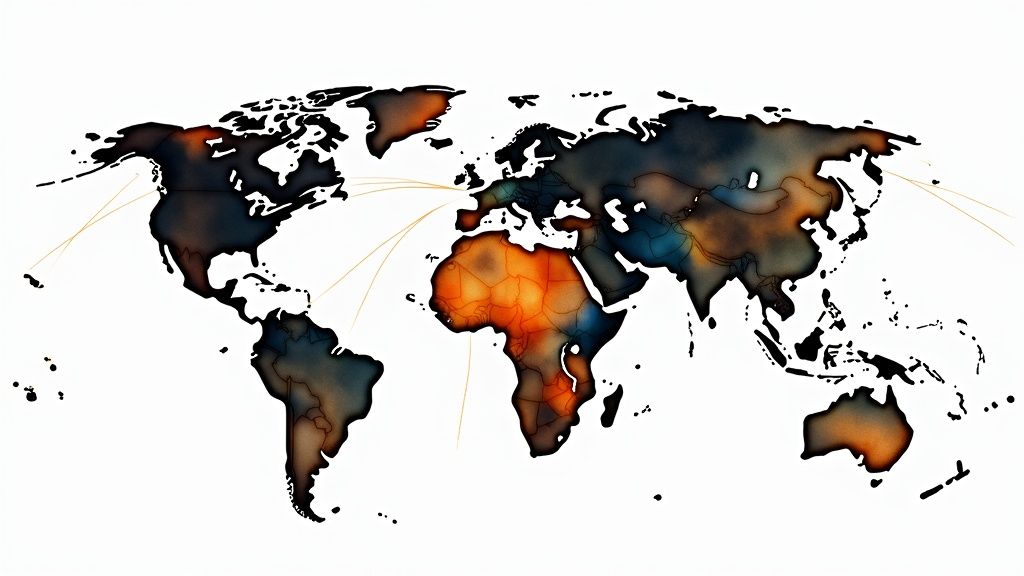

Cryptocurrency adoption follows distinct patterns across different regions worldwide. These differences emerge from the interplay between cultural beliefs, economic conditions, and available technology infrastructure. For market researchers and analysts, understanding these adoption patterns is essential for identifying opportunities and predicting future trends in the cryptocurrency space.

A society's existing relationship with financial systems shapes its openness to cryptocurrencies. In countries where people deeply trust traditional banks, the shift to decentralized currencies often happens more slowly. Risk tolerance also plays a key role - communities that are more comfortable with financial uncertainty tend to embrace volatile assets like cryptocurrencies more readily. For instance, some Asian markets show higher cryptocurrency trading volumes, reflecting cultural attitudes that are more accepting of financial innovation.

Local economic conditions create varied incentives for cryptocurrency use. In regions facing currency instability or limited banking access, cryptocurrencies often serve as practical financial tools rather than just investment vehicles. Take Nigeria as an example - with a significant portion of its population lacking basic banking services, cryptocurrency has become an essential financial solution. As a result, these economically underserved areas often show higher adoption rates compared to regions with stable financial systems. For more insights, see: How to master cryptocurrency market research in global adoption trends.

The 2024 cryptocurrency adoption landscape reveals interesting patterns. India, Indonesia, Nigeria, the United States, and Vietnam lead in adoption rates, while Kenya showed the most significant growth in transaction volume since 2023. In Nigeria specifically, 45% of the population has used cryptocurrency, largely driven by the need for alternative financial services among unbanked individuals. Read more about country-specific trends here.

The quality and reach of technical infrastructure directly affects how quickly cryptocurrencies can spread in different regions. While reliable internet access and widespread mobile phone use are fundamental requirements, other factors like regulatory restrictions and complex user interfaces can slow adoption. Understanding these technical barriers helps researchers identify both obstacles and growth opportunities in different markets.

The cryptocurrency market operates through a complex web of economic forces and technical factors. Understanding these underlying economic conditions is essential for anyone conducting serious cryptocurrency market research, as they shape both short-term price movements and long-term adoption trends.

Inflation stands out as a major driver pushing people toward cryptocurrencies. When traditional currencies rapidly lose value, businesses and individuals naturally seek alternatives to protect their wealth. Many view Bitcoin and other cryptocurrencies as potential hedges against inflation, similar to gold, due to their limited supply.

