The cryptocurrency market operates 24/7. Fortunes can shift dramatically and quickly. This inherent volatility presents both significant opportunities and substantial risks. Staying informed about market movements is essential for serious investors. This is where crypto alert apps become invaluable. These tools deliver real-time insights, allowing you to react to market changes, capitalize on opportunities, and manage your portfolio effectively.

Choosing the right crypto alert app requires careful evaluation. Key factors include the range of supported cryptocurrencies and exchanges, customization options for alerts (price, volume, technical indicators), the speed and reliability of alerts, and the overall user experience. A good app delivers timely, accurate, and actionable information without overwhelming the user.

Pricing models also vary. Some apps offer free tiers with limited features, while others have premium subscriptions for advanced functionalities. Technical aspects like API integration and mobile platform compatibility are also important considerations.

In this guide, we’ll examine seven of the best crypto alert apps. We'll analyze their strengths and weaknesses to help you choose the best tool for your investment strategy. Whether you're a seasoned trader, a long-term holder, a portfolio manager, or just a crypto enthusiast, this analysis will help you make informed decisions and improve your crypto game.

Coindive presents itself as a comprehensive crypto community and market intelligence platform. Its aim is to provide investors with the crucial data needed to navigate the volatile cryptocurrency market. Coindive's core strength lies in aggregating and analyzing data from various social media channels. These include Twitter, Telegram, Discord, and Reddit, offering a broad perspective on community sentiment and activity surrounding specific crypto projects.

This aggregation makes it a valuable tool for several key functions. Investors can use the platform to identify emerging trends, gauge community reactions to market events, and potentially anticipate future market movements. This provides a significant advantage in a market known for its rapid fluctuations.

For cryptocurrency traders and analysts, Coindive offers customizable alerts. These cover social activity, sentiment shifts, and AI-driven smart price alerts. These smart alerts offer more than simple price change notifications; they provide contextual analysis, connecting price movements to broader market trends, specific events within a sector, or news related to a particular project. This context is crucial for informed trading decisions, helping traders understand the why behind price fluctuations.

Consider a scenario where an altcoin experiences a sudden price surge. A Coindive user would receive an alert not only about the surge but also about information potentially linking it to a positive development announced on the project's Discord server. This actionable intelligence empowers strategic decision-making based on a comprehensive understanding of market dynamics.

Crypto researchers and portfolio managers can utilize Coindive’s intuitive dashboards. These provide a macro view of market and sector insights, allowing for a more strategic approach to portfolio management. Coindive employs advanced spam and bot filtering, backed by CoinGecko, to deliver cleaner, more reliable data.

This filtering is critical in mitigating the risks associated with artificial hype or manipulated sentiment, a significant concern in the crypto sphere. By minimizing noise, Coindive aims to present a more accurate reflection of genuine community engagement.

Pros:

Cons:

Website: https://coindive.app

Coindive's focus on actionable insights, derived from social listening and market analysis, earns it a place among valuable crypto resources. While the platform might present a steep learning curve for beginners, experienced traders, analysts, and researchers will find its powerful features beneficial. The lack of transparent pricing is a drawback. However, for serious crypto investors, the platform's sophisticated analytical capabilities may outweigh this concern. Further investigation into pricing and a hands-on trial are recommended for a full evaluation.

CoinMarketCap is a cornerstone of the cryptocurrency world. Serving as a primary data source, it caters to a wide user base, from casual observers to serious institutional investors. Tracking over 20,000 cryptocurrencies and more than 300 exchanges, its comprehensive coverage secures its position as a powerful and versatile crypto alerts app. While it excels at providing broad market overviews and real-time price tracking, its customizable price alerts set it apart.

This feature allows users to stay ahead of market fluctuations, a crucial aspect of successful crypto investing.

One of CoinMarketCap's greatest strengths is its intuitive, user-friendly interface. Even those new to cryptocurrency can quickly learn to set up price alerts and track their portfolio. Users can define specific price thresholds for any listed cryptocurrency and receive notifications via the mobile app or web browser. This is invaluable for traders looking to capitalize on price swings and for long-term investors monitoring significant price changes.

Beyond alerts, CoinMarketCap offers robust portfolio tracking. Users can manually input their holdings to view their portfolio's overall performance, including realized and unrealized gains and losses. Combined with the platform's comprehensive market data—including volume, market capitalization, and historical price charts—users have a holistic view of the crypto market and their position within it. The watchlist feature also allows users to curate a personalized list of cryptocurrencies for real-time updates.

