The cryptocurrency market remains a volatile and complex ecosystem. In 2025, navigating this landscape effectively requires more than intuition; it demands robust data analysis, reliable market intelligence, and the right tools to interpret the constant flow of information. Are you struggling to identify promising projects? Do you find it challenging to manage your portfolio's risk effectively? Separating hype from genuine potential can be difficult. The appropriate crypto market analysis tools can provide the clarity and insight required for informed decision-making and potentially maximizing returns.

This article will explore eight indispensable tools designed to empower all crypto participants, from seasoned institutional investors and portfolio managers to newcomers and long-term holders. We'll examine platforms offering everything from real-time market data and on-chain analytics to sentiment analysis and portfolio tracking.

Choosing the right tool depends on your specific needs, whether you require in-depth technical analysis, identification of emerging trends, understanding market sentiment, or conducting fundamental research. Key considerations include:

By the end of this article, you'll possess the knowledge to select the ideal toolkit to decode the crypto maze and navigate the 2025 market with confidence.

Coindive stands out as a robust social listening and market analysis platform tailored for the cryptocurrency landscape. For investors, traders, and enthusiasts, grasping community sentiment and tracking project updates in real-time is paramount. Coindive fulfills this need by aggregating data from major social platforms like Twitter, Telegram, Discord, and Reddit, offering a central hub for monitoring the ever-changing crypto market.

Keeping tabs on announcements, partnerships, and discussions across numerous projects can be daunting. Sifting through endless feeds and channels is inefficient and quickly becomes overwhelming. Coindive simplifies this by filtering the noise and presenting only the most pertinent information directly to your dashboard. This allows for the quick identification of developing trends, gauging community sentiment, and ultimately making better-informed investment choices.

A key strength of Coindive is its customizable alert system. Rather than generic price alerts, Coindive lets you define triggers based on multiple factors. These include social activity, sentiment changes, keywords, and significant announcements. You could configure an alert for when a project experiences a surge in positive sentiment on Twitter, or when a partnership is revealed on Telegram. This granularity allows for rapid responses to market-moving occurrences and capitalizing on emerging opportunities.

Coindive further utilizes AI-powered price alerts that offer valuable context to market volatility. Instead of simple price change notifications, the platform connects movements to relevant events like exchange listings, partnerships, and broader industry trends. This clarifies why prices fluctuate, supporting more strategic decision-making. The integration with CoinGecko bolsters data reliability and grants access to additional market details.

Pros:

Cons:

Website: https://coindive.app

(Pricing and technical details were not publicly available at the time of writing. See the Coindive website for the latest information.)

While similar tools exist for social media analysis, Coindive's crypto-specific focus, AI insights, and CoinGecko integration set it apart. For those committed to staying ahead in the dynamic cryptocurrency sphere, Coindive offers a significant advantage. Begin by exploring pre-configured alerts and dashboards, then customize them to align with your investment strategy and interests. This maximizes the platform's potential and yields relevant insights for your crypto portfolio.

TradingView is a powerful platform for cryptocurrency market analysis, earning its place on this list thanks to its robust charting tools, social features, and extensive data coverage. It caters to both fundamental and technical analysts, providing a solid foundation for examining market trends and building trading strategies. One of TradingView's key strengths is its advanced charting functionality. Traders can perform detailed price action analysis using over 100 technical indicators, drawing tools, and personalized workspaces across numerous timeframes. This multi-timeframe analysis is essential for identifying both short-term trading opportunities and long-term market direction. The platform provides real-time data for thousands of cryptocurrencies, giving users access to up-to-the-minute market information. For those interested in developing their own indicators, TradingView offers Pine Script, its proprietary scripting language. Consider reviewing this guide on how to read crypto charts for a thorough understanding of chart analysis techniques.

TradingView also operates as a dynamic social network for traders. Users can exchange trading ideas, discuss market conditions, and follow seasoned analysts. This community aspect fosters valuable insights and creates learning opportunities for traders of all experience levels. Additionally, TradingView is available as both a web and mobile application, enabling convenient access to market data and analytical tools.

While TradingView provides a feature-rich free tier, accessing its full capabilities requires a paid subscription. The Pro, Pro+, and Premium plans offer progressively more advanced features, including additional indicators, chart layouts, and access to exclusive content. The specific pricing is determined by the chosen plan and billing cycle. The platform’s expansive feature set may present a learning curve for new users. While the community and available educational resources are beneficial, mastering all of TradingView's tools takes time and focused effort. Lastly, compared to some specialized cryptocurrency tools, TradingView’s API integration capabilities are somewhat restricted.

