The cryptocurrency market, known for its volatility, presents both exciting opportunities and substantial risks. Staying informed about price fluctuations is no longer optional, but crucial for anyone serious about participating in this dynamic market.

Whether you're a seasoned trader aiming to capitalize on price drops or a long-term holder protecting your investments, cryptocurrency price alerts offer a powerful solution. They free you from constant monitoring, allowing you to react quickly to market movements. This empowers you to execute trades at optimal times and manage your portfolio efficiently without constant screen-watching.

With the multitude of price alert tools available, selecting the right one can be daunting. Key factors to consider include:

Some platforms offer free basic alerts while others provide advanced features via subscriptions. Technical aspects, like notification delivery methods (SMS, email, push notifications) and platform compatibility (mobile apps, web interfaces, desktop applications), also play a vital role in selecting an effective tool.

Finding the ideal tool requires careful consideration of your specific investment strategy and technical needs. Do you primarily trade Bitcoin or are you involved with a wider range of altcoins? This will dictate the breadth of cryptocurrency support you need.

Your trading style also influences the type of alerts you'll require. Simple price thresholds might suffice for long-term holders, while active traders may benefit from alerts based on technical analysis like Moving Averages or Relative Strength Index (RSI). Learn more about Technical Indicators.

Consider how you want to receive notifications. SMS alerts offer immediate notification but can be costly, while email alerts provide a record but might be less timely. Push notifications through a mobile app offer a balance of speed and convenience.

Seamless integration with your existing trading platform is another important factor. Direct integration allows you to execute trades directly from the alert, saving valuable time in fast-moving markets. This article will delve into the top 8 cryptocurrency price alert applications of 2025, analyzing their strengths and weaknesses to help you identify the perfect fit for your unique requirements.

Coindive offers cryptocurrency enthusiasts more than basic price alerts. This platform provides a comprehensive market tracking and community sentiment analysis system. Coindive goes beyond simple price triggers to offer valuable, context-driven insights. Instead of simply knowing that a price changed, you'll understand why.

Consider tracking a specific altcoin. Coindive alerts you to price fluctuations and analyzes related discussions across major social platforms like Twitter, Telegram, Discord, and Reddit. This feature connects price movements with real-time community sentiment, developer announcements, and emerging trends. This contextual awareness helps make informed trading and investment decisions in the volatile cryptocurrency market.

Coindive uses AI and data from CoinGecko for reliable, up-to-the-minute information. Its advanced spam and bot filtering ensures that sentiment analysis focuses on genuine engagement, increasing the accuracy of its insights. This focus is vital for separating actual trends from manipulated market activity or social media campaigns. For more information on price surges, see this article: Cryptocurrency Price Surges: Driving Factors.

Coindive offers several key features designed to provide a deeper understanding of the crypto market:

Here's a breakdown of the advantages and disadvantages of using Coindive:

Pros:

Cons:

Website: https://coindive.app

Coindive provides a unique blend of market data and community sentiment analysis. While its advanced features may require a learning curve, the insights offered make it a powerful tool. Investors, traders, and analysts seeking data-driven decisions will appreciate Coindive's focus on contextualized alerts, setting it apart from basic price alert tools. This focus provides a deeper understanding of the ever-changing cryptocurrency market.

