Managing multiple crypto assets across various exchanges is complex. A crypto portfolio tracker simplifies this by providing a consolidated view of your holdings, performance, and transactions. This listicle presents eight leading crypto portfolio trackers in 2025—CoinMarketCap, CoinGecko, FTX (formerly Blockfolio), CoinTracker, Koinly, Delta, Zerion, and Kubera—to help you choose the best tool. Discover which platform suits your needs, whether you require real-time data, tax reporting, or in-depth portfolio analytics. Read on to optimize your crypto investing strategy with the right crypto portfolio tracker.

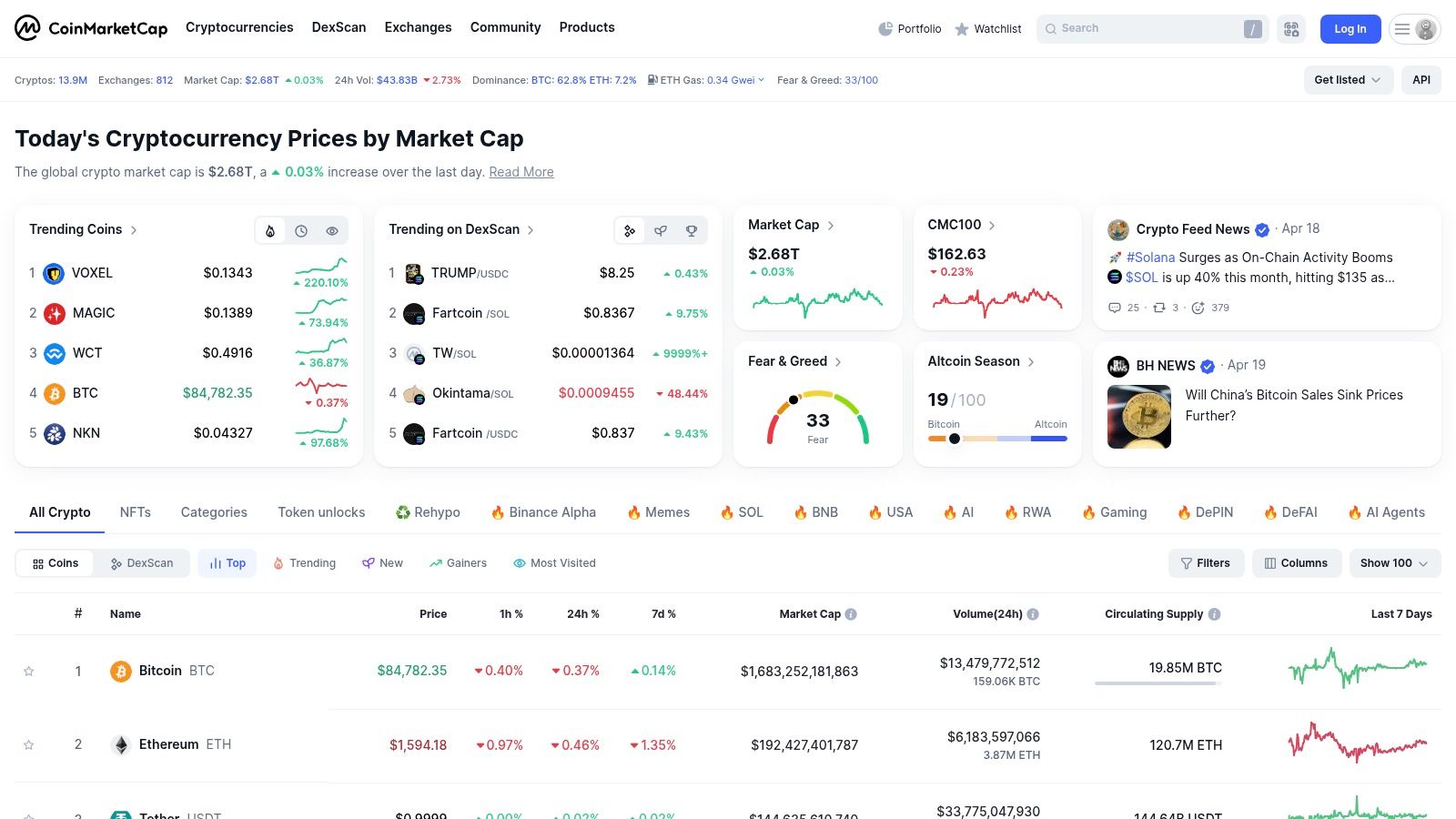

CoinMarketCap is a leading crypto portfolio tracker and a cornerstone resource for millions of cryptocurrency investors. Its popularity stems from its comprehensive database of over 20,000 cryptocurrencies, providing real-time price updates, market capitalization, trading volume, and other crucial market metrics. Beyond simple tracking, CoinMarketCap offers a robust portfolio feature that enables users to monitor their crypto holdings across various exchanges and wallets, consolidating all information into a single, user-friendly dashboard. This centralized view allows for efficient portfolio management and informed decision-making. For those seeking deeper insights, the platform provides in-depth analytics, historical data, and charting tools, empowering users to analyze market trends and make data-driven investment choices. This combination of real-time data, portfolio management, and analytical tools makes CoinMarketCap an indispensable tool for anyone serious about navigating the crypto market.

