Managing cryptocurrency investments has become increasingly complex as the market has expanded far beyond just Bitcoin. With thousands of digital assets spread across multiple exchanges, centralized platforms, decentralized protocols, and hardware wallets, keeping track of your complete crypto portfolio manually is no longer feasible. Having clear visibility into your total holdings and performance is essential for making informed investment decisions.

Traditional portfolio tracking via spreadsheets is time-consuming and prone to errors, especially given the 24/7 nature of crypto markets. This challenge led to the development of specialized crypto portfolio tracking tools that automatically aggregate holdings across platforms, calculate real-time portfolio values, and provide detailed performance analytics. Modern trackers offer crucial features like automated exchange integration, profit/loss calculations for tax purposes, and market trend analysis - capabilities that align with professional investment management practices.

This guide will examine the key capabilities you should look for in a crypto portfolio tracker and evaluate some of the top platforms currently available. Whether you're an active trader, long-term investor, or newcomer to crypto, you'll learn how to select the tracking solution that best fits your investment approach and helps you make data-driven decisions. The right portfolio management tools can make the difference between operating blind and having the insights needed for successful crypto investing.

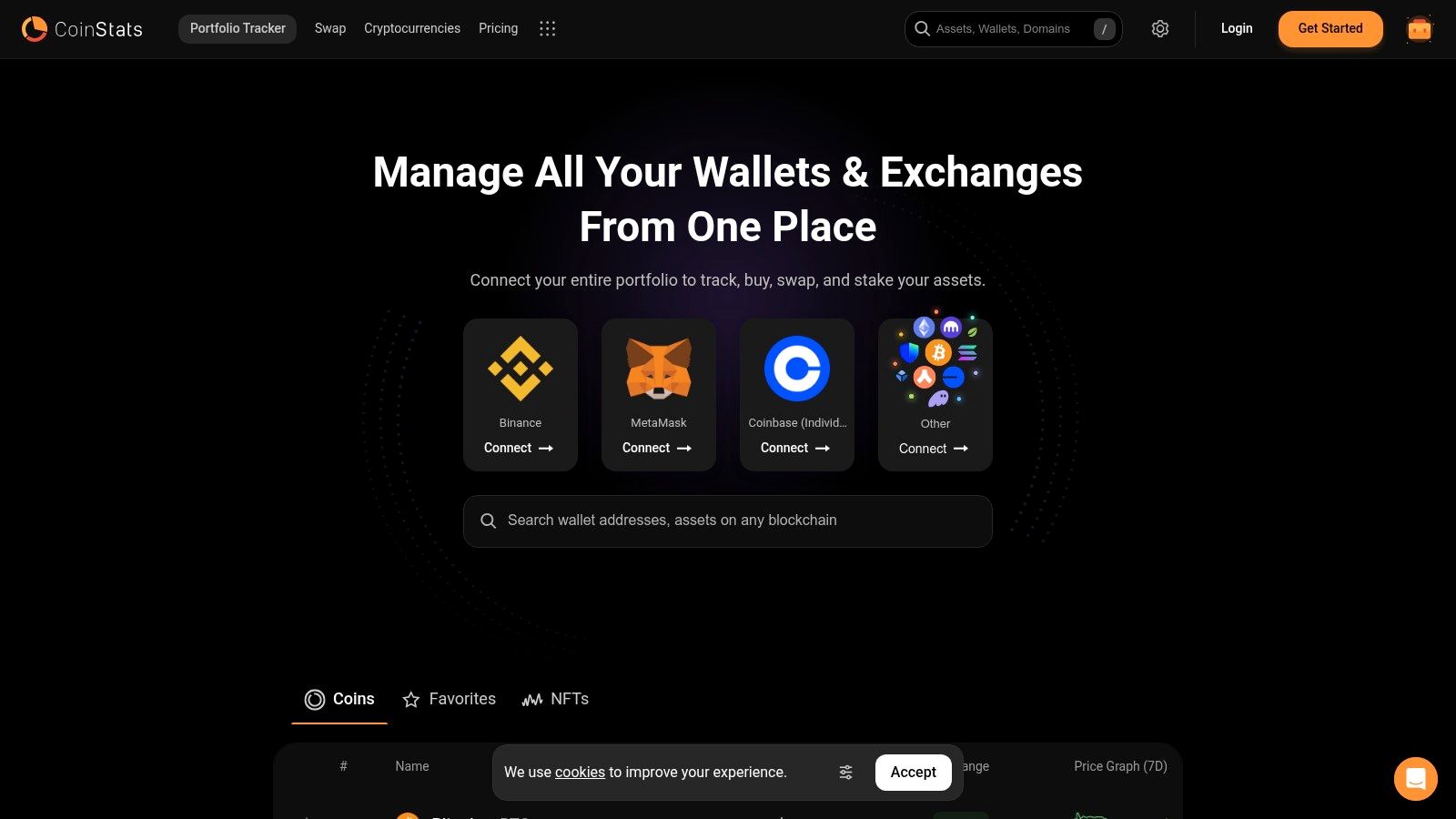

CoinStats has established itself as a leading cryptocurrency portfolio tracker by supporting over 8,000 cryptocurrencies and integrating with more than 300 exchanges and wallets. The platform delivers essential tools for monitoring digital assets, conducting market analysis, and staying updated on crypto news.