The basic plan is free, offering a substantial suite of features: price alerts, portfolio tracking, and market data. However, some advanced features, like in-depth market analysis tools, require a premium subscription. Like any platform relying on real-time data, CoinMarketCap can experience occasional notification delays, particularly during periods of high market volatility.

While CoinMarketCap offers a broad overview of market trends, its technical analysis tools are less comprehensive than dedicated charting platforms like TradingView. Traders relying heavily on technical indicators may need to supplement CoinMarketCap with specialized charting software.

Pros:

Cons:

Website: https://coinmarketcap.com/

CoinMarketCap's free price alerts provide a crucial tool for monitoring investments and making informed decisions. Its breadth of coverage and ease of use make it a valuable resource for anyone involved in the cryptocurrency market, from seasoned traders to long-term holders or those simply curious about digital assets. While not a perfect solution for every scenario, its comprehensive features and accessibility make it a valuable addition to any crypto enthusiast's toolkit.

CryptoHopper sets itself apart from simple crypto alert apps. It provides a full suite of tools for active traders and long-term investors. It’s more than alerts; it’s a trading platform with automation and in-depth analysis. This makes it a powerful choice for proactive portfolio management. While appealing to a broader audience, CryptoHopper is especially useful for automated trading based on technical indicators and market signals.

CryptoHopper’s alerts go beyond basic price changes. Imagine being alerted not just when Bitcoin hits a specific price, but when it crosses a key resistance level with an overbought RSI. This suggests a potential reversal. This granular detail is possible with CryptoHopper’s technical indicator alerts. These include RSI, MACD, Bollinger Bands, and many others. Users can pinpoint strategic entry and exit points based on multiple factors. This approach increases the likelihood of profitable trades.

For hands-off investors, CryptoHopper’s automated trading is a significant advantage. Users can build and deploy their own trading strategies. They can also use pre-built strategies from the marketplace. This automated approach suits those lacking the time or expertise for constant market monitoring. Backtesting allows strategy refinement and performance assessment before live deployment. The platform also supports multiple exchanges, allowing simultaneous monitoring and trading for maximum efficiency.

Here's a quick breakdown of the advantages and disadvantages:

| Pros | Cons |

|---|---|

| In-depth technical analysis alerts | Steeper learning curve for beginners |

| 24/7 cloud-based operation | Higher pricing (starting at $19/month) |

| Automated trading based on alerts | Can feel overwhelming due to many features |

Website: https://www.cryptohopper.com/

CryptoHopper bridges the gap between basic alerts and complete trading platforms. Its advanced features and automation cater to diverse needs. These range from experienced traders wanting sophisticated alerts to passive investors seeking automated solutions. The cost and complexity may be challenging for beginners. However, its power and flexibility make it a valuable tool for those serious about optimizing their crypto trading.

Coin Stats earns a spot on this list thanks to its robust portfolio tracking and highly customizable alerts. This makes it a valuable tool for various cryptocurrency users, from casual holders to active traders. It effectively bridges the gap between simply holding cryptocurrency and actively managing a diverse portfolio across various platforms.

Coin Stats excels at providing a unified dashboard for crypto holdings. Imagine monitoring your Bitcoin on Coinbase, Ethereum on MetaMask, and other altcoins scattered across exchanges—all within a single interface. This consolidated view eliminates the constant switching between platforms, saving time and providing a clear overview of overall portfolio performance. For investors and portfolio managers juggling multiple assets, this centralized management is crucial.

The platform's customizability is evident in its alert system. Unlike basic price alerts, Coin Stats offers granular control. You can set notifications for specific price targets, percentage changes, market cap thresholds, and even volume spikes. This allows for proactive portfolio management, enabling traders to capitalize on market movements and mitigate losses.

For example, an altcoin investor could set alerts for significant volume increases, potentially signaling breakouts. A long-term holder might prefer alerts for major price drops, indicating buying opportunities. This flexibility caters to a wide range of investment strategies.

Beyond tracking and alerts, Coin Stats provides additional features. News aggregation with sentiment analysis offers insights into market trends, potentially influencing investment decisions. The inclusion of DeFi portfolio tracking is a significant advantage for users involved in decentralized finance. Historical performance analytics allows for a deeper understanding of portfolio growth and identifies areas for improvement.

