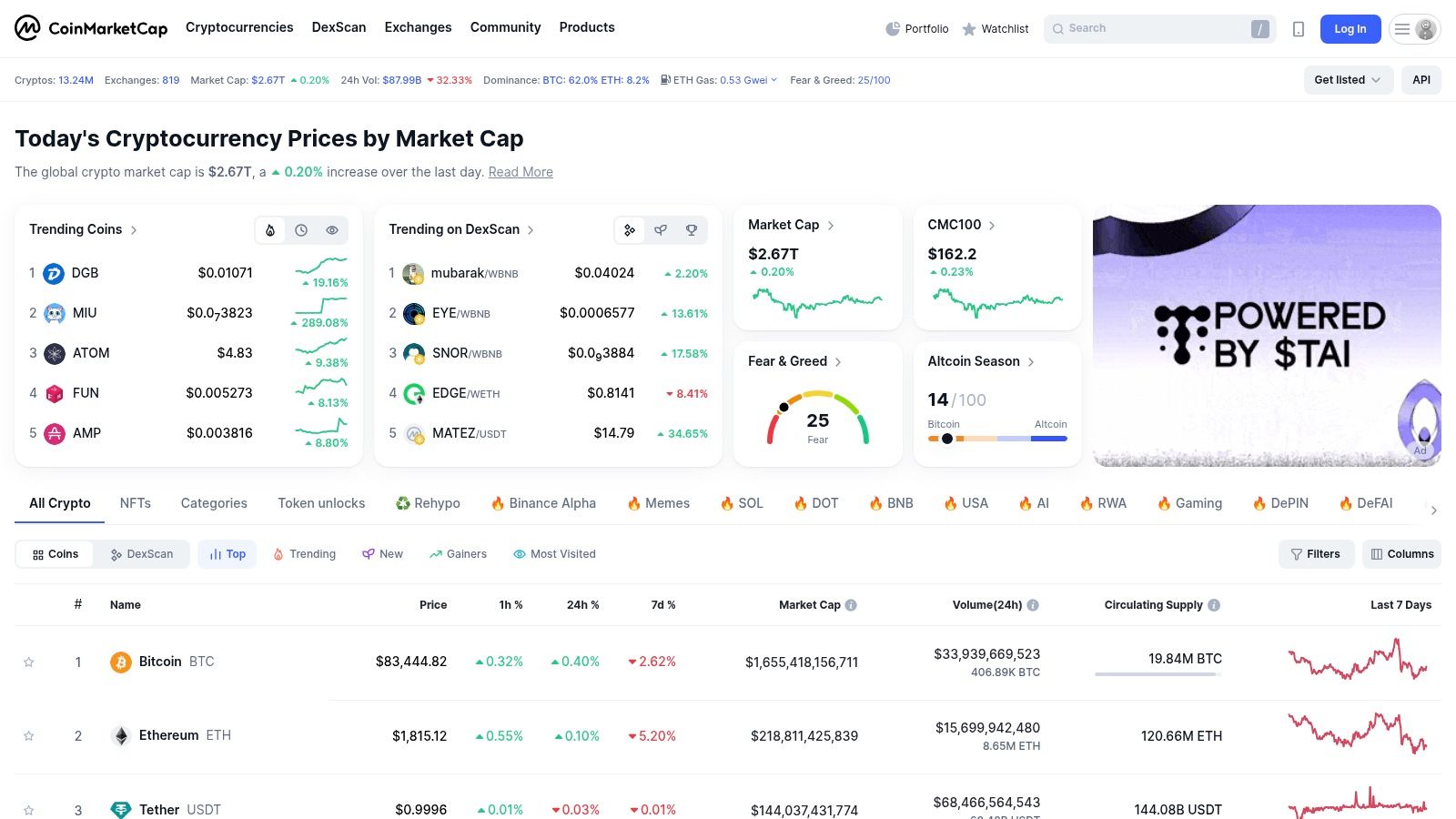

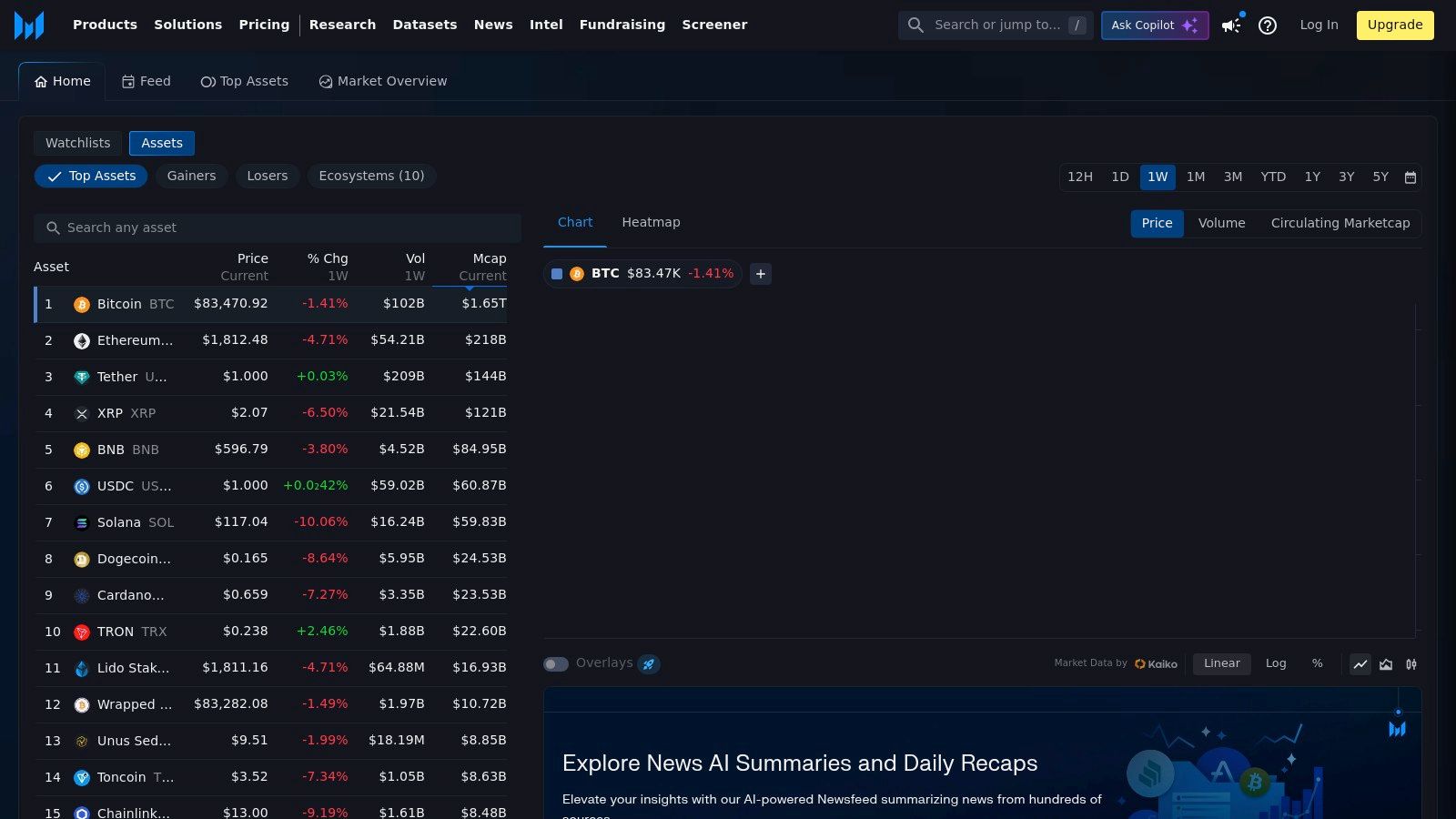

CoinMarketCap is a cornerstone resource for anyone involved in the cryptocurrency space, from casual observers to seasoned traders. Its widespread adoption stems from its comprehensive coverage of the crypto market, providing a one-stop shop for tracking prices, market capitalization, trading volumes, and other essential data points across thousands of digital assets. This breadth of information makes it invaluable for understanding market trends, comparing different cryptocurrencies, and gaining a general overview of the crypto landscape. It’s particularly useful for identifying newly listed coins and tokens, tracking the overall market sentiment, and gauging the performance of individual projects.

For practical applications, CoinMarketCap excels in several areas. Investors can utilize the platform's portfolio tracker to monitor their holdings across various exchanges, simplifying portfolio management and providing a consolidated view of their investments. The price alert functionality enables users to set notifications for specific price targets, ensuring they don't miss crucial market movements. Traders can leverage the real-time price data and exchange volume analysis to identify potential trading opportunities and make informed decisions. Furthermore, the 'Alexandria' educational portal provides valuable resources for learning about different aspects of the cryptocurrency market, benefiting both beginners and experienced users looking to expand their knowledge.

