The cryptocurrency market is a volatile landscape. Prices fluctuate wildly, new projects emerge constantly, and trading strategies can be incredibly complex. Sound decision-making requires more than intuition; it demands accurate data, insightful analysis, and efficient portfolio management. Whether you're a seasoned trader managing a diverse portfolio or just beginning to explore Bitcoin, a robust cryptocurrency tracking app is indispensable. These tools provide real-time market data, personalized alerts, portfolio performance tracking, and even tax reporting assistance.

Choosing the right tracking app can be challenging. Key factors include the range of supported coins and exchanges, the depth and accuracy of data, the availability of advanced charting and analytical tools, and the user interface's intuitiveness. A good crypto tracking app should consolidate information from multiple sources, offer customizable alerts for price changes and market events, and provide a clear overview of your portfolio's performance.

Pricing models vary widely. Some platforms offer free versions with basic features, while others require premium subscriptions for advanced analytics and portfolio management tools. Some integrate directly with exchanges for streamlined trading, while others focus on tracking and analysis. Technical considerations like security measures and platform compatibility (iOS, Android, web) are also important.

In this listicle, we'll explore the 10 best cryptocurrency tracking apps, examining their strengths and weaknesses to help you make an informed decision. We'll analyze core features, pricing, security protocols, and user experience, giving you the insights you need to improve your crypto strategy and navigate the market confidently. From established platforms to innovative newcomers, we'll help you find the perfect tool to maximize your crypto journey.

Coindive stands out by combining social listening with AI-powered market analysis. For those involved in the cryptocurrency market – investors, traders, and analysts – understanding community sentiment is critical. Coindive gathers information from major social platforms like Twitter, Telegram, Discord, and Reddit, providing a comprehensive view of project discussions and announcements. This is especially useful for altcoin investors and researchers seeking emerging trends and evaluating genuine community engagement. The platform helps separate authentic growth from manufactured hype.

Coindive goes beyond basic price tracking and alerts. Its AI-enhanced alerts provide contextualized insights, correlating price movements with market trends and significant events. Instead of just receiving a price spike alert, users receive analysis of related social media discussions, potentially revealing the catalyst for the movement. This feature is invaluable for portfolio managers and institutional investors who need a deep understanding of market dynamics.

The integration with CoinGecko strengthens Coindive's credibility and data accuracy. This partnership helps filter spam and bot activity, ensuring users receive reliable information based on genuine engagement. The platform provides comprehensive analytics, including sentiment analysis and growth metrics, empowering data-driven investment decisions. Crypto content creators can also use these insights to produce informed content.

Pros:

Cons:

(Pricing and technical requirements information not currently available. Check the Coindive website for the most up-to-date details.)

Website: https://coindive.app

Implementation Tip: Begin by focusing on a few key projects or sectors relevant to your investment strategy. Customize alerts to filter noise and receive only the most crucial insights. Explore Coindive's analytical tools to gain a deeper understanding of market dynamics. A focused approach will maximize effectiveness, particularly for new users.