The platform excels at centralizing cryptocurrency portfolio management through automated exchange and wallet synchronization. This eliminates manual data entry while enabling real-time tracking. Institutional investors benefit from detailed analytics for strategic planning, while DeFi users can seamlessly monitor their decentralized investments alongside traditional holdings.

Market researchers and content creators rely on CoinStats' news aggregation and social feeds to track industry developments and gauge market sentiment. The platform's comprehensive reporting tools help users understand portfolio performance and market trends.

While CoinStats offers basic features for free, premium functions require a paid subscription. The pricing structure is competitive given the platform's capabilities. Users can access CoinStats via web and mobile apps, though some mobile users report occasional performance issues.

When evaluated against similar tools like Delta and Blockfolio, CoinStats distinguishes itself through extensive exchange compatibility and robust DeFi tracking. New users should prioritize setting up auto-sync and exploring the analytics suite to maximize platform benefits.

CoinStats merits recognition for delivering a well-rounded solution that serves diverse user needs through an accessible interface. The platform particularly appeals to active traders and analysts who require quick access to market data.

Advantages:

Limitations:

For additional details, visit the CoinStats website.

Through its focus on serving different cryptocurrency user segments effectively, CoinStats proves invaluable for comprehensive digital asset portfolio management.

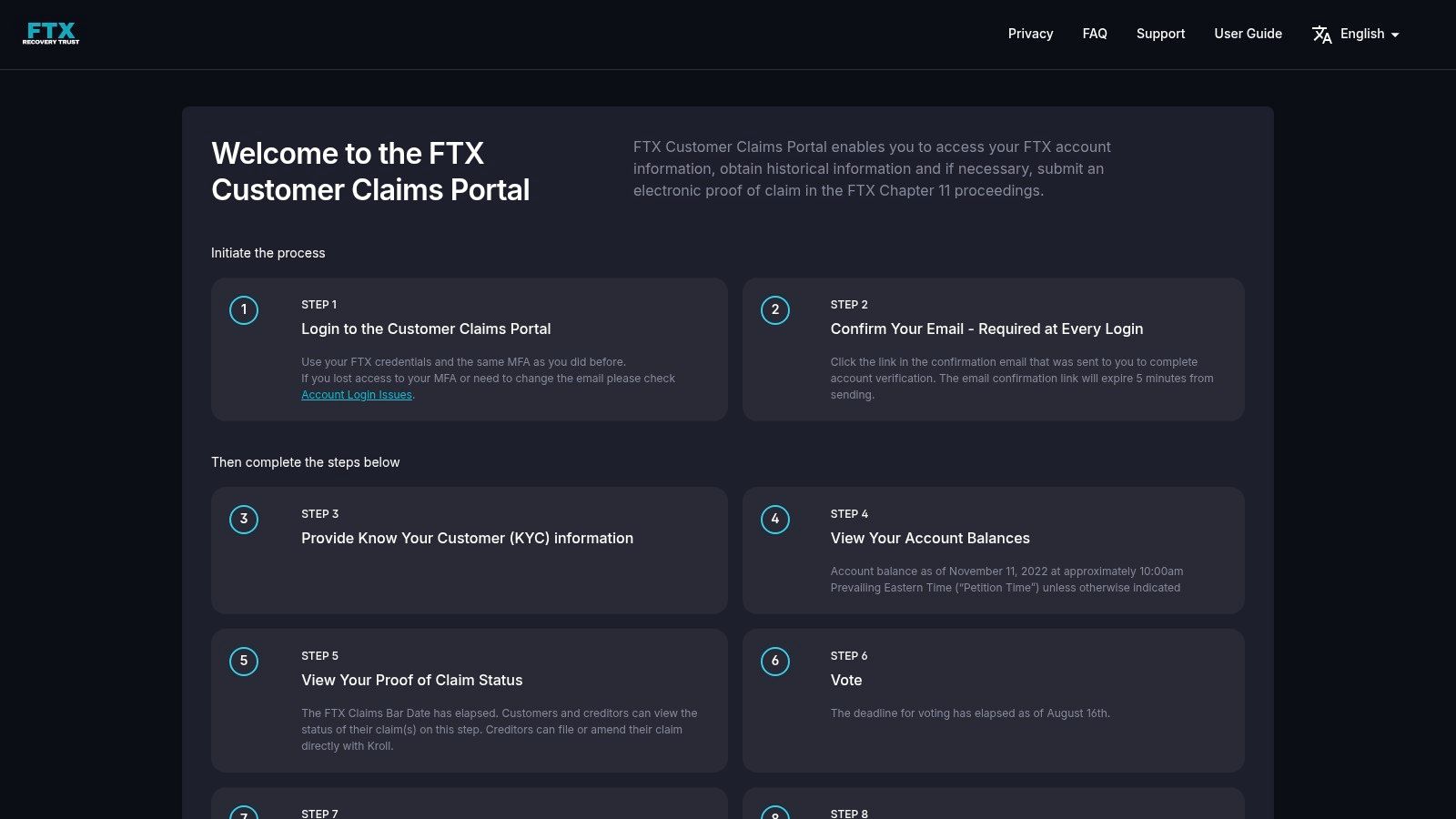

FTX, previously operating as Blockfolio, is a leading cryptocurrency tracking application with over 6 million active users. The platform combines portfolio management tools with trading capabilities and market analysis features, serving both individual investors and institutions.