Compared to similar platforms like CoinGecko, CoinMarketCap often boasts a larger selection of listed assets. While CoinGecko is known for its focus on decentralized finance (DeFi) and provides more granular data on individual tokens, CoinMarketCap's broader coverage makes it a more general-purpose tool for tracking the entire market. Both platforms offer free access to their basic functionalities, making them accessible to a wide range of users.

CoinMarketCap's basic features are free to use, including real-time price tracking, market cap data, and basic charting. However, more advanced features, such as in-depth analytics, API access, and certain portfolio tracking functionalities, require a paid subscription. There are no specific technical requirements to access the platform beyond a stable internet connection and a web browser or the mobile app (available on iOS and Android).

Implementation/Setup Tips:

Pros: Comprehensive coverage of cryptocurrencies and exchanges; user-friendly interface; free basic access with valuable data; mobile app available.

Cons: Some advanced features require a premium subscription; data accuracy can occasionally lag during high volatility; API access requires paid plans.

Website: https://coinmarketcap.com/

CoinMarketCap earns its spot on this list due to its comprehensive data offering, user-friendly interface, and widespread accessibility. While the free version offers significant value, the premium features provide enhanced analytical capabilities and data access for more serious investors and developers. Despite some limitations regarding data accuracy during periods of extreme market volatility, CoinMarketCap remains a highly valuable tool for navigating the complex and ever-evolving cryptocurrency market.