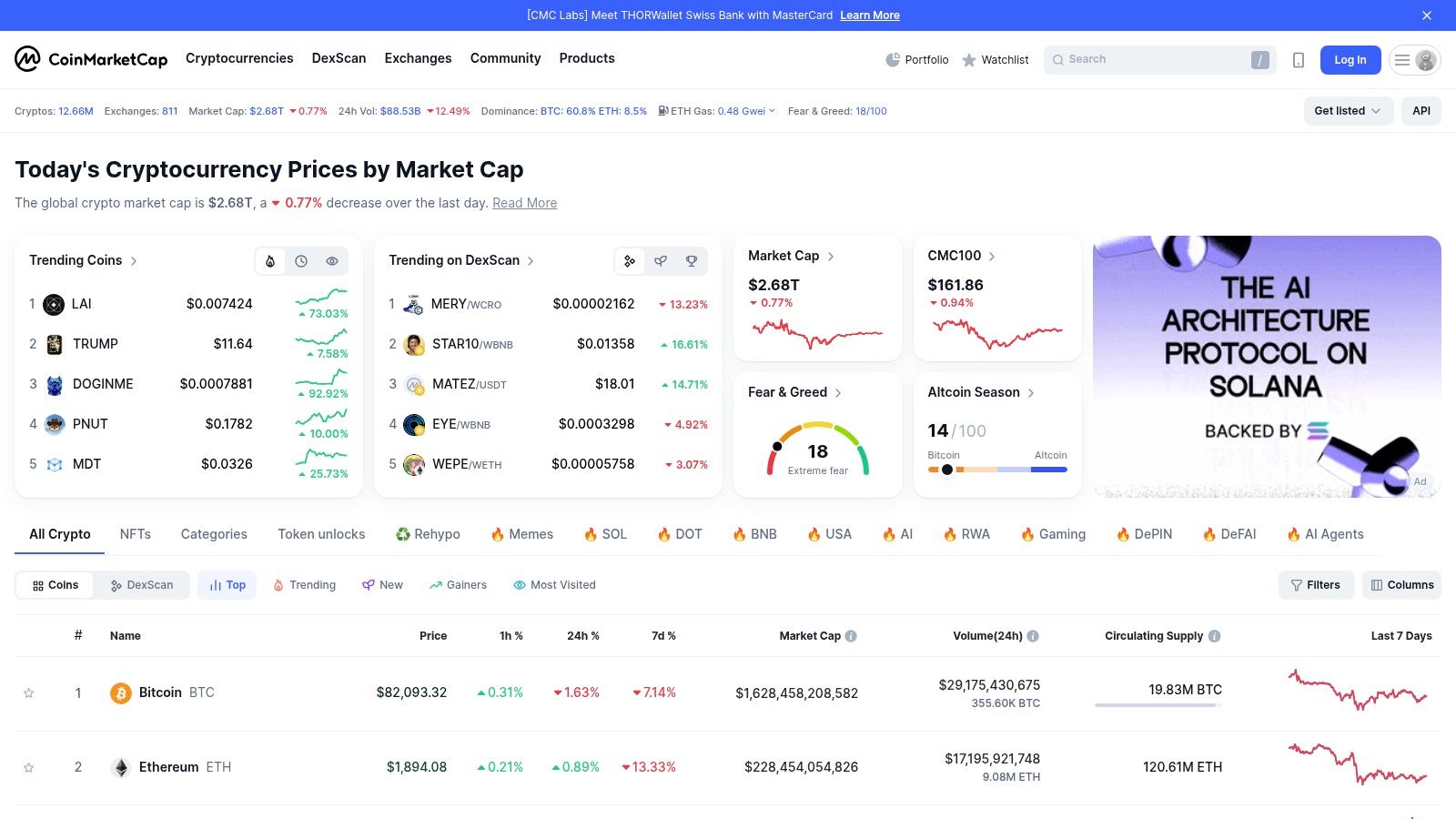

CoinMarketCap has solidified its position as a dominant cryptocurrency tracking platform. Its success is driven by comprehensive market data coverage and a user-friendly interface. Catering to everyone from casual observers to seasoned institutional investors, CoinMarketCap provides a centralized resource for navigating the dynamic cryptocurrency market. Whether you are a trader, a long-term holder ("hodler"), or a researcher, CoinMarketCap offers tools to enhance your understanding and management of digital assets.

CoinMarketCap's strength lies in providing real-time data on thousands of cryptocurrencies. This makes it invaluable for staying abreast of market fluctuations. This broad coverage is particularly useful for those interested in altcoins (alternative cryptocurrencies) and for researchers investigating niche projects. The platform's intuitive design simplifies navigation, even for newcomers.

Features such as customizable watchlists empower users to track specific cryptocurrencies. Personalized price alerts facilitate timely decisions in the often-volatile crypto market. More advanced users can leverage detailed charts and historical data for basic technical analysis. However, it's worth noting that CoinMarketCap’s analytical tools are not as extensive as those found on dedicated trading platforms like TradingView.

Beyond price tracking, CoinMarketCap provides robust portfolio tracking. Users can monitor their holdings and analyze performance over time. This feature is essential for both portfolio managers and individual investors seeking to understand the health and growth of their crypto investments. The platform also aggregates news, keeping users informed on the latest developments within the cryptocurrency ecosystem. This integrated news feed, combined with educational resources, fosters a holistic market understanding.

Starting with a watchlist is recommended. Create a free account, explore the cryptocurrency listings, and add assets of interest to your watchlist. Utilize the portfolio tracker to consolidate your investments. The free version provides ample functionality. However, a premium subscription might be beneficial if you need advanced charting or specialized features.

While platforms like CoinGecko offer similar services, CoinMarketCap distinguishes itself through its extensive market coverage, integrated news, and educational content. It remains a critical tool for anyone serious about navigating the cryptocurrency market. It offers a valuable combination of real-time data, portfolio management, and market insights, all within one accessible platform.