The platform enables real-time cryptocurrency investment tracking with comprehensive portfolio visualization. Users can connect their trading accounts directly within FTX, allowing for seamless transactions without switching platforms. The customizable news feed keeps users updated on market developments, making it valuable for researchers and content creators who need current market information.

Direct Trading Integration: Execute trades directly through the app, reducing management complexity

Customizable News Feed: Filter updates based on specific cryptocurrencies and market interests

Multiple Portfolio Support: Track various portfolios in one account for better diversification

Price Alerts and Notifications: Receive instant updates about price movements to act on opportunities

Pros:

Cons:

FTX earns its position among top crypto portfolio trackers through its approachable design and comprehensive feature set. The platform successfully combines trading capabilities with analytics tools, serving both retail and institutional users effectively.

For more information, visit their official website.

To get the most from FTX, ensure proper connection of all accounts and wallets to maintain data accuracy. Review your news feed settings regularly to match your investment approach. Set up strategic price alerts to monitor market movements effectively.

FTX balances user-friendly operation with trading functionality, making it appealing for both newcomers and experienced traders. While it may not offer extensive technical analysis tools, the free access and mobile capabilities make it an excellent choice for daily portfolio monitoring.

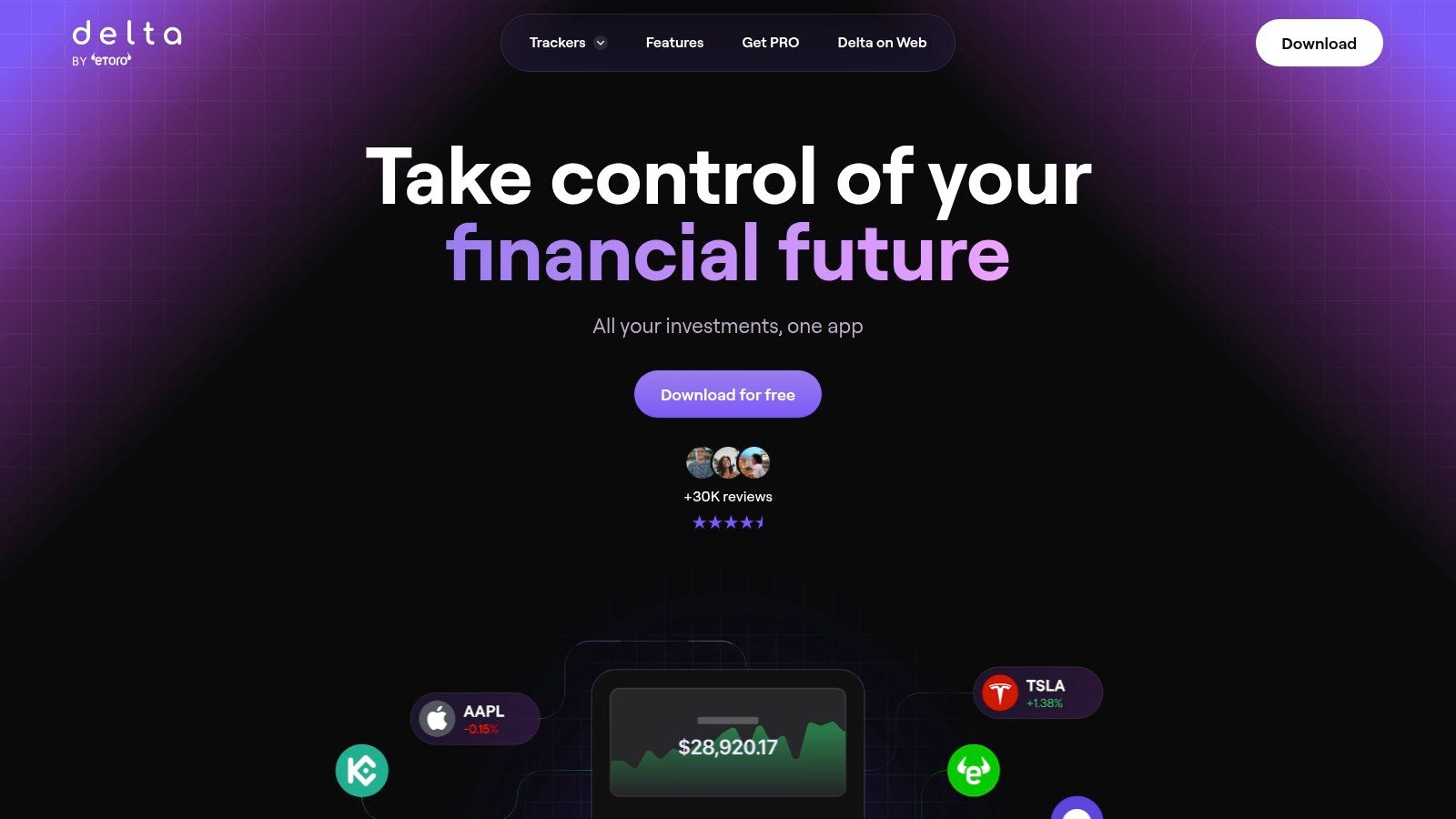

Delta excels in portfolio tracking by combining cryptocurrency and traditional investment management in one platform. This makes it especially valuable for investors who spread their assets across different classes. The platform offers powerful analytics tools and detailed charting capabilities that help users make data-driven investment decisions.