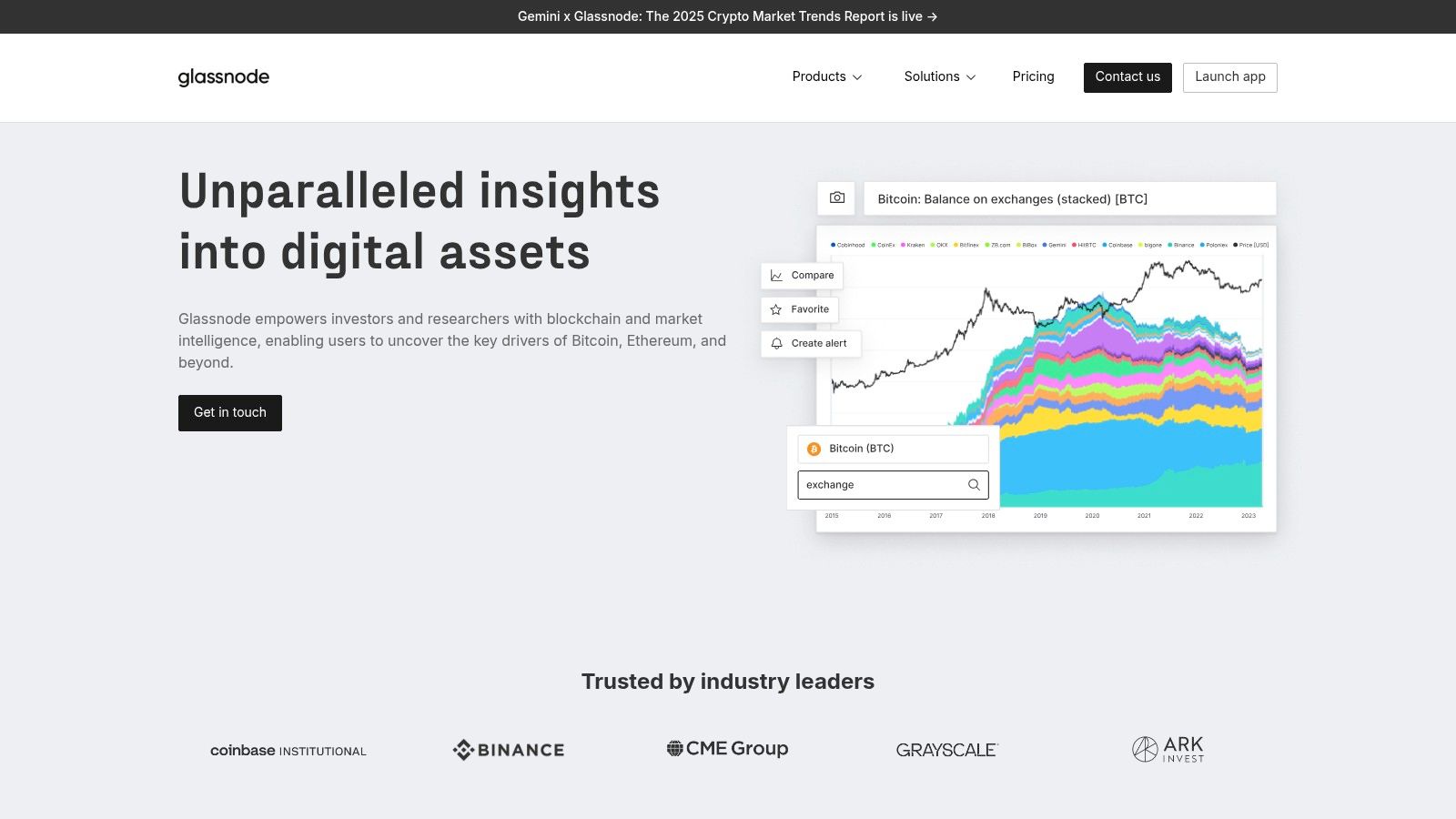

Glassnode stands out as a premier on-chain analytics platform, providing institutional-grade data insights for serious cryptocurrency investors. Its strength lies in transforming raw blockchain data into actionable metrics, offering a deep dive into network health, user behavior, and overall market sentiment. This allows investors to move beyond surface-level price analysis and understand the underlying dynamics driving market movements. For those seeking a data-driven approach to crypto investing, Glassnode is a powerful tool to uncover potential opportunities and manage risk.

One of Glassnode's key strengths is its comprehensive Bitcoin and Ethereum analytics. Metrics like the NUPL (Net Unrealized Profit/Loss) can help gauge market tops and bottoms, while the SOPR (Spent Output Profit Ratio) provides insights into investor profitability and potential selling pressure. Smart money tracking and whale alerts offer a glimpse into large investor movements, allowing users to anticipate potential market shifts. Furthermore, the platform's custom chart creation feature empowers users to visualize and analyze data according to their specific needs. For example, combining metrics like the aSOPR (Adjusted SOPR) with Exchange Net Position Change can paint a detailed picture of short-term and long-term holder behavior.

Compared to similar tools like Santiment or CryptoQuant, Glassnode often provides a more granular level of data and a wider range of sophisticated metrics. While platforms like CoinMetrics offer comparable institutional-grade data, Glassnode's intuitive visualizations and regular market reports make it more accessible to a broader range of experienced investors.

While Glassnode offers a free tier with limited access, unlocking its full potential requires a paid subscription. Pricing tiers vary based on the desired level of data access and features, with higher tiers offering more historical data, advanced metrics, and API access. This tiered structure can be a barrier for beginners or casual investors. Furthermore, the platform's wealth of data and complex metrics can present a steep learning curve. New users should be prepared to invest time in understanding the platform's various metrics and how to interpret them effectively. Finally, while Glassnode covers multiple blockchains, its primary focus remains on Bitcoin and Ethereum, offering less extensive coverage for smaller altcoins.

Implementation is straightforward, requiring only account creation and subscription selection on the Glassnode website (https://glassnode.com/). No specific technical requirements exist beyond a stable internet connection and a web browser. However, a strong understanding of blockchain fundamentals and on-chain analysis concepts is highly recommended to maximize the platform's value. Glassnode's Studio feature simplifies the process of creating custom dashboards and exploring complex metrics, even for users without advanced technical skills.

In conclusion, Glassnode earns its place on this list by providing powerful on-chain analytics capabilities, particularly for Bitcoin and Ethereum. While the cost and learning curve might be prohibitive for some, experienced investors seeking deep market insights will find Glassnode an invaluable resource for navigating the complexities of the cryptocurrency market.

TradingView stands out as a premier charting platform and social networking hub tailored for traders and investors across a multitude of markets, including the dynamic realm of cryptocurrencies. Its robust technical analysis tools, highly customizable charts, and vibrant community foster an environment where users can dissect market trends, share insights, and refine their trading strategies. This potent combination of features positions TradingView as an invaluable resource for both novice and seasoned cryptocurrency enthusiasts.