Pros:

Cons:

Website: https://www.tradingview.com/

CoinMarketCap is widely considered the leading resource for cryptocurrency data aggregation. Its comprehensive database and intuitive interface cater to a diverse user base, from casual investors to institutional traders. Its central role in tracking market trends, researching project fundamentals, and assessing market sentiment solidifies its position in the crypto ecosystem.

CoinMarketCap delivers real-time price updates for thousands of cryptocurrencies, providing essential metrics such as market capitalization, trading volume, and circulating supply. This data allows users to quickly evaluate the performance and scale of various projects. Beyond basic price tracking, CoinMarketCap offers detailed information on exchanges, enabling comparisons of trading fees, liquidity, and available cryptocurrencies. This information is crucial for traders seeking to refine their strategies and minimize expenses.

The platform's historical data and interactive charting tools further enhance its analytical value. These features empower users to conduct basic technical analysis and examine past performance, contributing to more informed investment decisions. For those actively managing a crypto portfolio, CoinMarketCap includes a dedicated portfolio tracking tool. Users can easily input their holdings and monitor their performance over time, obtaining a consolidated overview of their investment landscape.

While not a substitute for dedicated portfolio management software, this feature provides a convenient method for tracking portfolio value and asset allocation. Here is a summary of CoinMarketCap's key features:

Pros:

Cons:

Website: https://coinmarketcap.com/

Using CoinMarketCap is simple. Navigating to the website grants immediate access to real-time market data. To utilize the portfolio tracking feature, create a free account and input your holdings. Consider a premium API subscription for programmatic data access, particularly for automated trading strategies or advanced analytics.

While CoinGecko and other platforms offer similar features, CoinMarketCap’s extensive market coverage and established reputation provide a distinct advantage, especially for new users. CoinGecko often offers more comprehensive on-chain metrics and community data, whereas CoinMarketCap prioritizes market capitalization and trading data. The choice between the two often depends on individual needs and preferences.

In conclusion, CoinMarketCap remains an indispensable resource for anyone involved with cryptocurrency. Its free access to extensive market data, coupled with an intuitive interface, makes it essential for navigating the complexities of the crypto market. While its analytical tools may be less sophisticated than dedicated trading platforms, its function as a central data hub makes it a valuable asset for any crypto enthusiast.

Glassnode stands out as a leading platform for in-depth on-chain analysis. It offers professional-grade tools designed to understand the cryptocurrency market's underlying mechanics, moving beyond simple price speculation. While some platforms provide basic on-chain metrics, Glassnode offers a more granular view of key areas like network health, investor behavior, and overall market structure. This makes it a valuable resource for serious investors, analysts, and researchers.

Glassnode's comprehensive feature set includes:

Comprehensive On-Chain Metrics and Indicators: Investors can explore key metrics like realized capitalization, SOPR (Spent Output Profit Ratio), and NUPL (Net Unrealized Profit/Loss), among many others. These provide detailed insights into market dynamics, allowing investors to gauge market sentiment, identify potential market turning points, and assess the overall health of the network.

Advanced Market Cycle Analysis Tools: Glassnode provides tools designed to visualize and interpret market cycles, enabling investors to anticipate potential shifts and adapt their strategies accordingly. Understanding historical on-chain patterns empowers users to make more informed predictions about future price action.

Entity-Adjusted Metrics: This feature filters out the "noise" from exchange movements and large entities (often referred to as "whales"). This provides a clearer picture of organic network activity and genuine investor behavior.

Multiple Chart Options with Customizable Time Frames: Users can tailor charts and visualizations to their specific requirements, analyzing data across different timeframes to spot trends and patterns.

Institutional-Grade Crypto Intelligence: Glassnode offers curated research, reports, and dashboards that contextualize and interpret complex on-chain data. This helps users extract actionable insights from the wealth of information available.

Identifying Market Tops and Bottoms: Analyzing metrics like NUPL and SOPR helps investors identify potentially overbought or oversold conditions.

Assessing Network Health: Metrics such as transaction volume and active addresses provide insights into the overall health and user adoption of specific cryptocurrencies.

Understanding Investor Behavior: Analyzing whale activity and exchange flows can provide insights into how large investors interact with the market.