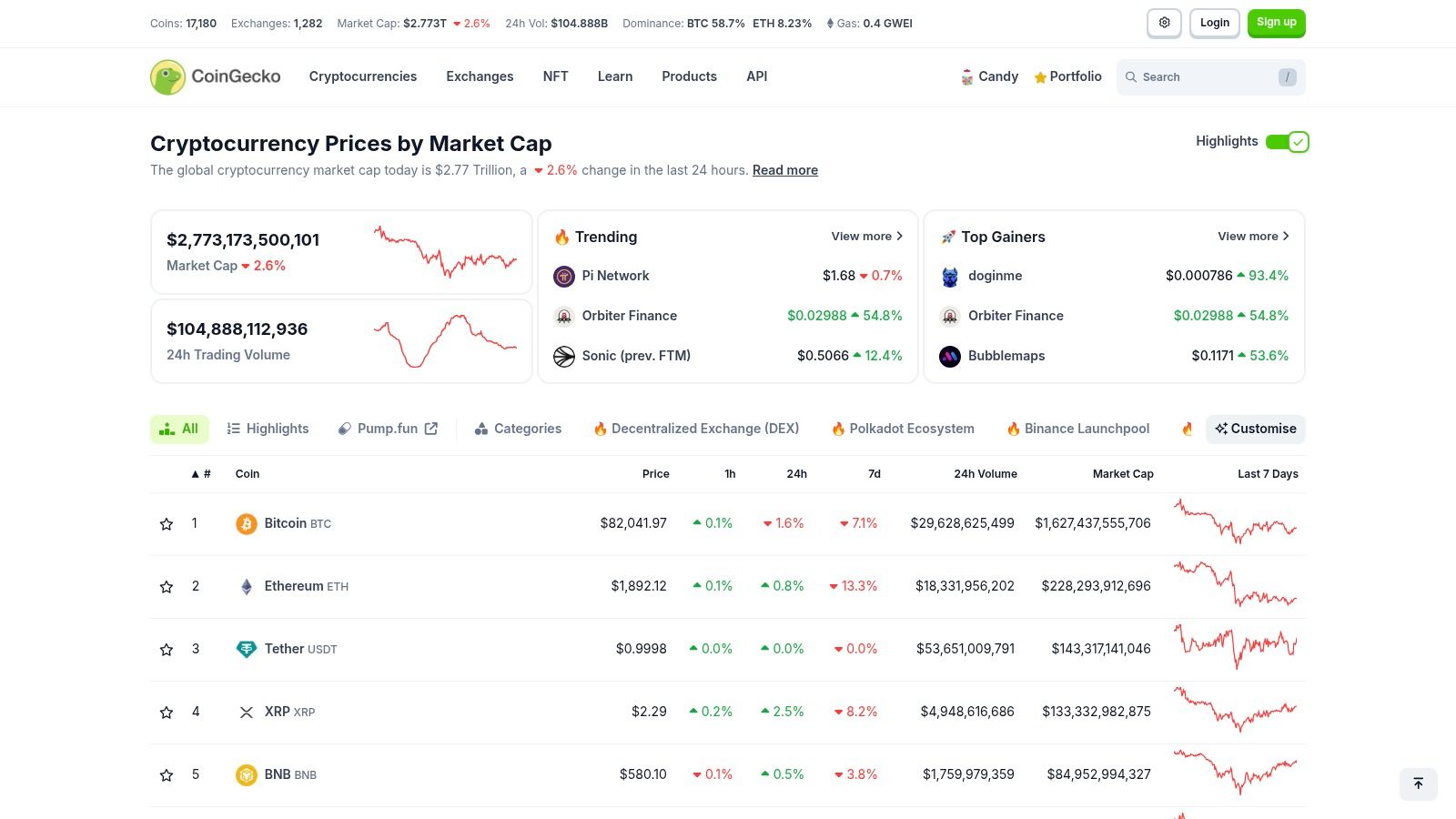

CoinGecko earns its place on this list as a premier free and comprehensive resource for tracking cryptocurrency. Its extensive data on over 10,000 cryptocurrencies across more than 500 exchanges makes it an invaluable tool for investors, traders, analysts, and even content creators. Unlike aggregators focused solely on price, CoinGecko provides a holistic overview of each project.

This overview includes key metrics such as market capitalization, trading volume, community growth, and development activity. By providing this breadth of information, CoinGecko empowers users to develop more informed investment strategies based on project fundamentals, rather than mere price speculation.

One of CoinGecko's most notable features is its proprietary "Trust Score." This metric helps users assess the reliability of various exchanges. In the volatile and sometimes opaque cryptocurrency market, an independent measure of exchange trustworthiness offers a significant advantage. Furthermore, CoinGecko extends its utility beyond centralized exchanges by offering tracking tools and information on Decentralized Finance (DeFi) yield farming opportunities.

CoinGecko boasts robust charting tools, including customizable candlestick charts with technical indicators. This functionality proves particularly beneficial for traders and analysts who rely on chart patterns and indicators to inform their trading decisions. Beyond price charts, CoinGecko provides insights into on-chain metrics and tokenomics, offering a granular understanding of a project's underlying mechanics and economic model. This deeper level of analytical data is especially crucial for researchers and institutional investors.

CoinGecko offers several advantages, most notably its free access to all features. Competitors often employ tiered pricing models, restricting access to advanced tools. CoinGecko’s commitment to in-depth fundamental analysis metrics, providing data beyond simple price, sets it apart. A user-friendly mobile app provides convenient access on the go. The platform also benefits from continuous updates, regularly adding new cryptocurrencies, exchanges, and features.

However, the sheer volume of data can feel overwhelming for newcomers to the crypto space. Occasional, minor price discrepancies can occur due to aggregation from multiple sources. While functional, the portfolio tracking features offer less customization compared to dedicated portfolio management apps.

Accessing CoinGecko is straightforward. Simply visit the CoinGecko website or download the mobile app. The interface is intuitive, and most features are self-explanatory. For beginners, exploring the "Explore" section provides a valuable overview of the cryptocurrency landscape. The "CoinGecko Learn" resources can further strengthen understanding of cryptocurrency fundamentals. From casual holders to institutional investors, CoinGecko presents a robust suite of free tools and resources. Its comprehensive data, intuitive interface, and commitment to transparency make it an indispensable resource for navigating the world of crypto.

Delta stands out as a robust portfolio tracker, well-suited for active cryptocurrency investors and traders. Beyond basic balance summaries, Delta offers deep portfolio analytics, including profit and loss calculations. It connects to over 300 cryptocurrency exchanges through API integration for automatic tracking. This automation eliminates manual entry, ensuring your portfolio remains current across all holdings. Furthermore, Delta supports tracking over 7,000 cryptocurrencies, providing broad coverage for diverse portfolios. For traders looking to improve their analysis, this guide on how to read crypto charts might prove useful.

Delta's versatility extends beyond crypto, integrating traditional stock and ETF tracking. This allows management of your entire investment portfolio within a single application. The platform's clean, intuitive interface simplifies complex data visualization, providing a clear overview of investment performance. Customizable widgets and watchlists enable focus on specific assets and market trends, optimizing your workflow. Multi-device synchronization ensures consistent access to your portfolio across platforms.

While Delta's core features are free, a Pro subscription, priced between $60-80 annually, unlocks its full potential. The Pro version offers advanced analytics, unlimited exchange connections, and other premium features. For dedicated investors and traders, these features often justify the subscription cost.

One potential issue is occasional API disconnection, requiring reconnection. While generally a minor inconvenience, it can be disruptive. Compared to simpler tracking apps, Delta also has a steeper learning curve, requiring time investment to master its features.

Website: Delta

For those seeking a powerful and comprehensive portfolio tracking solution, Delta presents a compelling option. Its advanced features and polished interface make it a valuable tool for serious crypto investors and traders seeking a premium experience. However, users prioritizing a completely free and simpler alternative might consider other options.