A key strength of TradingView lies in its extensive charting capabilities. With over 100 technical indicators, from classic moving averages and Relative Strength Index (RSI) to more specialized tools like the Ichimoku Cloud and Fibonacci retracements, traders can perform in-depth technical analysis to identify potential trading opportunities. The platform also supports multi-timeframe analysis, enabling users to examine price action across various time horizons, from minutes to months, to gain a comprehensive market perspective. Furthermore, the ability to create custom indicators using Pine Script provides advanced users with unparalleled flexibility in tailoring their analysis. This feature sets TradingView apart from many other charting platforms and is a boon for those seeking to develop and test proprietary indicators.

Beyond charting, TradingView's social networking aspect adds another layer of value. The platform allows users to share their trading ideas, chart setups, and market commentary, fostering a collaborative learning environment. This community-driven approach allows traders to learn from each other, discuss market developments, and gain new perspectives. For example, a beginner trader might learn about a new indicator or trading strategy by following experienced traders on the platform. Conversely, experienced traders can use the community to test their ideas and receive feedback.

While TradingView offers free access to basic features, unlocking the full potential of the platform requires a paid subscription. The Pro, Pro+, and Premium tiers offer progressively more advanced features, including more indicators, chart layouts, and real-time data. While the cost can be a barrier for some, the enhanced functionality often justifies the expense for serious traders. Users should carefully evaluate their needs and budget to determine which subscription tier, if any, is appropriate.

Compared to dedicated cryptocurrency platforms like Glassnode or CoinMetrics, TradingView offers limited on-chain data. While it integrates with some exchanges for order book and trade data, it doesn’t provide the same depth of blockchain analytics. This makes TradingView more suitable for technical analysis and short-term trading than for fundamental analysis based on on-chain metrics. However, its broader market coverage, including traditional stocks and forex, makes it a versatile tool for traders operating across multiple asset classes.

To get started with TradingView, simply create a free account on their website (https://www.tradingview.com/). The platform is accessible through a web browser or mobile apps for iOS and Android devices. New users are encouraged to explore the platform's extensive documentation and tutorials to familiarize themselves with the various features and functionalities. Experimenting with different chart setups, indicators, and drawing tools is crucial for developing a personalized trading approach.

In conclusion, TradingView's powerful charting tools, coupled with its active trading community and cross-market accessibility, justify its place among the best crypto research tools. While the free version offers valuable features, the paid subscriptions unlock the platform's true potential, catering to the needs of active traders and investors seeking a comprehensive charting and social networking experience. Its limitations regarding on-chain data should be considered, particularly for those focused on long-term fundamental analysis.

Santiment stands out as a powerful crypto market intelligence platform by offering a unique blend of on-chain, social, and developmental data. This combination empowers users to gain a holistic understanding of market dynamics, going beyond simple price charts. Its comprehensive suite of over 200 metrics provides valuable insights into emerging trends, social sentiment shifts, and developer activity across various blockchain projects. This makes Santiment particularly valuable for identifying potential market movements correlated with social buzz and developer behavior – factors often overlooked by traditional analysis. Instead of relying solely on technical analysis, Santiment allows investors to gauge the overall health and momentum of a project, making it a powerful tool for informed decision-making.

One of Santiment's key strengths lies in its social sentiment analysis. It tracks mentions, discussions, and overall sentiment across various social media platforms, providing a quantifiable measure of public opinion towards specific cryptocurrencies. This feature is particularly useful for identifying potential "hype cycles" or uncovering negative sentiment that might precede a price correction. For instance, a sudden surge in positive social media mentions around a specific altcoin, coupled with increased trading volume, might signal an upcoming price rally. Conversely, a spike in negative sentiment, especially amongst influential community members, could forewarn of a potential downturn.

Beyond social sentiment, Santiment delves into the critical area of developer activity. By tracking code commits, pull requests, and other developmental milestones, it offers insights into the progress and commitment of a project's team. This is crucial for assessing the long-term viability of a cryptocurrency. A project with consistent and active development suggests a dedicated team working to improve the technology and expand its use cases, a positive indicator for future growth.

Furthermore, Santiment's on-chain analysis provides valuable data on network activity, transaction volume, and holder distribution. This information helps users understand the underlying usage and adoption of a cryptocurrency. For example, analyzing the distribution of token holders can reveal potential whale activity or identify a growing community of smaller holders, both of which have implications for future price movements.

While Santiment offers a wealth of information, it’s important to acknowledge its drawbacks. Full access requires a subscription, which can be expensive for individual investors. The platform's interface, while powerful, has a steep learning curve and can be overwhelming for beginners. Additionally, historical data limitations exist for some metrics, which can restrict certain types of analysis.

Compared to tools like Glassnode or CryptoQuant, which primarily focus on on-chain data, Santiment differentiates itself by incorporating social and developmental metrics, providing a more comprehensive view. For implementation, users should familiarize themselves with the various metrics available and tailor their analysis based on their specific investment strategies. Learning to interpret the data in conjunction with other market indicators is key to effectively leveraging Santiment's insights. The platform provides educational resources and regular market reports to assist users in this process. Finally, accessing Santiment's website (https://santiment.net/) will provide the most up-to-date information on pricing and available features.

CryptoQuant distinguishes itself by offering in-depth on-chain data analysis, specializing in Bitcoin and Ethereum. This platform goes beyond basic market data, providing institutional-grade metrics and indicators that shed light on the underlying mechanics driving market movements. By tracking exchange flows, miner activities, and whale movements, CryptoQuant empowers users to anticipate potential price action based on the behavior of key market participants. For example, large inflows to exchanges can signal potential selling pressure, while significant outflows might suggest accumulation. This focus on on-chain analytics makes CryptoQuant an invaluable tool for serious crypto investors and traders seeking a deeper understanding of market dynamics.