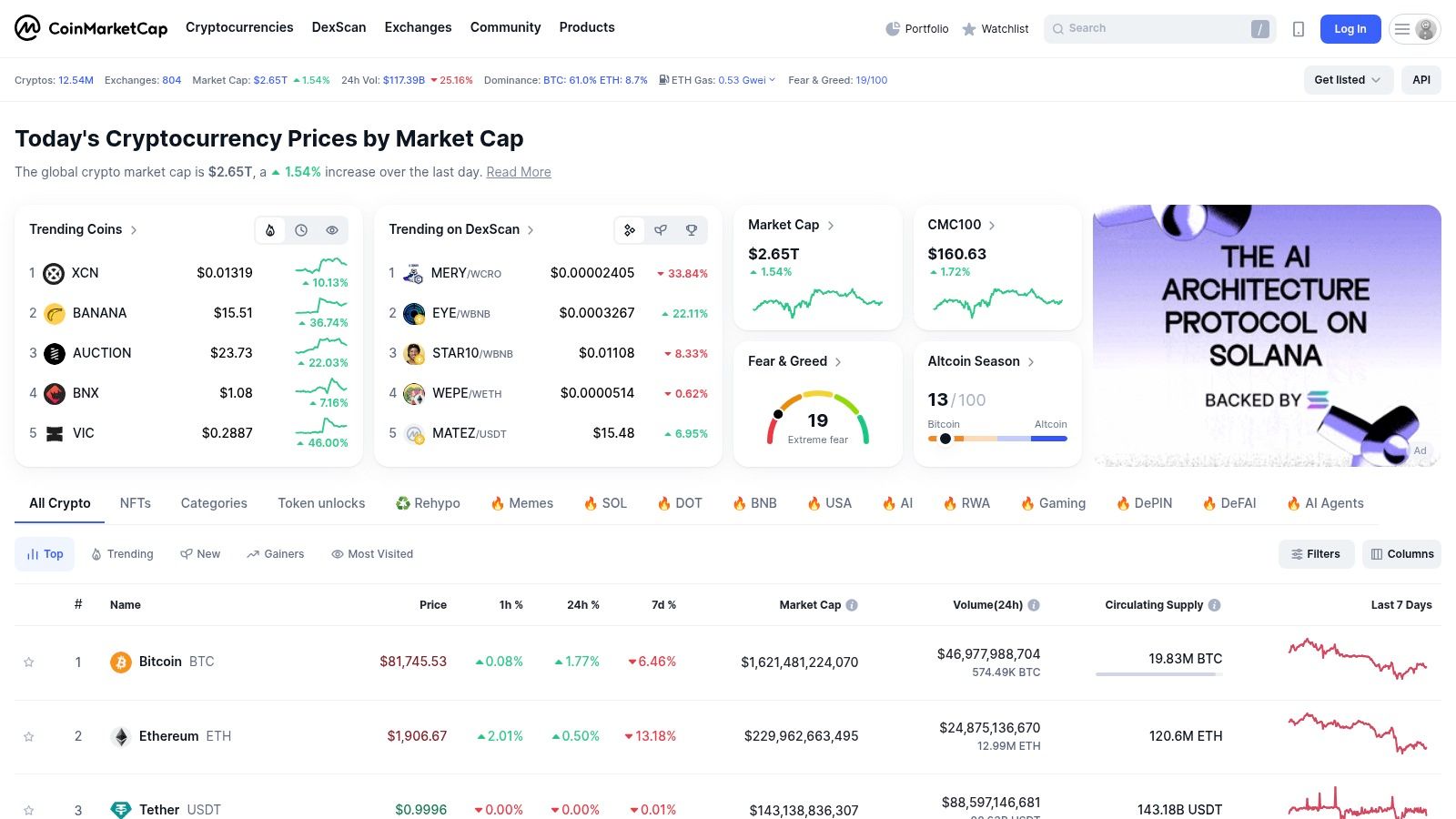

CoinMarketCap is a cornerstone resource in the cryptocurrency world. Its comprehensive coverage, reliable data, and accessible alert system justify its inclusion on this list. A robust free tier caters to basic price tracking and alerts, making it ideal for newcomers. More demanding traders can leverage paid features for enhanced functionality. CoinMarketCap's price alerts are valuable for anyone seeking to stay informed about this volatile market.

CoinMarketCap stands out by offering price alerts for over 10,000 cryptocurrencies. This extensive coverage benefits investors interested in a diverse range of assets. It includes everything from established coins like Bitcoin and Ethereum to emerging altcoins. Users customize alerts based on specific price targets, percentage changes (hourly, daily, or weekly), and even market capitalization fluctuations.

For example, an alert can be set if Bitcoin hits a predetermined price. Or, you might be notified if a low-cap altcoin experiences a sudden 20% surge. This granular control allows users to react quickly to market shifts, capitalizing on opportunities or mitigating potential losses.