While a free version exists, some advanced Coin Stats features require a premium subscription. Pricing details should be available on their website. Users have occasionally reported synchronization issues with certain exchanges—a factor to consider when relying on real-time data. Coin Stats is primarily a portfolio tracker and alert system; its trading capabilities are limited compared to dedicated trading platforms. Active traders may need supplementary tools.

Key Features & Benefits:

Pros:

Cons:

Website: https://coinstats.app/

Implementation Tip: Start by connecting your primary exchanges and wallets. Explore the alert customization options to tailor notifications to your investment strategy. Familiarize yourself with the analytical tools for deeper portfolio insights. Regularly review and adjust alerts and portfolio allocation.

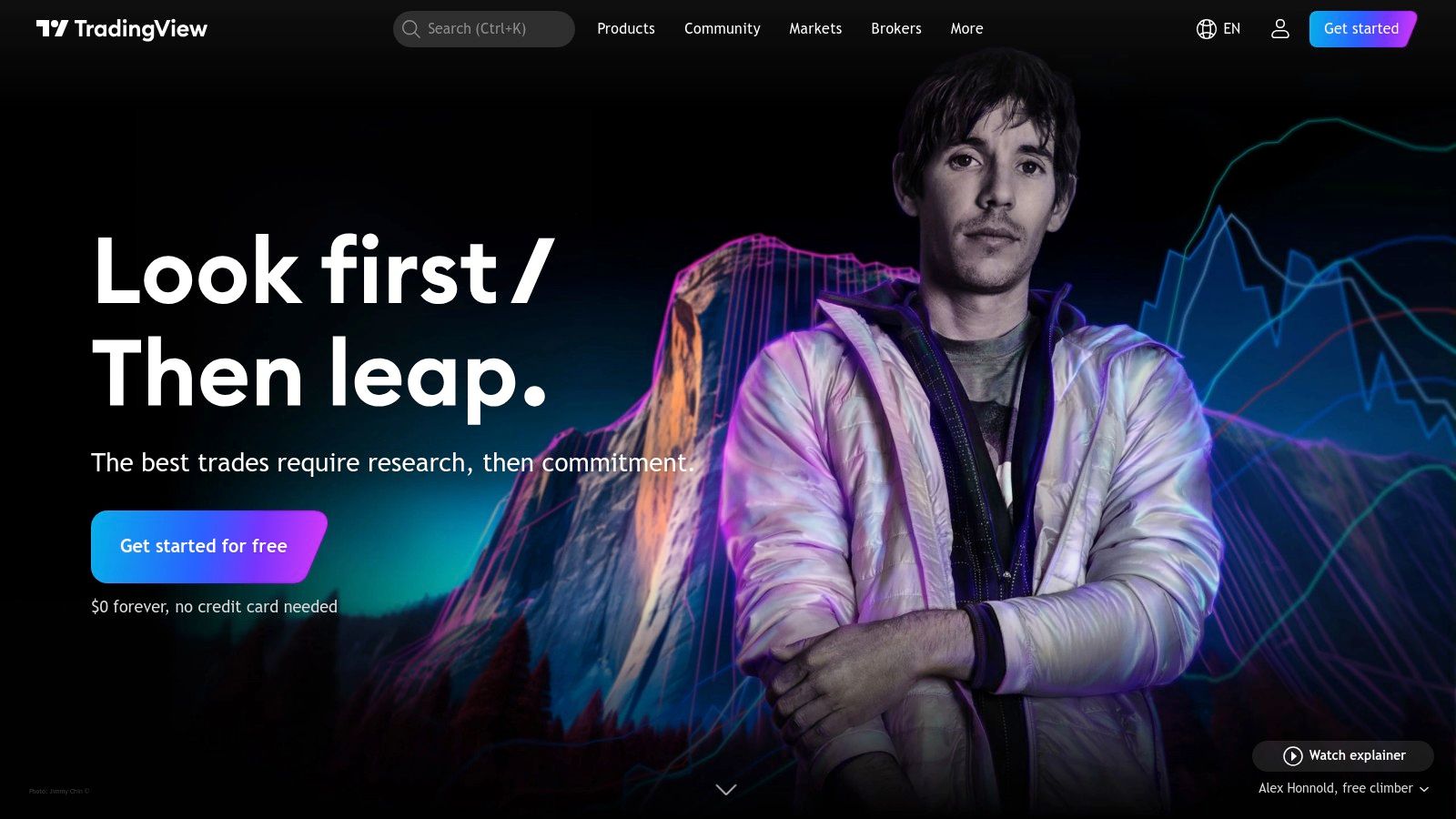

TradingView is widely considered the benchmark for charting and technical analysis, and its capabilities extend seamlessly into the cryptocurrency market. While not solely a crypto alerts app, its comprehensive tools and robust alerts make it an attractive option for serious crypto traders. The platform effectively bridges traditional markets and digital assets, offering a single environment for analysis and alert setup.

