The crypto market demands constant vigilance. Miss a key price movement and you could miss an opportunity or incur a loss. This list of eight top crypto alerts apps will help you stay ahead of the curve. Discover tools like Coindive, TradingView Alerts, CoinMarketCap Price Alerts, CryptoHopper, Coinigy, Coinrule, TabTrader, and Alertatron to receive real-time crypto alerts, monitor price fluctuations, and react quickly to market changes. This guide provides the insights you need to choose the best crypto alerts app for your investment strategy.

Coindive positions itself as the ultimate crypto community and market tracker, consolidating crucial information from across the web and delivering it directly to you. Instead of sifting through countless social media posts and news articles, Coindive aggregates updates from major platforms like Twitter, Telegram, Discord, and Reddit, presenting a streamlined view of project developments, community sentiment, and key growth metrics. This is particularly valuable for investors who rely on both technical analysis and social sentiment to inform their decisions. The platform's integration with CoinGecko adds another layer of reliability and ensures access to high-quality, up-to-date market data. By combining community insights with robust market analysis, Coindive aims to empower users with a 360-degree perspective on their favorite crypto projects.

One of Coindive's standout features is its suite of customizable crypto alerts. Beyond basic price alerts, users can configure notifications for specific social activity spikes, project popularity changes, and even custom keyword mentions. This level of granularity allows for highly targeted monitoring and enables users to stay ahead of important developments. The AI-powered smart price alerts attempt to contextualize price movements by connecting them to relevant market events, offering potentially valuable insights. For instance, if a token’s price surges, the alert might highlight a corresponding surge in positive social media sentiment or a significant partnership announcement, helping you understand the “why” behind the price action. While Coindive's website doesn't readily disclose pricing information, learn more about Coindive for further details. Technical requirements are minimal, primarily requiring a stable internet connection and a web browser or mobile device.

Compared to more basic crypto alert tools that focus solely on price fluctuations, Coindive offers a much more comprehensive approach. Its focus on integrating social sentiment analysis provides an additional layer of information, enabling users to gauge the overall community perception of a project. This can be especially useful for identifying emerging trends and separating genuine excitement from manufactured hype. Coindive also allows users to compare individual coin performance with broader market trends, facilitating a more informed investment strategy.

Pros:

Cons:

Coindive earns its spot on this list because it goes beyond basic crypto alerts by offering a powerful combination of social intelligence and market analysis. Its focus on providing contextualized insights makes it a valuable tool for any serious crypto investor, trader, or analyst looking to navigate the complex crypto landscape with confidence. For those interested in exploring its features, visit the Coindive website.

TradingView has earned its spot as a leading platform for charting and technical analysis, but it's the robust crypto alerts system that truly sets it apart for serious crypto investors. More than just basic price triggers, TradingView allows you to monitor virtually any cryptocurrency across a multitude of exchanges, setting alerts based on a vast array of technical indicators, price movements, and even custom drawings on your charts. This level of granularity is invaluable for traders and analysts seeking precise entry and exit points. Whether you're a day trader scalping short-term price fluctuations or a long-term holder tracking macro trends, TradingView's alert system can be tailored to your specific needs. This flexibility is what makes TradingView a top choice for staying informed in the volatile crypto market.

The platform's true power lies in its customization. You can set alerts based on simple price thresholds, or delve into more complex criteria involving indicators like RSI, MACD, moving averages, and more. The ability to create alerts based on intersections of trendlines or the breaking of support/resistance levels drawn directly on the charts opens up sophisticated trading strategies. Alerts can be delivered via email, on-site pop-ups, mobile push notifications, and SMS (for paid subscribers), ensuring you never miss a crucial market movement, no matter where you are. For those who require even greater automation, TradingView's webhook support allows integration with external trading bots and other automated systems. Furthermore, the ability to add notes to your alerts provides invaluable context when reviewing past triggers.

Compared to simpler crypto alert tools, TradingView offers significantly greater depth. While some platforms might offer basic price alerts, TradingView provides a full suite of tools for technical analysis, making it a one-stop shop for chart analysis and automated notifications. The platform’s large and active community provides a wealth of shared scripts, indicators, and trading ideas, further enhancing the learning and development of your own alert strategies.