Beyond simple price alerts, CoinMarketCap offers portfolio tracking with integrated alerts. Users monitor their entire crypto portfolio's performance in one centralized location. Notifications are provided for significant gains or losses, especially beneficial for managing diversified portfolios and assessing overall market exposure. While the platform excels at price tracking, its technical indicator alerts are less developed compared to specialized charting platforms like TradingView.

Website: https://coinmarketcap.com

Start with alerts for your core holdings. Experiment with percentage-based alerts to refine your strategy. Use the portfolio tracker for a holistic view and related alerts. For advanced charting and technical analysis for alerts, explore platforms like TradingView. However, CoinMarketCap remains an excellent free resource for basic price and market cap alerts.

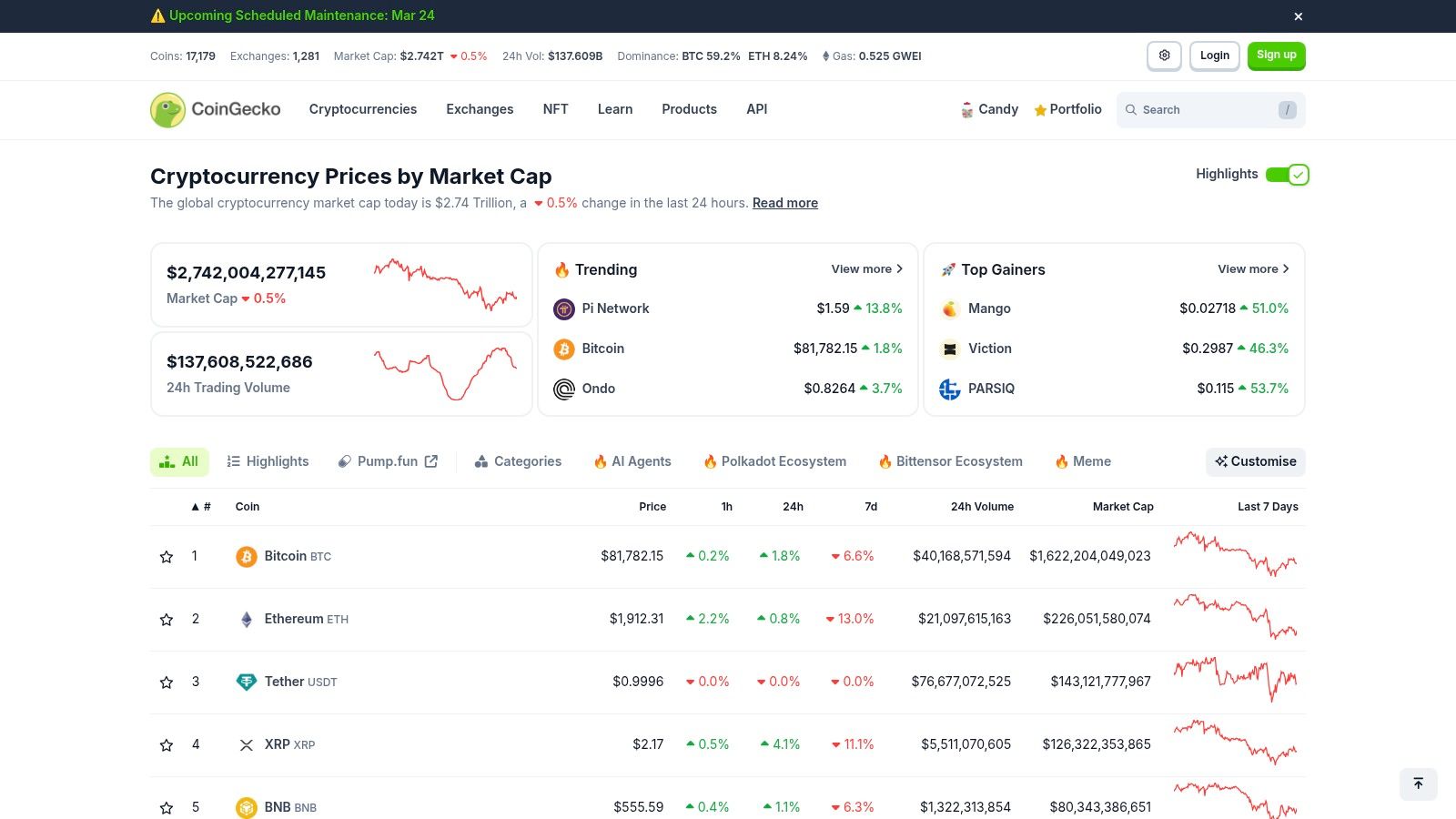

CoinGecko earns its place on this list thanks to its comprehensive and free price alert system, coupled with its commitment to data transparency and a user-friendly interface. From casual cryptocurrency enthusiasts to seasoned portfolio managers, CoinGecko offers a valuable tool for staying abreast of market fluctuations. The platform allows users to track over 10,000 cryptocurrencies, significantly expanding investment opportunities and supporting diversification strategies.

One of CoinGecko's core strengths is its customizable price alerts. Users can set alerts for specific price points, percentage changes, and even candlestick patterns. This level of detail is especially helpful for traders and analysts who use technical indicators to inform their decisions. Multi-currency support, including USD, EUR, BTC, and ETH, allows users to monitor price movements in their preferred currency.

Furthermore, portfolio-based alerts empower users to track the total performance of their holdings and receive notifications when their portfolio value hits a predefined limit. This is a vital feature for managing risk and optimizing capital allocation.

For those constructing a diversified portfolio, CoinGecko's broad coverage offers a distinct edge. The platform goes beyond simply listing prices. It delivers in-depth information on each cryptocurrency, including market capitalization, trading volume, circulating supply, and community activity. This detailed data helps users make informed investment choices.