The platform serves portfolio managers and institutional investors who need to monitor diverse investments from a single dashboard. By pulling data from multiple exchanges, Delta creates a clear view of your complete portfolio. The built-in tax reporting functionality helps simplify financial compliance - a critical need for active traders.

Users can choose between the free basic version and Delta PRO premium tier. While the free version covers fundamental tracking needs, PRO provides access to detailed analytics and enhanced visualization tools. The platform requires a smartphone running iOS or Android since it primarily operates through a mobile app.

When compared to tools like Blockfolio or CoinTracking, Delta stands out by supporting both traditional and crypto assets in one interface. This broad coverage gives it an edge for investors active in both markets. However, first-time users may need time to learn the platform's extensive features.

The setup process is straightforward with Delta's clean interface. Here's how to begin:

The platform leads in portfolio tracking thanks to its complete feature set serving both retail and professional investors. Its strong security and multi-exchange support make it particularly appealing for serious traders.

Benefits:

Drawbacks:

Check out Delta's website to explore their full offering and see if it matches your investment needs. You may also find value in: How to Diversify Crypto Portfolio: A Strategic Guide to Smart Risk Management.

For investors seeking comprehensive portfolio management across both crypto and traditional assets, Delta provides a robust and reliable solution.

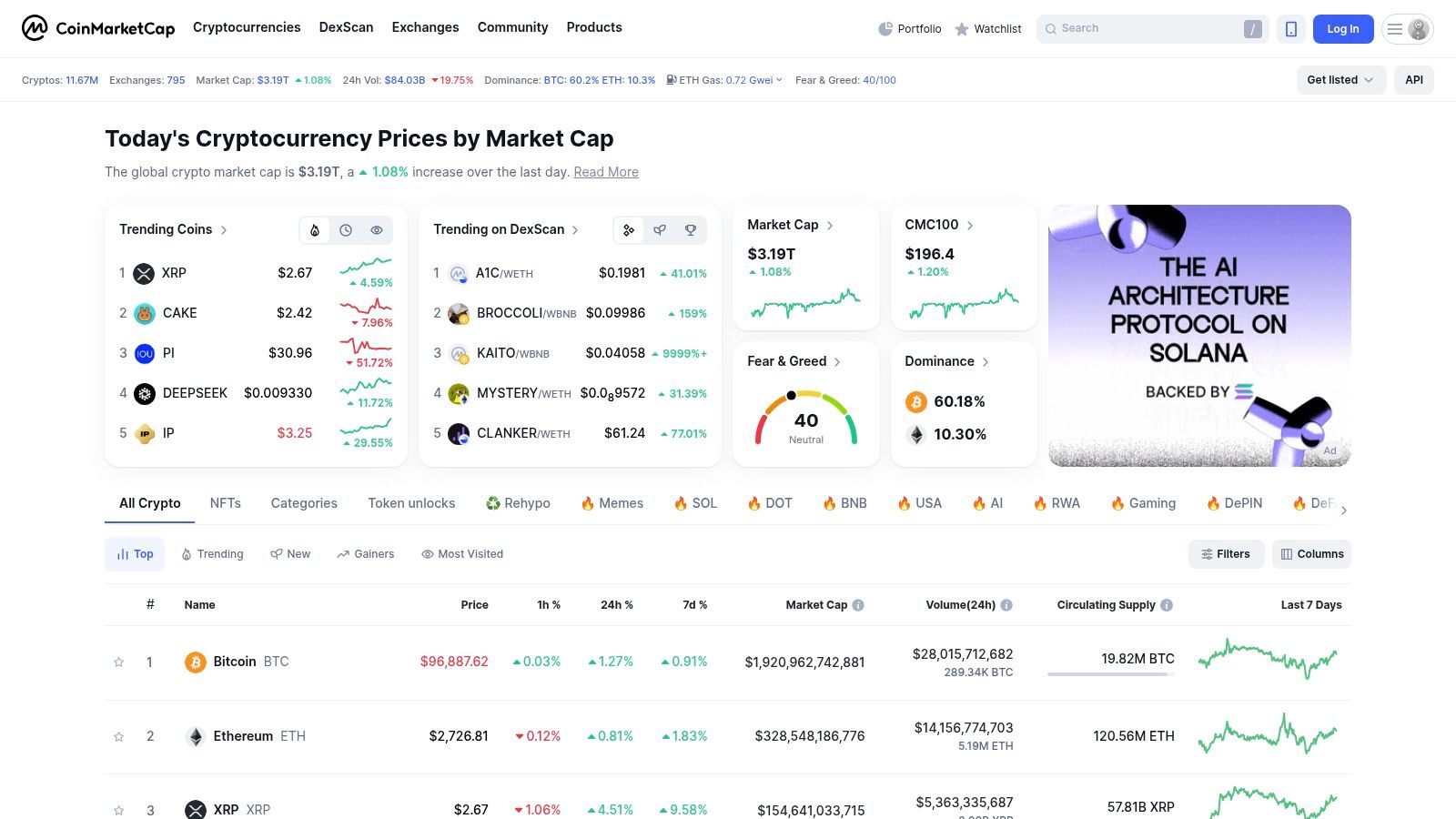

CoinMarketCap is among the most visited cryptocurrency websites globally. The platform combines detailed market data services with portfolio tracking features, making it a go-to resource for investors, traders, and analysts who need reliable crypto information.