CryptoQuant’s key strength lies in its exchange flow indicators. These metrics track the movement of Bitcoin and Ethereum into and out of cryptocurrency exchanges, providing a crucial window into potential buying and selling pressure. Combined with miner flow and behavior analysis, users can assess the overall health of the network and potential selling activity from miners. Whale transaction alerts provide real-time notifications of large transactions, allowing users to track the movements of significant holders. Further supplementing these core features are stablecoin flow tracking and derivatives market indicators, giving a more holistic view of the market landscape.

While several platforms provide on-chain data, CryptoQuant's focus on exchange flows and intuitive dashboards sets it apart. Similar tools like Glassnode and Nansen also provide comprehensive on-chain data, but CryptoQuant's specialized dashboards and alerts for exchange flows offer a more targeted approach for traders specifically interested in this data. This focus makes it less cluttered and easier to navigate for those seeking actionable insights based on exchange activity.

CryptoQuant offers various subscription tiers, starting with a free version offering limited access to historical data and basic metrics. The more valuable features, such as real-time data, advanced indicators, and whale alerts, require a premium subscription. While pricing details can be found on their website, it's important to note that unlocking the full potential of CryptoQuant requires a financial investment. The platform is accessible via a web browser and also provides an API for institutional clients seeking to integrate data directly into their trading systems. There are no specific technical requirements other than a stable internet connection and a modern web browser.

For optimal use, begin by familiarizing yourself with the various metrics and indicators available on the platform. Start with the free version to explore the basic features and then consider upgrading to a premium subscription for access to more advanced tools and real-time data. Focus on understanding the relationship between exchange flows and price movements. Combine this information with other on-chain metrics and market data to form a comprehensive view of the market. Leverage the platform's alerting system to stay informed about significant market movements.

While CryptoQuant excels in providing insights into Bitcoin and Ethereum, its limited coverage of smaller altcoins is a drawback for those interested in a broader range of cryptocurrencies. Furthermore, while the platform provides clean and intuitive dashboards, it may not be as comprehensive as some competitors for general market data outside of its specialized on-chain metrics. Despite these limitations, CryptoQuant earns its place on this list due to its specialized focus on exchange flows and its ability to provide actionable insights for Bitcoin and Ethereum traders. The platform provides a powerful toolkit for anticipating market movements based on the behavior of key players and adds significant value for those seeking a deeper understanding of on-chain dynamics. You can explore CryptoQuant and its offerings by visiting their website: https://cryptoquant.com/

Messari is a powerful research platform designed to provide in-depth data, analytical tools, and research reports for the cryptocurrency ecosystem. It's a valuable resource for anyone serious about understanding the complexities of digital assets, from individual investors to institutional players. Messari helps navigate the often-opaque world of crypto by offering transparent methodologies for crucial metrics, including market capitalization and circulating supply, allowing for more informed investment decisions. This commitment to data integrity, combined with its comprehensive suite of tools, firmly establishes Messari's place among the best crypto research tools.

One of Messari's core strengths lies in its detailed asset profiles. These profiles go far beyond basic price charts, offering insights into tokenomics, team backgrounds, and project roadmaps. The platform's governance tracking feature is particularly useful for understanding how decentralized projects are managed and the potential impact of governance proposals on token value. On-chain activity monitoring allows users to analyze transaction volumes, active addresses, and other key metrics, providing a deeper understanding of network health and user engagement. For investors seeking comparative analysis, Messari provides screening and comparison tools that allow users to filter assets based on a wide range of fundamentals, streamlining the process of identifying promising investment opportunities. Learn more about Messari to delve even further into their offerings. Moreover, staying informed about regulatory developments is crucial in the rapidly evolving crypto landscape, and Messari delivers with up-to-date news and analysis on regulatory changes that could impact the market.

While Messari offers a wealth of free resources, its premium research reports, offering deep dives into specific projects and market trends, require a subscription. Pricing details for these subscriptions aren't readily available on the public website and typically require contacting their sales team. While Messari boasts comprehensive asset coverage, some data points may be updated less frequently than competitors who specialize in real-time market data. Furthermore, access to advanced features, including certain charting tools and analytical dashboards, are locked behind a Pro membership, which could be a barrier for casual users.

Features:

Pros:

Cons:

Website: https://messari.io/

In summary, Messari is a robust research platform that caters to a wide range of crypto stakeholders. Its focus on data transparency, in-depth research, and user-friendly tools makes it an invaluable resource for anyone looking to navigate the complexities of the cryptocurrency market. While the premium features come at a cost, the free resources alone offer significant value.

DeFi Pulse is a specialized analytics platform dedicated to decentralized finance (DeFi) protocols and applications. It serves as a crucial resource for understanding the DeFi landscape by tracking the Total Value Locked (TVL) across different protocols, offering insights into the growth and adoption of this rapidly evolving sector. This makes it an invaluable tool for investors, analysts, and developers seeking to navigate the DeFi space. By providing a clear overview of the market, DeFi Pulse enables users to identify trends, compare protocols, and assess the overall health of the DeFi ecosystem.

DeFi Pulse's core strength lies in its focused approach to DeFi metrics. Its primary feature, TVL tracking, provides a quantifiable measure of the capital invested in various DeFi protocols. This allows users to quickly gauge the relative popularity and market share of different projects. Beyond simple TVL rankings, DeFi Pulse also presents historical growth charts, enabling users to identify trends in DeFi adoption over time. Furthermore, the platform offers insights into yield farming opportunities, allowing users to explore potential returns from providing liquidity to different protocols. While DeFi Pulse doesn't provide in-depth technical analysis tools like some broader crypto platforms, it does offer some DeFi risk assessment features to help users evaluate the potential risks associated with different protocols.