Setting up price alerts on CoinGecko is simple. Create a free account, navigate to the cryptocurrency you want to track, and click the bell icon to configure your alerts. You can choose between web and mobile notifications, guaranteeing you don't miss important market updates. While CoinGecko offers a mobile app, setting up alerts requires logging in through the website.

Compared to platforms like Crypto.com or Binance, CoinGecko stands out by offering its entire suite of alert features entirely free. While some exchanges might require premium subscriptions for advanced alerts, CoinGecko's commitment to accessibility makes it a compelling option, particularly for cost-conscious investors. However, it lacks some of the social features present on other platforms, a potential drawback for users seeking community insights.

Pros:

Cons:

Website: CoinGecko

In summary, CoinGecko delivers a robust and accessible price alert system. Its comprehensive features, combined with its commitment to free access and transparent data, make it a valuable asset for cryptocurrency investors of all experience levels. While some limitations exist, its strengths solidify CoinGecko as a leading choice for keeping informed in the dynamic cryptocurrency market.

TradingView stands out as a professional-grade charting platform suitable for serious cryptocurrency traders and analysts. While it covers a wide range of financial markets, its advanced charting tools and sophisticated alert system make it especially powerful for crypto enthusiasts. TradingView’s strength lies in its flexibility and depth, enabling users to create highly customized alerts based on complex technical indicators, drawing tools, and even custom scripts.

For example, an investor looking to enter a long position on Bitcoin when the RSI crosses below 30 can easily set up an alert. A day trader can create an alert for a potential short entry when the price breaks below a key support trendline. The platform's custom scripting language, Pine Script, opens near-limitless possibilities for creating alerts tailored to specific trading strategies. Imagine alerts based on moving average crossovers, volume spikes combined with price action, or even alerts generated by sentiment analysis indicators built using Pine Script.

Compared to simpler mobile-first alert apps, TradingView offers a more comprehensive and customizable experience. While apps like CoinGecko and Crypto.com offer basic price alerts, they lack the depth of technical analysis and alert customization. This makes TradingView more appealing to traders relying on technical indicators, chart patterns, and advanced charting techniques.