The platform provides straightforward tools for monitoring cryptocurrency portfolios. Users can create watchlists to track specific coins and set up price alerts for important market movements. The historical data tracking capability helps investors analyze trends and make data-backed decisions.

One of the platform's main advantages is that it's completely free to use. There are no special technical requirements - you only need a modern web browser to access the platform from any device.

While some portfolio trackers focus on complex exchange integrations, CoinMarketCap emphasizes reliable market data alongside basic tracking features. Though its portfolio tools may be simpler than dedicated management platforms, its extensive market information database makes it essential for crypto research.

The setup process is simple - create an account to begin tracking portfolios. Make use of the watchlist feature to monitor specific cryptocurrencies and configure price alerts for automated notifications. Review historical data regularly to guide your investment decisions.

CoinMarketCap earns its spot on our list through its position as a trusted data source and its extensive cryptocurrency database. Despite basic portfolio features and limited exchange connectivity, its comprehensive market analysis tools and user-friendly interface make it valuable for understanding the cryptocurrency market.

Advantages:

Limitations:

To explore the full range of features and start tracking cryptocurrencies, visit CoinMarketCap's website.

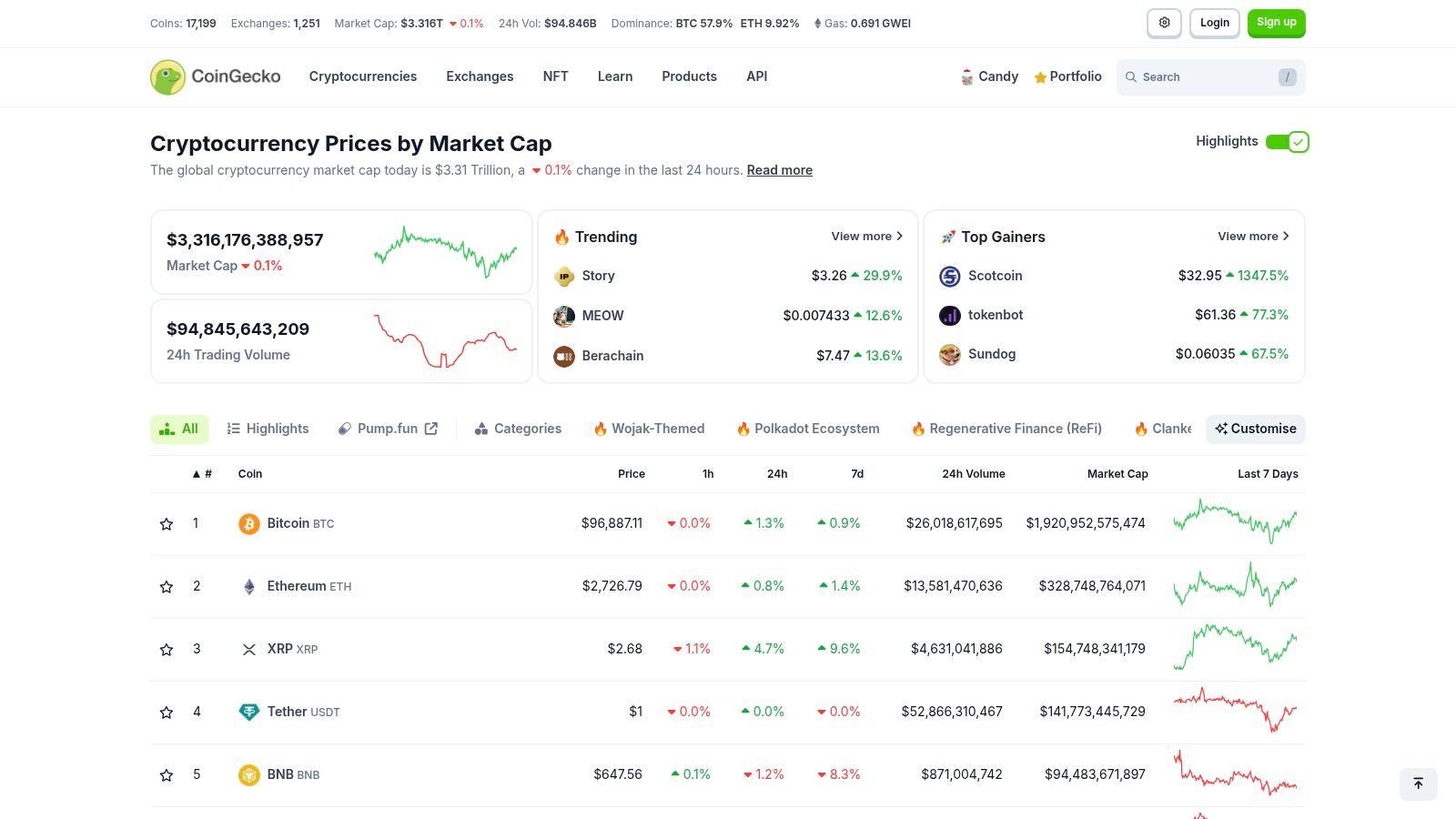

Coin Gecko provides an accessible yet powerful crypto tracking platform built for both new and experienced investors. The platform offers in-depth market data, analysis tools, and portfolio management in one central dashboard.

Portfolio managers and crypto investors use Coin Gecko to effectively track and manage their digital assets. Market analysts rely on its extensive data for research and trading decisions. The platform's NFT tracking capabilities serve both collectors and investors in the digital art space. From individual traders to large institutions, users gain actionable insights to guide their investment strategies.