One of CoinMarketCap's strengths lies in its flexibility for portfolio tracking. Users can manually input their transactions or leverage API integrations with various exchanges for automatic updates. This makes it suitable for both casual investors managing a few assets and active traders working across multiple platforms. Customizable watchlists and price alerts help users stay informed about market movements and react swiftly to price fluctuations. Detailed performance analytics, including profit/loss calculations and historical portfolio value charts, offer valuable insights into investment performance over time. The availability of a mobile app (iOS and Android) further enhances accessibility, allowing users to monitor their portfolios on the go.

Compared to other crypto portfolio trackers, CoinMarketCap stands out with its vast cryptocurrency coverage and freely available basic portfolio tracking features. While platforms like Delta or Blockfolio offer similar functionality, CoinMarketCap's extensive market data and established reputation as a trusted data source give it a significant edge, particularly for users interested in exploring a wide range of crypto assets. While basic portfolio tracking is free, users looking for advanced features like in-depth analytics and API integrations will need to opt for a premium subscription. It's important to note that during periods of extreme market volatility, CoinMarketCap has occasionally experienced delays in price updates. Another limitation is its relatively basic tax reporting capabilities, which might necessitate using a separate tax software for more complex reporting requirements.

Key Features & Benefits:

Pros:

Cons:

Website: https://coinmarketcap.com/

CoinMarketCap earns its place on this list as a powerful and versatile crypto portfolio tracker suitable for a broad range of users. Its combination of extensive market data, flexible tracking options, and analytical tools provides a valuable resource for both novice and experienced crypto investors. While the premium features come at a cost, the free version offers a robust entry point for those looking to begin effectively managing their crypto investments.

