In the dynamic world of cryptocurrency, monitoring the movements of large holders—commonly known as "crypto whales"—provides critical market insights. These powerful entities control substantial capital that can trigger significant price movements, potentially creating or destroying value for other investors. Their transactions often generate domino effects that influence both immediate market volatility and longer-term trends. Much like a massive oceanic creature causing ripples throughout surrounding waters, whale activities send waves across the entire crypto ecosystem, creating both risks and opportunities for regular traders. This reality highlights the fundamental importance of whale tracking as a practice that has evolved alongside the cryptocurrency market itself.

The methods for monitoring whale activity have transformed dramatically since Bitcoin's early days. Initially, the crypto space emphasized anonymity, making whale tracking relatively basic and centered on public blockchain explorers. Today's landscape offers much greater transparency, enabling more sophisticated tracking approaches. The emergence of specialized blockchain analytics platforms has revolutionized how investors monitor large-scale transactions. Modern whale tracking involves comprehensive analysis of on-chain metrics, complex transaction pattern recognition, and advanced data aggregation techniques to identify and anticipate significant market movements. By studying the historical context of major transactions, investors can develop more accurate predictions about future market behavior.

This listicle examines seven essential crypto whale tracking tools that can help you navigate cryptocurrency markets with greater confidence and insight. You'll discover how to effectively use these resources to identify potential market manipulation, anticipate major price shifts, and make more informed investment decisions based on whale behavior patterns. By uncovering the hidden movements of these crypto giants, you can gain a significant advantage in the fast-moving world of digital assets.