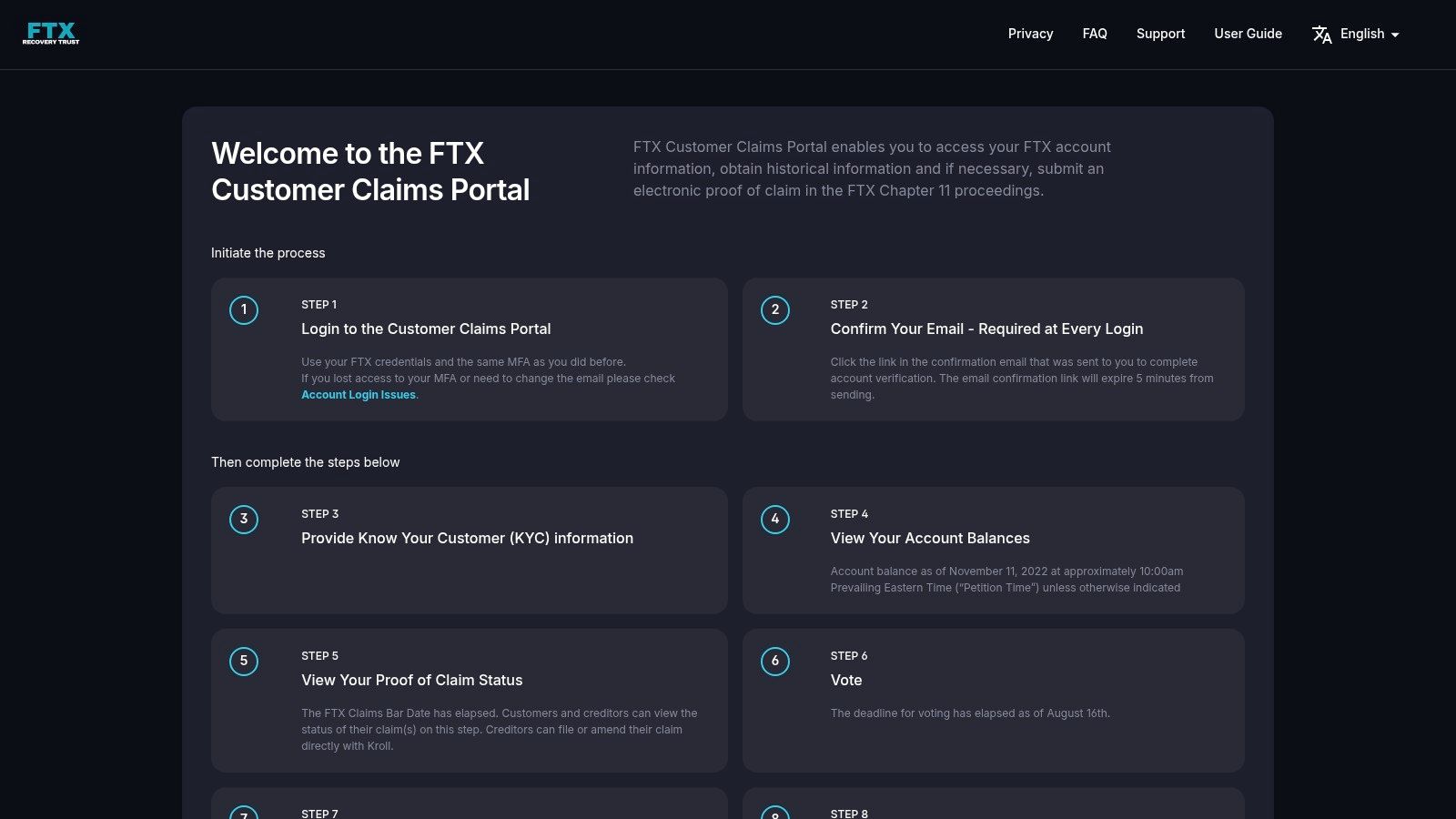

Blockfolio, now under the FTX brand, remains a popular cryptocurrency portfolio tracker. It's particularly useful for those already using the FTX exchange. While the core functionality remains free, its close relationship with FTX presents both advantages and disadvantages. The seamless trading integration is a plus, but it also raises concerns for some. Its ease of use, broad cryptocurrency support, and integrated news feed earn it a place on our list, making it valuable for both casual and active traders.

The platform's key strength is its simplified portfolio tracking. Users can monitor real-time price data from multiple exchanges, consolidating their holdings into a single view. This eliminates manual checks across different platforms and spreadsheets, streamlining portfolio management. Supporting over 10,000 cryptocurrencies, Blockfolio/FTX caters to diverse portfolios, including those focused on altcoins. The clean, user-friendly interface improves accessibility for all experience levels.

For FTX traders, the app integration is a significant benefit. Executing trades directly within Blockfolio/FTX minimizes friction and enables quick responses to market changes. This makes it appealing to active traders who prioritize speed and efficiency. The "Signal" feature, delivering official project announcements, provides valuable insights that can inform trading decisions. Price alerts and a personalized news feed further enhance the experience, providing timely information relevant to individual holdings.

The FTX acquisition has, however, caused some user apprehension, particularly regarding data privacy and the platform's future. While Blockfolio/FTX remains free without subscription fees, the acquisition's long-term implications warrant consideration. Some have reported occasional synchronization issues with certain exchanges, potentially affecting portfolio tracking accuracy. Additionally, the platform's analytical tools, while adequate for casual traders, may not meet the needs of serious traders requiring in-depth market analysis. Compared to platforms with advanced charting and analytics, Blockfolio/FTX falls short in this area.

Start by Connecting Your Exchange Accounts: This allows Blockfolio/FTX to automatically import your transaction history for an accurate portfolio overview.

Customize Your News Feed: Select your preferred cryptocurrencies to receive relevant news and updates.

Set Price Alerts: Stay informed on significant price fluctuations for your assets.

Blockfolio/FTX offers a compelling free solution for cryptocurrency portfolio tracking, especially for those already using FTX. While concerns about the acquisition and occasional sync issues exist, the app's ease of use, broad cryptocurrency support, and direct trading integration make it a useful tool for many cryptocurrency investors. Users seeking advanced analytical tools, however, should explore other platforms.

The Crypto.com App earns a place on this list by combining portfolio tracking and diverse cryptocurrency services in one platform. It goes beyond basic tracking, aiming to be a central hub for all crypto needs, from casual investors to seasoned traders. This all-in-one approach simplifies managing cryptocurrency activities.

Crypto.com doesn't just display your portfolio's value. It tracks over 250 cryptocurrencies in real-time, lets you set price alerts for specific assets, and provides detailed charts for technical analysis. These features are crucial for informed decisions and responding to market shifts, particularly when building a diversified portfolio. Traders benefit from the integrated exchange, executing buy and sell orders directly within the app.

A key differentiator for Crypto.com is its financial services. Users can earn interest on their crypto holdings, an attractive feature for long-term investors. This passive income potential enhances the app's utility. A tiered rewards system, often linked to staking their native CRO token, encourages deeper platform engagement. The Crypto.com Visa card offers crypto cashback rewards, bridging traditional finance and the crypto world.