TradingView’s key strength lies in its advanced charting. With over 100 technical indicators and the flexibility of Pine Script for building custom indicators and alerts, the possibilities are extensive. Consider setting an alert triggered only when the RSI dips below 30 while the price concurrently breaks above a key resistance level on the 4-hour chart. This level of granularity and customization distinguishes TradingView. Unlike simpler alert apps limited to basic price thresholds, TradingView allows traders to construct highly specific, multi-condition alerts based on complex technical analysis.

Beyond alerts, TradingView hosts a thriving social trading community. Traders can exchange ideas, follow seasoned analysts, and glean market insights, all within the platform. This social element is valuable for both new and experienced traders, providing learning opportunities and diverse market perspectives.

For crypto portfolio managers and institutional investors, TradingView's server-side alerts are essential. These alerts operate continuously, even when the app is closed, ensuring crucial price movements or indicator triggers are never missed. This reliability is paramount for managing substantial holdings and enabling timely decision-making in the volatile crypto market.

Pros:

Cons:

Begin with the free version to explore the platform and its functionality. Master a few core indicators and alert types before delving into the complexity of Pine Script. The TradingView community and extensive documentation are excellent learning resources.

Pricing: Free tier with limitations; Paid plans start at $14.95/month.

Website: TradingView

While the learning curve may be steeper than simpler crypto alert apps, the power and flexibility TradingView provides justify the investment for serious crypto traders, analysts, and portfolio managers requiring sophisticated charting and highly customizable alerts. For those aiming to go beyond basic price alerts and harness the full power of technical analysis in their crypto trading, TradingView is a leading contender.

