The cryptocurrency market has rapidly transitioned from a niche interest to a complex and dynamic ecosystem. Successfully navigating the thousands of coins and tokens requires more than intuition; it demands data-driven insights and a strategic approach. This is where cryptocurrency screeners become essential.

From Bitcoin's early days as a decentralized digital currency to the rise of altcoins and DeFi protocols, the need for robust analytical tools has grown exponentially. Simple price trackers have evolved into powerful platforms capable of filtering assets based on numerous criteria, reflecting the market's increasing complexity.

An effective screener provides not just raw data, but the ability to tailor that data to individual investment strategies. Whether you're a long-term holder focused on fundamental analysis or a day trader seeking volatile short-term opportunities, the right tools are crucial.

The success of any crypto investment strategy hinges on identifying promising projects, assessing risk effectively, and capitalizing on emerging trends. A robust screening tool empowers investors to cut through the noise and make informed decisions.

This article explores the top 8 cryptocurrency screeners for 2024, providing the knowledge to choose the perfect tool to elevate your crypto game. Understanding the strengths and weaknesses of each platform is essential for maximizing your returns.

Coindive stands out as a cryptocurrency screening tool by focusing on social sentiment and community engagement. Rather than relying solely on technical indicators, Coindive uses AI and real-time social media monitoring to provide a more complete market view. This makes it a valuable tool for a wide range of users, from experienced traders to newcomers in the crypto space.

Coindive aggregates data from platforms like Twitter, Telegram, Discord, and Reddit, filtering out irrelevant information and highlighting key project updates, community sentiment shifts, and engagement trends. Identifying growing community interest around an altcoin before a price surge is the power Coindive offers. Its AI-powered price alerts don't just notify you of changes; they provide context by connecting price action to trends, sector-specific events, or project news. This allows users to understand the why behind the movements, facilitating more informed investment choices.

For diverse crypto portfolios, Coindive offers customizable alerts for social activity, popularity, and key mentions. This granular control ensures users receive only relevant notifications, keeping them informed without information overload. Furthermore, advanced filtering algorithms help identify and eliminate inauthentic social media growth, focusing on genuine community engagement. This separates real interest from manufactured hype.

Features:

Pros:

Cons:

While specific setup details are not readily apparent, the process likely involves creating an account and selecting the cryptocurrencies and social channels to track. Given the platform's emphasis on customization, exploring the various alert options and tailoring them to individual needs and investment strategies is recommended.

Website: https://coindive.app

Coindive offers a unique approach to cryptocurrency screening by incorporating real-time social sentiment analysis and advanced AI. This provides deeper insight that complements traditional technical analysis. While pricing information remains unclear and the platform's complexity might be initially challenging, its potential to uncover hidden opportunities and anticipate market movements makes it a valuable tool for crypto investors, traders, and researchers. Its backing by CoinGecko strengthens its position as a reputable resource within the crypto community.

TradingView is a highly versatile cryptocurrency screening platform. It combines advanced charting with robust screening tools, making it useful for a wide range of investors. Its active community and social features allow users to share insights and strategies, contributing to its popularity.

TradingView's strength lies in its comprehensive filtering. Users can screen cryptocurrencies based on numerous criteria. These include market capitalization, trading volume, price change percentages, and various technical indicators like RSI, MACD, and moving averages. This level of control allows investors to pinpoint assets matching their specific criteria.

For example, a swing trader might use TradingView to find altcoins with a market capitalization above $500 million that have recently broken through resistance levels. Meanwhile, a long-term investor might focus on projects with steadily rising volume and positive price trends. This flexibility makes TradingView adaptable to various investment strategies.

Beyond screening, TradingView offers a suite of charting features. Users have access to over 100 technical indicators and drawing tools, enabling in-depth technical analysis to identify potential entry and exit points. Beginners interested in learning more about chart reading might find this resource helpful: How to Read Crypto Charts: A Complete Guide for Successful Trading Analysis.

The platform supports multiple timeframes, from minutes to years, accommodating diverse trading styles. Real-time data and customizable price alerts enhance its utility for active traders. These features combined make TradingView a robust platform for technical analysis.