Beyond inflation, currency instability creates another compelling reason for crypto adoption. When a national currency becomes unpredictable, it disrupts business planning and daily transactions. This instability often leads people to explore cryptocurrencies as a more reliable option, especially for international payments where stability is crucial.

In regions where traditional banking services are limited, cryptocurrencies fill a critical gap. This is particularly evident in developing economies with large unbanked populations. For these communities, crypto provides a gateway to participate in the global economy without needing a conventional bank account.

The impact is clear in the data - emerging markets consistently show higher crypto adoption rates compared to developed nations. This trend highlights how cryptocurrencies serve real economic needs rather than just investment purposes. Learn more about global crypto adoption here.

Real-world economic changes directly affect how people use cryptocurrencies. Take Argentina and Brazil as examples - both countries have seen significant increases in crypto adoption as their citizens cope with weakening national currencies. In Argentina, one-third of the population engaged with cryptocurrencies in 2023 to protect their savings from rapid currency devaluation.

Brazil shows similar patterns, with more people turning to crypto as an economic safety net. These cases demonstrate how local economic conditions drive cryptocurrency adoption and usage patterns. For market researchers, understanding these economic relationships helps predict future adoption trends and market movements.

Effective cryptocurrency market research requires analyzing multiple data points to develop meaningful price predictions. By combining technical indicators, fundamental analysis, and market sentiment, experienced analysts can build forecasting models that provide valuable investment insights.

Historical price data holds key patterns that can signal future market movements. Analysts use tools like moving averages, relative strength index (RSI), and Bollinger Bands to identify trends and potential trading opportunities. For example, when a short-term moving average crosses above a long-term one, it may indicate the start of an uptrend.

Beyond price charts, fundamental analysis examines core project elements that create lasting value. This includes evaluating the development team's capabilities, the underlying technology, real-world adoption metrics, and competitive position. Projects with strong fundamentals tend to maintain value better during market downturns.

The collective mood of market participants often drives short-term price action. By monitoring social media activity, news coverage, and trading volumes, analysts can gauge whether investors feel bullish or bearish. This psychological component helps explain why markets sometimes move against technical or fundamental indicators.

Multiple forecasting approaches exist, each with distinct advantages. Time series analysis identifies statistical patterns in historical data, while regression analysis reveals relationships between different market variables. For 2025, analysts predict Bitcoin reaching $75,500 to $150,000, with potential peaks near $180,000. Ethereum forecasts range from $2,670 to $5,990, possibly hitting $6,660 in strong market conditions. Review detailed projections here.

Successful forecasting requires a balanced approach that considers multiple indicators. Relying too heavily on any single metric often leads to flawed predictions. Markets can shift rapidly due to unexpected events, making it essential to remain flexible and avoid overconfidence. Regular review and adjustment of forecasting models helps maintain their reliability over time.

Major financial institutions have become key drivers of cryptocurrency market behavior. Their sizeable capital investments and strategic moves frequently shape market trends and prices. By carefully monitoring institutional activity, individual investors can gain critical insights to inform their own strategies.

Not all institutional interest translates to serious investment commitment. The most reliable indicators come from sustained investments through Exchange Traded Products (ETPs), dedicated cryptocurrency funds, and direct purchases of digital assets. These actions demonstrate long-term confidence rather than speculative trading.

Regulatory filings and public announcements provide another important window into institutional thinking. For instance, when major investment firms disclose new cryptocurrency allocations in their portfolios, it often signals broader shifts in how traditional finance views digital assets.

Institutions access cryptocurrency markets through several channels. ETPs offer a regulated way to gain cryptocurrency exposure without managing private keys or custody. Specialized crypto funds allow institutions to spread risk across multiple digital assets while benefiting from professional management.

Direct ownership, where institutions hold cryptocurrencies on their balance sheets, represents the strongest vote of confidence. This approach requires significant infrastructure and security measures but gives institutions complete control over their assets.

Large institutional trades can trigger significant price movements. Major buy orders tend to create bullish momentum as other investors follow their lead. Conversely, institutional selling can spark bearish trends as markets react to apparent loss of confidence.