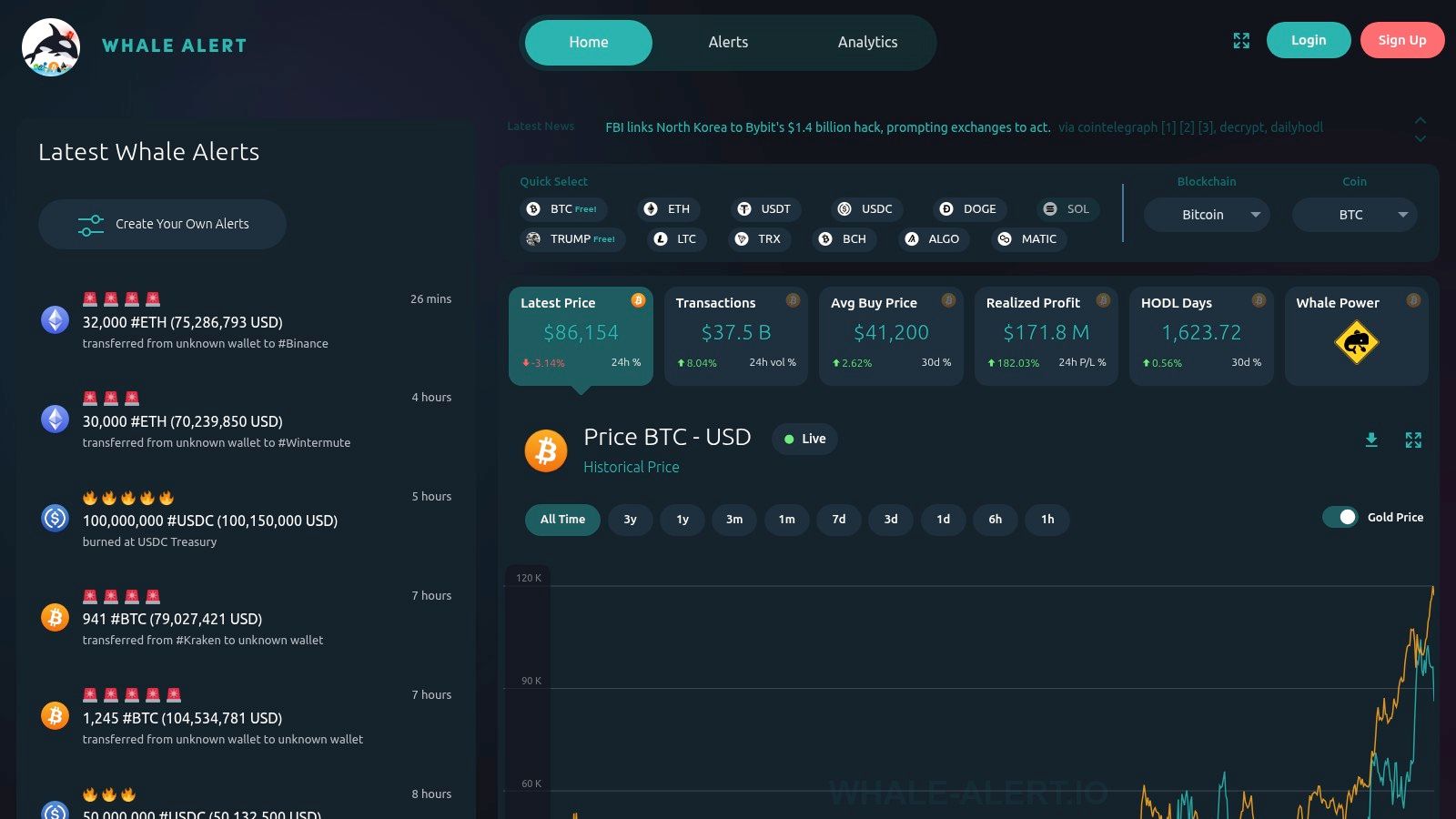

Whale Alert stands at the top of this list due to its extensive coverage, instant monitoring capabilities, and substantial community following. This platform excels at tracking major cryptocurrency transactions—commonly known as "whale movements"—across numerous blockchains. The data it provides serves both individual investors gauging market sentiment and institutional players monitoring significant asset movements.

The service specializes in identifying and reporting large cryptocurrency transfers across multiple networks, including Bitcoin, Ethereum, XRP, Tron, NEO, EOS, and Stellar. By monitoring these movements in real-time and publishing alerts through its website, social media, and API, Whale Alert enables users to stay informed about major shifts in crypto assets that may signal emerging market trends.

Consider this practical application: when Whale Alert detects a sudden influx of Bitcoin into a known exchange, this could signal an impending sell-off—valuable intelligence for traders. Conversely, large withdrawals from exchanges might indicate accumulation and suggest bullish market sentiment. Tracking these substantial transactions helps investors better understand market dynamics and adjust their strategies accordingly.

Key Features & Benefits:

Pricing: The platform offers a free basic service with access to real-time alerts and limited historical data. Premium features, including customizable alerts and comprehensive historical data, require a paid subscription. Detailed pricing information is available on their website.

Technical Requirements: Basic Whale Alert features need only a web browser or social media access. API integration requires development skills and familiarity with their documentation.

Pros:

Cons:

Implementation Tips:

You might be interested in: How to Analyze On-Chain Data using CoinDive Explorer. Combining whale movement analysis with other on-chain metrics provides a more complete view of market activity.

Read also: [Understanding the Impact of Whale Movements on Crypto Prices]. This resource offers valuable insights into how large transactions influence price volatility.