TradingView offers a free version, but its full potential requires a paid subscription. The Pro, Pro+, and Premium tiers offer increasing functionality. These include more charts per layout, saved layouts, custom indicators, and server-side alerts. This tiered pricing could be a drawback for beginners who might find the features overwhelming and the cost prohibitive.

For developers and algorithmic traders, TradingView’s API access allows integration of market data and programmatic trade execution. This enables the creation of custom trading bots and automated strategies. This makes it a powerful tool for those seeking advanced trading capabilities.

Pros:

Cons:

Website: TradingView

TradingView is a robust tool for cryptocurrency investors of all levels. While the free version provides a solid base, paid subscriptions unlock the platform's full potential, making it a valuable resource for serious traders. For those interested in improving their charting skills, we recommend reading: How to Read Crypto Charts: A Complete Guide for Successful Trading Analysis. This will further enhance your understanding and usage of TradingView's charting tools.

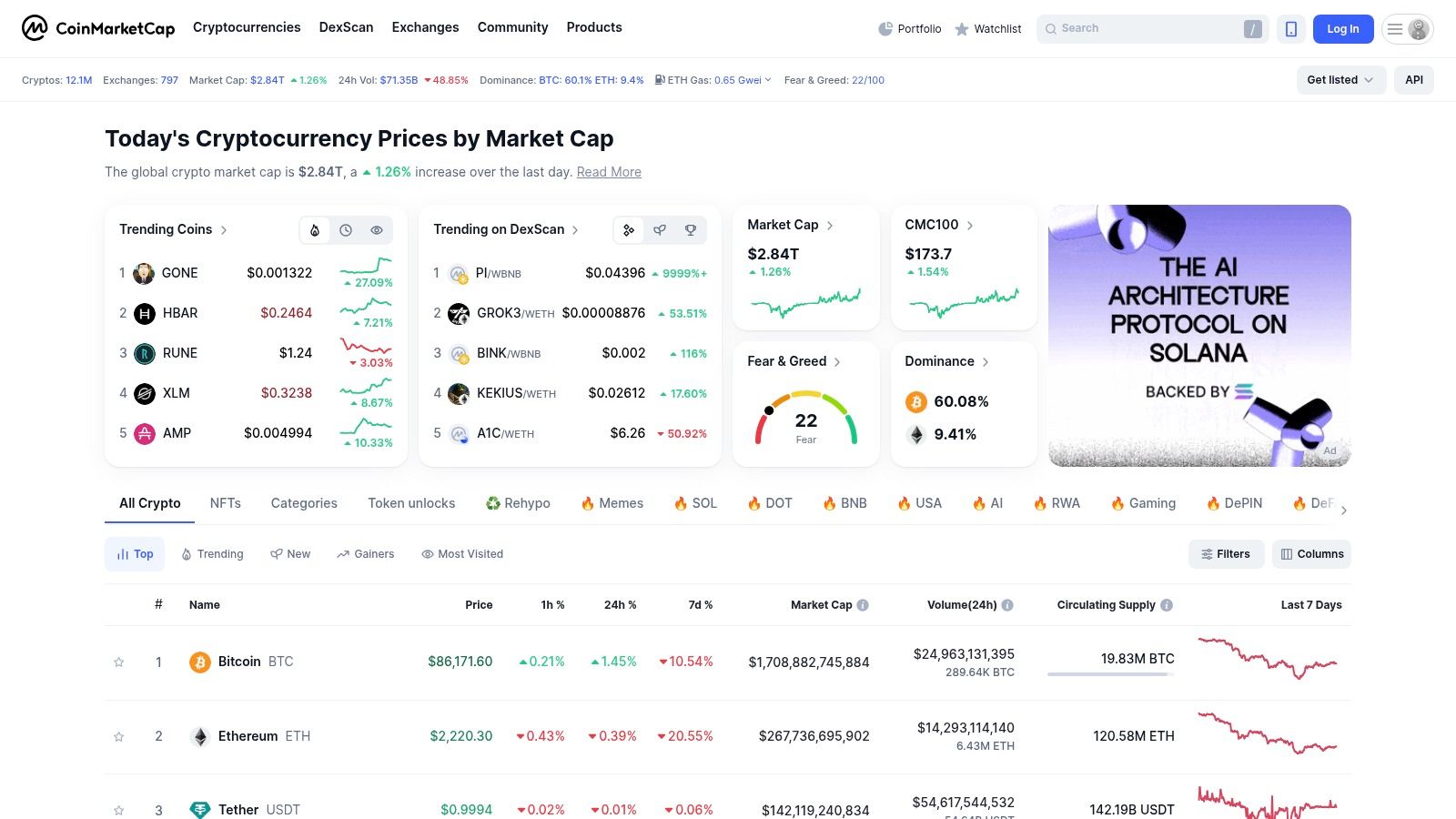

CoinMarketCap stands as a central pillar within the cryptocurrency ecosystem. It serves as a primary data source for a wide spectrum of users, ranging from casual observers to dedicated institutional investors. Its comprehensive screener secures its position on this list, offering a potent yet accessible tool for navigating the complexities of the crypto market. Whether researching potential investments, monitoring portfolio performance, or simply keeping abreast of market fluctuations, CoinMarketCap provides the necessary resources.

CoinMarketCap offers significant utility across various aspects of cryptocurrency engagement:

Market Analysis: Discern trending cryptocurrencies based on factors like market capitalization, trading volume, and price volatility. Employ historical data and interactive charts to dissect market cycles, identifying promising entry and exit points.

Portfolio Tracking: Construct tailored watchlists to oversee the performance of your crypto assets. Monitor price changes, market cap rankings, and other key metrics in real-time.

Due Diligence: Conduct thorough research on cryptocurrency projects before committing capital. Access in-depth information regarding project descriptions, tokenomics, team composition, and community sentiment.