Developing Data-Driven Investment Strategies: Glassnode empowers investors to make decisions based on concrete data analysis, moving beyond speculation and hype.

Glassnode uses a tiered subscription model, offering free, advanced, and professional plans. The free tier provides access to a limited set of metrics, while the paid tiers unlock more advanced features and datasets. Pricing details are available on the Glassnode website. Access is primarily through their web-based platform, requiring only a web browser and an internet connection.

While platforms like CryptoQuant and Santiment offer some overlapping functionality, Glassnode differentiates itself with its extensive range of on-chain metrics, advanced charting tools, and institutional-grade research. New users should begin with the basic metrics and gradually explore more advanced features. Glassnode provides comprehensive documentation and educational resources.

Pros:

Cons:

Website: https://glassnode.com/

CryptoQuant distinguishes itself by offering a specialized, in-depth analysis of on-chain data, particularly for Bitcoin and Ethereum. Unlike broader market analysis platforms, CryptoQuant's focus is providing actionable insights derived directly from the blockchain. This makes it a valuable resource for serious traders and investors looking for a competitive edge. It allows users to move beyond surface-level price fluctuations and understand the underlying network activity that truly drives market trends.

CryptoQuant provides data-driven insights that can be applied to various trading and investment strategies:

Identifying Potential Buy/Sell Signals: Tracking metrics like exchange inflows and outflows allows users to gauge pressure on asset prices. High exchange inflows can indicate increased selling pressure, while significant outflows may suggest accumulation.

Analyzing Miner Behavior: Understanding miner activity, including miner reserves and selling pressure, offers valuable clues about potential price movements. Increased selling from miners can sometimes precede price declines.

Assessing Market Sentiment: Metrics like the "Fear and Greed Index" and "Net Unrealized Profit/Loss (NUPL)" provide a snapshot of overall market sentiment, assisting in identifying potential market tops and bottoms.

Evaluating Derivative Market Dynamics: CryptoQuant offers data on the futures market, including open interest and funding rates. This information is crucial for understanding short-term price volatility.

CryptoQuant's strength lies in its curated selection of on-chain metrics, presented in an accessible dashboard. Key features include:

Real-Time On-Chain Data Analysis: Users can stay informed about the latest blockchain activity and identify developing trends.

Exchange Flows Monitoring: Track the movement of cryptocurrencies into and out of exchanges to anticipate potential price changes.

Mining Pool Analytics: Gain deeper understanding of miner behavior and its influence on market dynamics.

Derivative Market Insights: Analyze the relationship between spot and futures markets.

Customizable Alerts for Key Metrics: Set alerts for specific thresholds on chosen metrics, enabling rapid responses to market shifts.

Specialized Focus: CryptoQuant provides a depth of analysis on key on-chain indicators not typically found in general market platforms.

User-Friendly Dashboard: The platform is designed for ease of navigation and understanding, even for those new to on-chain analysis.

Regular Market Updates: CryptoQuant provides regular updates and insights from analysts, adding context and interpretation to the raw data.

Premium Subscription for Full Access: Basic access is limited. Advanced features require a premium subscription, with varying plans available to suit different needs. Pricing details are not readily available on their website.

Limited Altcoin Coverage: Analysis for altcoins is less comprehensive than some competitors, such as Glassnode.

Technical Requirements: Users will benefit from a stable internet connection and a basic understanding of blockchain data.

While Glassnode offers a broader range of metrics and asset coverage, CryptoQuant shines in its focused, actionable insights specifically for Bitcoin and Ethereum traders. For those primarily interested in these two major cryptocurrencies, CryptoQuant's specialized tools and user-friendly interface make it a compelling choice.

Start with the free version to familiarize yourself with the platform and available metrics.

Identify the key indicators most relevant to your specific trading strategy.

Set up customized alerts to stay informed about significant market changes.

If you find value in the basic offering, consider upgrading to a premium subscription to unlock the full suite of features.

CryptoQuant is a valuable tool for those seeking to leverage the transparency of blockchain data for informed investment decisions. By understanding the underlying reasons behind market movements, users gain a substantial advantage in the volatile world of cryptocurrency.

Santiment distinguishes itself in the crowded crypto analysis arena. It offers a robust blend of on-chain, social, and developmental data, moving beyond basic price charts to provide a more complete market view. This empowers investors with the insights needed to make informed decisions, making Santiment a valuable tool for serious crypto investors, traders, analysts, and researchers.