However, accessing the full range of benefits, such as higher interest rates and better card rewards, usually requires substantial CRO token staking. This commitment might deter some users. Also, while Crypto.com aims for global reach, some features and services face regional restrictions due to regulations. Compared to dedicated exchanges, Crypto.com's trading fees can be higher.

Features:

Pros:

Cons:

Website: https://crypto.com/

Start by exploring the free features and gradually expand your involvement based on your individual needs and risk tolerance. Carefully research the CRO staking tiers and their benefits before committing substantial capital.

For those wanting a centralized platform combining portfolio tracking with other crypto services, the Crypto.com app is a viable choice. However, weigh the potential benefits against the commitment required to maximize its features. Compare its fee structure with other exchanges to ensure it aligns with your trading strategy.

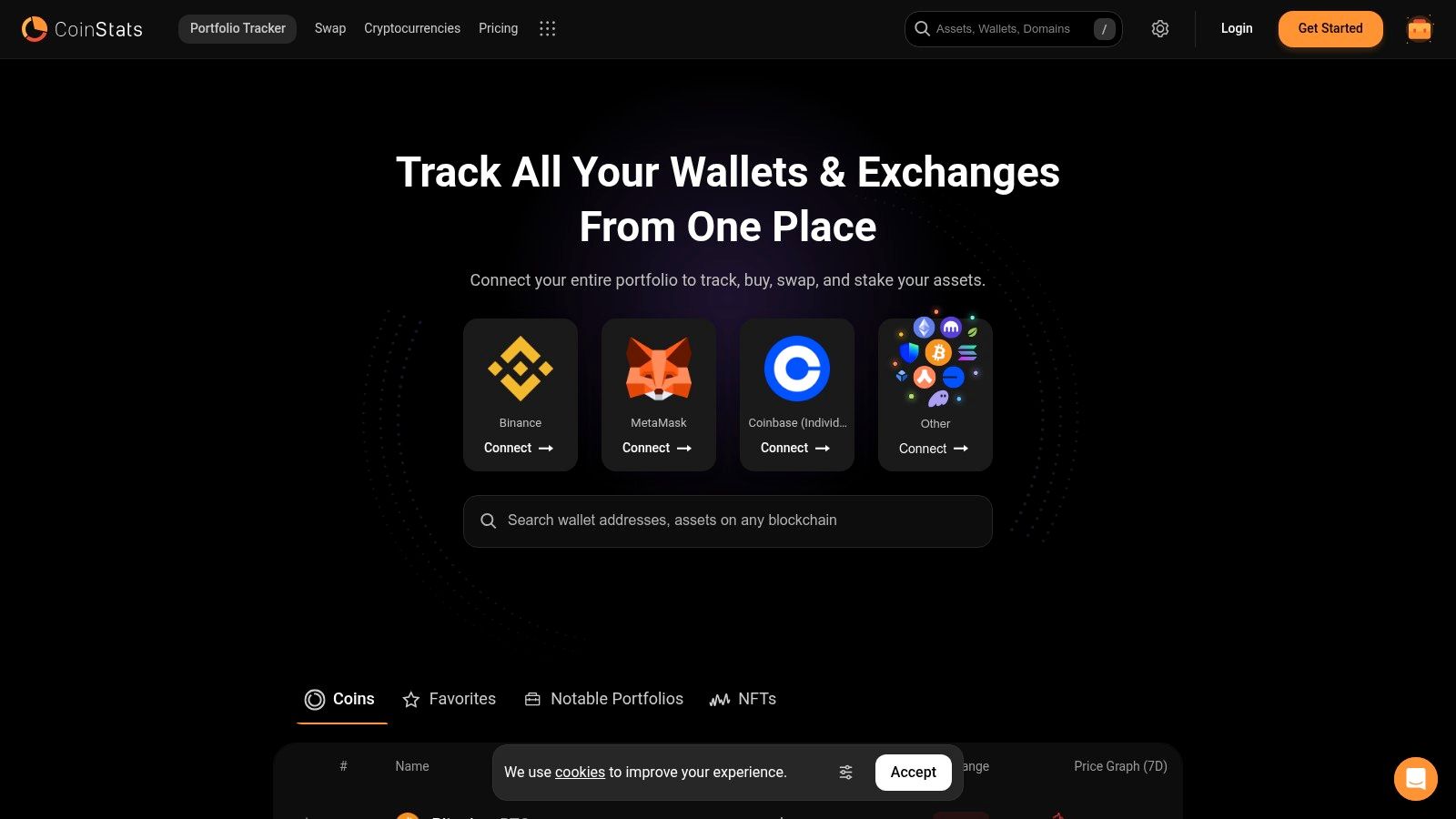

Coin Stats stands out due to its powerful portfolio tracking and analytical tools. Its comprehensive DeFi integration and built-in tax reporting are particularly noteworthy. For investors active in decentralized finance (DeFi), Coin Stats offers a streamlined way to monitor assets across various protocols. Its intuitive interface simplifies complex portfolio management.

This platform excels at providing a consolidated overview of cryptocurrency investments. Connecting multiple wallets and exchanges (over 100 supported) allows Coin Stats to automatically synchronize transactions. This provides real-time data on over 8,000 cryptocurrencies. Automated tracking eliminates manual entry and allows quick assessment of overall portfolio performance.

Beyond basic tracking, Coin Stats delivers advanced analytics. These include profit/loss calculations, portfolio allocation visualizations, and historical performance charts. This data empowers investors to make informed decisions. Imagine visualizing your exposure to different crypto sectors or quickly identifying your top performers. These features make Coin Stats a powerful tool for both casual and serious investors.

Coin Stats shines in its DeFi tracking capabilities. Users can monitor their staking, lending, and farming activities across a wide range of DeFi protocols. This consolidated view of DeFi investments is particularly valuable in this rapidly evolving space. Managing investments across multiple platforms becomes significantly easier.

The integrated tax reporting tools are another key advantage. They simplify calculating capital gains and losses, potentially saving users significant time and effort during tax season. This feature addresses the complexities of cryptocurrency taxation, a major concern for many investors.