While TradingView’s free tier is limited to only one active alert at a time, the paid plans offer significantly more capacity and features, including unlimited alerts and SMS notifications. The pricing varies depending on the chosen plan, with options to pay monthly or annually. The biggest hurdle for new users is the learning curve associated with mastering the platform's advanced features. However, the wealth of educational resources and the active community can significantly aid in this process.

Implementation Tips:

TradingView is a powerful tool for any serious crypto investor. Its versatility, depth of features, and integration with a comprehensive charting platform make it a top choice for those seeking a highly customizable and powerful crypto alert system. Visit TradingView

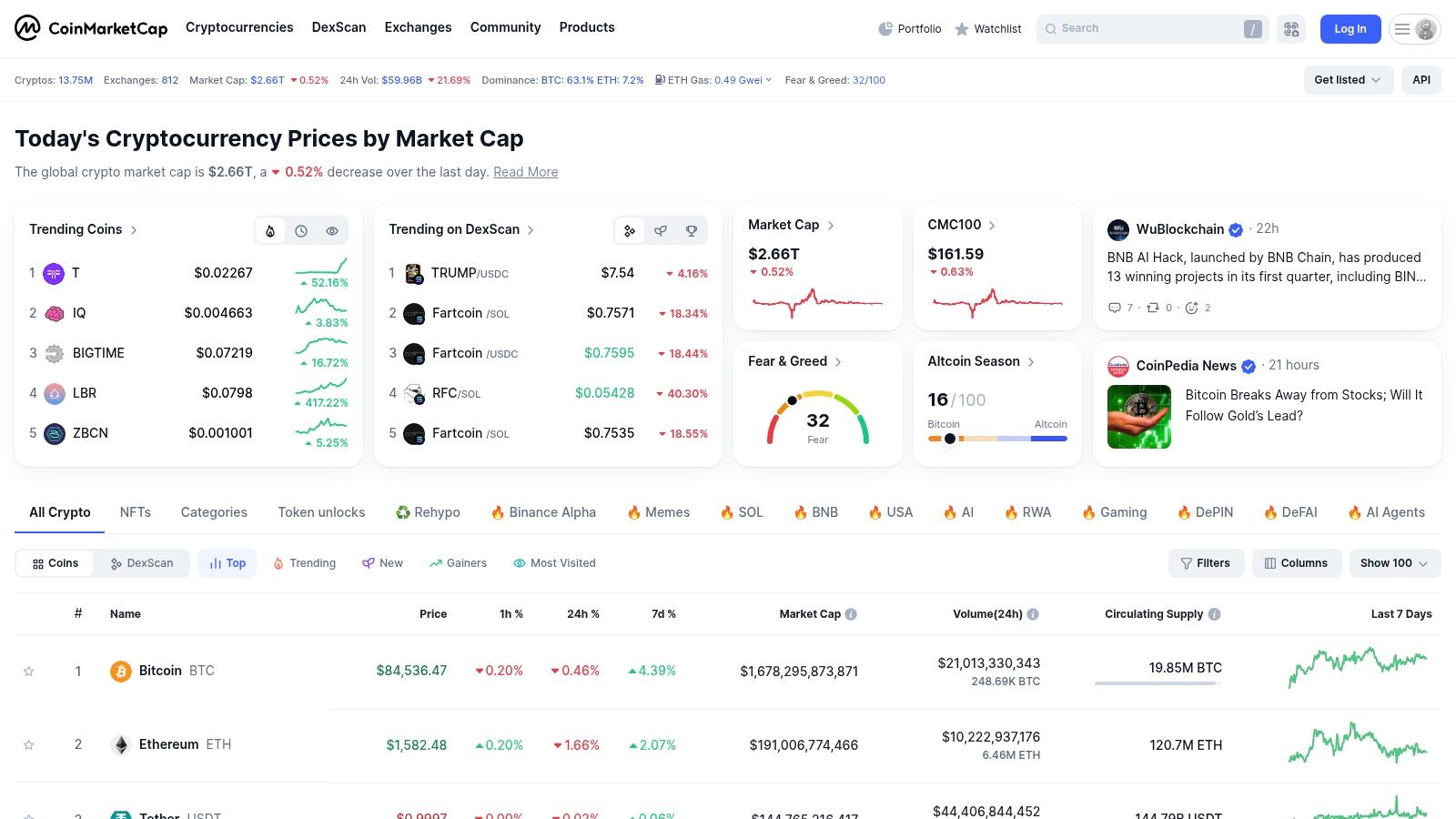

Staying informed about cryptocurrency price movements is crucial for any investor, trader, or enthusiast. CoinMarketCap, a leading cryptocurrency data aggregator, recognizes this need and offers a robust, free price alert system that makes tracking your favorite assets easier than ever. This tool allows you to set up customized alerts for virtually any cryptocurrency listed on their extensive database, empowering you to make well-informed decisions based on real-time market dynamics. Whether you're a seasoned trader or just starting your crypto journey, CoinMarketCap's price alerts can be a valuable addition to your toolkit. This is particularly true for those managing a diverse portfolio or tracking volatile altcoins. Its ease of use and comprehensive coverage make it a strong contender among crypto alert platforms.

CoinMarketCap's alert system shines with its simplicity. Users can set price-based alerts, receiving notifications when a specific cryptocurrency hits their target price. This is invaluable for setting buy or sell orders and capitalizing on market fluctuations. Alternatively, you can configure percentage-based alerts to be notified of significant price swings, say, a 10% drop or a 20% surge. This allows for quick reactions to market volatility, a key advantage in the fast-paced world of cryptocurrency. The platform also integrates with your portfolio and watchlist, further streamlining the process of monitoring your investments.

One of CoinMarketCap's biggest strengths is its extensive coverage. It tracks thousands of cryptocurrencies, ensuring that even those interested in lesser-known altcoins can benefit from its alert system. This broad coverage is a major differentiator compared to some other platforms that might focus solely on major cryptocurrencies. Furthermore, the service is entirely free to use, with no strict limitations on the number of alerts you can create. This accessibility, combined with a user-friendly interface and reliable data sourced from multiple exchanges, makes it an ideal choice for beginners.