Website: Whale Alert

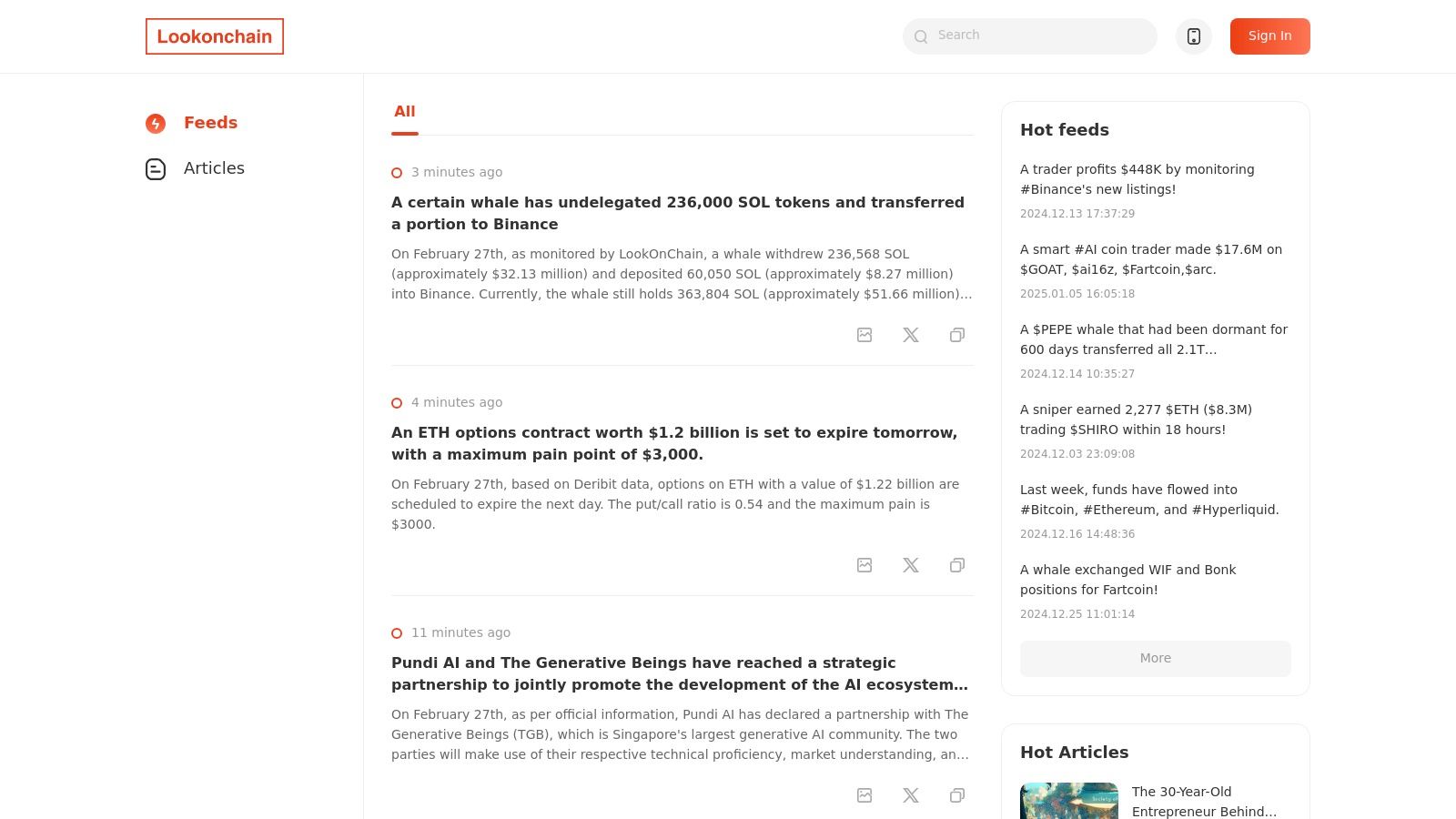

Lookonchain stands out as a specialized on-chain analytics platform designed to track "smart money" – the whale investors and institutions that often drive market movements. Unlike general blockchain explorers, Lookonchain delivers specific insights into whale behavior, giving users the ability to spot market trends before they become obvious to the broader market. The platform achieves this through targeted features that decode the strategies of large holders.

For those involved in crypto markets, Lookonchain serves as a crucial research tool for identifying potential trading opportunities. By observing when whales accumulate or distribute assets, users gain valuable market signals. For example, when you notice a prominent whale building a position in a particular altcoin, this information – combined with fundamental analysis – might indicate an upcoming price movement. Similarly, monitoring large sell-offs provides early warning signals that could help mitigate downside risk.

The platform offers both free and paid subscription options. The free tier provides basic whale tracking and analysis, while premium tiers unlock more comprehensive features including detailed wallet analysis, profit/loss calculations for whale trades, customizable alerting systems, and enhanced data visualization tools. While premium pricing exceeds some competing services, the depth of analysis and actionable intelligence often justifies the investment for serious market participants. Full pricing information is available on their website.

Key Features and Benefits:

Pros:

Cons:

Implementation/Setup Tips:

Getting started with Lookonchain is straightforward. Visit their website (www.lookonchain.com), explore the free resources, and evaluate whether premium features align with your investment approach. Take time to understand the various dashboards and visualization tools to properly interpret the data. Test different alert configurations to receive timely notifications about relevant whale activities that match your investment interests.

For investors focused on the Ethereum ecosystem who want to understand and potentially benefit from the actions of major market participants, Lookonchain offers powerful analytical tools. While premium features represent an additional cost, the insights provided can be valuable for serious crypto investors, traders, and market analysts looking to make more informed decisions.

Santiment stands out as a comprehensive crypto whale tracker that delves deeper than basic transaction reporting. The platform offers a robust suite of analytical tools designed to uncover the underlying motivations driving whale movements by integrating on-chain, social, and development data. This makes it particularly valuable for investors seeking substantive insights into market dynamics.

While most trackers simply show that a whale moved funds, Santiment aims to reveal why. For example, are they accumulating or distributing? Does their activity correlate with social media trends or project milestones? This context is essential for making informed decisions. Consider a large Bitcoin transaction – by itself, this information has limited value. However, Santiment enables you to correlate that transaction with metrics like the NVT ratio, exchange flows, and social sentiment to determine whether this movement signals a potential price surge or decline.

Santiment's key features for whale tracking include:

Pros:

Cons:

Website: Santiment

Implementation Tip: Begin with a free account to explore the platform and identify which metrics matter most to your investment strategy. Investing time to learn the platform's capabilities will significantly enhance its value. Consider upgrading to a paid subscription if you find the in-depth analysis and custom dashboards beneficial.

For crypto investors, traders, and analysts, Santiment provides a powerful framework for interpreting the often-obscure world of whale activity. While the platform's complexity and subscription fees may present initial barriers, the insights gained can be invaluable for those seeking deeper understanding of market forces.