Competitive Analysis: Compare various cryptocurrencies head-to-head, evaluating market performance, trading volume, and other relevant metrics.

Mobile Accessibility: The CoinMarketCap mobile app offers convenient access to market data and portfolio management, ensuring continuous engagement even while on the move.

CoinMarketCap’s screener boasts a robust suite of features:

Advanced Filtering: Refine searches based on market cap, price, volume, circulating supply, price fluctuations over various timeframes, and other pertinent criteria.

Customizable Watchlists: Create and manage personalized watchlists to monitor your preferred cryptocurrencies.

Historical Data Visualization: Explore interactive charts and historical data for comprehensive price trend and market performance analysis.

Comprehensive Project Information: Gain access to in-depth project insights, including whitepapers, team details, and community resources.

Mobile App Integration: Maintain constant market connectivity and manage your portfolio seamlessly through the dedicated mobile app.

The majority of CoinMarketCap's features are freely available. A premium subscription, however, unlocks supplementary functionalities such as advanced charting tools, exclusive market data, and personalized alerts. The platform is accessible via web browser and mobile apps (iOS and Android).

While analogous to platforms like CoinGecko, CoinMarketCap differentiates itself through its extensive market coverage and larger user base, contributing to a more comprehensive data ecosystem. Specialized platforms, however, may offer more granular data analysis tools geared toward professional traders.

Beginning with CoinMarketCap is simple:

Navigate to the CoinMarketCap website.

Explore the screener and familiarize yourself with the various filters.

Register for a free account to access enhanced features such as watchlists and personalized alerts.

Download the mobile app for convenient access on your smartphone.

Pros:

Cons:

CoinMarketCap remains an indispensable tool for navigating the cryptocurrency landscape. Its fusion of comprehensive data, user-friendly interface, and freely accessible core functionalities solidifies its standing as a leading cryptocurrency screener for a broad audience.