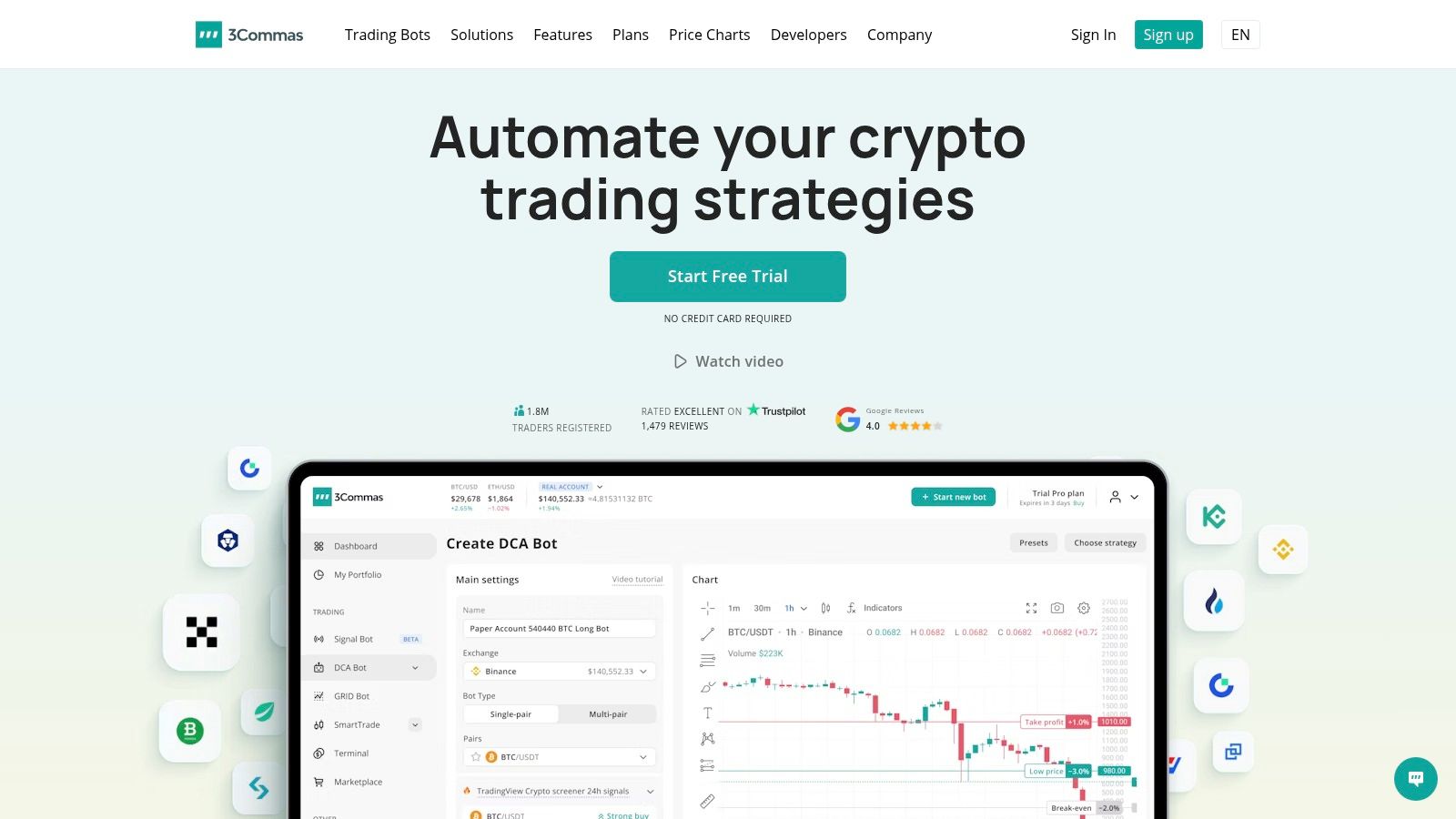

3Commas secures its spot on this list as a robust all-in-one platform exceeding basic alert functionality. It offers a comprehensive suite of tools designed for active cryptocurrency traders. While potentially excessive for casual investors seeking simple price notifications, its advanced alert system, combined with automated trading features, makes it an attractive option for those looking to refine their trading strategies and efficiently manage multiple exchange accounts.

3Commas transcends a simple alert app; it constitutes a complete trading ecosystem. Its alert system integrates seamlessly with TradingView, enabling users to configure alerts based on sophisticated technical analysis indicators. Consider receiving an alert not simply when Bitcoin reaches a specific price, but when a particular candlestick pattern emerges on the 5-minute chart, suggesting a potential breakout. This level of detail is what 3Commas delivers.

Furthermore, alerts can initiate automated actions, such as executing trades through the Smart Trade terminal with predefined take profit and stop loss orders. This automation capability is significant for active traders, allowing them to seize opportunities and manage risk even when not actively monitoring the market.

For those exploring automated trading strategies, 3Commas provides a bot marketplace and tools for designing custom DCA (Dollar Cost Averaging) bots. This allows users to automate repetitive buying strategies, reducing the emotional influence of market fluctuations and potentially optimizing returns over time. Integrated portfolio management features simplify performance tracking across various exchanges, presenting a consolidated view of your holdings.

Key Features and Benefits:

Pros:

Cons:

Implementation Tip: Begin with the paper trading feature to become acquainted with the platform and its capabilities before committing real capital. Explore the pre-built bot templates and modify them to align with your risk tolerance and trading style.

Comparison: While platforms like Cryptohopper offer comparable automation features, 3Commas differentiates itself through its tight TradingView integration and robust Smart Trade terminal, providing greater control and customization for experienced traders.

Website: https://3commas.io/

3Commas is a powerful tool tailored for active crypto traders. Its comprehensive features, while requiring a learning investment, offer significant potential for those aiming to automate their trading strategies and efficiently manage cryptocurrency portfolios across multiple exchanges. If you seek more than basic price alerts and are willing to dedicate time to mastering its intricacies, 3Commas can be a valuable addition to your trading toolkit.

Crypto Alerting sets itself apart by concentrating solely on providing a robust and specialized crypto alert system. Unlike all-in-one platforms that treat alerts as a secondary feature, Crypto Alerting prioritizes notifications. This makes it a perfect fit for users wanting granular control over their crypto information stream, without the added noise of trading tools. This laser focus easily earns it a spot on our list of best crypto alert apps.

Consider tracking a low-cap altcoin showing potential for a breakout. Crypto Alerting allows you to configure alerts for specific percentage price changes. This ensures you won't miss a sudden price surge. Alternatively, perhaps you're observing whale activity on a particular DeFi protocol. Crypto Alerting's whale transaction alerts can notify you of large movements, potentially signaling upcoming market shifts. Specialized features, including smart contract interaction alerts and exchange listing/delisting notifications, deliver valuable insights often unavailable on other platforms.