Consider gauging true sentiment around a cryptocurrency, bypassing the often-misleading "noise" on social media. Santiment's weighted social sentiment analysis aggregates and analyzes mentions across platforms, filtering out bots and inorganic activity. This provides a clearer picture of actual investor sentiment. This feature can be crucial for identifying potential market turning points. For example, extreme positive sentiment might suggest an overbought market. Conversely, excessive negativity could signal capitulation, indicating a potential buying opportunity. Tracking developer activity also offers insight into a project's long-term health and viability. Increased activity could point to an upcoming product launch or significant upgrade, while decreased activity might suggest stagnation or potential abandonment.

Here’s a breakdown of Santiment's advantages and disadvantages:

| Feature | Description |

|---|---|

| Pros | |

| Unique Social Sentiment Indicators | Access sentiment data not found on other platforms. |

| Comprehensive Developer Activity Metrics | Gain a deeper understanding of project development. |

| Custom Alert System | Set alerts for key indicators to stay informed. |

| Intuitive Data Visualization | Easily interpret complex data. |

| Cons | |

| Pricing | Advanced features come at a premium, starting around $49/month. |

| Learning Curve | The platform's data depth requires time to master. |

| Limited Historical Data | Newer metrics may have shorter historical data sets. |

While platforms like Glassnode offer on-chain analytics, Santiment's focus on social sentiment and developer activity offers a more holistic perspective.

Santiment offers a powerful combination of data and analysis, allowing investors to go beyond surface-level metrics. Its emphasis on social sentiment and developer activity makes it a valuable asset for anyone serious about understanding the crypto market's driving forces. While it requires investments of time and money, the potential insights can be invaluable for informed decision-making.