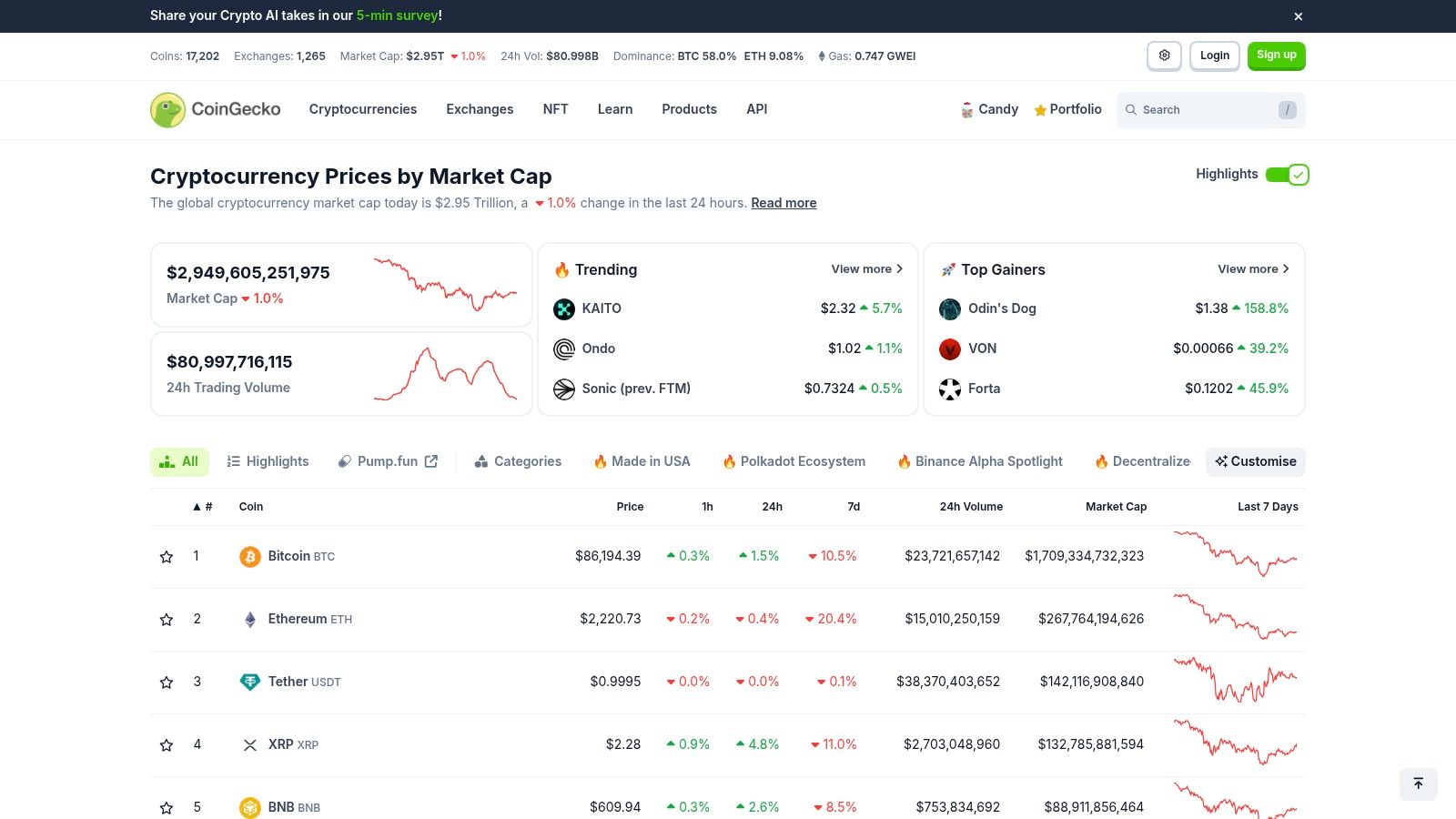

CoinGecko earns a place on this list for its thorough approach to cryptocurrency data. The platform offers a robust, free screener alongside in-depth fundamental analysis metrics. This makes it a valuable resource for everyone from casual crypto enthusiasts to institutional investors.