Beyond just price fluctuations, Crypto Alerting also offers on-chain data alerts, a powerful tool for serious crypto investors. This feature allows users to monitor key metrics like transaction volume and network activity, providing a deeper understanding of underlying market trends. For instance, a spike in on-chain transactions could suggest growing adoption, potentially preceding a price increase.

The platform provides a generous free tier with essential functionalities, making it accessible to users of all experience levels. Multiple notification channels, including email, Telegram, and Discord, ensure prompt alert delivery. SMS notifications are an option on paid plans.

While Crypto Alerting excels in its dedicated alert system, it's important to acknowledge its limitations. Portfolio tracking capabilities are not as comprehensive as those found in broader platforms. The platform also doesn't offer direct trading functionality or as many technical analysis-based alerts as dedicated trading platforms. For a more extensive platform comparison, you might be interested in: Our guide on the 8 Best Cryptocurrency Price Alerts Apps of 2025.

Features:

Pros:

Cons:

Website: https://cryptoalerting.com/

| Platform | Key Features ✨ | User Experience ★ | Value Proposition 💰 | Audience 👥 |

|---|---|---|---|---|

| Coindive 🏆 | Social metrics, AI price alerts, bot filtering | Intuitive dashboards, detailed insights | Evidence-based crypto insights | Investors, analysts, enthusiasts |

| CoinMarketCap | Real-time prices, portfolio, market data | User-friendly, beginner-friendly | Extensive coverage, free core features | Traders, beginners |

| CryptoHopper | Technical alerts, automated trading, multi-exchange | Advanced, steep learning curve | Comprehensive analysis with automation | Experienced traders |

| Coin Stats | Portfolio sync, customizable alerts, analytics | Clean interface, smooth tracking | Unified asset management & analysis | Portfolio trackers and holders |

| TradingView | Advanced charts, multi-condition alerts, Pine Script | Robust, feature-rich, learning curve | In-depth technical analysis across markets | Technical traders, analysts |

| 3Commas | Trading bots, portfolio manager, TradingView integration | Integrated, complex but powerful | Automated trading with complex scenarios | Active traders, strategy builders |

| Crypto Alerting | Whale alerts, on-chain data, exchange notifications | Simple, focused, alert-centric | Dedicated alerts for precise market moves | Alert-focused crypto users |

Choosing the best crypto alerts app hinges on several factors: your trading style, experience level, and specific needs. Are you a day trader meticulously tracking real-time price fluctuations? Perhaps you're a long-term holder more interested in major news and sentiment shifts? Or maybe you're a researcher focused on specific on-chain metrics. The ideal app will vary considerably based on these individual requirements.

When evaluating tools like Coindive, CoinMarketCap, CryptoHopper, Coin Stats, TradingView, 3Commas, and Crypto Alerting, consider the following key aspects:

Implementation and Getting Started: Ease of use is paramount. Does the platform require coding knowledge or complex integrations? A user-friendly interface and clear documentation should be top priorities.

Budget and Resources: Most apps offer free tiers with limited features, while premium subscriptions unlock more advanced functionalities. Assess your budget and the value proposition of each tier to determine the optimal choice. Factor in the time investment needed to effectively utilize the platform's capabilities.

Integration and Compatibility: Seamless integration with your existing trading platforms or portfolio trackers is crucial. Verify compatibility with the exchanges, wallets, and other tools you regularly employ. This streamlines your workflow and enhances overall efficiency.

Features and Functionality: Scrutinize the specific alerts offered by each app. Do they align with your investment strategy? Prioritize the alerts that matter most to you, whether it's price alerts, technical indicators, social sentiment analysis, on-chain metrics, or a combination thereof.

Here's what to keep in mind when making your decision:

Real-time Alerts: Essential for active traders who need to react swiftly to market movements.

Customizability: The ability to tailor alerts to specific criteria is vital for filtering out noise and focusing on relevant information.

Accuracy and Reliability: Dependable alerts help prevent missed opportunities and minimize the risk of acting on false signals.

User Experience: An intuitive interface simplifies setup and ongoing management, saving you valuable time and effort.

Analyzing the cryptocurrency market demands staying informed and adapting to constant fluctuations. Coindive offers a robust solution for tracking your favorite crypto projects efficiently. From AI-driven context for price alerts to monitoring social sentiment across multiple platforms, Coindive provides valuable insights for informed investment decisions. Stop wading through endless data streams and start making more strategic moves. Explore the capabilities of Coindive today: https://coindive.app