Advantages:

Drawbacks:

The platform provides key features free of charge while reserving premium analytics for paid subscribers. As a web application, Coin Gecko works smoothly on any modern browser with a stable internet connection.

Compared to alternatives like CoinMarketCap and Blockfolio, Coin Gecko stands out by offering substantial features without upfront costs. New users should start with basic functions before exploring advanced capabilities as their experience grows.

Coin Gecko earns its place among top crypto platforms through robust features serving both retail and institutional investors. The combination of extensive market data, portfolio tools, and NFT tracking creates a versatile solution for managing digital assets.

Visit Coin Gecko to explore the platform.

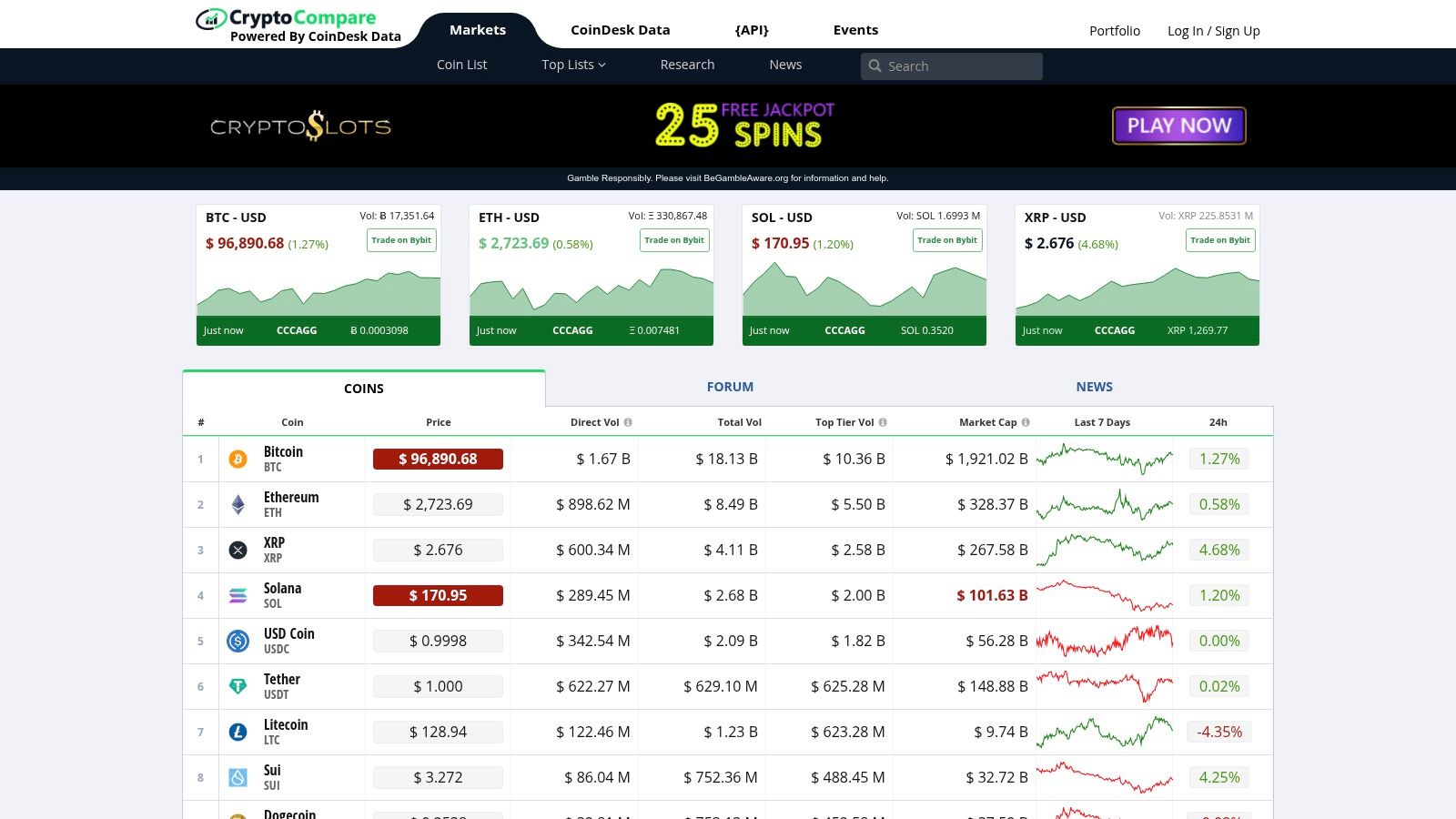

CryptoCompare stands out as a complete platform that serves multiple needs in the cryptocurrency space. The platform combines portfolio tracking, market analysis, price comparison, and social trading capabilities, making it valuable for both new investors and experienced traders.

Users can track cryptocurrency holdings across multiple wallets and exchanges to get a clear view of portfolio performance. The platform excels in its analytical capabilities - offering detailed charts, historical data, and market trend analysis to help users make data-driven decisions. For cryptocurrency miners, the platform includes a mining calculator to assess operational profitability.

The social trading aspect sets CryptoCompare apart from other platforms. Users share portfolios and discuss trading approaches, creating an environment where new investors can learn from experienced traders. The platform also maintains a knowledge base covering blockchain technology and cryptocurrency fundamentals.