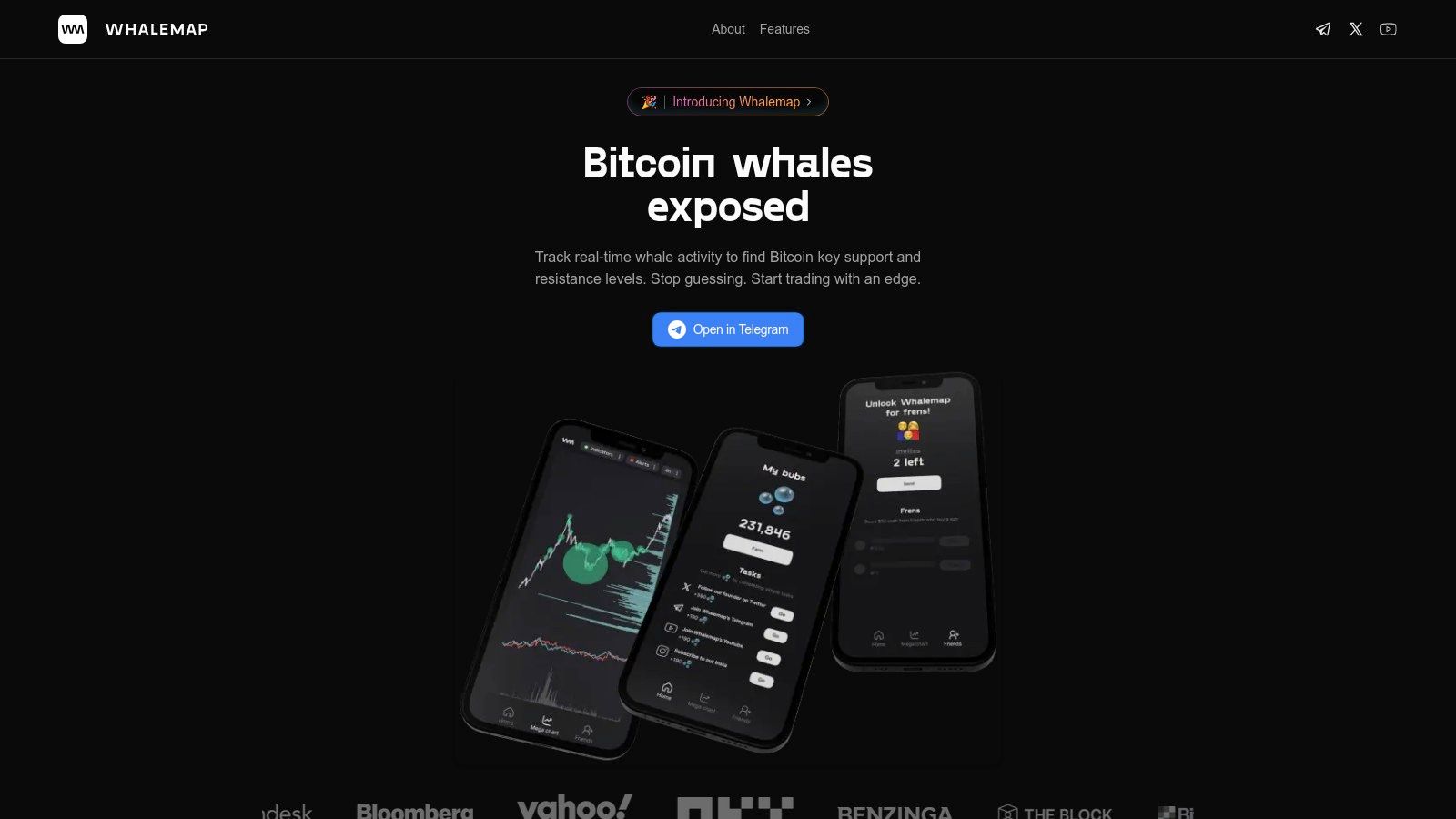

WhaleMap offers a distinct approach in the crypto whale tracking space by concentrating exclusively on Bitcoin and displaying large holder activities through advanced heatmap and cluster analysis methods. Rather than simply cataloging large wallets, WhaleMap examines Unspent Transaction Outputs (UTXOs) to map where whales accumulate and distribute Bitcoin. This creates a powerful visual representation of potential support and resistance zones, making it an essential resource for dedicated Bitcoin traders and analysts.

Practical Applications and Use Cases:

Features and Benefits:

Pros:

Cons:

Implementation/Setup Tips:

While the free version provides a solid foundation, consider upgrading to the premium tier for access to historical data and more detailed analysis. Investing time to understand the UTXO concept and its relationship to whale activity will significantly enhance your ability to interpret the data WhaleMap presents.

Comparison with Similar Tools:

Unlike tools that merely track large wallet balances, WhaleMap's UTXO approach delivers a more sophisticated and actionable view of whale activity. While other platforms might cover altcoins, WhaleMap's exclusive focus on Bitcoin enables a deeper level of specialized analysis.

Website: WhaleMap

WhaleMap earns its place on this list through its distinctive visualization method and focus on actionable insights. Its ability to connect whale clusters with key support and resistance levels makes it a valuable asset for any serious Bitcoin trader or analyst seeking market advantages. Though the UTXO-based analysis requires some learning, the potential improvements in trading decisions make this effort worthwhile.