CoinGecko goes beyond basic market statistics by examining project health. The platform provides insights into developer activity, community growth, and assigns a proprietary "CoinGecko Trust Score." This allows for a more nuanced understanding, moving past simple market trends.

Consider a crypto investor researching altcoins. Using CoinGecko's screener, they can filter projects based on criteria like market cap, trading volume, and price change. They can further analyze using metrics like developer activity and community engagement.

This focused approach helps identify potentially undervalued projects or those displaying strong growth potential. The coin comparison tool facilitates direct side-by-side analysis, simplifying the evaluation of multiple investment opportunities.

Beyond the screener, CoinGecko offers a wealth of information for due diligence. Detailed project pages outline the team, technology, and tokenomics. This detailed information empowers users to assess the long-term viability and potential risks of each project.

For portfolio managers, CoinGecko’s portfolio tracking functionality offers a convenient way to monitor holdings and market movements. Researchers and analysts can use CoinGecko’s comprehensive DeFi and NFT market data to identify emerging trends within these growing sectors.

While CoinGecko offers a powerful free tier, nearly all core features are accessible without a paid subscription. This sets it apart from competitors who place advanced tools behind paywalls. Platforms like CryptoCompare offer similar screening, but CoinGecko emphasizes fundamental analysis and its unique trust score. Occasional slowdowns during high volatility and limited charting tools are minor drawbacks. The platform's overall information and user-friendly design make it invaluable for any serious cryptocurrency enthusiast.