While CoinMarketCap excels in its breadth and ease of use, it does have some limitations. Its focus is primarily on price alerts, lacking advanced technical analysis features or indicator-based alerts that more experienced traders might require. Platforms like TradingView offer more sophisticated charting tools and custom indicator alerts, although these often come at a subscription cost. Another minor drawback is occasional delays in notification delivery. While generally reliable, real-time notifications can sometimes be slightly delayed, which could be a concern for high-frequency traders. Finally, push notifications are exclusively delivered through the CoinMarketCap mobile app. While email notifications are available, those who prefer desktop notifications will need to install the app.

Setting up alerts is straightforward:

In conclusion, CoinMarketCap's price alerts offer a valuable, free service for anyone involved in the cryptocurrency market. Its comprehensive coverage, ease of use, and reliable data make it an excellent entry point for beginners. While it may not satisfy the needs of advanced traders seeking sophisticated technical analysis tools, its free access and straightforward functionality solidify its place as a valuable tool for staying informed about crypto price movements.

CryptoHopper stands out as a sophisticated platform offering much more than basic crypto alerts. It's a comprehensive trading bot platform with a robust alert system integrated into its core functionality. This makes it a powerful tool for active traders seeking automated or semi-automated trading strategies triggered by specific market conditions. Instead of simply notifying you of price changes, CryptoHopper allows for alerts based on a wide range of criteria, including technical indicators like moving averages, RSI, and Bollinger Bands, as well as market sentiment analysis. This allows for a much more nuanced approach to crypto alerts, enabling traders to react to specific market developments that align with their trading strategies. For those looking to move beyond manual monitoring and capitalize on real-time market movements, CryptoHopper offers a compelling solution.

CryptoHopper’s key strength lies in its ability to link alerts directly to automated trading actions. Through API integration with various exchanges, the platform can execute trades based on predefined parameters when an alert is triggered. For instance, you can configure it to buy a certain altcoin when its price drops below a specified threshold or sell Bitcoin when the RSI crosses a certain overbought level. This feature makes CryptoHopper particularly appealing to traders who want to take advantage of market opportunities 24/7 without constant manual oversight. The platform’s backtesting capabilities also enable users to fine-tune their alert strategies and assess their historical performance before deploying them in live trading.

While other tools might offer basic price alerts, CryptoHopper’s sophisticated features place it in a different category. Compared to simpler alert services, CryptoHopper provides a more comprehensive and automated approach, albeit at a higher price point. Setting up CryptoHopper requires some technical proficiency, and navigating its extensive feature set can be challenging for beginners. Users will need to understand the intricacies of technical indicators and trading strategies to effectively utilize the platform.