Features:

Pros:

Cons:

Pricing: Basic version free with core features. Premium subscriptions unlock advanced capabilities. See website for current pricing details.

Technical Requirements: Access via web browser on desktop/laptop. Mobile apps for Android and iOS available.

Platform Comparison: Unlike CoinMarketCap and CoinGecko which focus mainly on market data, CryptoCompare provides portfolio tracking, social features, and analysis tools in one platform.

Getting Started: Create a free account, connect your crypto exchanges and wallets, and begin tracking. Take time to explore features and customize the dashboard to your needs.

Website: https://www.cryptocompare.com

Crypto Pro stands out as a high-quality portfolio tracker built specifically for Apple devices. While it requires a paid subscription, its polished interface and deep integration with iOS and Apple Watch make it an excellent choice for investors who primarily use Apple products. The app excels at providing a secure, user-friendly mobile experience.

The app goes beyond basic tracking capabilities. Users can configure detailed price alerts to actively manage their portfolios and avoid missing key market moves. The multi-portfolio management system helps investors separate different investment strategies or manage funds for multiple parties. Real-time data updates ensure your portfolio view stays current and accurate.

The native iOS design creates a fluid experience that feels natural on Apple devices. The app includes customizable widgets for quick portfolio checks without opening the full interface. Apple Watch support brings your crypto data right to your wrist, making it perfect for investors who need constant market awareness.

Security is a core focus for Crypto Pro. The app maintains strong user privacy protections, appealing to investors who prioritize keeping their financial data secure.

The main limitations are the premium cost and Apple-only availability. Users of Android devices will need to explore other options, and the platform restrictions make it less versatile than cross-platform alternatives. For dedicated Apple users seeking top-tier features, the price may be justified, but it's an important consideration. Full pricing details are available on the App Store.

Implementation Tip: Enter complete transaction history during setup for precise tracking and P&L calculations. Fine-tune alert settings based on your specific investment goals and risk preferences.

Comparison: While free tools like Delta and CoinStats work across all platforms, Crypto Pro provides enhanced iOS integration and a more refined mobile experience, though at an added cost. The app presents a compelling option for iOS users who value quality and data privacy.

Zerion is a specialized portfolio tracker designed for users active in Decentralized Finance (DeFi). It stands out by combining multiple DeFi protocols and investments into one clear interface. Unlike other trackers that only scratch the surface of DeFi integration, Zerion makes it the central focus of its platform.

The platform excels at delivering clear insights into DeFi positions across different blockchain networks. Users can monitor their yield farming activities, staked assets, liquidity pool investments, and NFT holdings all in one place. The cross-chain functionality lets investors manage assets on various networks without switching between different tools. Real-time data updates keep users informed about their current positions, while detailed analytics help them spot trends and make data-driven choices.

For DeFi users, Zerion's platform integration offers significant practical value. It removes complexity from managing DeFi investments by bringing everything into a unified view. Think of checking positions on Aave, Compound, Uniswap, and Curve - all through a single dashboard.

The platform's DeFi focus can be both a strength and limitation. Users mainly holding assets on centralized exchanges might find Zerion's specialized features unnecessary. New users may need time to understand the platform's advanced features and DeFi terminology.

Features:

Pros:

Cons:

Website: Zerion

Pricing: Free tier available with core features. Premium tiers may be offered for advanced features or institutional use. Check their website for current pricing details.

Technical Requirements: Access through web browsers and mobile apps. Requires Web3-enabled browser or compatible mobile wallet for wallet connections.

Implementation/Setup Tips:

Begin by visiting the website or installing the mobile app and connecting your Web3 wallets. The system automatically displays your DeFi holdings in an organized format. Spend time exploring different features and dashboards. While new DeFi users may need extra time to adjust, Zerion's documentation provides helpful guidance.

In summary, Zerion delivers robust features for dedicated DeFi investors. Its thorough protocol integration, multi-chain capabilities, and instant updates make it effective for complex DeFi portfolio management. Though perhaps not ideal for beginners or those focused on centralized exchanges, it proves valuable for experienced DeFi users seeking comprehensive portfolio oversight.

Kubera stands out by offering a complete financial tracking solution for investors who manage both cryptocurrency and traditional assets. Unlike platforms focused solely on crypto, Kubera provides an integrated view of your entire portfolio - including stocks, real estate, precious metals, bank accounts, and digital currencies. This makes it particularly useful for investors seeking a unified platform to track their complete financial position.

The platform's core strength is its multi-asset tracking system. Users can input crypto holdings manually or connect to exchanges for automatic updates, though this functionality is more basic compared to specialized crypto trackers. Where Kubera excels is in traditional asset monitoring, with smooth integration for bank accounts and investment platforms. The platform offers clear net worth calculations and visual reporting tools to help users understand their overall financial status. A unique feature is its estate planning tools, including beneficiary management and automated inheritance protocols.

For crypto investors, Kubera's main advantage lies in showing how digital assets fit into their broader investment strategy. The platform helps evaluate crypto holdings' impact on total net worth and financial objectives. However, users needing detailed technical analysis or advanced DeFi features may find dedicated crypto platforms more suitable.

Features:

Pros:

Cons:

Implementation Tips:

For best results, connect your financial accounts directly rather than relying on manual input. Take time to explore the reporting tools to gain deeper insights into your asset allocation and overall financial health.