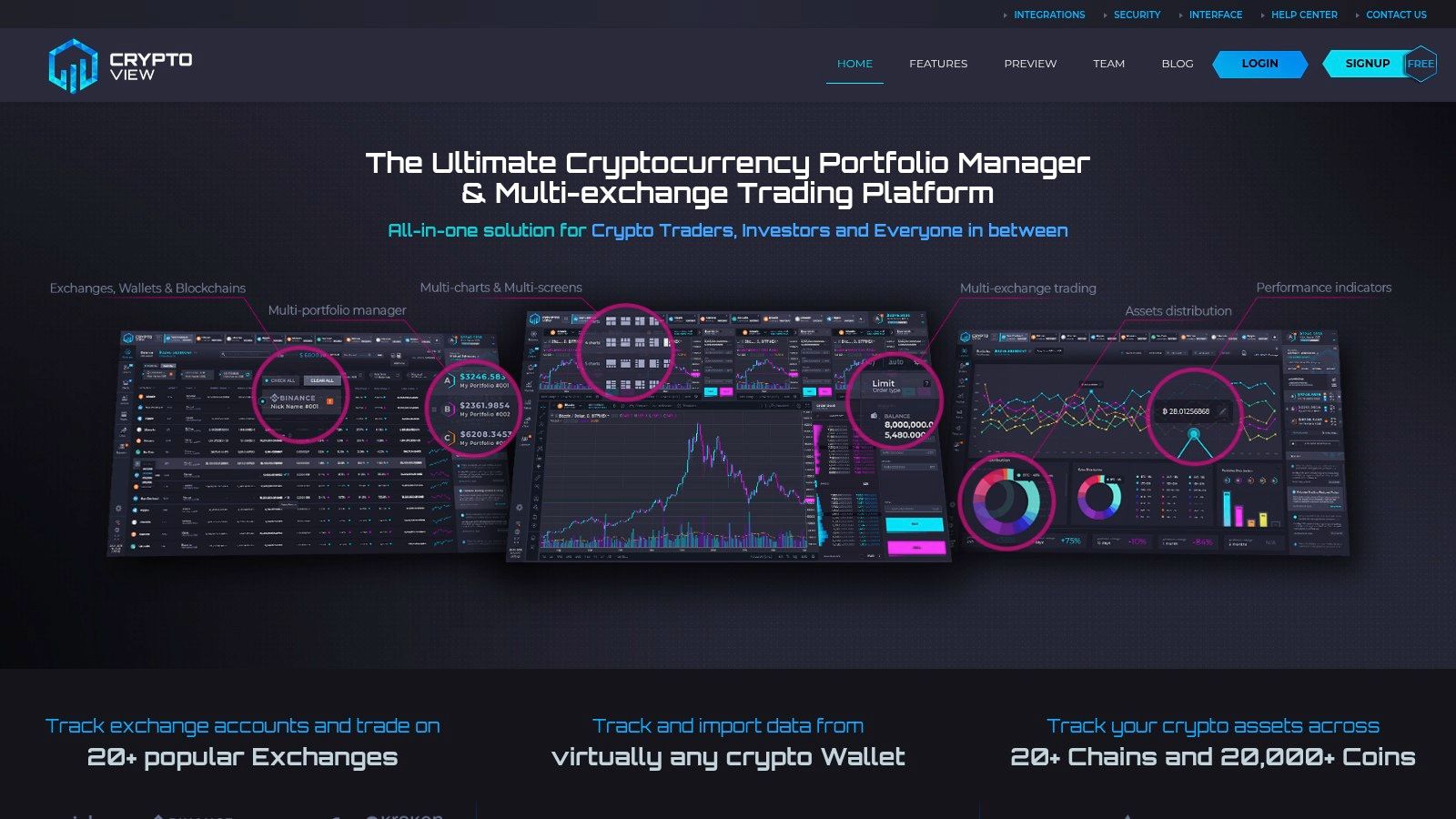

CryptoView stands out as a specialized platform designed for serious cryptocurrency traders and analysts. Unlike broader crypto screeners, CryptoView prioritizes in-depth technical analysis tools and aggregates market data from multiple exchanges. This focus makes it well-suited for identifying trading opportunities and executing complex strategies.

Consider the needs of a day trader seeking arbitrage opportunities or a swing trader looking for specific technical patterns. CryptoView excels in these scenarios. Its cross-exchange price comparison quickly highlights price discrepancies across different platforms, enabling swift arbitrage execution. The platform's advanced pattern recognition automatically detects chart patterns like head and shoulders, triangles, and flags. This automation saves valuable time and potentially reveals profitable setups. Coupled with customizable alerts for price movements and identified patterns, traders can react quickly to market changes and manage risk effectively.

CryptoView's order book visualization and market depth analysis provide a granular view of market liquidity. This detailed information allows traders to assess the potential impact of their trades and anticipate price movements. For those developing algorithmic trading strategies, CryptoView offers historical backtesting. This feature provides a robust testing environment for refining strategies before live market deployment.

While specific pricing details aren't readily available on the website, it's anticipated that a CryptoView subscription will be higher than basic screening tools. This premium likely reflects the platform's advanced features, targeting professional traders willing to invest in sophisticated tools. Technical requirements are likely minimal, primarily needing a stable internet connection and a modern web browser. Compared to platforms like TradingView, CryptoView emphasizes cryptocurrency-specific features, while TradingView offers broader market coverage.

Pros:

Cons:

Begin with a free trial or demo, if available, to explore the platform's interface and features. Invest time in learning the advanced charting and screening tools to maximize potential returns.

Website: CryptoView

CryptoView might not be suitable for casual investors due to its complexity and cost. However, for dedicated traders and analysts seeking powerful technical analysis tools and comprehensive market data, CryptoView provides a robust platform to enhance trading strategies.

LunarCrush distinguishes itself in the crowded crypto screening market by emphasizing social sentiment. While many platforms focus primarily on technical analysis, LunarCrush recognizes the significant influence of social media trends on cryptocurrency prices. This focus makes it a powerful tool for a range of users, including crypto investors, traders, analysts, and content creators seeking to understand market sentiment and identify trending projects.

Instead of relying solely on charts and trading volume, LunarCrush analyzes millions of social media posts across various platforms to measure the current pulse of the crypto community. This yields valuable insights into which projects are generating buzz, experiencing positive or negative sentiment, and potentially primed for price fluctuations. Proprietary metrics such as Galaxy Score (a combined measure of social activity and market performance) and AltRank (which ranks coins based on social engagement relative to their market capitalization) offer efficient ways to identify potential investment opportunities based on these social trends.