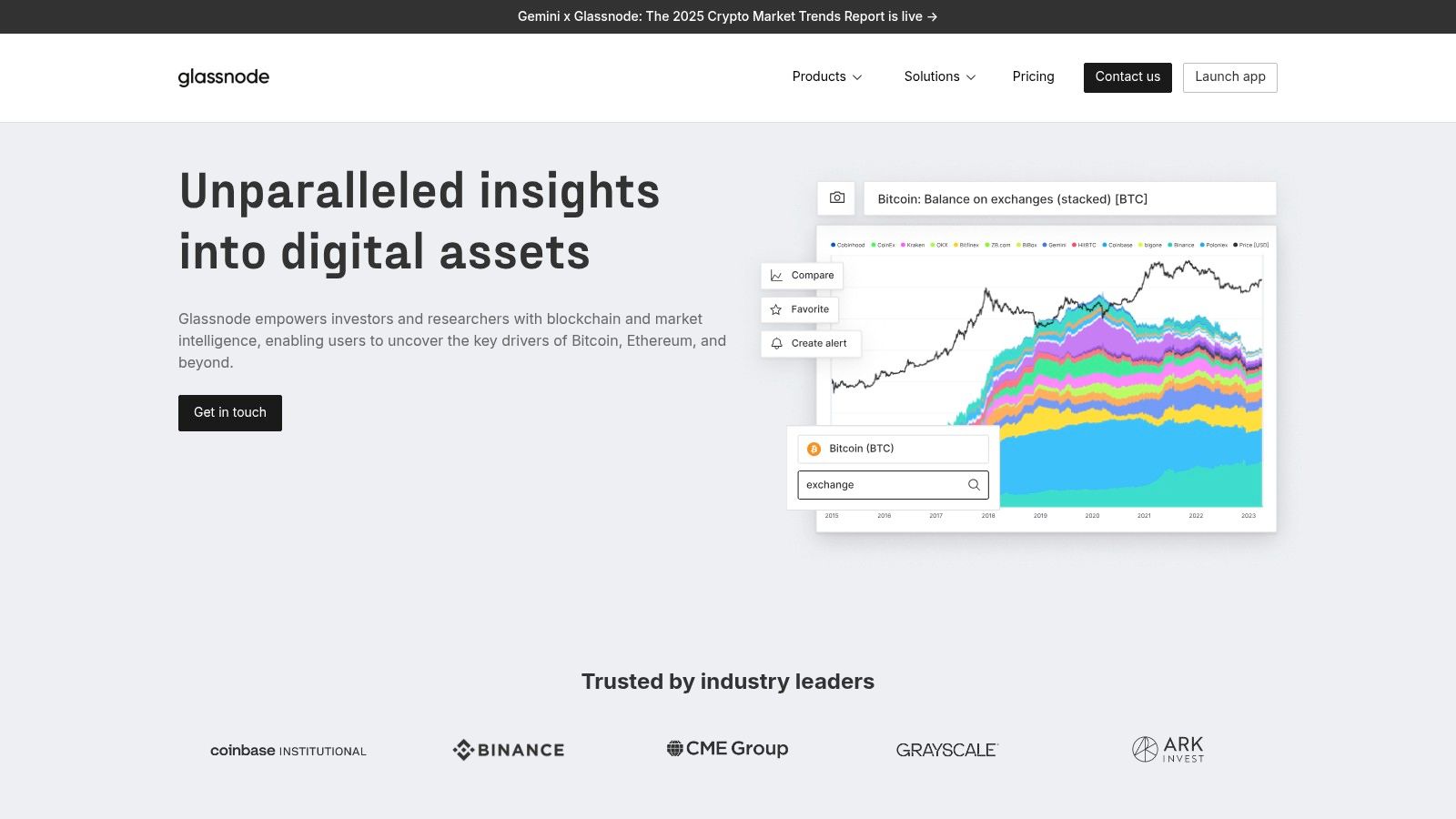

Glassnode stands as the gold standard for on-chain analytics, offering institutional-grade whale tracking within a comprehensive suite of powerful tools. While commanding a premium price point, its exceptional data quality and analytical depth make it essential for serious crypto investors, analysts, and institutions seeking deep market insights.

Beyond simple transaction identification, Glassnode provides a complete view of whale behavior through analysis of exchange flows, HODL waves, coin days destroyed, supply distribution charts, and profit/loss metrics of whale positions. This comprehensive approach reveals not just what whales are doing, but their likely motivations. For example, by correlating exchange outflows with decreased coin days destroyed, you can determine that long-term holders (typically whales) are accumulating, potentially indicating a bullish market shift. The realized cap distribution by cohort size further clarifies which whale segments (those holding for 1-2 years versus 2-3 years) are driving these movements.

For portfolio managers and institutional investors, Glassnode data proves critical for making evidence-based investment decisions. The detailed insights into whale accumulation and distribution patterns offer valuable signals about market trends and possible price movements. Research teams can use Glassnode's extensive datasets to conduct thorough studies on how whale behavior affects broader market dynamics.

Features:

Pros:

Cons:

Website: Glassnode

Implementation Tips:

Begin with a free trial or lowest tier to familiarize yourself with the platform. Focus on select key metrics relevant to your specific investment strategy. Use Glassnode's academy and research reports to learn proper data interpretation. Consider pairing Glassnode with a real-time alerting tool if immediate notifications of whale activity are necessary.