Coin Stats offers a free tier for beginners. However, unlocking the full platform potential, including connecting multiple portfolios, requires the premium plan at $4.99/month. This is a cost-effective solution for serious investors, especially compared to platforms with similar functionalities.

While Coin Stats offers a robust feature set, some users have reported occasional syncing issues. Also, customer support on the free tier is limited. These are potential drawbacks to consider, especially for those relying heavily on seamless data synchronization and responsive support.

Key Features & Benefits:

Pros:

Cons:

Website: https://coinstats.app/

Coin Stats offers a compelling solution for investors seeking a platform to manage both centralized and decentralized cryptocurrency holdings. Its robust tracking, analytical, and tax reporting features are valuable assets. While the premium subscription unlocks full functionality, its price remains competitive.

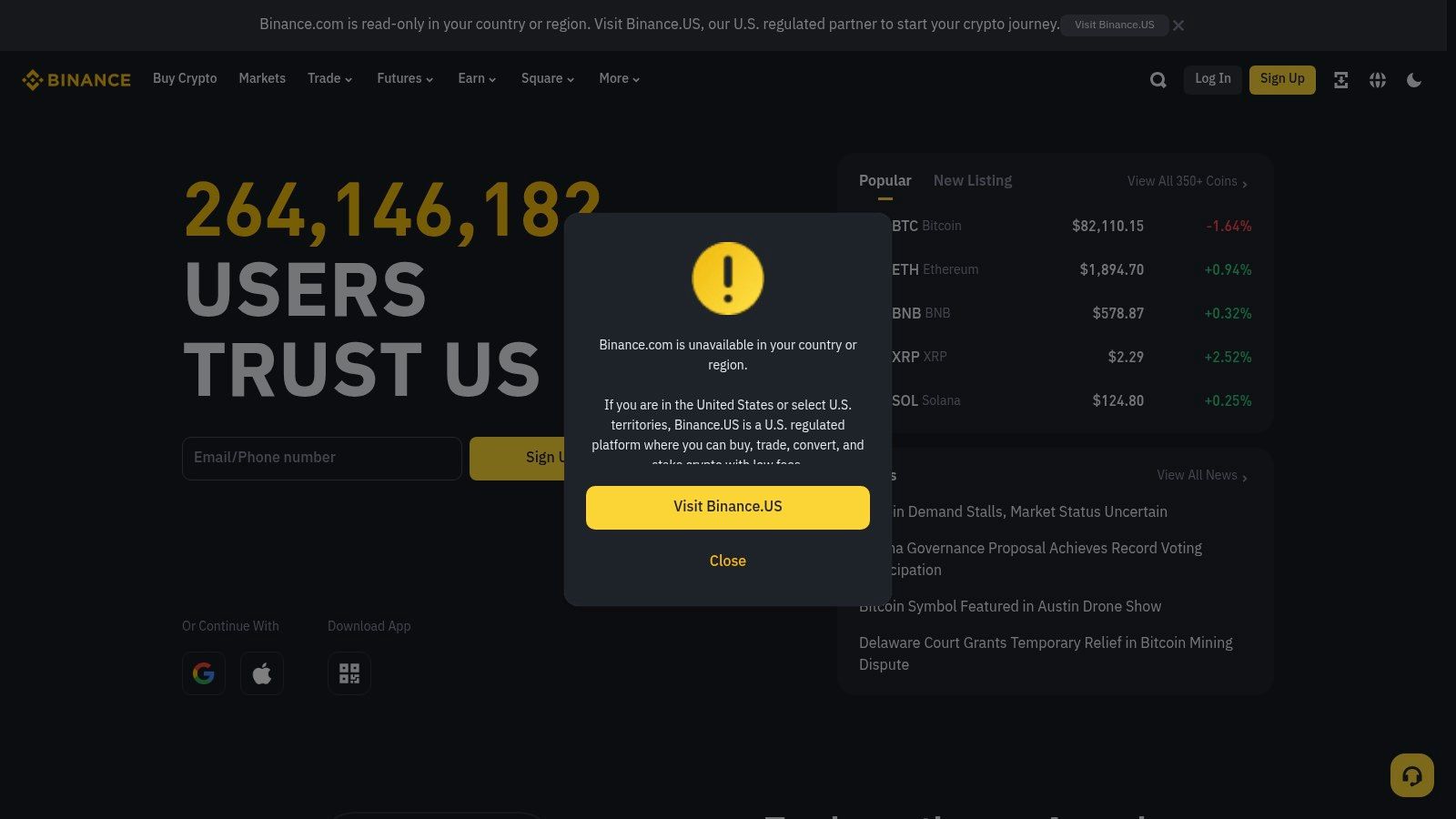

Binance, primarily known as a global cryptocurrency exchange, stands out due to its robust tracking features. These extend beyond trading functionalities, making it a valuable tool even for those managing portfolios elsewhere. While portfolio management isn't its core focus, Binance offers a comprehensive suite of tools for monitoring the crypto market, conducting technical analysis, and staying up-to-date on the latest news, all within one app.

Binance provides real-time market data for thousands of cryptocurrencies, exceeding the capabilities of many dedicated tracking apps. The platform’s advanced charting tools incorporate multiple technical indicators, including MACD, RSI, and Bollinger Bands, enabling in-depth market analysis. This is particularly useful for traders and analysts seeking a detailed view of market trends. For passive investors, the watchlist feature allows for easy monitoring of specific assets. Customizable price alerts notify users of significant market fluctuations.

The integrated news and market analysis section keeps users informed about the latest developments in the crypto space, directly impacting investment decisions. While platforms like CoinGecko and CoinMarketCap offer similar news aggregation, Binance’s integration within its trading platform creates a more streamlined user experience.

For users actively trading on Binance, the app seamlessly integrates portfolio tracking with a detailed transaction history and performance analytics. This provides a holistic overview of trading activity and overall portfolio performance. Furthermore, Binance offers staking and earning opportunities for various cryptocurrencies, allowing users to generate passive income on their holdings. This added utility distinguishes it from standard tracking apps.