Website: https://santiment.net/

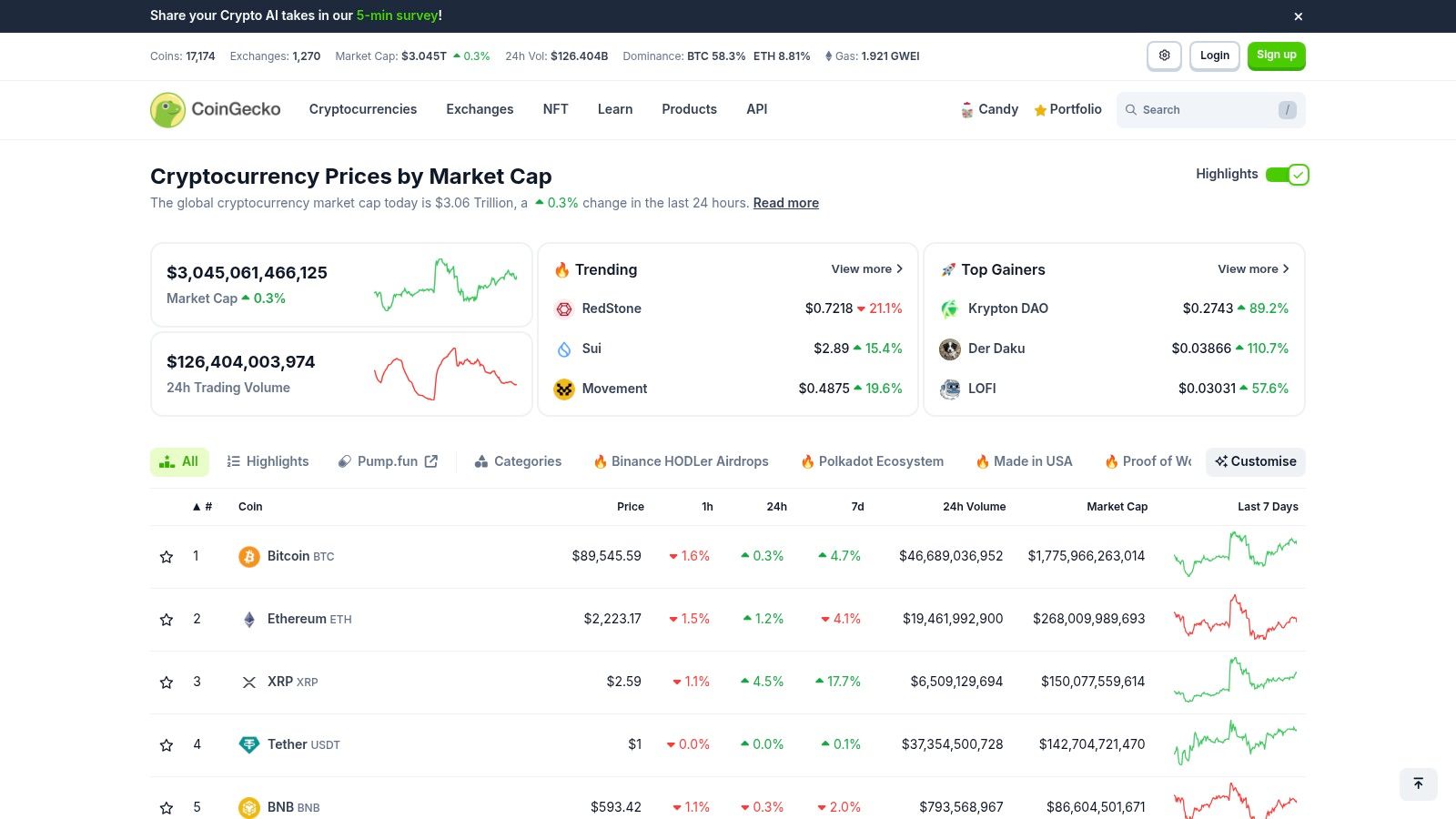

CoinGecko earns its place on this list as an accessible resource for cryptocurrency market analysis. It caters to a wide range of users, from newcomers to experienced traders. CoinGecko provides significant free data and tools whether you are researching a new altcoin, evaluating exchange reliability, or tracking overall market sentiment.

CoinGecko is notable for its in-depth analysis of over 10,000 cryptocurrencies. It goes beyond basic price tracking, providing key metrics such as market capitalization, trading volume, circulating supply, and historical performance. This detailed data enables investors to conduct due diligence and make sound investment choices.

A key feature is CoinGecko's "Trust Score" for exchanges. This score considers factors like liquidity, cybersecurity, and regulatory compliance, offering a valuable risk assessment tool. Furthermore, CoinGecko provides insights into developer activity, community growth, and on-chain metrics, allowing users to assess a project's long-term potential. For portfolio management, CoinGecko offers tracking tools and price alerts. Its growing coverage of DeFi and NFT markets enhances its position as a central hub for cryptocurrency market intelligence.

Altcoin Research: Discover promising projects by analyzing metrics like developer activity and community growth.

Exchange Selection: Make informed choices about exchanges based on CoinGecko's Trust Score and volume analysis.

Portfolio Tracking: Monitor your crypto investments and set up price alerts.

Market Overview: Understand market trends and sentiment.

DeFi and NFT Analysis: Explore decentralized finance and non-fungible token markets.

While platforms like CoinMarketCap offer similar market data, CoinGecko distinguishes itself through its Trust Score, comprehensive developer and social statistics, and a broader set of metrics for each coin. This makes it a strong choice for in-depth research.

Create a Free Account: While much of the data is accessible without an account, creating one unlocks features like portfolio tracking and personalized alerts.

Explore the "Categories" Section: This section offers a curated view of the crypto market, categorized by sectors like DeFi, NFTs, and Layer-1 protocols, allowing for targeted research.

Utilize the "Compare" Tool: Directly compare multiple cryptocurrencies to quickly spot key differences and evaluate investment opportunities.

Most of CoinGecko's features are free. A premium API is available for developers and businesses needing access to more extensive datasets and frequent updates.

Access CoinGecko via any web browser. Mobile apps are available for iOS and Android.

Website: https://www.coingecko.com/

CoinGecko's user-friendly interface, combined with its extensive free data and unique features, makes it a powerful tool for anyone involved with cryptocurrencies. Whether an experienced trader or just beginning to explore, CoinGecko provides the resources to make more informed decisions in the evolving world of digital assets.