While Glassnode's advanced features and higher cost may not suit everyone, its analytical power and data accuracy deliver exceptional value for serious crypto investors and institutions seeking deep understanding of whale behavior. It represents an investment in informed decision-making, offering a significant advantage when navigating the volatile cryptocurrency market.

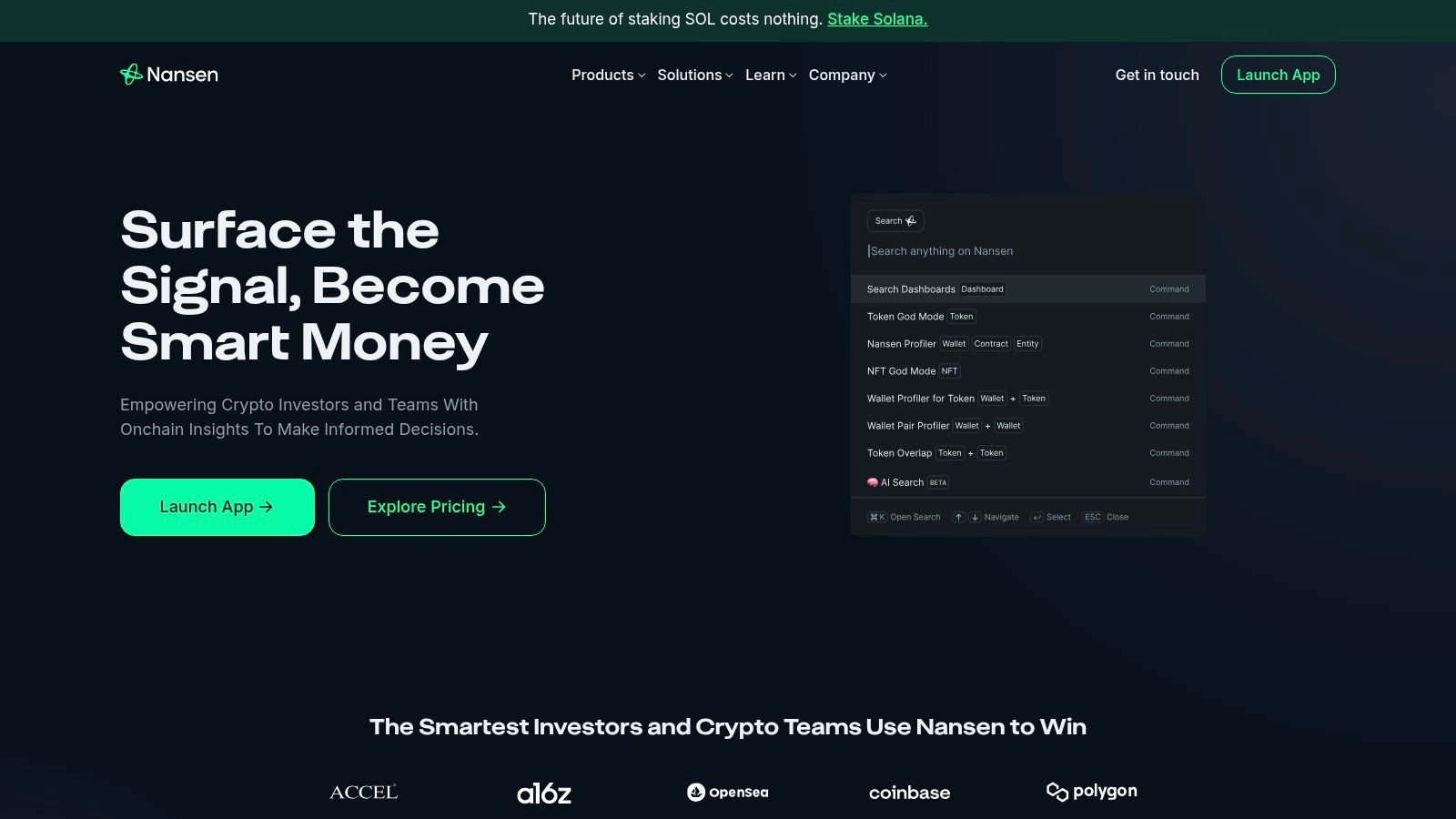

Nansen earns its place on this list through its exceptional capacity to identify and track "smart money" in the cryptocurrency market. Unlike basic blockchain explorers, Nansen delivers more than raw transaction data. It employs AI-powered algorithms to label wallets, providing essential context about the activities of institutional investors, whales, and other key market players. This gives users the ability to anticipate market movements and make better-informed investment decisions.

Nansen excels at converting raw on-chain data into actionable insights. Features such as "Smart Money Labels" and the "Hot Contracts" dashboard enable users to spot which tokens are attracting attention from successful traders and large holders. For example, if several labeled "whale" wallets suddenly accumulate a particular altcoin, this might indicate an upcoming price movement. The "Token God Mode" feature offers deeper analysis of individual token holdings, showing the distribution and movements of major holders, which strengthens due diligence processes. For NFT enthusiasts, "NFT Paradise" delivers similar tracking capabilities for the NFT market, allowing users to monitor prominent collectors and identify trending projects. The "Wallet Profiler" provides historical performance data on specific wallets, enabling users to learn from successful trading strategies.