CryptoHopper operates on a subscription model, with plans ranging from $19 to $99+ per month. The higher-tier subscriptions unlock more advanced features, including increased trading limits, access to more technical indicators, and the ability to connect to multiple exchanges simultaneously. The platform is cloud-based, ensuring 24/7 operation and eliminating the need for users to run their own servers.

Implementation Tips:

CryptoHopper deserves its place on this list due to its advanced capabilities and unique combination of crypto alerts with automated trading. While the learning curve and cost might deter casual users, its powerful features make it a valuable asset for serious traders seeking a comprehensive solution for automated trading based on real-time market analysis. For more information and to explore the platform's features, visit https://www.cryptohopper.com/.

For serious cryptocurrency traders seeking advanced charting, technical analysis, and real-time crypto alerts across a vast range of exchanges, Coinigy offers a professional-grade solution. It stands out from basic crypto alert tools by providing a centralized platform to manage and execute trades across over 45 exchanges, coupled with a highly customizable alert system. This makes Coinigy particularly well-suited for those engaging in arbitrage, high-frequency trading, or managing a diversified portfolio across multiple platforms. If you need to stay ahead of market movements and react swiftly to opportunities, Coinigy’s robust alert features can be a valuable asset.

Coinigy's crypto alerts go beyond simple price triggers. Users can set alerts based on a wide array of technical indicators, such as moving averages, RSI, MACD, and Bollinger Bands. This allows for sophisticated trading strategies and precise entry and exit points. Furthermore, Coinigy offers volume-based notifications, alerting you to significant shifts in trading volume that might precede major price movements. Portfolio value change alerts provide a convenient way to monitor the overall health of your investments. These alerts can be delivered via email, SMS, or browser notifications, ensuring you never miss a critical update. This multi-faceted approach to crypto alerts sets Coinigy apart from more basic solutions and justifies its place on this list.

The platform's API access further enhances its appeal for advanced users and developers. This allows for programmatic access to market data and the creation of custom trading bots, enabling automated trading strategies based on your specific criteria. The multi-exchange monitoring capability is a key advantage, eliminating the need to log in to multiple platforms individually. Coinigy aggregates all your exchange data into a single interface, streamlining your workflow and saving valuable time.

While Coinigy's comprehensive feature set caters to seasoned traders, it's important to acknowledge that the platform's complexity might be overwhelming for beginners. The interface is packed with data and charting tools, requiring a learning curve to master. Additionally, Coinigy operates on a premium subscription model, with the most basic plan starting at $21.95 per month. The limited free trial period may not provide sufficient time to fully explore the platform’s capabilities. Therefore, it's crucial to weigh the cost against the benefits and consider your trading experience level before committing to a subscription.

For those who need to track crypto alerts across multiple exchanges and leverage advanced charting tools, the investment in Coinigy could be worthwhile. The platform provides powerful tools for technical analysis, portfolio management, and automated trading, making it a valuable resource for professional traders. You can explore Coinigy and its features further by visiting their website: https://www.coinigy.com/

Coinrule bridges the gap between basic crypto alerts and fully automated trading bots. It empowers users, even those without any coding experience, to set up sophisticated crypto alerts and automated trading strategies. This is achieved through an intuitive "if-this-then-that" interface, enabling you to define specific market conditions that trigger alerts and subsequent actions. Instead of merely being notified of a price change, Coinrule allows you to automatically execute trades based on these predefined conditions. This makes it a powerful tool for taking advantage of market volatility and executing your trading strategy 24/7, even while you sleep. This positions Coinrule as an ideal platform for both active traders and those who prefer a more hands-off approach to managing their crypto portfolio.

Coinrule's key strength lies in its no-code rule builder. Users can define rules based on various indicators such as price changes, trading volume, or even indicators like the Relative Strength Index (RSI). For example, you could create a rule that automatically buys Bitcoin if its price drops by 5% in a one-hour period, or sells Ethereum if its RSI exceeds 70, indicating an overbought condition. This allows for highly customized crypto alerts that go beyond simple price thresholds, enabling you to react to specific market dynamics. This functionality sets Coinrule apart from simpler alert systems that merely notify you of price changes.