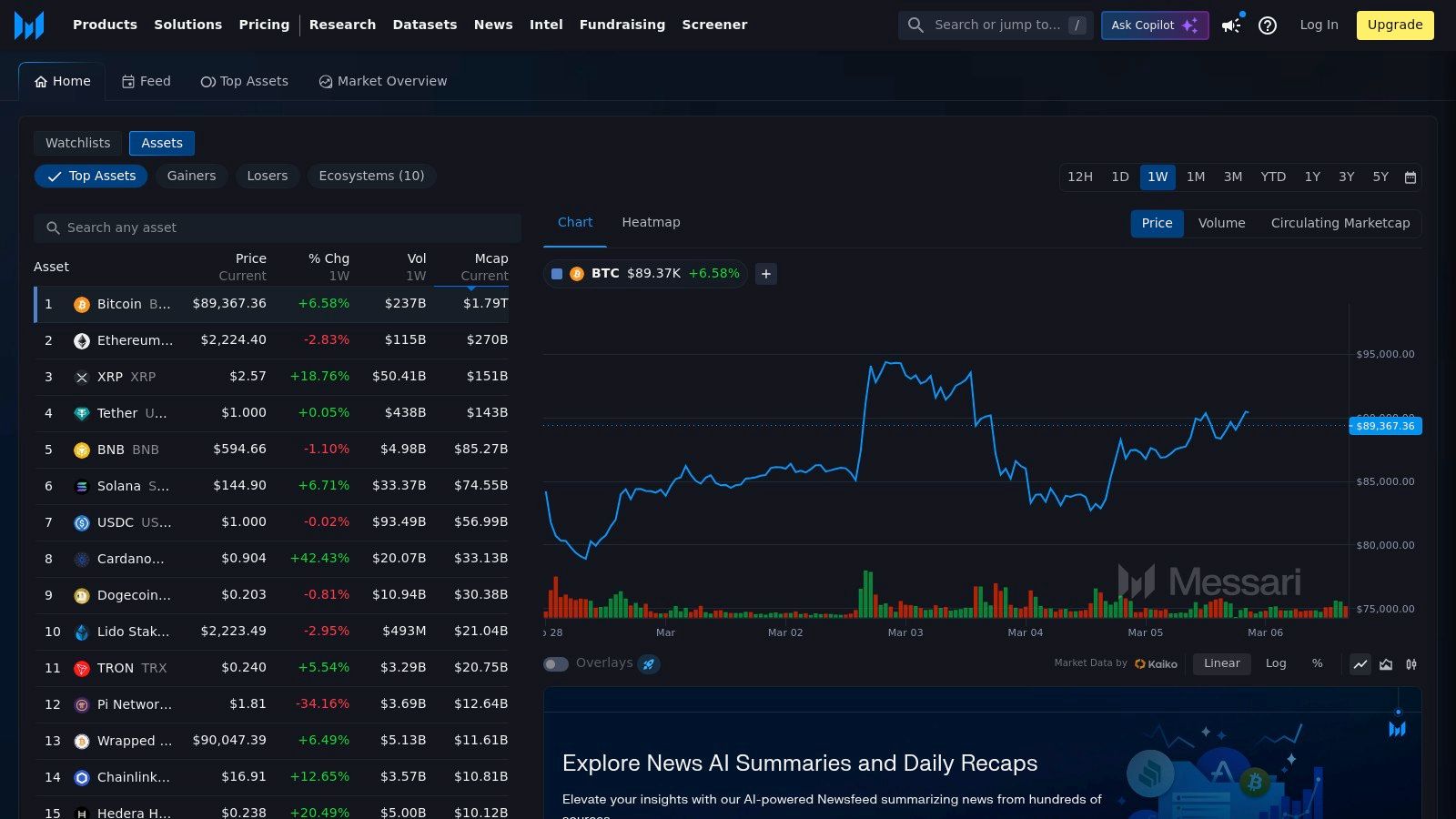

Messari earns a place on this list as a leading crypto intelligence platform. It caters to serious investors, analysts, and researchers. Its defining features include in-depth research reports, on-chain data analysis, and a focus on fundamental analysis over short-term trading signals. While platforms like CoinGecko and CoinMarketCap provide a general market overview, Messari delves deeper. It offers valuable insights into tokenomics, governance, and the core technology of various crypto projects.

Messari empowers users to make data-driven investment decisions through several key features:

Detailed Asset Profiles: Move beyond basic price charts with comprehensive profiles. These outline tokenomics, team information, project roadmaps, and key metrics like market capitalization and circulating supply. Investors can better understand the potential and risks associated with each asset.

Professional Research Reports and Market Analyses: Messari’s research team delivers high-quality reports. These cover market trends, regulatory developments, and emerging technologies, giving crucial context for identifying promising investment opportunities.

Customizable Screeners: Filter through thousands of cryptocurrencies using specific criteria. These include market cap, trading volume, and on-chain metrics, allowing investors to quickly pinpoint assets matching their investment strategies.