Start with the free plan: The free plan allows you to explore the platform and familiarize yourself with its interface. You can set up basic price alerts and experiment with some technical indicators.

Explore the community scripts: TradingView has a vibrant community of traders who share custom indicators and scripts. This is a valuable resource for finding pre-built alerts and learning Pine Script.

Invest in a paid subscription when ready: To unlock the full potential of TradingView’s alert system, consider upgrading to a paid plan. This removes limitations on alert numbers and grants access to more advanced features.

TradingView offers various subscription plans ranging from $14.95 to $59.95 per month, each unlocking progressively more features and data. The platform is accessible through a web browser and offers mobile apps for iOS and Android.

Here's a breakdown of the advantages and disadvantages of using TradingView:

Pros:

Cons:

TradingView earns its spot on this list by offering a powerful and versatile platform for setting up highly customized cryptocurrency price alerts. Its advanced charting tools, combined with the flexibility of Pine Script, cater to serious traders and analysts who require more than basic price notifications. While the learning curve might be steeper than simpler alternatives, the potential rewards for mastering TradingView are significant for active crypto traders.

The Crypto.com App offers a convenient, all-in-one solution for managing cryptocurrency and tracking prices. It combines exchange functionality, a built-in wallet, and a robust price alert system. This simplifies the process for casual investors and active traders alike. Rather than using multiple platforms, users can monitor their portfolio, set price alerts, and execute trades all within a single application.

The app excels in streamlining the trading process based on price triggers. Consider setting a price alert for Bitcoin to notify you when it reaches a specific target. The moment the price hits your predefined level, you receive an instant notification on your mobile device. From there, you can directly access the trading platform within the app. This allows you to execute a buy or sell order with a single click, minimizing the risk of missing market opportunities. This feature is especially valuable for traders aiming to capitalize on volatile price swings.

The Crypto.com App provides a variety of alert types. These include price target alerts, percentage change alerts (1h, 24h, 7d), and price movement trend alerts. While the app may offer fewer technical analysis-based alerts than dedicated charting platforms like TradingView, the core functionality meets the needs of most cryptocurrency investors. The recurring price check feature ensures you stay informed, even without constant market monitoring.

Features:

Pros:

Cons:

Pricing and Technical Requirements:

The price alert feature is free with the Crypto.com App, available for both iOS and Android devices.

When setting up alerts, consider combining price targets and percentage change alerts. This creates a comprehensive monitoring strategy. For example, set a price target alert for your desired entry or exit point. Also, set a percentage change alert to be notified of significant market movements. These movements could indicate a trend change.

Compared to dedicated portfolio trackers like Blockfolio or Delta, the Crypto.com App offers less in-depth portfolio analysis. However, it offers the significant advantage of integrated trading execution. For users prioritizing convenient, quick trading based on price alerts, this integration is a distinct advantage.

Website: https://crypto.com/app

In conclusion, the Crypto.com App is a valuable tool for cryptocurrency investors. It provides a streamlined platform for price tracking and trading. Its user-friendly interface, real-time notifications, and direct exchange integration make it an excellent option. It particularly suits investors prioritizing speed and convenience when executing trades based on market movements. Traders requiring advanced charting and technical analysis-based alerts may want to supplement the app with a dedicated charting platform.

Coinbase, a leading cryptocurrency exchange, offers an integrated price alert system. This provides a convenient solution for users already trading on the platform. While not as feature-rich as dedicated cryptocurrency alert tools, its simplicity and direct trading integration make it valuable, especially for beginners. This allows users to monitor price movements of assets they hold or are interested in, without needing a separate third-party application.

For investors primarily focused on the cryptocurrencies available on Coinbase, the built-in alerts offer a seamless experience. Consider the scenario of accumulating Bitcoin and wanting to be notified when it hits a specific price target. With Coinbase's system, a threshold alert can be set. This triggers a push notification or email when Bitcoin reaches that price, allowing for rapid reaction and potential trade execution directly within the app.