Comparison:

When compared to CoinMarketCap or CoinGecko, Kubera offers less detailed crypto data but provides a more complete view of your finances. The specialized platforms excel at real-time market data and technical analysis, while Kubera focuses on comprehensive wealth management. Choose based on your primary needs - detailed crypto analysis or unified asset tracking.

TokenTax sets itself apart from other crypto portfolio tracking tools through its specialized focus on tax reporting and compliance. While basic tax reporting is common among trackers, TokenTax delivers professional-grade tools built specifically for active traders and high-net-worth individuals. This targeted approach makes it essential for serious crypto investors, especially those dealing with complex tax regulations.

The platform's tax-loss harvesting capabilities are particularly effective for investors focused on tax optimization. It helps identify opportunities to offset gains with losses to reduce overall tax liability. The system supports multiple tax accounting methods (FIFO, LIFO, HIFO) to match individual needs. Direct integration with major exchanges eliminates manual data entry and reduces errors. When tax season arrives, TokenTax automatically generates required forms, significantly reducing the time and effort needed for compliance.

The platform's advanced features come with premium pricing that reflects its specialized nature. The higher cost makes it less practical for casual investors with smaller portfolios. Since pricing details require direct contact with TokenTax, interested users should inquire directly about current rates. Additionally, the narrow focus on tax implications means users may need separate tools for general portfolio management and analysis, which could add complexity to their crypto tracking setup.

Key Features:

Pros:

Cons:

Who should use TokenTax?

TokenTax works best for:

Implementation Tip:

Given tax law complexity, work with a qualified tax professional when using TokenTax, particularly for advanced trading strategies.

TokenTax stands out for its dedicated focus on cryptocurrency taxation. While not ideal for every investor, its specialized tools and thorough tax support provide essential value for those prioritizing tax efficiency and regulatory compliance. For more information, visit TokenTax's website.

| Platform | Core Features ✨ | UX & Quality ★ | USP & Target Audience 👥🏆 | Pricing & Value 💰 |

|---|---|---|---|---|

| CoinStats | Syncs exchanges, DeFi tracking, real-time alerts | User-friendly, smooth performance | Wide exchange support for active crypto traders | Free basic; premium for advanced tools |

| FTX (Blockfolio) | Direct trading, customizable news, price alerts | Clean, intuitive, excellent mobile experience | Popular with 6M+ users & beginner-friendly traders | Free offering |

| Delta | Multi-exchange tracking, tax reporting, advanced charts | Professional-grade with detailed analytics | Suited for sophisticated investors needing deep market insights | Free basic; premium features can be costly |

| CoinMarketCap | Watchlist, price alerts, historical data | Trusted, simple interface | Ideal for beginners and data seekers with vast crypto info | Free basic |

| CoinGecko | Portfolio tracking, candlestick charts, NFT tracking | Extensive market data with regular updates | Comprehensive data platform for research-oriented users | Free basic; some premium features |

| CryptoCompare | Price comparison, social trading, mining calculator | Detailed analytics, active community insights | All-in-one analytics for traders looking for varied data streams | Free basic; occasional delays |

| Crypto Pro | Widget support, multi-portfolio, Apple Watch support | Excellent iOS integration with a clean design | Premium tracker focused on Apple users needing privacy | Paid app |

| Zerion | DeFi protocol integration, NFT & cross-chain tracking | Modern interface with real-time updates | Best for DeFi investors seeking comprehensive protocol insights | Free basic |

| Kubera | Multi-asset tracking, bank integration, net worth tools | Modern security with estate planning features | Ideal for high-net-worth individuals tracking all assets | Relatively expensive |

| TokenTax | Tax loss harvesting, multiple accounting, tax forms | Professional, focused on compliance | Best for investors needing specialized tax reporting tools | Expensive |

Selecting an optimal crypto portfolio tracker requires careful evaluation of the diverse options available. From established platforms like CoinMarketCap and Coin Gecko to specialized tools like Zerion and Kubera, each platform delivers distinct capabilities suited for different investment approaches and experience levels.

When comparing portfolio trackers, assess these key factors:

Core Features: Consider whether you need real-time price alerts, technical charting tools, DeFi protocol integration, or tax reporting functionality. Match the features to your specific investment strategy and objectives.

Setup Process: Evaluate how straightforward it is to connect your exchange accounts and crypto wallets. Look for clear documentation, responsive support, and an intuitive interface that enables efficient portfolio management.

Cost Structure: Review the free vs premium features and determine if paid subscriptions provide value. Key considerations include number of supported exchanges, transaction volume limits, and level of customer service access.

Platform Support: Check compatibility with your preferred trading venues and wallets. Ensure the tracker works with both centralized exchanges and decentralized protocols to avoid manual data entry.

Your choice of portfolio tracker can significantly impact investment outcomes. Take time to thoroughly evaluate options based on your specific requirements to effectively manage assets and make data-driven decisions.

While price tracking is essential, understanding community dynamics and social sentiment provides crucial context for crypto investments. Look beyond pure numbers to grasp the full narrative around projects.

Make smarter crypto decisions backed by comprehensive data and insights. Coindive combines detailed community tracking with market analytics to surface key project updates, social trends, and emerging opportunities - all in one focused view. From customizable event alerts to AI-powered context on price movements, Coindive helps you cut through the noise and invest with confidence. Start exploring smarter crypto tracking today.