For newcomers to automated trading, Coinrule provides a library of template strategies to get started. These pre-built rules cover common trading approaches and can be customized further to fit individual needs. More experienced users can build their own complex rulesets from scratch. The platform connects to multiple major cryptocurrency exchanges, allowing users to manage their trading activity across different platforms. This integration is crucial for those who diversify their holdings across different exchanges.

One of the most valuable features for testing and refining strategies is Coinrule's demo mode. It allows users to simulate their rules in a risk-free environment before deploying them with real funds. This minimizes the risk of losses due to improperly configured rules and allows for iterative optimization.

While Coinrule provides a compelling platform for automated trading, it's essential to consider its pricing structure. The free plan is quite limited in terms of the number of rules and exchange connections. Paid plans range from $29.99 to $449.99 per month, offering increasing functionality and access to more advanced features at higher tiers. This makes the platform a significant investment, especially for users just starting out. While the lower tiers offer a reasonable entry point, unlocking the platform’s full potential necessitates subscribing to higher-priced plans.

Implementation Tips:

Coinrule earns its place in this list by providing a user-friendly yet powerful platform for setting up sophisticated crypto alerts tied to automated trading actions. It caters to both novice and experienced traders, though the pricing structure may be a barrier for some. If you're looking for more than simple price alerts and are interested in automating your trading strategy, Coinrule is a platform worth exploring. The link to their website is: https://coinrule.com/

TabTrader is a mobile-first cryptocurrency trading terminal that excels in providing a comprehensive, yet streamlined, alert system tailored for traders who need real-time market information directly on their mobile devices. Its ability to connect to over 30 different exchanges makes it a powerful tool for managing a diverse portfolio and receiving timely crypto alerts, allowing you to react swiftly to market fluctuations wherever you are. This multi-exchange support, coupled with its mobile-optimized interface, earns TabTrader a well-deserved spot on this list of top crypto alert platforms.

For those constantly monitoring the crypto market, TabTrader offers push notifications for price crossing alerts and percentage change alerts. This means you can set an alert to notify you when Bitcoin crosses $30,000 or when Ethereum drops by 5%, for example. The low-latency notifications ensure you receive alerts promptly, a crucial factor in the fast-moving world of cryptocurrency trading. Beyond just monitoring, TabTrader also allows you to trade directly from the alert itself, minimizing the time it takes to execute a trade based on a triggered alert. This is particularly useful for scalpers and day traders who capitalize on short-term market movements.

While TabTrader’s free tier offers robust basic functionality, including setting price alerts across multiple exchanges, some advanced features require a subscription of $9.99 per month. This subscription unlocks further customization options, although it still doesn't reach the level of granularity offered by some dedicated desktop platforms. While the mobile experience is excellent, with a clean and intuitive interface, the desktop version isn’t as fully developed. Furthermore, the technical analysis tools available for setting alert conditions are somewhat limited compared to other platforms that offer more complex indicators and drawing tools. For example, while you can set alerts based on simple price crosses, you might not find the ability to create alerts based on complex moving average crossovers or other technical indicators.

Implementation Tips:

Despite some limitations in technical analysis and customization, TabTrader’s mobile-first design, multi-exchange support, and low-latency crypto alerts make it a valuable tool for traders seeking a convenient and efficient way to stay informed and react to market movements from anywhere. Visit their website at https://tab-trader.com/ for more information.

Alertatron stands out as a dedicated solution for those heavily reliant on TradingView for charting and technical analysis. This powerful crypto alert tool acts as a bridge, connecting TradingView alerts to a wider range of platforms than TradingView natively supports. This allows traders to centralize their technical analysis within TradingView and automate their trade execution or notification processes through various channels like Discord, Telegram, SMS, and email. This makes Alertatron particularly attractive to algorithmic traders and those seeking a streamlined workflow originating from their TradingView setups. If you find TradingView's native alert system lacking in flexibility or reach, Alertatron offers a compelling solution.

A key strength of Alertatron lies in its automated trade execution capabilities. While TradingView offers some integrations, Alertatron expands this functionality considerably. By forwarding alerts and triggering actions based on them, it effectively extends the reach of TradingView to platforms that might not have direct integration. For example, you could configure an alert in TradingView for a specific price point on Bitcoin, and Alertatron can automatically place a buy order on your exchange via a connected bot. This automation potential significantly enhances trading efficiency and allows for the rapid execution of strategies based on technical analysis. Alertatron’s custom message formatting feature provides additional control over the information delivered via notifications, ensuring users receive precisely the data points they need.