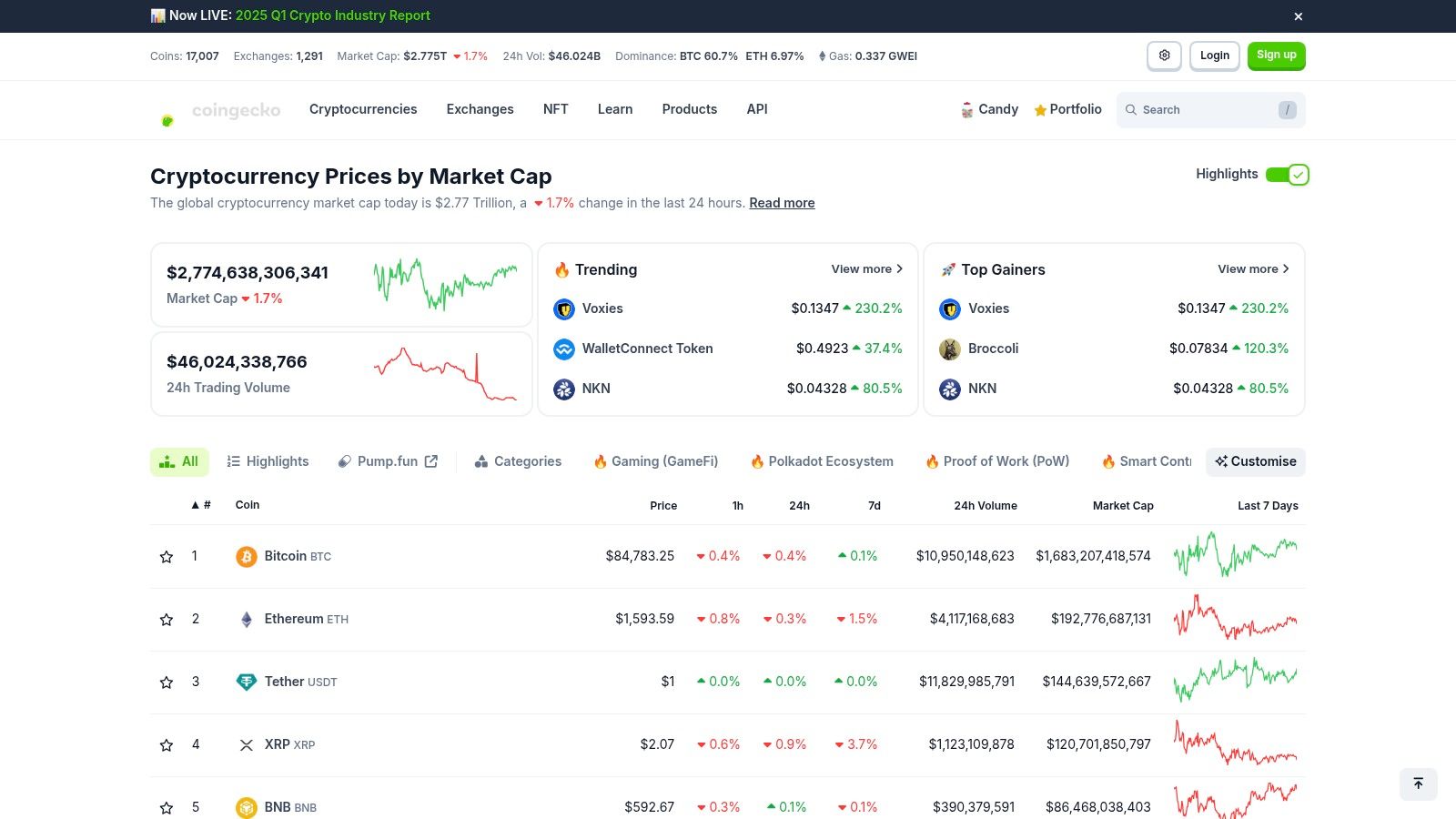

CoinGecko stands out as a leading choice for a free and comprehensive crypto portfolio tracker. It provides a robust platform for monitoring your digital assets across various wallets and exchanges, giving you a consolidated view of your holdings and their performance. This is particularly useful for investors managing diverse portfolios across multiple platforms. Beyond simple tracking, CoinGecko offers deep analytical tools, making it suitable for both casual cryptocurrency enthusiasts and serious traders. The platform's dedication to transparency and data accuracy earns it a spot on this list. Whether you're a seasoned trader or just beginning your crypto journey, CoinGecko offers the tools you need to stay informed and manage your investments effectively.

One of CoinGecko's most compelling features is its free access with no premium tiers, unlike some competitors that restrict advanced features behind paywalls. This makes it an excellent entry point for those new to crypto portfolio tracking. For setting up your portfolio, you'll need to manually input your transactions, which can be time-consuming initially, especially for users with extensive trading histories. However, the platform's detailed profit/loss calculations and performance metrics, visualized through clear candlestick charts and technical analysis indicators, make this effort worthwhile. You can track not only the overall portfolio performance but also drill down into the individual asset performance.

CoinGecko goes beyond basic portfolio tracking with its unique "Trust Score" system, providing an extra layer of security awareness for users. This system evaluates the reliability of cryptocurrency exchanges, helping investors make informed decisions about where to trade and store their assets. Furthermore, CoinGecko's impressive data breadth sets it apart. It supports over 10,000 cryptocurrencies, providing in-depth information ranging from developer activity and community growth metrics to fundamental analysis data often unavailable on other platforms. These metrics can be particularly useful for researchers, analysts, and altcoin investors looking for emerging projects. While the interface can feel cluttered at times due to the sheer amount of data presented, the excellent mobile app provides a more streamlined experience for users on the go.

Compared to competitors with more extensive exchange API integrations, CoinGecko's manual entry approach may be less convenient for high-frequency traders. However, for long-term holders and those focused on fundamental analysis, the comprehensive data and free access make CoinGecko a powerful tool. Additionally, the inclusion of DeFi portfolio tracking capabilities caters to the growing decentralized finance sector. CoinGecko provides price alerts and notifications, enabling users to react quickly to market movements and manage their risk effectively. For a free crypto portfolio tracker with a wealth of information and analytical tools, CoinGecko is a compelling choice. You can explore its features and begin tracking your portfolio by visiting their website: https://www.coingecko.com/