Compared to generalized cryptocurrency data aggregators like CoinGecko or CoinMarketCap, DeFi Pulse excels in its specialized focus. While the broader platforms offer some DeFi data, DeFi Pulse provides a significantly more granular and comprehensive view of the DeFi landscape. This specialization makes it an ideal tool for users deeply involved in or looking to enter the DeFi space. For example, an investor looking to allocate capital to a DeFi lending platform can use DeFi Pulse to compare the TVL, historical growth, and associated risks of different lending protocols before making an investment decision. A DeFi developer, on the other hand, can use the platform to track the adoption of different protocols and identify potential areas for innovation.

DeFi Pulse is freely accessible via their website (https://defipulse.com/), and doesn't require any specific technical setup or software installation. While information regarding specific APIs or data feeds isn't readily available on the main site, exploring their resources might reveal more advanced integration options.

One potential drawback of DeFi Pulse is its limited scope outside of DeFi. Users looking for information on other aspects of the cryptocurrency market, such as NFTs or metaverse projects, will need to supplement DeFi Pulse with other tools. Additionally, while DeFi Pulse strives for comprehensive coverage, newer protocols might experience a delay in listing on the platform. Finally, as mentioned earlier, DeFi Pulse lacks the in-depth technical charting and analysis features found in some broader crypto platforms.

Despite these limitations, DeFi Pulse's specialized focus, ease of use, and comprehensive coverage of the DeFi landscape make it a highly valuable resource. Its place on this list is well-deserved, as it provides crucial insights for anyone serious about understanding and participating in the decentralized finance ecosystem.

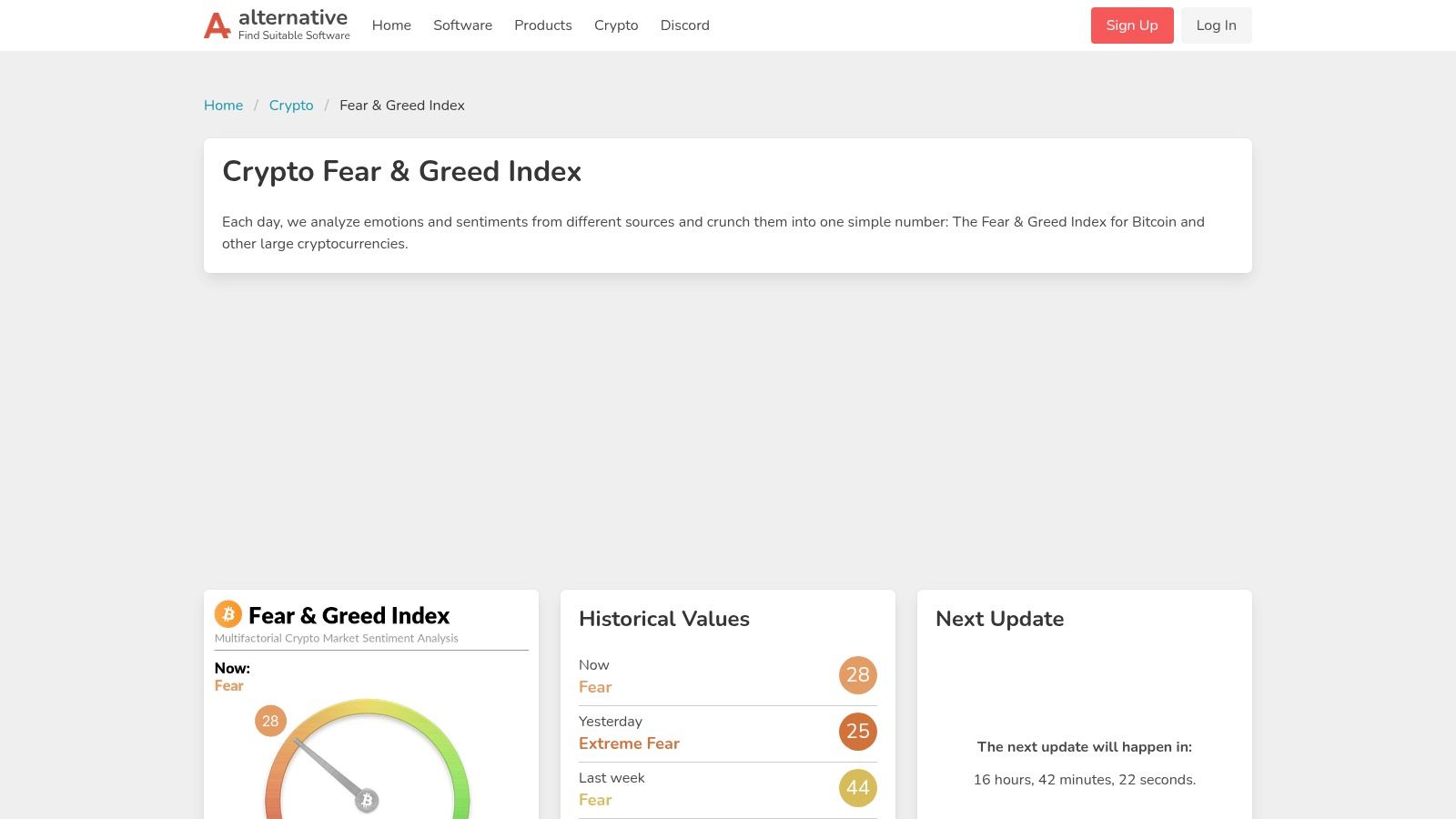

The Crypto Fear & Greed Index provides a valuable snapshot of the prevailing market sentiment within the Bitcoin market, serving as a contrarian indicator for potential trading opportunities. By aggregating factors such as volatility, market momentum, social media trends, and surveys, the index distills complex market psychology into a single, easily digestible score ranging from 0 (extreme fear) to 100 (extreme greed). This allows investors to quickly gauge the overall emotional temperature of the market and make more informed decisions.