While Nansen supports multiple chains including Ethereum, Solana, BSC, and Polygon, its primary strength lies in the Ethereum ecosystem. This makes it particularly useful for investors focused on ERC-20 tokens and DeFi projects. Real-time alerts for smart money movements provide a significant advantage in the fast-moving crypto market, allowing users to quickly respond to emerging opportunities.

However, this advanced platform comes with a premium price tag. Nansen is among the most expensive crypto whale tracking tools available, with pricing tiers ranging from hundreds to thousands of dollars monthly. This positions it as more appropriate for serious investors and professional traders. Additionally, the platform's rich feature set and data-intensive interface can be difficult for newcomers to navigate. There's a definite learning curve involved in effectively using all of Nansen's capabilities. While real-time data is available for many features, some advanced analytics and historical data may experience delays.

Pros:

Cons:

Website: Nansen

Implementation Tips:

Nansen stands as a powerful tool for serious crypto investors seeking market advantages. Its advanced analytics and smart money tracking capabilities provide valuable insights, though at a premium cost. While it demands an investment of both time and money, the potential benefits for those who master its features can be considerable.

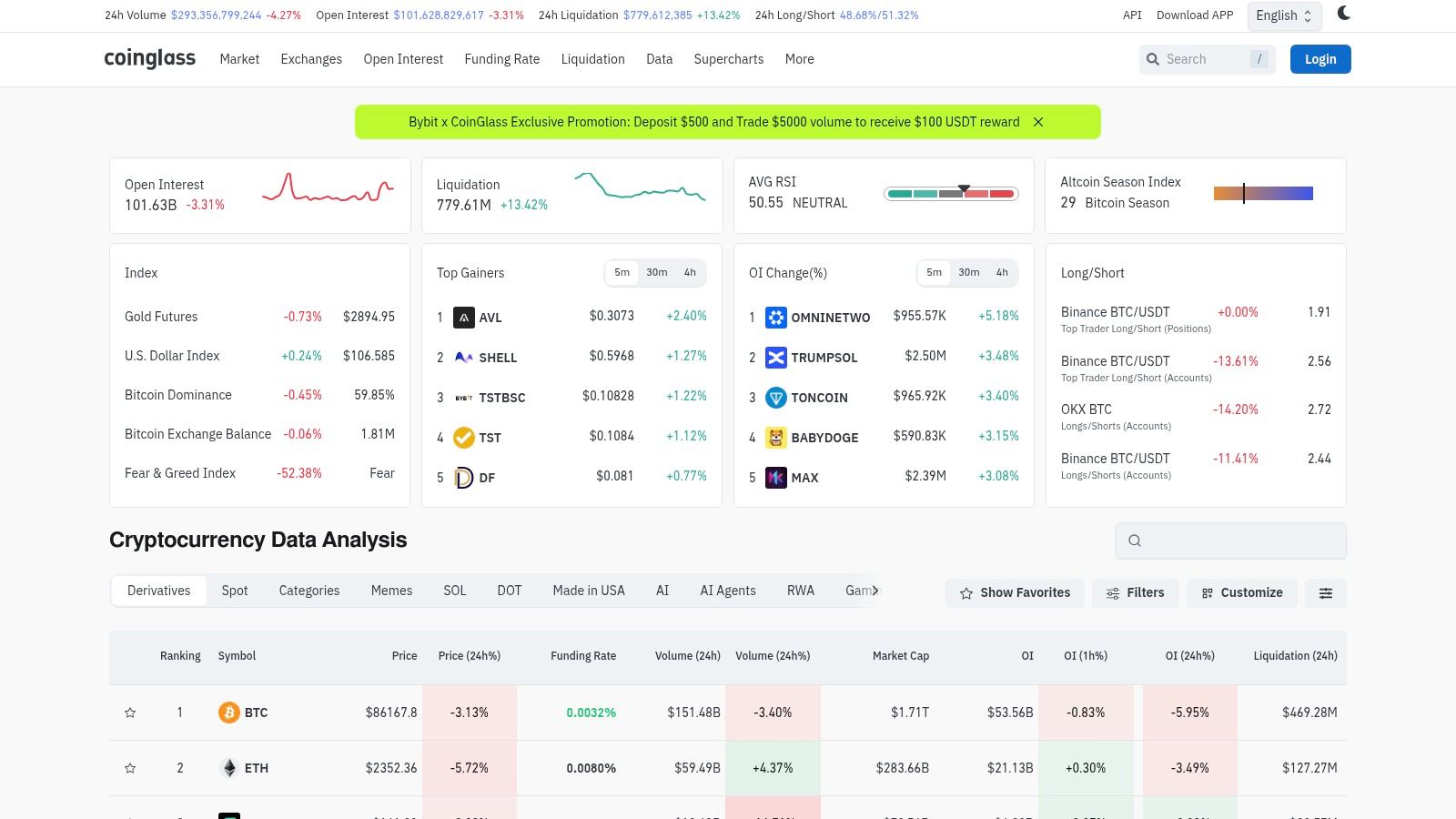

Coinglass (formerly ByBt) stands out among whale tracking platforms with its specialized focus on cryptocurrency derivatives markets. While most trackers monitor on-chain spot transactions, Coinglass delves into the often more influential world of futures, options, and perpetual swaps. This distinctive approach makes it an essential resource for traders seeking to understand the major forces driving market volatility and directional movements.