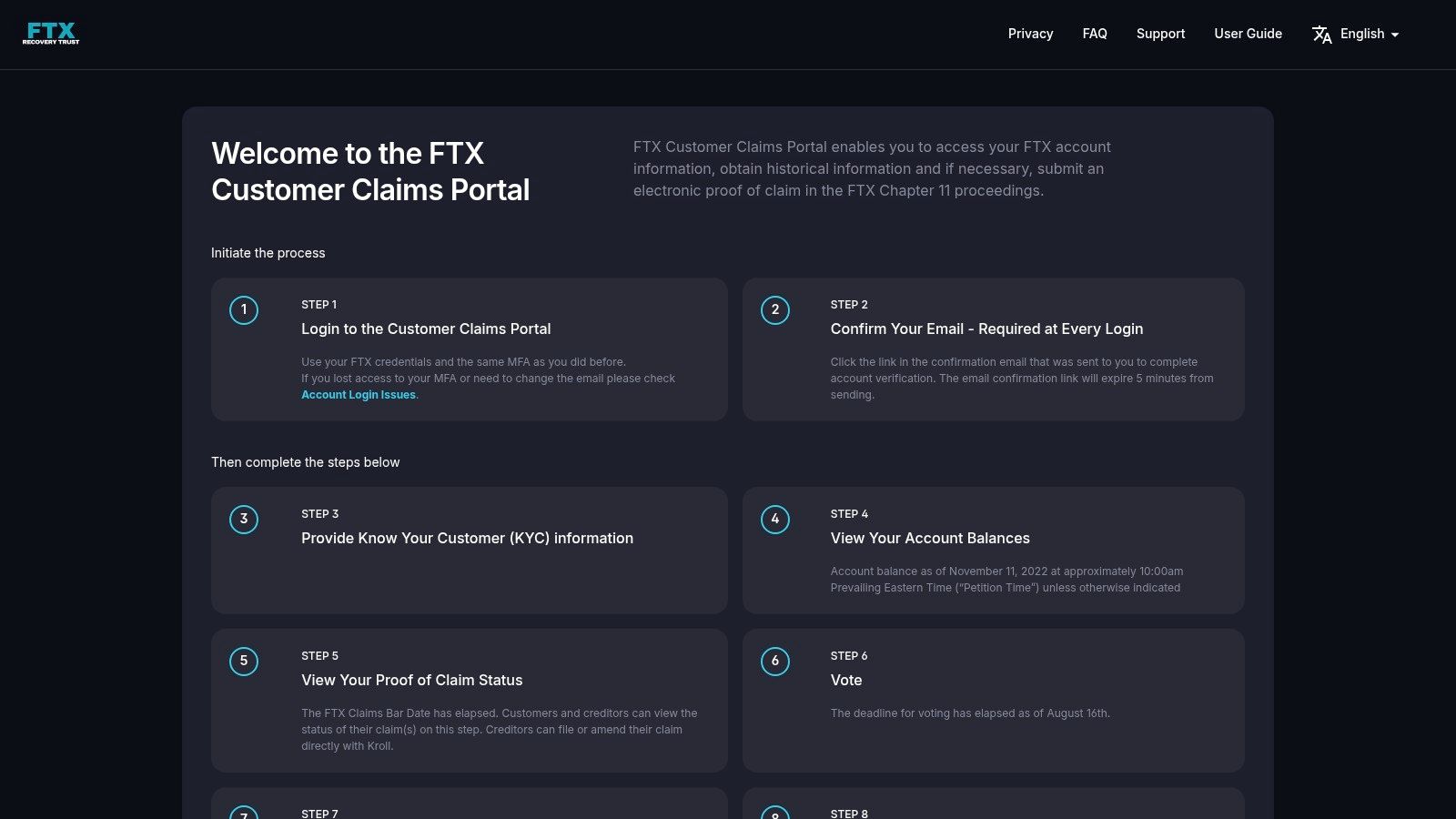

FTX (formerly Blockfolio) stands out as a popular choice among crypto portfolio trackers, especially for mobile users. Originally lauded for its clean interface and real-time updates, Blockfolio's acquisition by FTX exchange has transformed it into a more comprehensive platform. This integration allows users not just to monitor their crypto investments but also to execute trades directly within the app, streamlining the entire process from tracking to transacting. This makes it a powerful tool for active traders who need to react quickly to market fluctuations and manage their portfolio on the go. For those seeking a unified platform for managing and trading crypto, FTX (formerly Blockfolio) offers a convenient solution.

A key strength of FTX (formerly Blockfolio) lies in its mobile-first design. The app provides an intuitive user experience, enabling users to effortlessly track thousands of cryptocurrencies across various exchanges. This broad compatibility is crucial for investors diversified across different platforms. Real-time price updates, customizable alerts, and a curated news feed for each coin further enhance the monitoring experience. The "Signal" feature, allowing project teams to communicate directly with users, adds another layer of engagement and transparency. For instance, imagine receiving an update directly from the development team of a coin you hold, providing insights into upcoming developments or addressing community concerns. This direct line of communication can be invaluable for informed decision-making.

Compared to other crypto portfolio trackers, FTX (formerly Blockfolio) distinguishes itself by offering direct trading functionality integrated seamlessly into the tracking interface. This eliminates the need to switch between separate apps for monitoring and trading, a significant advantage for active traders. Moreover, the app is free to use without any premium subscription required, making it accessible to a wider audience. This is a considerable benefit compared to some competitors who charge for advanced features or data access.

While FTX (formerly Blockfolio) excels in its mobile offering, the web platform is not as robust, which could be a drawback for users who prefer a desktop experience. Another limitation is the limited tax reporting features, a crucial aspect for serious investors. Some users have also reported occasional issues with exchange API connections, which can disrupt real-time data flow. However, the platform remains under active development, and future updates may address these limitations.

Setting up FTX (formerly Blockfolio) is straightforward. Simply download the mobile application, create an account, and connect your exchange accounts via API keys. Remember to prioritize security best practices when generating and storing API keys. Overall, FTX (formerly Blockfolio) earns its place in this list by offering a user-friendly mobile-first experience combined with direct trading capabilities, all within a free-to-use package. The platform is best suited for mobile-focused users prioritizing ease of use and integrated trading functionality, while users seeking advanced charting, tax reporting, or a robust web platform may need to consider alternative options. You can download the app and explore its features at https://blockfolio.com/.