A key strength of the Fear & Greed Index lies in its simplicity. The numerical score and corresponding visual representation make it easy to understand even for those new to market sentiment analysis. Historically, extreme fear readings have often coincided with market bottoms, presenting potential buying opportunities. Conversely, extreme greed readings can serve as a warning sign of impending corrections, prompting investors to consider taking profits or adjusting their portfolios. The index is freely accessible at https://alternative.me/crypto/fear-and-greed-index/ without any technical requirements beyond a web browser.

While similar sentiment analysis tools may exist, few offer the same combination of simplicity and historical correlation with market cycles. For example, some platforms provide more granular sentiment data based on specific news sources or social media platforms, but these often require paid subscriptions and can be overwhelming for less experienced users. The Fear & Greed Index excels as a quick, free, and readily available pulse check on the market's emotional state. Tracking the index daily allows investors to identify shifts in sentiment and potentially anticipate market turning points.

However, it's important to acknowledge the limitations of the index. Its primary focus is on Bitcoin, making its applicability to altcoins less direct. Additionally, it functions as a single metric without offering customization options or a detailed breakdown of its contributing factors. While historical data shows a good correlation with market cycles, the index can sometimes lag behind rapid market changes. Therefore, it's crucial to use the Fear & Greed Index as just one piece of a larger research puzzle, combining it with fundamental analysis, technical indicators, and other relevant data sources before making investment decisions. Relying solely on the index without considering other factors would be unwise. Nevertheless, its ease of use and historical relevance solidify its place as a valuable tool for navigating the volatile cryptocurrency market.

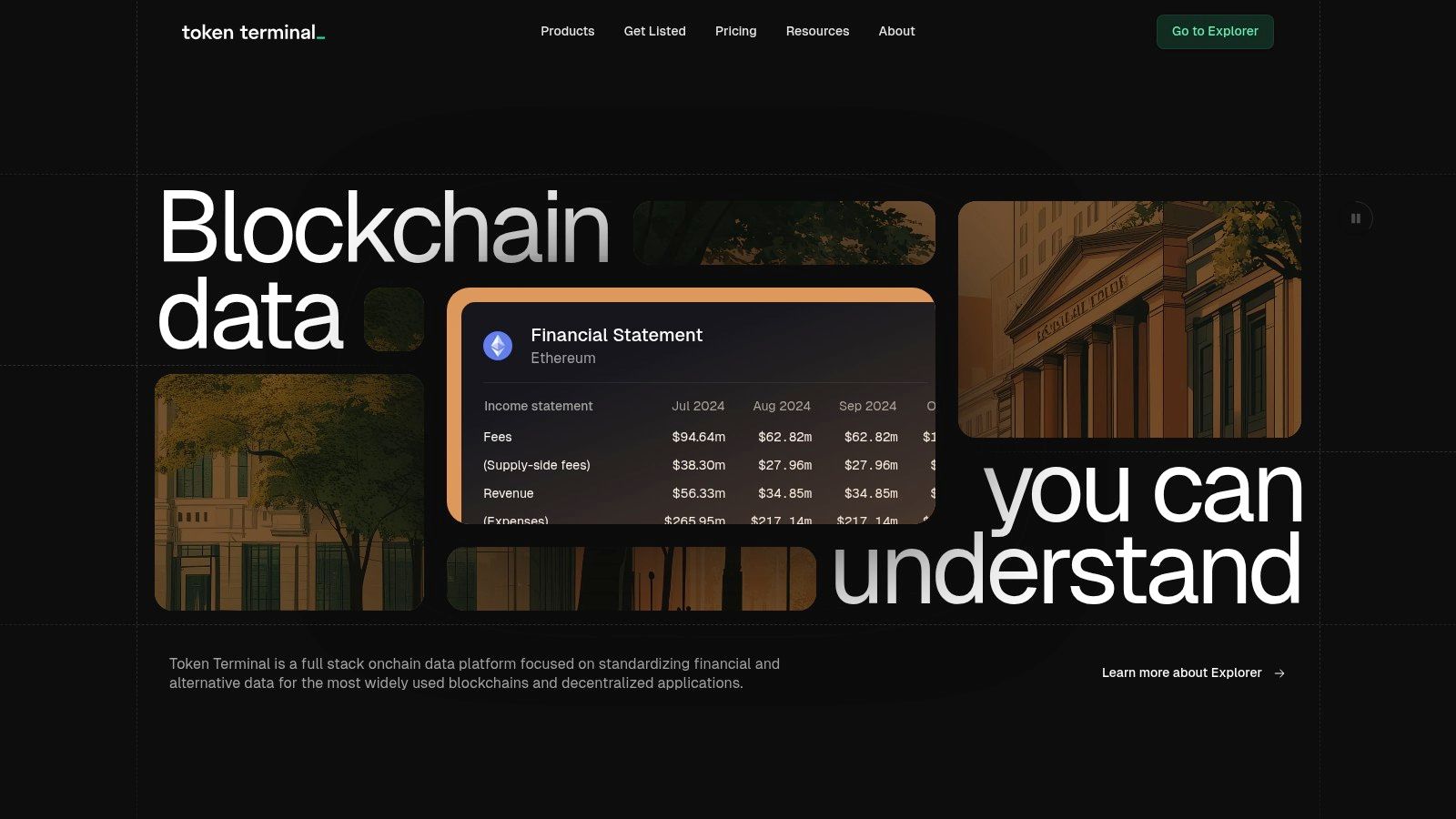

Token Terminal offers a unique perspective on crypto asset analysis by applying traditional financial metrics to blockchain protocols. Instead of relying solely on market hype or technical indicators, Token Terminal focuses on the underlying economic activity of projects, providing insights into their revenue generation, profitability, and valuation. This approach is particularly valuable for investors seeking fundamentally strong projects with sustainable growth potential. It bridges the gap between traditional financial analysis and the decentralized world of crypto, enabling investors to assess blockchain projects with familiar metrics like price-to-earnings ratios and profit margins.