Identifying Trending Projects: Increased social media discussion often precedes a price surge. LunarCrush helps identify this early activity, potentially allowing users to spot breakouts.

Gauging Market Sentiment: Analyzing the tone of social media conversations provides insights into market sentiment surrounding specific cryptocurrencies. This information can be vital for informed investment decisions.

Influencer Tracking: LunarCrush allows users to monitor key influencers and analyze the impact of their opinions on overall market sentiment.

Content Creation: Content creators in the crypto space can use LunarCrush to identify trending topics and tailor their content accordingly.

Portfolio Management: Integrating social sentiment analysis into portfolio management strategies provides a more comprehensive perspective on holdings and the overall market.

Social Media Sentiment Analysis and Tracking: Real-time monitoring of social media mentions helps users identify shifts in sentiment.

Proprietary Ranking Systems (Galaxy Score, AltRank): These metrics offer a data-driven approach to evaluating cryptocurrencies based on social activity.

Influencer Identification and Tracking: Follow influential figures and understand their impact on market dynamics.

Correlation Between Social Metrics and Price Movements: Visualizations illustrate the relationship between social activity and price changes.

Real-time Social Feed: Stay current on the latest crypto-related news and discussions.

Pros:

Cons:

LunarCrush offers both free and paid plans. The free version provides access to basic features, while paid subscriptions unlock advanced analytics, historical data, and premium functionalities. Visit the LunarCrush website for specific pricing details.

LunarCrush provides a valuable and unique perspective on the crypto market by focusing on the important relationship between social sentiment and price action. It offers investors and traders insights that complement traditional technical analysis. While it may not replace a dedicated charting platform, its social intelligence capabilities make it a useful tool for crypto enthusiasts.

CryptoScreener.io distinguishes itself as a robust platform dedicated to cryptocurrency screening through technical analysis. Unlike platforms offering broader market overviews, CryptoScreener.io focuses on providing traders with tools to identify opportunities based on technical indicators and chart patterns. This specialized approach appeals to active traders and technical analysts.

The platform's strength lies in filtering cryptocurrencies across multiple exchanges based on specific technical criteria. Searching for altcoins with a bullish MACD crossover on the 4-hour chart? CryptoScreener.io lets you set up a screener with these exact parameters, significantly reducing manual chart analysis time. The platform also boasts chart pattern recognition for over 20 common patterns, including head and shoulders and double bottoms, further automating trade setup identification.

Beyond pre-built indicators, CryptoScreener.io allows users to create custom screeners tailored to their strategies. This customization is invaluable for traders who rely on specific indicator combinations or unique market metrics. A custom alert system notifies you when an asset meets your criteria, ensuring you don't miss potential opportunities.

Website: https://cryptoscreener.io/

(Pricing and technical requirements were unavailable at the time of writing. Consult the official website for the most up-to-date information.)

Begin with a pre-built screener template to familiarize yourself with the platform. Then, experiment with custom indicators and filters to create screeners aligned with your trading strategy. Regularly review and refine these screeners based on market conditions and your evolving approach.

Crypto Bubbles offers a unique perspective on cryptocurrency analysis. Instead of overwhelming users with extensive features, it prioritizes rapid visual assessment. Its core strength lies in its innovative bubble chart visualization. Each cryptocurrency is represented by a bubble, its size and color dynamically reflecting key metrics like market capitalization, trading volume, and price performance. This allows for immediate identification of market trends and standout performers.

Consider the task of quickly identifying the top 10 cryptocurrencies by market cap. Traditional table-based screeners can be cumbersome. Crypto Bubbles, however, visually highlights these leading assets as the largest bubbles. Similarly, significant price fluctuations become readily apparent through color changes, enabling swift responses to market movements. This visual immediacy provides a considerable advantage for active traders.

While Crypto Bubbles excels in visual data representation, its features are more streamlined than those offered by platforms like TradingView or CoinGecko. It provides dynamic filtering by timeframe (1h, 24h, 7d, 30d) and a basic watchlist function. However, it lacks the in-depth technical analysis tools and advanced alerting found in more comprehensive platforms. This makes it less suitable for traders who rely on complex charting and indicator-based strategies. Its data coverage for smaller, less-established cryptocurrencies is also less extensive.