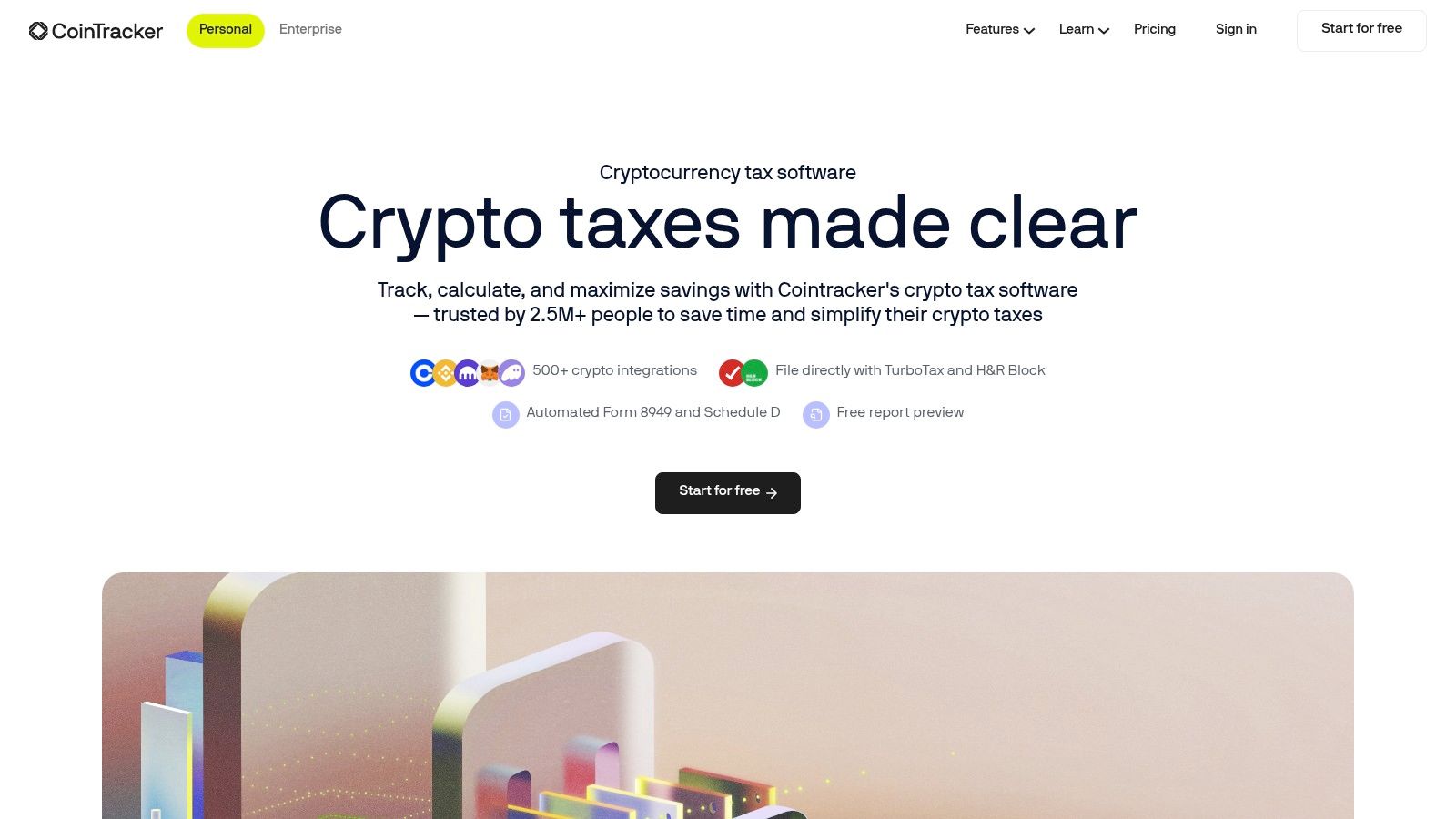

CoinTracker is a robust crypto portfolio tracker designed for serious investors and traders who prioritize accurate performance tracking and tax compliance. Its automatic synchronization with a vast network of exchanges and wallets, coupled with its sophisticated tax reporting features, makes it a standout choice for those navigating the complex world of cryptocurrency taxation. This platform goes beyond basic portfolio overview, offering granular insights into your holdings and their historical performance, allowing for data-driven investment decisions. For users needing to meticulously track their crypto transactions for tax purposes, CoinTracker offers a streamlined solution to generate necessary reports and forms.

One of CoinTracker's key strengths lies in its comprehensive tax reporting capabilities. It automatically calculates cost basis for all transactions, identifies tax loss harvesting opportunities, and generates IRS Form 8949. This is crucial for minimizing tax liabilities and ensuring compliance, particularly for active traders. While other crypto portfolio trackers offer basic performance tracking, CoinTracker excels by providing detailed metrics and historical data, enabling users to analyze long-term trends and make informed decisions. The platform's support for DeFi protocols and NFTs further broadens its applicability in the evolving cryptocurrency landscape. This makes it particularly relevant for investors diversifying beyond traditional cryptocurrencies.