Beyond simple price thresholds, Coinbase also offers percentage change notifications. This feature is helpful for monitoring broader market movements. For example, an alert can be set to notify you if Ethereum drops by 5%, enabling a swift response to market volatility. Portfolio-specific alerts further enhance the experience by allowing users to track the overall value of their Coinbase holdings.

Compared to tools like TradingView or Cryptowatch, Coinbase's system is basic. These platforms offer advanced charting and a broader array of technical indicator alerts. However, Coinbase’s simplicity is beneficial for new crypto investors. It avoids the complexity of external platforms, allowing them to manage their portfolio within a familiar interface.

To set up price alerts in Coinbase, navigate to the asset you want to track and locate the bell icon or alert option. You can then specify the price or percentage change that will trigger the notification.

For existing Coinbase users, this integrated alert feature is a practical tool. While advanced traders might find its functionality limiting, it’s a straightforward solution for casual investors and beginners looking to monitor price movements on a trusted platform. Visit Coinbase to learn more.

Blockfolio, now integrated into FTX, remains a popular mobile-first platform for cryptocurrency portfolio tracking and price alerts. Its broad coverage and user-friendly interface make it a solid choice for casual investors and those who value straightforward price notifications across a wide range of exchanges. While Blockfolio may not offer the in-depth technical analysis tools found on other platforms, its ease of use, free access to all features, and extensive exchange support make it a valuable tool.

Blockfolio's core strength lies in its price alert functionality. Users can set alerts for specific price thresholds (like Bitcoin reaching $30,000) or for percentage changes (like Ethereum dropping by 5%). This flexibility allows for personalized notifications tailored to individual investment strategies. Consider the scenario of tracking a low-cap altcoin on a smaller exchange. With support for over 500 exchanges, Blockfolio likely has it covered. This broad reach is a significant advantage, particularly for altcoin investors.

Beyond basic alerts, Blockfolio's "Signal" feature provides a unique informational edge. By relaying updates directly from token team developers, Blockfolio offers insights into project developments, roadmap changes, and other news that might affect a cryptocurrency's price. This adds a qualitative layer to price alerts, enabling users to consider both market movements and fundamental factors. A price drop alongside a positive development update, for instance, might signal a buying opportunity. This feature is especially helpful for crypto researchers, developers, and content creators.

Features:

Pros:

Cons:

To get started, download the Blockfolio app (now FTX) on your mobile device. Add the cryptocurrencies you want to track and select the bell icon next to each asset to configure alerts. Experiment with different price thresholds and percentage changes to align alerts with your risk tolerance and investment goals. Explore the "Signal" feature for additional insights directly from project teams.

While similar to Delta or CoinStats in portfolio tracking, Blockfolio stands out with its wider exchange coverage and the unique "Signal" feature. If your focus is technical analysis and chart-based alerts, TradingView or similar platforms might be better suited. However, for a free, user-friendly, mobile-first experience centered on price alerts across a broad spectrum of cryptocurrencies and exchanges, Blockfolio (FTX) remains a strong contender.

FTX (Blockfolio)

Altrady distinguishes itself as a professional-grade cryptocurrency price alert platform built for active traders. Unlike basic crypto portfolio trackers, Altrady's focus isn't general portfolio management. Instead, it provides the specific tools traders need to rapidly respond to market fluctuations across a range of exchanges. This targeted approach makes it especially appealing for those managing diverse portfolios or engaging in high-frequency, short-term trading.

Altrady's strength lies in its comprehensive alert system. It moves beyond simple price alerts to offer technical indicator alerts (RSI, MACD), custom alerts with multiple parameters, and specialized scanners. The Base scanner helps identify potential breakout points for longer-term entries, while the Quick scanner targets short-term trading opportunities. This granular control allows traders to minimize irrelevant alerts and focus on actionable market insights.

For traders operating across multiple exchange accounts, Altrady offers a centralized interface. This unified platform allows users to manage price alerts across all connected exchanges. This streamlines the monitoring process, saving valuable time previously spent toggling between different exchange platforms. Altrady currently supports over 20 major exchanges, ensuring broad coverage for most active traders.