Market responses aren't always straightforward though. Regulatory news, technical factors, and general investor sentiment all influence how prices respond to institutional activity. Current data shows increasing institutional embrace of cryptocurrencies - particularly Bitcoin. In 2024, U.S. spot Bitcoin ETPs attracted substantial inflows from prominent hedge funds including Millennium, Tudor, and D.E. Shaw. Projections suggest these ETPs will reach $250 billion in total assets by 2025, coming within 19% of surpassing all U.S. physical gold ETPs. Learn more about these trends on Galaxy Digital's research portal.

Monitoring institutional investment patterns provides valuable market intelligence. Beyond tracking direct investments, pay attention to their public communications, research publications and industry event participation. These signals help build a complete picture of institutional sentiment and likely future moves.

Professional cryptocurrency analysis requires a systematic approach to gathering and interpreting market data. Understanding how experienced analysts work with data helps build a strong foundation for making informed investment decisions. Let's explore the key tools and methods you need for effective market research.

The backbone of cryptocurrency research lies in on-chain analytics platforms like Glassnode and CryptoQuant. These tools reveal actual blockchain activity through metrics like transaction volume and active addresses. For instance, when large holders (known as "whales") make significant moves, it often signals upcoming market shifts.

Beyond the numbers, understanding market sentiment is crucial. Sentiment analysis platforms such as Santiment and LunarCrush monitor social media and news coverage to gauge investor attitudes. This data helps researchers anticipate how the market might react to emerging developments.

Quality research depends on having reliable information sources. This means actively joining cryptocurrency communities, following experienced analysts, and reading trusted news outlets. But information quality varies widely - it's essential to cross-reference data from multiple sources to spot potential biases or misleading claims.

Successful analysts create structured approaches to evaluate market data. This includes setting up research dashboards to monitor key metrics and establishing clear rules for making investment decisions. A practical example would be creating alerts for significant changes in trading volume that might indicate market opportunities.

Cryptocurrency markets move quickly, so efficient research processes are vital. Set up automated data tracking tools and customize news feeds to focus on relevant information. Review and adjust your research methods regularly to keep pace with market changes and new analytical tools. Remember that thorough research is an ongoing process - staying current with market developments and regulatory changes helps maintain an edge in cryptocurrency analysis.

A systematic evaluation process forms the foundation of effective cryptocurrency research. Just as traditional investors carefully analyze stocks before investing, crypto investors must thoroughly examine digital assets to understand their potential risks and rewards. Let's explore the key components and frameworks used by successful analysts in their due diligence process.

The team behind a crypto project provides crucial signals about its potential for long-term success. Begin by researching the backgrounds and track records of key team members. Are they open about their identities and past experiences? A transparent, qualified team typically indicates stronger project fundamentals.

The project's whitepaper serves as another essential evaluation tool. Look for clear explanations of the problem being solved, the proposed technical solution, and specific development milestones. A well-written whitepaper should demonstrate deep technical expertise while remaining accessible. Vague or poorly articulated whitepapers often signal underlying issues.

Effective due diligence requires a sharp eye for warning signs. Watch out for projects relying heavily on marketing hype rather than substance. Be wary of teams that lack transparency around token distribution and financial details. Like spotting counterfeit currency, learning to identify red flags comes with experience and careful attention to detail.

The regulatory environment also demands close scrutiny. Consider whether the project operates within established legal frameworks in its target markets. Regulatory uncertainty or potential compliance issues can severely impact a project's viability and token value over time.

In the cryptocurrency space, security vulnerabilities can be catastrophic. Review independent security audit reports and examine the project's track record handling potential threats. Previous security incidents or lack of regular auditing practices should raise serious concerns.

Understanding the competitive landscape provides crucial context. Analyze how the project differentiates itself from existing solutions. Does it solve problems in novel ways or merely replicate existing approaches? This competitive analysis helps assess the project's potential market position.

A structured evaluation checklist helps ensure thorough analysis. Key areas to examine include:

Using frameworks like SWOT analysis adds another useful layer to project evaluation. This systematic approach helps identify strengths, weaknesses, opportunities and threats in a structured way.

Looking to enhance your cryptocurrency research process? Coindive provides powerful tools for tracking market trends, analyzing community sentiment, and staying informed about promising projects. Explore its comprehensive features today: Discover Coindive.