Setting up CoinTracker is relatively straightforward. Users connect their exchange accounts and wallets via API keys, allowing the platform to automatically sync transaction data. While the platform boasts compatibility with over 300 exchanges and 8,000+ cryptocurrencies, some users have reported occasional synchronization issues with certain exchanges. This is something to be mindful of, and testing the connection thoroughly after setup is recommended.

CoinTracker offers a free tier limited to 25 transactions, suitable for users with smaller portfolios and limited trading activity. For more active traders or those with complex portfolios, the premium plans offer unlimited transactions, enhanced tax features, and priority customer support. However, these premium plans can be comparatively expensive. Competitors like Delta or Blockfolio offer similar portfolio tracking functionalities but may not match CoinTracker's depth of tax reporting features. CoinTracker's intuitive interface and clear performance visualizations are strengths that contribute to a positive user experience.

Pricing: Free tier (25 transactions), Paid tiers available with increasing features and transaction limits.

Technical Requirements: Internet access, exchange/wallet API keys for synchronization.

Implementation Tips:

CoinTracker earns its place in this list because it addresses a critical need for crypto investors: simplifying tax reporting while providing robust portfolio tracking. While the cost of the premium plans may be a barrier for some, the comprehensive feature set and accurate data make it a valuable tool for serious crypto investors and traders. You can explore CoinTracker's features and pricing plans on their website: https://www.cointracker.io/

Koinly is a robust crypto portfolio tracker specializing in tax reporting and compliance. While it effectively monitors your investments across various platforms, its primary strength lies in simplifying the often-dreaded process of cryptocurrency tax calculation. This makes Koinly particularly valuable for active traders, international investors, and anyone seeking to maintain meticulous tax records in the complex world of crypto. Instead of manually tracking transactions across multiple exchanges and wallets, Koinly automates the import process and calculates your capital gains, losses, and income, ensuring compliance with relevant tax regulations.

Koinly integrates with over 350 exchanges and wallets, covering a broad spectrum of crypto investment platforms. This broad compatibility ensures that users can consolidate their entire portfolio, regardless of where they trade or store their assets. The platform then employs various accounting methods (FIFO, LIFO, HIFO, etc.) to calculate capital gains, offering flexibility depending on individual tax situations. Beyond basic trading, Koinly supports complex transactions including margin trading, futures, and even DeFi activities like staking and liquidity pool participation – a crucial feature for investors involved in these increasingly popular segments of the crypto market. Its intuitive dashboard provides a clear overview of your portfolio's performance with key metrics readily available. What sets Koinly apart is its comprehensive tax reporting features specifically tailored for various jurisdictions, including the US, UK, Canada, and Australia. This is a significant advantage for international users who often face the challenge of navigating different tax regulations.

Compared to other crypto portfolio trackers that may offer basic tax reporting as an add-on feature, Koinly places tax management at its core. While tools like CoinMarketCap or Delta focus primarily on portfolio tracking and market analysis, Koinly shines in its tax reporting depth and breadth. This specialized focus makes it an ideal solution for users prioritizing tax compliance and efficient reporting.

Implementation and Setup Tips:

Pricing: Koinly offers a tiered pricing structure based on the number of transactions. While a free plan is available for up to 10,000 transactions, paid plans offer increased transaction limits and access to priority support. Specific pricing details are available on their website.

Technical Requirements: Koinly is a web-based platform accessible through any modern browser. No specific hardware or software requirements exist beyond a stable internet connection.

Pros:

Cons:

Website: https://koinly.io/

Koinly earns its place on this list by providing a powerful and specialized solution for cryptocurrency tax management. While it might not offer the most extensive portfolio analytics, its dedicated tax reporting features, combined with broad platform compatibility, make it an invaluable tool for crypto investors seeking to simplify tax compliance and maintain accurate financial records. For users who prioritize tax reporting and management, Koinly provides a dedicated and efficient platform.

Delta is a sophisticated crypto portfolio tracker that offers a comprehensive solution for managing both cryptocurrency and traditional investments. It provides a centralized platform for monitoring the performance of diverse assets, ranging from Bitcoin and Ethereum to stocks, ETFs, and mutual funds. This makes Delta particularly attractive to investors who want a holistic view of their entire portfolio, eliminating the need for multiple tracking applications. Delta's strength lies in its ability to bridge the gap between traditional finance and the evolving crypto market. This focus on a unified investment experience sets it apart from crypto-only trackers, making it a valuable tool for the modern investor.

For crypto enthusiasts, Delta supports connection to over 300 exchanges via API, allowing for automatic synchronization of transaction data. This automated tracking eliminates the tedious task of manual entry and ensures up-to-the-minute accuracy in portfolio valuation. Delta’s advanced analytics, including correlation metrics, offer valuable insights into portfolio diversification and risk management, features particularly appealing to traders and analysts. The customizable watchlists and alerts allow users to stay informed about specific assets and market movements, enabling proactive investment decisions. Beyond crypto, Delta's comprehensive support for traditional assets, including stocks, ETFs, and mutual funds, positions it as a one-stop shop for managing a diversified portfolio.