Altrady's trading focus is further emphasized by its integrated advanced trading tools. This seamless integration allows users to move directly from alert notification to trade execution within the same platform. While this integration is a major advantage for active traders, it can also contribute to a steeper learning curve for newcomers to the platform.

Altrady is a powerful platform, but its specialized features may not suit all investors. Casual investors or those focused on long-term holding strategies might find the subscription cost and complexity unnecessary. However, for serious cryptocurrency traders seeking a robust, multi-exchange alert system integrated with advanced trading tools, Altrady may be a worthwhile investment. You can explore Altrady and its pricing plans on their website: https://www.altrady.com

| Platform | Core Features ✨ | UX & Value Proposition ★ | Target Audience 👥 | Price Points 💰 |

|---|---|---|---|---|

| Coindive 🏆 | Real-time social alerts, AI-driven insights, advanced spam filtering | Clear visuals, evidence-based insights, smart alert customization | Traders, investors, developers | N/A / TBD |

| CoinMarketCap | Price targets, percentage alerts, portfolio tracking | User-friendly interface, reliable charts, extensive crypto data | Beginners & experienced traders | Free basic; paid upgrades |

| CoinGecko | Customizable threshold alerts, multi-currency support | Clean design, comprehensive data, free alert features | Crypto enthusiasts, casual traders | Free |

| TradingView | Advanced technical alerts, custom script-based alerts, multi-condition functionality | Professional-grade charting, high customization | Advanced traders, technical analysts | $14.95–$59.95 subscription |

| Crypto.com App | Instant price alerts, trend monitoring, one-click trading | Seamless integration with trading, mobile-friendly | Everyday traders, mobile users | Free with exchange account |

| Coinbase | Simple threshold & percentage alerts, portfolio notifications | Easy setup, integrated trading experience | Beginner traders, Coinbase users | Free for users |

| Blockfolio (FTX) | Multi-exchange alerts, team signals, portfolio value notifications | Intuitive mobile interface, free comprehensive features | Mobile traders, portfolio managers | Free |

| Altrady | Breakout scanners, technical indicator alerts, multi-exchange price alerts | Sophisticated trading tools, focused design for rapid decision-making | Professional crypto traders | $9.99–$39.99 subscription |

The ideal cryptocurrency price alert app hinges on several factors: your trading style, experience level, and desired features. Are you a day trader needing real-time technical analysis alerts? Platforms like TradingView and Altrady might be a good fit. Or perhaps you're a long-term investor simply seeking price notifications? In that case, CoinMarketCap, CoinGecko, the Crypto.com App, and Coinbase offer straightforward solutions. For those tracking specific coins, Blockfolio (FTX) provides focused portfolio tracking and alerts.

Choosing the right platform requires careful consideration. Here's a breakdown of key factors:

Some platforms demand more technical expertise. Beginners should prioritize intuitive interfaces and clear documentation. Consider the ease of setting up alerts and customizing notification parameters.

Many platforms have free tiers with limited features, while premium subscriptions unlock advanced functionalities. These often include real-time data, custom indicators, and increased alert limits. Carefully evaluate your needs and budget to determine the best fit.

Does the platform integrate with your current exchange accounts or trading tools? Verify compatibility with your preferred devices (desktop, mobile) and operating systems. Critically, ensure the platform supports the specific cryptocurrencies you’re interested in.

Think about what you need. Are basic price alerts sufficient, or do you require more advanced features? These could include social sentiment analysis, community growth metrics, or AI-driven insights. Different platforms cater to different needs. Understanding your requirements will guide your decision.

Here's a summary of the essential considerations:

Thorough market monitoring is critical for successful cryptocurrency investing. While basic price alerts can be valuable, consider platforms offering more comprehensive analysis. For example, Coindive provides AI-driven context for price movements, connecting them to broader market trends and sector shifts. It also incorporates social sentiment analysis and community growth metrics, offering deeper insights into market fluctuations. This allows you to move beyond simply reacting to price changes and start anticipating them.