Token Terminal's core strength lies in its ability to analyze protocols based on their revenue and profit metrics. This allows for direct comparisons between different protocols and even traditional companies, offering a more objective evaluation framework. For instance, you can compare the price-to-earnings ratio of a decentralized exchange (DEX) like Uniswap with a centralized exchange or even a traditional stock exchange. This cross-comparison helps identify potentially undervalued or overvalued protocols based on their financial performance rather than pure speculation. The platform provides historical financial data, allowing users to track the performance of protocols over time and identify trends. Furthermore, the protocol comparison tools offer a clear visualization of key metrics across multiple projects, facilitating informed investment decisions.

While Token Terminal excels in fundamental analysis, it's crucial to understand its limitations. The platform’s coverage is not as extensive as some broader crypto data aggregators. Certain financial metrics might be less relevant for specific types of protocols. For example, evaluating a governance token primarily on revenue might not be as insightful as analyzing its impact on the overall ecosystem. Additionally, while the basic platform offers a good range of features, accessing premium features like advanced charting and custom dashboards requires a paid subscription. Potential users should explore the free version to gauge its suitability before committing to a subscription. Finally, utilizing the platform effectively requires a certain level of financial literacy. Understanding concepts like P/E ratios, profit margins, and other financial metrics is crucial for interpreting the data presented.

Token Terminal is not a market sentiment analysis tool or a technical indicator platform. Instead, it's a specialized platform for fundamental analysis, filling a critical gap in the crypto research landscape. Users looking for on-chain analytics, social sentiment data, or in-depth technical charts will need to supplement Token Terminal with other tools. However, for investors prioritizing fundamental analysis and seeking a data-driven approach to valuing crypto protocols, Token Terminal offers unparalleled value. It deserves its place on this list for its unique approach and its potential to identify promising investment opportunities based on solid financial fundamentals rather than short-term market fluctuations. You can explore the platform and its features at https://tokenterminal.com/.

| Platform | Core Features ★ | User Experience 👥 | Unique Selling Points ✨ | Pricing 💰 |

|---|---|---|---|---|

| 🏆 Coindive | Social tracking (Twitter, Telegram, Discord, Reddit); Custom alerts; AI-driven price context | Comprehensive insights; may overwhelm beginners | Endorsed by CoinGecko; Filters out noise | Subscription details unclear |

| CoinMarketCap | Real-time prices; Market cap rankings; Portfolio tracker | User-friendly; Mobile app available | Extensive crypto coverage | Free basic; Premium for advanced |

| Glassnode | On-chain metrics; Network health; Sentiment analysis | Institutional-grade; Steep learning curve | Deep BTC/ETH analytics | Expensive subscription |

| TradingView | Advanced charting; 100+ technical indicators; Alerts | Customizable; Active trader community | Integrated exchange data; Social idea sharing | Paid for advanced features |

| Santiment | Social, on-chain & dev metrics; Network growth tracking | Complex interface; Steep learning curve | Unique social sentiment data | Premium subscription required |

| CryptoQuant | Exchange flow indicators; Miner & whale alerts; Stablecoin tracking | Clean dashboards; Niche focus | Predictive market indicators | Premium required |

| Messari | Detailed asset profiles; Research reports; Governance tracking | Comprehensive; User-friendly | Transparent methodology | Subscription for premium research |

| DeFi Pulse | TVL tracking; Protocol rankings; Historical charts | Straightforward for DeFi users | Focused on DeFi analytics | Free/basic access |

| Crypto Fear & Greed Index | Daily sentiment score; Historical mood tracking | Simple; Free to use | Effective contrarian indicator | Free |

| Token Terminal | Financial stats; Revenue & P/E metrics; Asset comparisons | Professional; Requires financial literacy | Bridges traditional finance with crypto | Subscription needed |

The cryptocurrency market, with its inherent volatility and complexity, demands diligent research for informed decision-making. This exploration of 10 leading crypto research tools – Coindive, CoinMarketCap, Glassnode, TradingView, Santiment, CryptoQuant, Messari, DeFi Pulse, Crypto Fear & Greed Index, and Token Terminal – provides a robust foundation for navigating this dynamic landscape. From on-chain analytics and market trends to community sentiment and DeFi insights, these tools offer diverse perspectives to empower your crypto journey. The key takeaway is that utilizing a combination of these platforms, tailored to your specific needs, will yield the most comprehensive understanding of the crypto market.

Choosing the right tool depends on your individual objectives. Are you a day trader focused on technical analysis? TradingView may be your go-to. Perhaps you're a long-term investor interested in fundamental analysis and project health? Messari and Token Terminal can provide crucial insights. DeFi enthusiasts will find DeFi Pulse invaluable, while sentiment analysis platforms like Santiment offer a window into collective market psychology. Remember to consider factors like data accuracy, user interface, cost, and the specific metrics offered when implementing these tools into your research process.

Effectively managing your research and insights can amplify your success. For instance, disseminating your findings and engaging with the broader crypto community can be streamlined with leading social media management tools from Publora. These tools can assist in scheduling content, tracking relevant discussions, and building a strong network within the crypto space.

Ultimately, successful crypto investing relies on continuous learning and adaptation. The tools outlined here provide a powerful arsenal for staying informed and making data-driven decisions. Ready to dive deeper into on-chain metrics and unlock advanced analytical tools? Explore Coindive, a platform that offers a comprehensive suite of features for serious crypto researchers and investors looking to gain an edge in the market.