Delta's intuitive interface, combined with a strong focus on mobile accessibility and biometric security, ensures a seamless user experience. The detailed transaction history and performance metrics offer granular insights into investment performance over time. While the basic version of Delta is free, unlocking premium features like advanced analytics and unlimited exchange connections requires a subscription. The pricing for Delta Pro varies depending on the subscription duration, offering monthly and yearly options. Some users have reported occasional synchronization issues with certain exchanges, a potential drawback to consider. Furthermore, while Delta tracks transaction history, its tax reporting functionality is currently limited, potentially necessitating the use of additional tax software for comprehensive reporting.

Compared to crypto-only trackers like Blockfolio or CoinStats, Delta provides a more holistic view of an investor's financial landscape. While tools like Personal Capital offer robust tracking for traditional investments, Delta’s integrated approach caters to users heavily invested in both crypto and traditional markets.

Setting up Delta is straightforward. Users can download the app from the App Store or Google Play Store and create an account. Connecting to exchanges is done via API keys, and Delta provides clear instructions for each supported exchange. Manual entry of transactions is also possible for assets held outside of connected exchanges. For users seeking a powerful and versatile portfolio tracker that seamlessly integrates both crypto and traditional assets, Delta is a strong contender. Visit Delta.

Zerion is not just another crypto portfolio tracker; it's a powerful command center specifically designed for navigating the complex world of Decentralized Finance (DeFi). If your crypto investments lean heavily towards DeFi protocols, yield farming, liquidity pools, and token swaps, Zerion deserves a prominent place in your toolkit. It offers a level of granular insight and direct interaction with DeFi platforms that few other portfolio trackers can match, making it a must-have for serious DeFi investors.

Zerion excels at providing a real-time, comprehensive overview of your DeFi positions across multiple blockchains. Instead of jumping between different platforms and interfaces, you can monitor everything in one place. This includes tracking your staked assets, liquidity pool positions, yield farming rewards, and even your NFT holdings. Beyond simply tracking, Zerion allows you to directly interact with various DeFi protocols through its interface. You can execute token swaps, lend and borrow assets, and participate in liquidity pools without ever leaving the Zerion platform. This deep integration with the DeFi ecosystem streamlines your workflow and simplifies complex DeFi interactions. Learn more about Zerion and how it's revolutionizing portfolio monitoring.

One of Zerion's standout features is its gas fee optimization tools. Gas fees can eat into your DeFi profits, so having a tracker that helps you minimize these costs is invaluable. Zerion analyzes gas prices across different networks and suggests the most cost-effective options for your transactions. Furthermore, Zerion offers historical portfolio performance analytics, enabling you to track your DeFi investment performance over time and make data-driven decisions.

Features:

Pros:

Cons:

Website: https://zerion.io/

Pricing: While Zerion offers a free version with robust features, certain advanced features are unlocked with a premium subscription. Details regarding pricing tiers can be found on their website.

Technical Requirements: Zerion is accessible through a web browser and mobile apps (iOS and Android). Connecting your existing crypto wallets to Zerion is straightforward and doesn't require sharing your private keys, ensuring the security of your assets.

Zerion’s focus on DeFi makes it an ideal crypto portfolio tracker for users heavily involved in this segment of the crypto market. However, investors primarily focused on centralized exchanges might find its DeFi-centric approach limiting and should consider exploring other trackers better suited for tracking CEX holdings. For those deeply engaged with DeFi, Zerion provides a powerful and indispensable tool for managing and optimizing their investments.

Kubera distinguishes itself from other crypto portfolio trackers by offering a holistic approach to wealth management. Instead of solely focusing on digital assets, Kubera allows users to track their entire financial portfolio, including cryptocurrencies alongside traditional assets such as stocks, real estate, vehicles, and precious metals. This makes it an ideal solution for investors looking for a single platform to manage their complete financial picture. This comprehensive overview enables users to calculate their total net worth across all asset classes, providing a more accurate and insightful understanding of their financial standing. This broader perspective makes Kubera a compelling option for those seeking a more encompassing view of their financial health, going beyond just crypto holdings. For users seeking a consolidated view of all their assets, Kubera fills a unique niche.

Kubera shines with its automatic valuation updates for most asset types, simplifying portfolio tracking and reducing manual input. Furthermore, its "dead-man's switch" feature offers a unique approach to estate planning by allowing users to designate beneficiaries for their digital assets, addressing a crucial aspect often overlooked by other platforms. This feature alone makes it an attractive option for those concerned about the secure transfer of their assets in unforeseen circumstances. Security is another strong point, boasting bank-level security with 256-bit encryption. Kubera also provides recap emails with portfolio performance summaries, keeping users informed about the status of their investments.