The platform excels at collecting and synthesizing data across major exchanges, providing a comprehensive view of whale positions and liquidation events.

Key features that set Coinglass apart include:

Practical Applications and Use Cases:

Pros:

Cons:

Pricing and Technical Requirements: Coinglass offers a free tier with access to core features. Premium feature pricing varies by subscription plan. The platform works through any standard web browser with no special technical requirements.

Comparison with Similar Tools: Unlike platforms such as Whale Alert that focus on on-chain transactions, Coinglass concentrates on derivatives activity. This makes it a complementary rather than competing tool, offering an alternative perspective on whale behavior.

Implementation/Setup Tips: Begin with the free tier to become familiar with the platform's features and data presentation. Explore the various dashboards to understand how they apply to your trading strategies. Consider upgrading to a premium subscription if you need more comprehensive historical data or advanced analytics.

Website: Coinglass

| Service | Core Features ✨ | UX Quality ★ | Value/Price 💰 | Audience 👥 |

|---|---|---|---|---|

| Whale Alert | Real-time multi-chain alerts, customizable thresholds, historical analytics | ★★★★ – Comprehensive but sometimes overwhelming | 💰 Free basic; Premium upgrade | 👥 Crypto traders & enthusiasts |

| Lookonchain | Wallet analysis, smart money tracking, profit/loss insights, trend identification | ★★★★ – Clear visuals with slight learning curve | 💰 Premium pricing | 👥 Active traders & institutional investors |

| Santiment | Integration of on-chain, social, and sentiment data; customizable dashboards and alerts | ★★★★ – Advanced features, may be complex for beginners | 💰 Subscription required | 👥 Advanced investors & researchers |

| WhaleMap | Bitcoin-specific UTXO visualization, heatmaps, cluster analysis, support/resistance identification | ★★★ – Intuitive visuals but limited to Bitcoin | 💰 Free basic; Paid upgrades | 👥 Bitcoin traders & technical analysts |

| Glassnode | Institutional-grade analytics, exchange flow monitoring, HODL waves, supply distribution | ★★★★★ – High data quality with advanced metrics | 💰 High premium pricing | 👥 Institutions & professional traders |

| Nansen | AI-driven wallet labeling, smart money insights, real-time alerts, cross-chain analysis | ★★★★★ – Rich data with potential information overload | 💰 Expensive premium service | 👥 Pro investors & sophisticated analysts |

| Coinglass | Derivatives whale tracking, liquidation data, open interest heatmaps, exchange comparisons | ★★★★ – Real-time insights with complex interpretation | 💰 Free tier available; Premium for depth | 👥 Options/futures traders & market analysts |

Selecting an appropriate crypto whale tracker demands careful consideration of your specific trading requirements. Each platform offers distinct capabilities that may align differently with your investment approach. Important selection criteria include the types of data provided (such as exchange flows, significant transactions, and wallet holdings), historical data depth, cryptocurrency coverage, and the quality of analytical tools. For instance, Whale Alert excels in delivering timely notifications, while Glassnode provides comprehensive on-chain analysis. Santiment combines whale tracking with social sentiment indicators, Nansen concentrates on smart money movements, Lookonchain highlights individual whale transactions, WhaleMap offers Bitcoin UTXO distribution visualization, and Coinglass presents exchange-wide open interest and liquidation data.

Implementation typically requires either API integration or direct use of web platforms. Getting started usually involves account creation, interface familiarization, and customizing alerts or dashboards to match your priorities. Platform pricing models vary significantly – some offer limited free access while others operate on subscription-based tiers with costs reflecting data accessibility and analytical capability levels. Consider your financial constraints alongside technical requirements when making your selection. Compatibility with your existing trading systems or portfolio management tools is equally crucial to ensure efficient data utilization.

Key considerations when selecting a crypto whale tracker include:

While tracking whale movements provides valuable market insights, it represents just one component of a comprehensive trading strategy. Sound fundamental analysis, disciplined risk management, and thorough understanding of market dynamics remain essential for successful cryptocurrency investing. Use whale activity as supplementary information rather than the sole basis for your investment decisions.

Looking to cut through the complexity of whale tracking and market volatility? Coindive delivers essential project updates, community metrics, and AI-driven context for price movements, connecting market shifts to broader trends and social sentiment. The platform enables you to focus on meaningful signals through customizable alerts, detailed community analysis, and actionable insights delivered directly to you. Experience clearer, more confident navigation of the cryptocurrency ecosystem by visiting Coindive today.