Pros:

Cons:

Crypto Bubbles is exceptionally user-friendly. Simply visit the website; the interactive bubble chart loads automatically. Explore different timeframes using the filters and hover over individual bubbles for detailed information on each cryptocurrency. The watchlist feature allows for easy tracking of specific assets.

Despite its limitations in advanced technical analysis, Crypto Bubbles offers a distinct advantage. Its intuitive and free visual approach to market analysis is particularly beneficial for newcomers, visual learners, and anyone seeking a quick market overview. It complements more feature-rich platforms by providing an alternative perspective on market data, making it a valuable addition to any cryptocurrency enthusiast's toolkit.

| Title | Core Features ✨ | UX & Quality ★ | Value Proposition 💰 | Target Audience 👥 |

|---|---|---|---|---|

| 🏆 Coindive | Real-time social updates, AI price alerts | User-friendly dashboard; robust filtering | Evidence-based insights with minimal noise; unclear pricing | Investors, traders, crypto enthusiasts |

| TradingView | Advanced charting, screening tools, social network | Intuitive yet feature-rich; potential overwhelm for beginners | Comprehensive analysis with premium plans | Technical traders, chart analysts |

| CoinMarketCap | Extensive crypto data, customizable watchlists | Beginner-friendly; reliable and updated info | Free core features; upgrade for premium tools | New and seasoned traders |

| CoinGecko | Deep fundamental metrics, trust scores, portfolio tracking | Clean interface; comprehensive market data | Free, in-depth project analysis | Investors, researchers, crypto fans |

| CryptoView | Cross-exchange data, technical alerts, visualization | Professional-grade; steep learning curve | Advanced tools for serious traders; higher cost | Professional traders |

| LunarCrush | Social sentiment analysis, Galaxy Score, influencer tracking | Intuitive social visuals; clear sentiment insights | Early trend detection with premium options | Social media savvy investors, trend followers |

| CryptoScreener.io | Technical indicator filters, chart pattern recognition | Focused interface; easy custom screening | Affordable, tech-focused solutions | Technical traders |

| Crypto Bubbles | Dynamic bubble charts, visual filtering by metrics | Highly intuitive visuals; mobile-friendly design | Free, innovative visualization with limited analytics | Visual learners, casual traders |

Selecting the optimal cryptocurrency screener requires a careful assessment of individual needs and investment style. Platforms like Coindive, TradingView, CoinMarketCap, CoinGecko, CryptoView, LunarCrush, CryptoScreener.io, and Crypto Bubbles each offer a unique set of features. Defining your priorities is the first step.

Are technical indicators central to your analysis? Is social sentiment a primary driver of your decisions? Or perhaps a combination of on-chain metrics and community engagement forms the cornerstone of your strategy? Understanding your investment approach will guide you toward the most suitable platform.

Implementation is generally straightforward. Most platforms provide free tiers or trial periods, enabling hands-on evaluation before subscribing. Familiarization with the interface, exploration of available features, and testing customization options are essential for ensuring alignment with your workflow.

Budget considerations are paramount. Free screeners offer basic functionality, while premium subscriptions unlock advanced features. Real-time data, custom alerts, and in-depth analytics are often exclusive to paid plans. Assessing your budget and determining an appropriate investment level relative to your trading frequency and anticipated returns is crucial.

Integration and compatibility should also factor into your decision. Verify whether the chosen screener integrates with your existing trading platforms or portfolio management tools. Seamless data flow across platforms can significantly improve efficiency.

Finding the right cryptocurrency screener can significantly impact trading and investment strategies. Accurate, real-time data, community insights, and streamlined information are essential for informed decision-making. Coindive offers this targeted approach, empowering users with data-driven insights. From AI-powered context for price alerts to customizable alerts on social activity and sentiment, Coindive provides a comprehensive market overview. Explore Coindive and enhance your crypto journey: Visit Coindive now