Features:

Pros:

Cons:

Website: https://www.binance.com/

Downloading the Binance app is straightforward on both iOS and Android devices. After installation, users can create an account or log in with existing credentials. While not required for tracking, KYC verification unlocks full trading functionalities. New users should explore the interface and customize their watchlist. Numerous online tutorials and resources are available for guidance.

While not explicitly designed as a portfolio tracker, Binance's expansive features make it a powerful tool for crypto enthusiasts of all levels. These features include real-time data, advanced charting, news integration, and earning opportunities. However, new users should be prepared for a complex interface, and some users may encounter regional limitations on available features. For active Binance traders, the app is invaluable for both trading and portfolio overview.

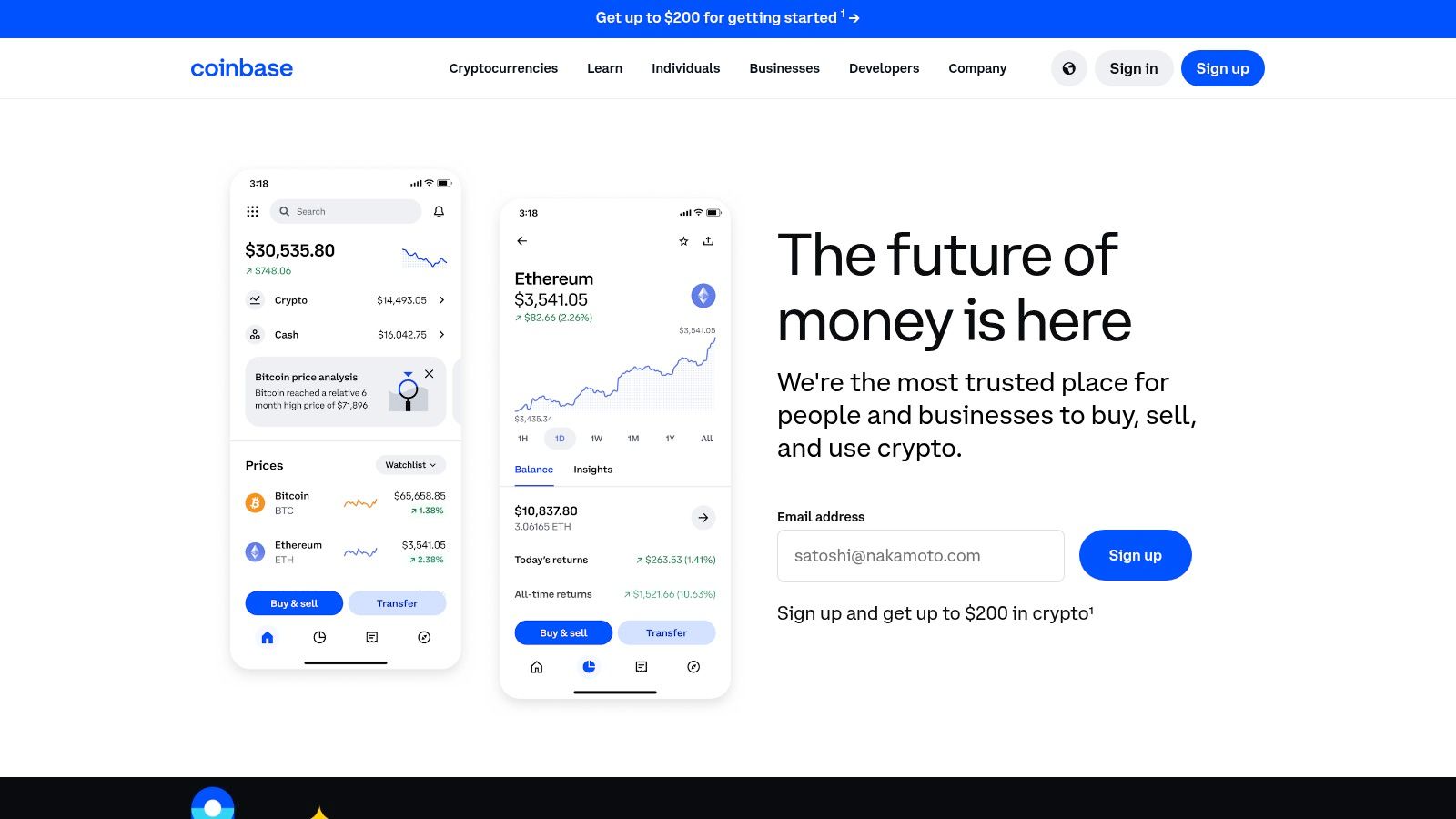

Coinbase secures a place on this list thanks to its smooth integration of cryptocurrency tracking and a user-friendly exchange. This design is appealing to both new crypto investors and seasoned traders seeking an all-in-one platform. While specialized portfolio trackers might offer more in-depth analysis, Coinbase's simplicity and accessibility are key strengths.

Coinbase delivers real-time price updates, interactive charts, and news for major cryptocurrencies, helping users stay on top of market movements. The integrated portfolio tracker visually displays your holdings, clearly showing profits and losses for convenient performance monitoring. This combined functionality enables users to manage assets and execute trades within a single application, streamlining the investment process.

A distinguishing feature of Coinbase is its emphasis on education. The platform's learn-to-earn programs incentivize users to learn about different cryptocurrencies, rewarding them with crypto for completing educational modules. This is particularly helpful for beginners navigating the crypto landscape.

For more experienced traders, Coinbase offers direct buying and selling with a variety of payment methods, including bank transfers and debit cards. Recurring purchases facilitate dollar-cost averaging, a strategy designed to reduce risk in volatile markets. Coinbase also supports staking for select cryptocurrencies, allowing users to earn passive income.

Features:

Pros:

Cons:

Website: https://www.coinbase.com/

Setting up a Coinbase account is straightforward, involving standard KYC (Know Your Customer) procedures. Users can link their bank accounts or debit cards for seamless transactions. The mobile app is available on both iOS and Android. Beginners are encouraged to utilize the educational resources to familiarize themselves with the platform and the crypto market.