Alertatron offers different subscription tiers ranging from $29 to $49 per month, depending on the features and usage limits required. While this represents a cost, the efficiency gains and potential for improved trade execution could make it a worthwhile investment for serious traders. The platform does require some technical setup and understanding of both TradingView and the target platforms you want to connect. Users will need to familiarize themselves with Alertatron's interface and configuration options to maximize its potential.

Key Features and Benefits:

Pros:

Cons:

Alertatron earns its spot on this list by providing a crucial link between TradingView's analytical power and a trader’s execution platform. It caters specifically to traders who depend on TradingView and desire more control over their alert-driven actions. While it involves a learning curve and a subscription fee, the benefits in terms of automation and expanded platform support make it a compelling crypto alert solution. You can explore Alertatron and its features further on their website: https://alertatron.com/

| Product | Core Features ✨ | User Experience ★ | Value Proposition 💰 | Target Audience 👥 |

|---|---|---|---|---|

| 🏆 Coindive | Social metrics, AI-enhanced alerts, multi-channel tracking | Streamlined & insightful, slight learning curve | Evidence-based crypto insights backed by CoinGecko | Investors & active traders |

| TradingView Alerts | Custom charts, price/indicator alerts, multi-delivery | Robust charting, versatile alert system | Advanced technical alerts integrated with chart tools | Technical traders & analysts |

| CoinMarketCap Price Alerts | Price & percentage alerts, portfolio tracking, watchlist integration | User-friendly and reliable free alerts | Broad crypto coverage at no cost | Beginners & casual traders |

| CryptoHopper | Technical & sentiment alerts, automated trading | Powerful tools, but steep learning curve | Automated trading on multiple exchanges | Active, tech-savvy traders |

| Coinigy | Multi-exchange monitoring, technical indicators, volume alerts | Professional-grade, complex interface | Comprehensive trade tools for high-frequency trading | Professional traders |

| Coinrule | No-code rule builder, template strategies, auto-trading alerts | Intuitive design, accessible for non-tech users | Easy-to-use automation for rule-based trading | Beginner to intermediate traders |

| TabTrader | Mobile-optimized alerts, price crosses, multi-exchange support | Excellent mobile experience, limited desktop options | Instant notifications tailored for mobile trading | Mobile-focused traders |

| Alertatron | TradingView integration, webhook forwarding, auto trade execution | Efficient for algorithmic setups, requires setup | Bridges TV alerts to automated trading | Algorithmic & advanced traders |

From basic price trackers like CoinMarketCap Price Alerts to sophisticated trading bots like CryptoHopper and automated rule-based platforms like Coinrule, the options for setting up crypto alerts are diverse. This article explored eight popular tools, each with its strengths and weaknesses. Key takeaways include the importance of considering the types of alerts offered (price fluctuations, volume changes, technical indicators), the exchanges supported by the platform, the ease of use and setup, and of course, the cost. TradingView Alerts, for instance, are excellent for chart-based technical analysis, while Coinigy offers a comprehensive platform for managing multiple exchanges. TabTrader provides mobile-first convenience, while Alertatron allows for highly customizable alerts.

Selecting the right tool depends heavily on your individual needs and trading style. A long-term "hodler" might be content with simple price alerts, while an active day trader may require real-time alerts based on complex technical indicators. Institutional investors and portfolio managers might find value in tools like Coindive that offer advanced portfolio tracking and market analysis alongside alerting features. For those interested in tracking their crypto-related Twitter activity, several dedicated Twitter analytics tools can provide deeper insights into engagement, reach, and audience behavior. This resource, Best Twitter Analytics Tools: A Comprehensive Guide for Modern Marketers from SuperX, can be a valuable starting point. Remember that effectively implementing these tools requires careful planning and ongoing monitoring to avoid alert fatigue and ensure the alerts align with your overall investment strategy.

Ultimately, the power of crypto alerts lies in their ability to keep you informed and ahead of the curve. By leveraging these tools strategically, you can navigate the volatile crypto market with greater confidence and efficiency. To experience a powerful platform that combines advanced charting, portfolio tracking, and customizable crypto alerts, explore Coindive. Coindive provides a comprehensive solution for managing your crypto investments and staying informed about market movements, enabling you to make better decisions in the dynamic world of digital assets.