Governance and On-Chain Activity Monitoring: Track key on-chain metrics. These include transaction volume, active addresses, and developer activity, offering a glimpse into the health and adoption of a particular blockchain network. This is particularly valuable for understanding the fundamental drivers of price action.

Real-time News Aggregation and Analysis: Stay informed on the latest crypto news and developments. Messari's aggregated news feed and analysis helps investors respond effectively to market-moving events.

Pros:

Cons:

Getting started is simple. Create a free account to access basic market data and explore the platform. To unlock its full potential, consider the Pro subscription. Explore the available screeners and research reports to familiarize yourself with its capabilities.

Website: https://messari.io/

In conclusion, Messari is a powerful tool for serious crypto investors and analysts. Those looking for in-depth research, data-driven insights, and a comprehensive market understanding will find it particularly valuable. Its focus on fundamental analysis and transparent methodology makes it a valuable resource for navigating the complex world of digital assets.

| Platform | Core Features | UX & Insights | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Coindive 🏆 | Social alerts, AI price context, community metrics | Streamlined dashboard, real-time data | Evidence-based insights; noise-free alerts | Investors, traders, enthusiasts | Genuine engagement filtering |

| TradingView | Advanced charts, technical indicators, social sharing | Customizable workspaces; steep curve | Free tier with upgrade options | Experienced traders | Custom indicators with Pine Script |

| CoinMarketCap | Real-time data, market cap, volume stats | Beginner-friendly, intuitive interface | Free and comprehensive market stats | Beginners, market watchers | Most comprehensive crypto database |

| Glassnode | On-chain metrics, blockchain analysis | Data-rich; steep learning curve | Institutional-grade insights; premium pricing | Serious investors, analysts | Deep blockchain fundamentals |

| CryptoQuant | On-chain analysis, exchange flows, alerts | User-friendly dashboard | Focused on key indicators; premium for full features | Traders seeking real-time alerts | Targeted alerts on major market movements |

| Santiment | Social sentiment, developer activity, on-chain data | Intuitive visualizations; rich data | Premium analytics with unique sentiment insights | Trend seekers, researchers | Combines social and developer analytics |

| CoinGecko | Extensive metrics, trust scores, portfolio tracking | User-friendly, extensive data | Free access with comprehensive insights | General crypto enthusiasts | Broad data coverage including DeFi and NFT trends |

| Messari | Professional research, asset profiles, screeners | Detailed reports; technical depth | Enterprise-grade analysis; Pro subscription required | Institutional, advanced investors | High-quality, transparent methodologies |

The crypto market is in constant flux. Staying informed is critical for success. Integrating the right crypto market analysis tools is essential for navigating this complex landscape, identifying emerging trends, and making informed investment decisions, not just in 2025, but for the foreseeable future. Research is key, and selecting tools aligned with individual needs and investment strategies is paramount.

The ideal combination of tools hinges on your specific objectives. Are you a day trader seeking quick profits? A long-term investor looking for steady growth? A researcher delving into market mechanics? Or a content creator sharing insights with an audience? Each tool offers unique advantages.

For example, TradingView is renowned for its charting capabilities, while Glassnode provides deep dives into on-chain data. CoinMarketCap and CoinGecko offer comprehensive market overviews, perfect for keeping your finger on the pulse of the industry.

When incorporating these tools, it's prudent to begin with the free versions. This allows you to familiarize yourself with the features and functionalities before committing to a paid subscription. As your analytical needs expand, upgrading unlocks advanced features like custom alerts, in-depth reports, and institutional-grade data access.

Budget and resource allocation are crucial factors. While many tools offer free tiers, the most powerful features often come at a cost. Carefully evaluate the cost-benefit ratio of each tool, selecting those that align with your budgetary constraints and analytical requirements. Time investment is another critical element. Some platforms have steeper learning curves than others, demanding more time for mastery.

Integration and compatibility are also essential considerations. Some tools offer APIs, enabling seamless integration with your existing applications or trading bots. Ensure that the chosen tools mesh with your current workflow and systems to maximize efficiency.

Staying ahead in the volatile crypto market demands accurate, timely, and relevant data. Don't get lost in the information overload. Coindive offers a powerful solution by aggregating social sentiment data, delivering AI-powered contextualized alerts, and providing actionable insights, empowering you to make data-driven decisions. Stop wasting time sorting through endless social media feeds. Maximize your crypto potential with Coindive and experience the difference.