Compared to dedicated portfolio trackers like Blockfolio or Delta, Coinbase's tracking is less comprehensive. It lacks the advanced charting and analysis tools that experienced traders may prefer. However, its integrated exchange functionality is a major differentiator. Compared to exchanges like Binance or Kraken, Coinbase’s fees are generally higher, but it offers a more beginner-friendly experience and prioritizes security and regulatory compliance. This makes Coinbase an attractive option for those valuing ease of use and security, especially new crypto investors.

Zerion distinguishes itself as a mobile-first platform for tracking and managing Decentralized Finance (DeFi) investments. While some apps offer basic DeFi tracking, Zerion provides granular insights into holdings across multiple EVM-compatible chains like Ethereum, Polygon, and Binance Smart Chain. This detailed approach makes it a valuable tool for investors deeply engaged in the DeFi ecosystem.

Zerion's primary strength is its comprehensive portfolio tracking. It aggregates data from connected wallets, displaying a unified view of tokens, liquidity pools, yield farming positions, and even NFTs. This allows users to easily monitor diverse assets, from staked assets in Aave on Polygon to LP tokens in a Uniswap V3 pool on Ethereum, all within a single interface. This consolidated perspective simplifies complex DeFi participation and promotes informed decisions.

Beyond tracking, Zerion facilitates direct interaction with DeFi protocols. Users can trade tokens, provide liquidity, and manage farming positions directly within the app, eliminating the need to navigate multiple dApps. This streamlines the entire DeFi experience, allowing users to adjust their collateralization ratio on MakerDAO or harvest yield from a Yearn.finance vault without ever leaving the Zerion app.

While the free version offers substantial functionality, the premium subscription ($9.99/month) unlocks advanced features. These include historical portfolio performance analytics, gas fee optimization tools, and priority customer support. Active DeFi traders will find these features particularly useful for minimizing costs and maximizing returns.

For investors seeking a powerful tool to navigate the complexities of DeFi, Zerion emerges as a leading option. Its user-friendly interface, extensive features, and cross-chain support make it a valuable resource for both experienced and novice DeFi users. While its DeFi focus might not suit all investors, those actively participating in this evolving space will find Zerion offers a robust and efficient experience.

| Platform | Core Features (✨) | User Experience (★) | Value Proposition (💰) | Target Audience (👥) |

|---|---|---|---|---|

| 🏆 Coindive | Real-time social alerts, AI context, spam filtering | Smooth, info-rich ★★★★ | Evidence-based insights, backed by CoinGecko | Seasoned investors & blockchain pros |

| CoinMarketCap | Real-time data, customizable watchlists, detailed charts | Beginner-friendly ★★★★ | Comprehensive market insights, free essentials | Beginners & casual investors |

| CoinGecko | 10K+ coins data, Trust Score, rich on-chain analytics | Data-dense yet intuitive ★★★★ | Free, deep fundamental analysis | Advanced users & enthusiasts |

| Delta | API integration, portfolio analytics, cross-asset tracking | Premium design, slight learning curve ★★★★ | Advanced performance tracking (premium options) | Serious traders & multi-asset investors |

| Blockfolio (now FTX) | Real-time tracking, direct trading via FTX | Clean and simple ★★★★ | Seamless trading integration, free access | Active traders & portfolio managers |

| Crypto.com App | All-in-one tracking, trading, lending, NFT integration | Comprehensive, robust ★★★★ | Earn interest, rewards through staking | Mainstream users & all-in-one investors |

| Coin Stats | Multi-wallet syncing, detailed analytics, DeFi integration | Intuitive interface ★★★★ | Robust tracking with tax tools (premium for extras) | Active investors & detail-oriented users |

| Binance | Advanced charting, wide technical tools, integrated news | Professional, complex ★★★★ | Extensive exchange features and earning options | Experienced traders & professionals |

| Coinbase | Easy buying/selling, educational content, staking rewards | User-friendly, secure ★★★★★ | Regulated platform with learn-to-earn programs | Beginners & casual investors |

| Zerion | Specialized DeFi tracking, protocol interactions, NFT support | Best-in-class UI ★★★★★ | Deep DeFi insights, optimized transactions (premium) | DeFi users & seasoned crypto explorers |

Selecting the optimal cryptocurrency tracking app requires careful consideration of your individual needs and investment strategy. Factors such as the depth of information required, the specific cryptocurrencies you hold, and the features most valuable to you will all play a role in your decision. Are you a high-volume altcoin trader needing real-time data feeds? Or perhaps a long-term holder focused on fundamental analysis and community sentiment? Maybe you're a researcher delving into on-chain metrics and developer activity. Knowing your investment style is the first step.

Implementing your chosen tracker typically involves creating an account, often linking exchange APIs like those offered by Binance for automatic portfolio tracking, and customizing your watchlist and notification preferences. Most apps offer intuitive interfaces and helpful onboarding resources, making getting started relatively straightforward.

Budget is a key factor. Many apps offer free versions with basic tracking functionalities, but premium features—such as advanced charting, portfolio analysis, and custom alerts—often require a subscription. Carefully assess the value proposition of these premium features against your individual needs and available resources.

Integration and compatibility are also critical. Consider whether the app integrates with your preferred exchanges, wallets, or other financial tools. Checking device compatibility ensures seamless access across your desktop, mobile, and other devices.

In summary, evaluating your investment style, required data depth, desired features, budget constraints, and integration needs are essential steps in selecting the right crypto tracker. By carefully considering these factors and exploring various options—including Coindive, CoinMarketCap, CoinGecko, Delta, FTX (formerly Blockfolio), Crypto.com App, Coin Stats, Binance, Coinbase, and Zerion—you can find the tool best suited to support your crypto journey.

Are you ready to enhance your crypto tracking and gain a market advantage? Coindive offers a robust solution for staying ahead. By monitoring social sentiment, on-chain metrics, and key project developments, Coindive provides actionable insights, cutting through the noise and empowering you to make informed investment decisions. Explore Coindive now!