While Kubera excels in comprehensive wealth management, it's essential to acknowledge its limitations concerning crypto-specific features. Compared to dedicated crypto trackers, Kubera offers fewer specialized tools for analyzing cryptocurrency investments. For example, detailed analytics, advanced charting, and tax reporting features commonly found in crypto-focused platforms might be less extensive in Kubera. Furthermore, limited exchange API integrations may necessitate manual entry for some users, which can be a drawback for those actively trading across multiple platforms. Another potential hurdle is the subscription-based pricing model with no free tier. While pricing details aren't publicly available, the lack of a free version might deter some users, especially those with smaller portfolios or those primarily focused on crypto.

Implementation and Setup Tips: Setting up Kubera is relatively straightforward. After subscribing, users can manually add their assets or connect to supported financial institutions. For crypto holdings, manual entry is often required, though some integrations are available. It's crucial to accurately input all asset details to leverage Kubera's comprehensive reporting capabilities.

Comparison with Similar Tools: While platforms like CoinStats and Blockfolio focus primarily on crypto tracking, Kubera caters to a broader audience by incorporating traditional assets. This positions Kubera as a more all-encompassing wealth management tool, rather than a specialized crypto tracker. For users who prioritize comprehensive financial oversight, Kubera offers a valuable solution, but those deeply involved in cryptocurrency trading might find dedicated crypto trackers more feature-rich.

Why Kubera deserves its place on this list: Kubera offers a unique perspective on portfolio tracking by focusing on holistic wealth management. Its inclusion of traditional assets alongside crypto provides a comprehensive financial overview not found in most other crypto portfolio trackers. The estate planning features and robust security further solidify its value proposition for users seeking a secure and comprehensive solution. While it may not be the ideal choice for hardcore crypto traders due to limited exchange integrations and crypto-specific analytics, its comprehensive approach and unique features justify its place on this list for those seeking a broader wealth management perspective. Visit Kubera

| Platform | Core Features ★ | UX Quality 🏆 | Value Prop. 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| CoinMarketCap | Real-time prices, multi-portfolio, alerts | User-friendly, clean | Free basic tracking, comprehensive data | Beginners to advanced crypto investors | Extensive coin database, trusted global source |

| CoinGecko | Detailed coin data, portfolio tracker, Trust Score | Solid mobile app; can feel cluttered | Completely free, in-depth fundamental metrics | Investors needing detailed crypto insights | Unique Trust Score system, broad coin support |

| FTX (formerly Blockfolio) | Real-time tracking, integrated trading, alerts | Intuitive mobile-first design | Free use with direct trade integration | Mobile users & active traders | Curated news feed, seamless trading within tracker |

| CoinTracker | Auto sync with exchanges, tax reporting, analytics | Intuitive interface with clear visualizations | Invaluable for tax compliance and detailed reporting | Tax-focused crypto investors | IRS form generation, tax loss harvesting suggestions |

| Koinly | Multi-country tax reports, DeFi & staking tracking | User-friendly dashboard | Excellent tax support for diverse jurisdictions | Investors needing robust tax reporting | Supports margin, futures, and complex transactions |

| Delta | Tracks crypto, stocks & ETFs, advanced analytics | Sleek, minimalist with biometric security | Comprehensive multi-asset monitoring | Diversified investors | Single app for traditional and crypto asset tracking |

| Zerion | Real-time DeFi tracking, multi-chain alerts, protocol interaction | Clean interface for complex DeFi positions | Best-in-class for DeFi portfolio management | DeFi enthusiasts and advanced users | Direct protocol interactions, gas fee optimization |

| Kubera | Holistic wealth tracking, net worth calculation | Minimalist, secure, easy to navigate | All-in-one financial tracking with estate planning | Comprehensive wealth managers | Tracks all asset classes, unique beneficiary management |

Choosing the right crypto portfolio tracker from the array of options available, such as CoinMarketCap, CoinGecko, FTX (formerly Blockfolio), CoinTracker, Koinly, Delta, Zerion, and Kubera, can significantly impact your investment journey. Key takeaways from this article highlight the diverse functionalities offered, ranging from basic portfolio tracking to advanced tax reporting and DeFi support. Remember, the ideal crypto portfolio tracker is the one that best aligns with your specific needs.

The most important factors to consider include the number of exchanges and wallets you utilize, the types of crypto assets you hold (including NFTs and DeFi positions), and the level of detail you require in your performance analysis. For instance, if you're actively involved in various DeFi protocols, a platform with robust DeFi tracking is essential. If tax reporting is a primary concern, focus on tools specifically designed for this purpose.

Managing your crypto portfolio effectively also often involves affiliate marketing or referral programs to diversify your income streams. For those interested in exploring this aspect, using reliable best affiliate tracking software can be beneficial in optimizing your campaigns. (Source: Best Affiliate Tracking Software | Top Platforms 2025 from Refgrow)

Ultimately, selecting and implementing a crypto portfolio tracker is an investment in itself. By carefully evaluating your needs and exploring the options discussed, you can streamline your portfolio management, make more informed decisions, and navigate the crypto market with greater confidence. For a comprehensive platform that combines portfolio tracking with crucial market insights and community metrics, consider exploring Coindive. Coindive can provide you with a deeper understanding of the projects in your portfolio and empower you to make data-driven investment decisions.